IRS Form 944 is a document for smaller employers to report their annual withholding taxes. This form allows eligible small business owners, whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less, to file just once a year instead of every quarter, as is typically required with Form 941.

The purpose of Form 944 is to simplify the tax filing process for small employers, reduce administrative burdens, and make it easier to comply with tax obligations. The IRS selects and notifies employers who are eligible to file Form 944. If not notified but believe they qualify for this filing method, employers can contact the IRS to request to file this form. Form 944 ensures smaller businesses can manage payroll tax reporting more efficiently while complying with federal tax requirements.

Other IRS Forms for Self-employed

For small businesses in the US, there are specific forms prepared by the IRS. Learn more about such forms on our other pages with IRS forms.

How to Fill Out IRS Form 944

Before you proceed to complete the 944-template, ensure the IRS has notified you in a written form about filing the annual report instead of the quarterly forms 941.

Begin the process by downloading the up-to-date valid PDF template using our software. Fill out the form with printed or typed letters.

The Employer’s Federal Annual Tax Return Guide

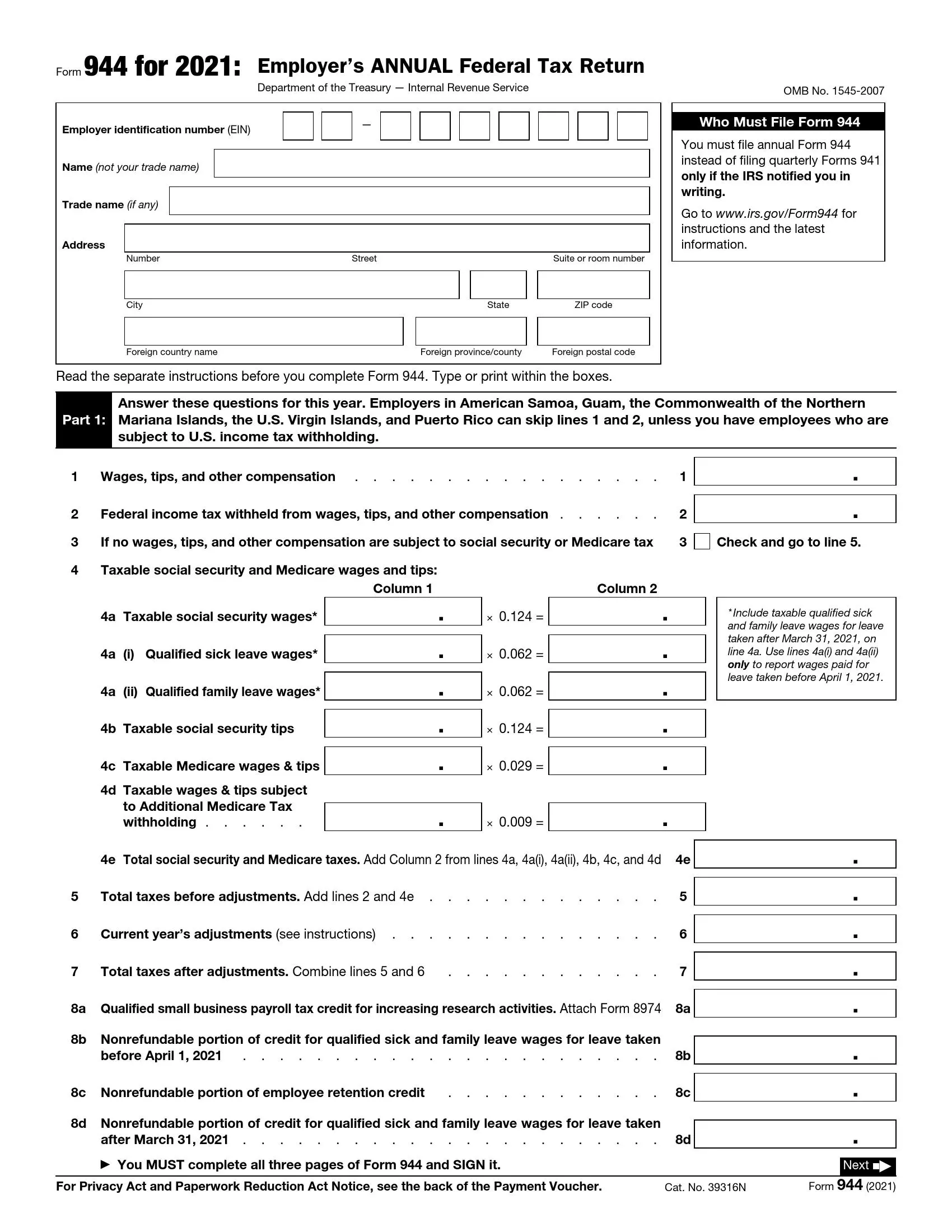

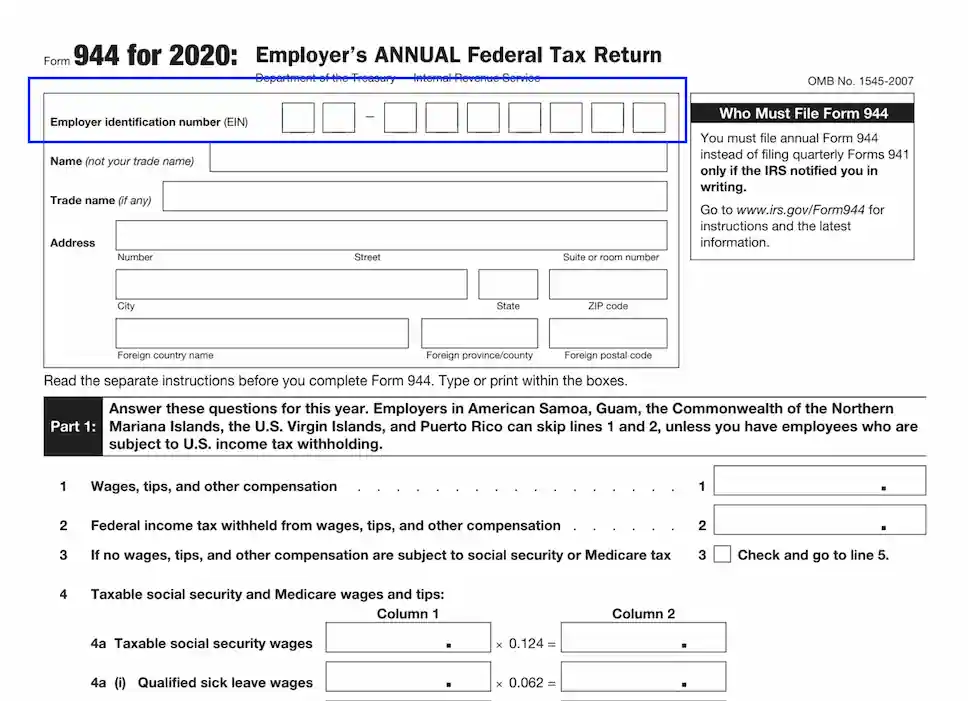

Enter the EIN

Use the space in the referenced boxes to enter the employer ID number — use a separate box to insert each next digit.

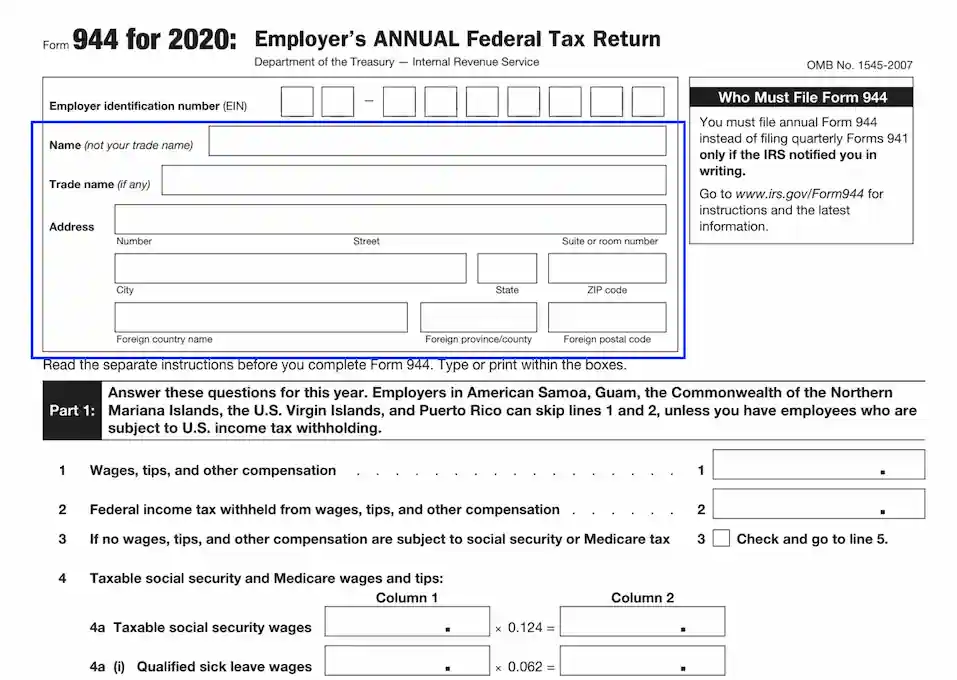

Identify the Entity

Once you have specified the tax profile data, clarify the entity’s owner data. Enter the following information:

- Complete legal name

- Trade name (if applicable)

- Mailing address, including the unit (room) number, street, city, state, and ZIP code. If the proprietor resides in foreign territories, ensure to specify the foreign country name, province, and postal specifications.

Ensure to enter the legal name and the EIN on each sheet of form 944. Find the needed boxes on top of each page.

Complete Units 1-12

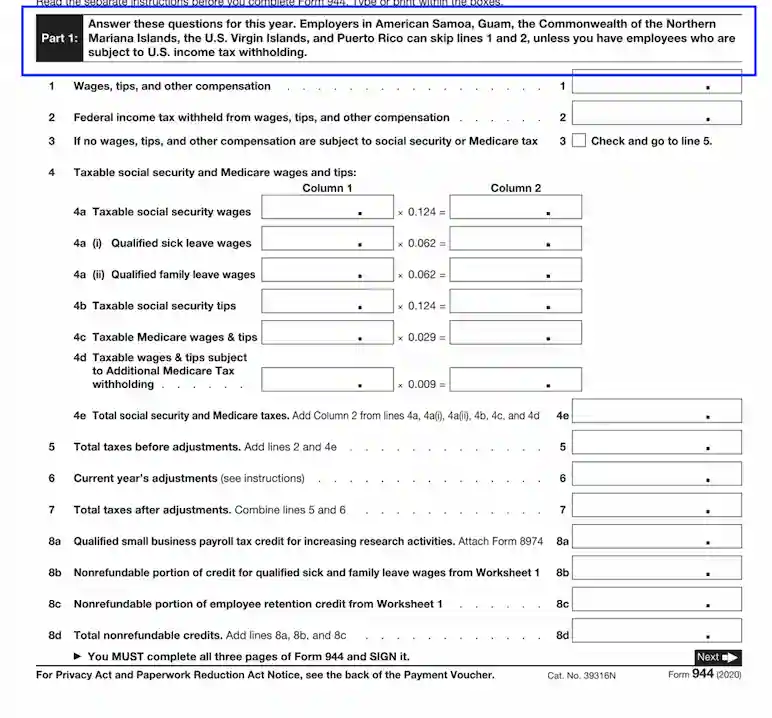

Part I covers aspects regarding the report year taxation, expenses, wages, and withholdings. Insert valid info in the boxes opposite each unit, following the directions of the 1-12 questions carefully.

Residents of the defined regions are exempt from completing units 1-2 unless they have employees whose income is qualified for tax withholding.

Specify the Entity’s Liability to Taxation

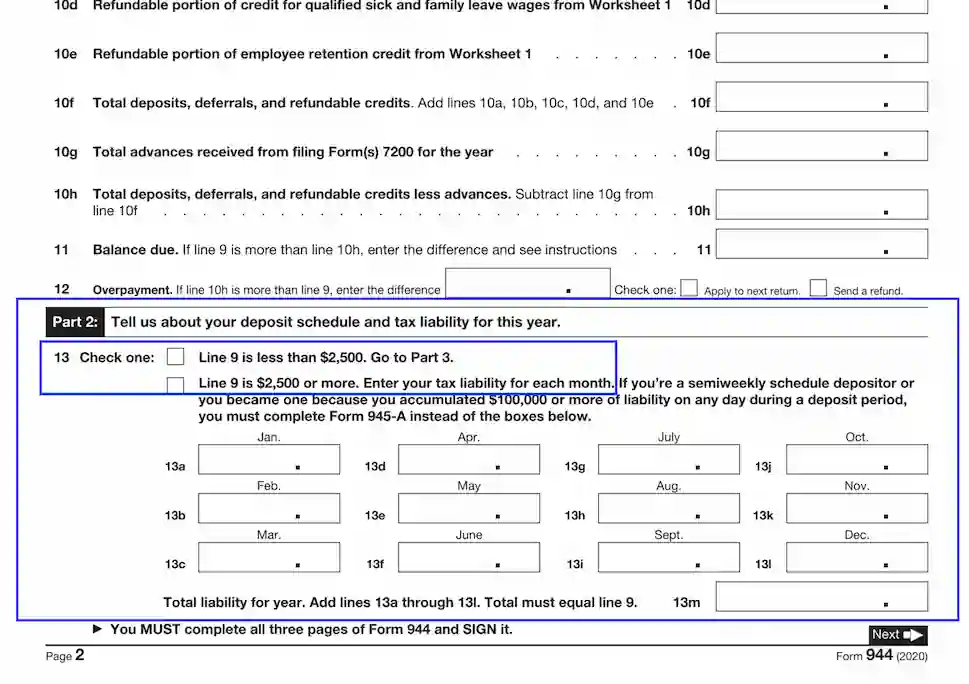

In Part II (unit 13, 13a-13m), the preparer needs to submit their liability to taxation. First, select and tick one box in Unit 13. Revise the amount in unit 9 and checkbox the slot if it equals to or is under 2,500 USD. If the answer satisfies the condition, proceed to Part III instantly.

If the amount indicated on line 9 exceeds 2,500 USD, checkbox the appropriate slot and specify your tax liability schedule for each monthly period. Semiweekly depositors should report Form 945-A instead of completing the referenced schedule.

Describe the Entity or Business

Part III covers aspects that describe inherent data about your business. Answer Units 14-19 where applicable. If any question cannot be applied to your situation, please, leave the space blank.

Authorize an Appointed Person to Negotiate with the IRS

If you acknowledge an appointed third-party person (the tax preparer or any other entity’s employee) to discuss any related topics with the IRS, check “Yes” and provide the designee’s data:

- Legal name

- Address

- PIN (Personal ID number)

Sign Form 944

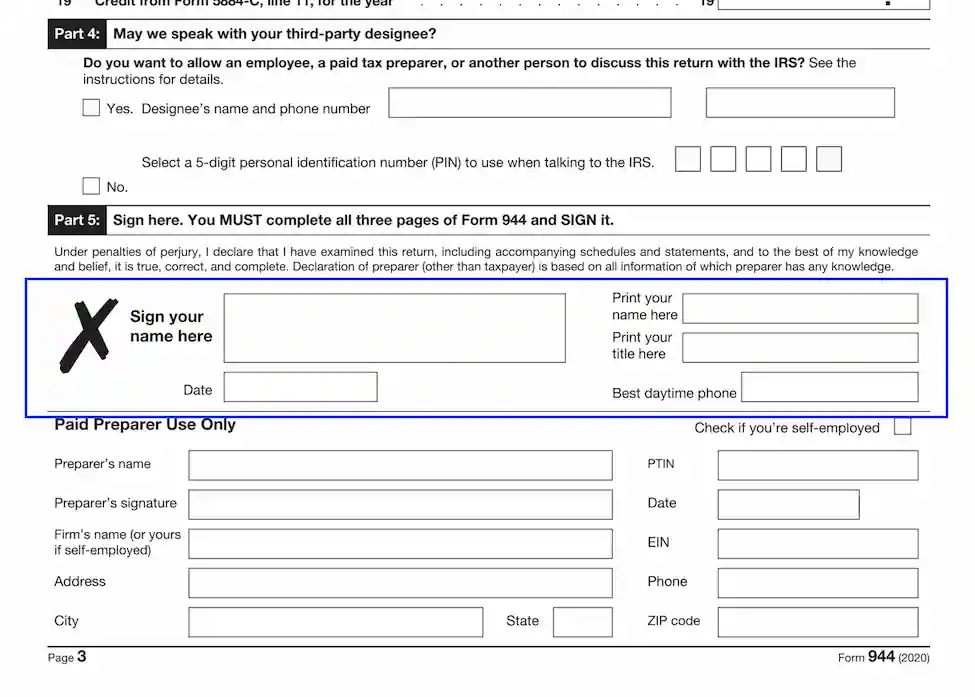

Once you have entered all the required information, append your signature and identify the signatory as follows:

- Current date

- Printed name and title

- Daytime contact phone

In case you have invited a licensed paid specialist to prepare the form, complete the upcoming subsection of Part V.

Introduce the Paid Preparer (If Applicable)

Allow the paid specialist who is preparing this annual tax return to complete the section. Collect the following data:

- The specialist’s name and their PTIN

- Signature

- The company’s name where the preparer is working followed by the company’s EIN. If they are self-employed, enter your entity’s name.

- Address and contact phone number

- Calendar date

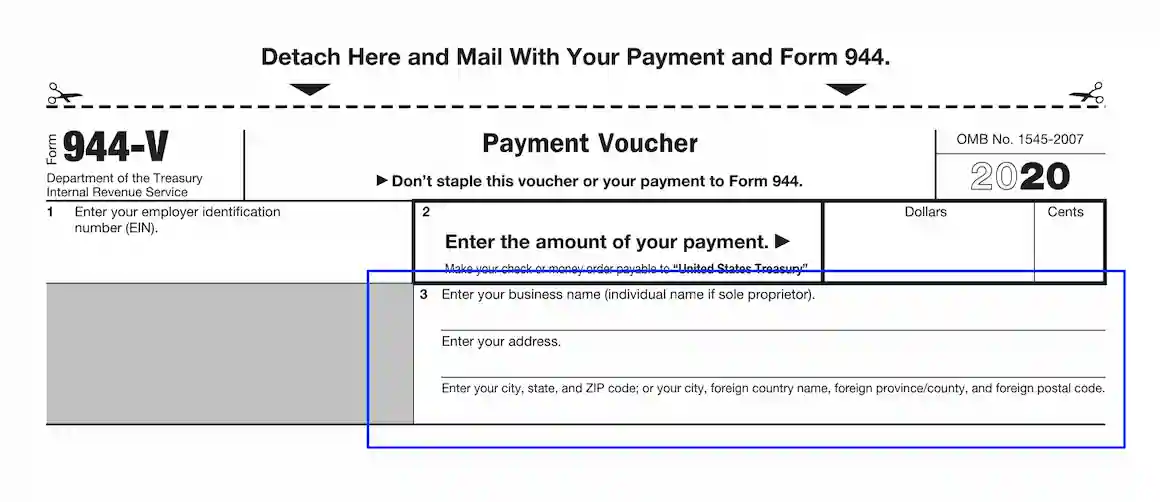

The 944-V Form (Voucher) Guide

The preparer needs to complete and file the payment Voucher 944 together with the return form 944 if they are going to provide payments.

Once the voucher is complete, do not staple it with other papers. Detach it down the dashed line and include a check or money order into the set. It is vital not to send cash. We encourage you to make use of the below-tailored guide:

Specify the Employer ID Number

The number you provide in 944-Voucher must correlate with the data indicated in the afore-mentioned From 944. If the proprietor or the entity has no EIN, they can legally apply for one on the IRS’s official internet portal or fax (mail) Form SS-4 to the IRS. If your application is still pending, use the box signed “Applied for” and specify the date of your request to know more details.

Enter the Payment Amount

Enter the funds you make payable to the “United States Treasury.” Submit the amount in dollars and cents; if the sum is equal, place “00” in the “Cents” box.

Submit the Company’s Details

Here, the authorized person (or the preparer) should enter their business name and complete mailing address. In case you are a sole proprietor, you are encouraged to provide your legal name.