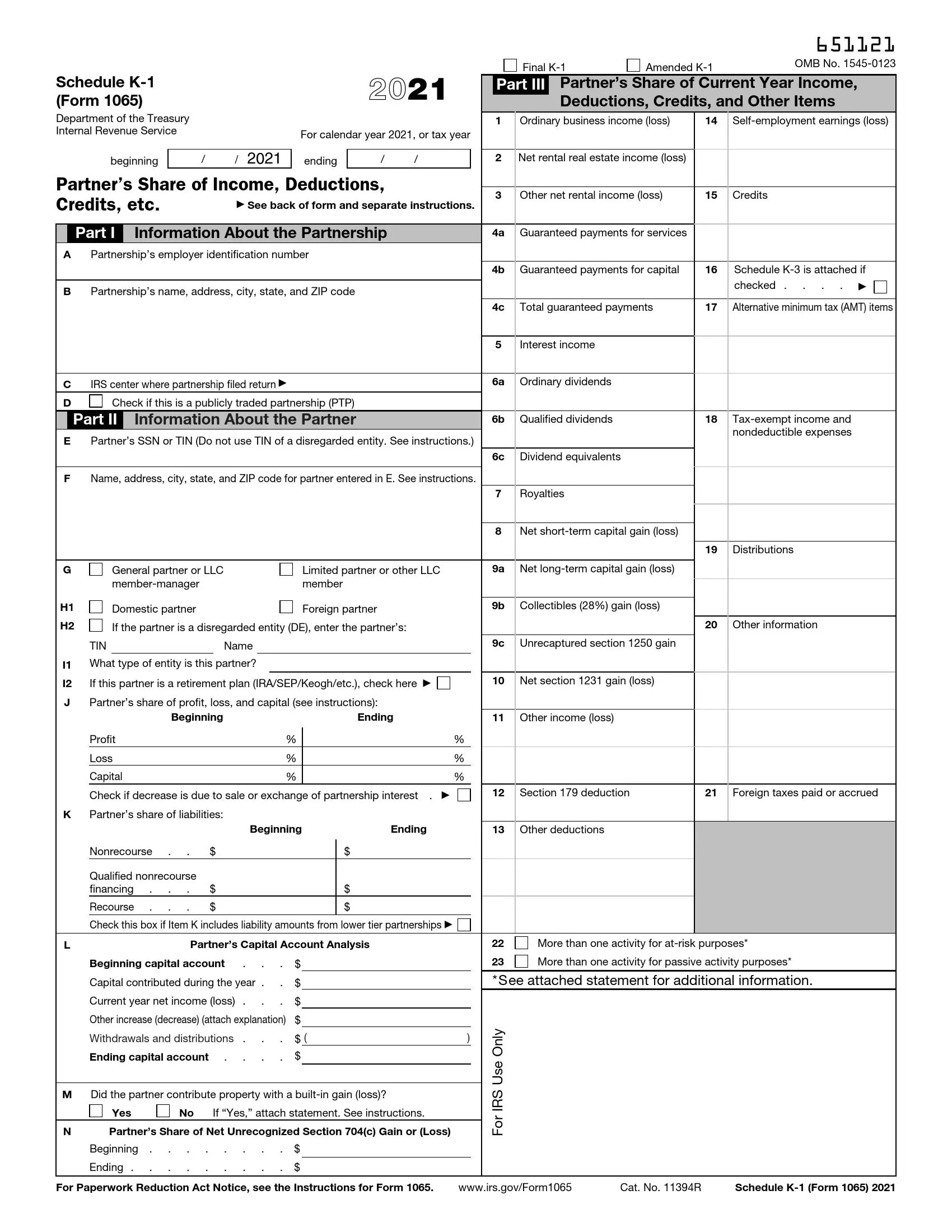

IRS Schedule K-1 for Form 1065 is a tax form used by partnerships to report each partner’s share of partnership income, deductions, credits, and other tax-related items. It is an essential document for partners to report their share of partnership income and deductions on their individual tax returns. Schedule K-1 is prepared and provided to each partner by the tax preparer or accountant. The IRS Schedule K-1 for Form 1065 includes:

- The partner’s identifying information, such as name, address, and taxpayer identification number (TIN),

- Details of the partnership’s income, deductions, credits, and other tax items allocated to the partner,

- Tax-related information is required for the partner to report their share of the partnership’s tax items on their individual tax return.

By completing Schedule K-1, partnerships fulfill their reporting requirements to partners and provide them with the information they need to accurately report their share of the partnership’s income and deductions on their individual tax returns. This form helps ensure proper tax reporting and compliance for partnerships and their partners.

Other IRS Forms for Business

A Schedule K-1 copy should be prepared and completed by each partner. Learn what other IRS forms are required of partnerships.

How to Fill Out the Schedule

You should get the actual Schedule K-1 template before you begin creating the record. You have two options: either visiting the Service’s website and get it there or using our advanced form-building software that can generate you any template you need, including this specific form.

Obviously, the second option is easier and quicker since you are already on our site. Download the file and read our guide to complete the form.

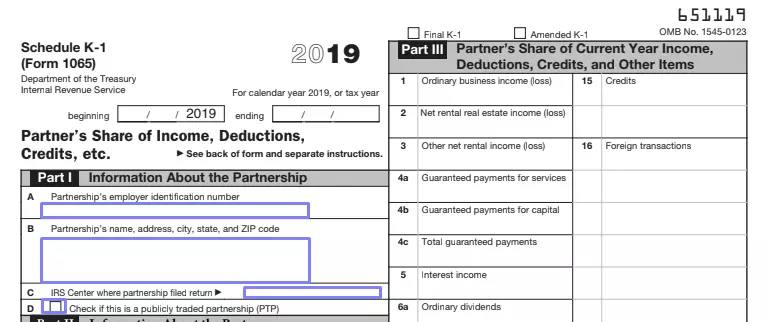

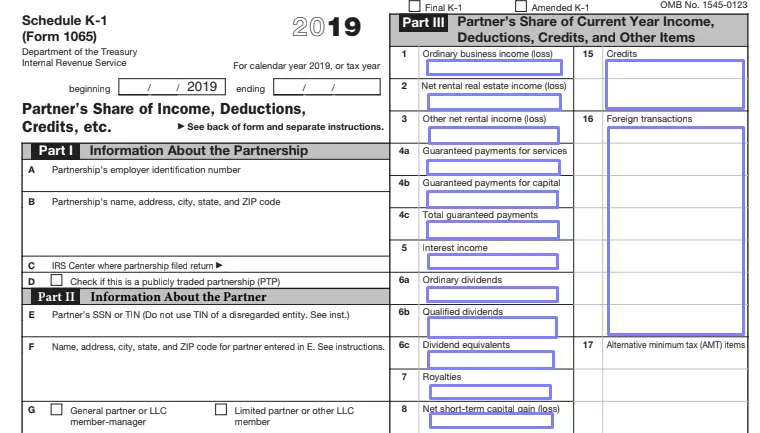

Define the Tax Year

Each entity uses its own time frame (year) to calculate taxes. It often coincides with a calendar year, but sometimes there are exceptions. Write the dates your partnership uses in the line on the form’s top.

Describe the Partnership

Below the year, you will see four boxes where you have to add details about your partnership. Enter its employer identification number (or EIN), name, and full address. Then, specify to which office the entity’s tax return was submitted previously. If you are a member of a publicly-traded partnership (or PTP), mark the box below.

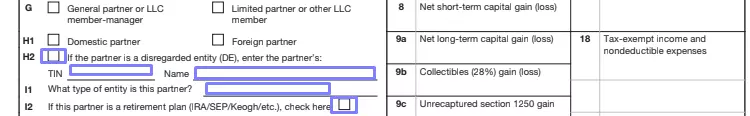

Add Your Data

You, as a partner, must introduce yourself as well. In the first line, write your SSN (social security number) or TIN (tax identification number). Provide your name and address. Choose if you are a general or limited partner; then, mark if you are a domestic or foreign partner.

If you are a disregarded entity (DE) partner, mark the relevant box, insert the TIN and name, and provide the required details.

Describe your share as a percentage in the beginning and ending of the considered year for profit, loss, capital, and liabilities. Then, analyze your capital account by adding the required numbers (the beginning and ending capital account, capital invested during the year, withdrawals, and other items).

If you have invested any property with a built-in gain or loss to your business, choose a relevant answer and add a required attachment described in the IRS instructions. Then, look at Section 704(c) in your Form 1065 and write the number in the designated line.

Define Your Share of the Year

Before you start completing this massive part, pay attention to the template’s second page. Here, you will find tips on the data you have to include. Each line indicates the IRS guidelines or forms you can use to extract the needed numbers correctly.

Generally, this part serves as a description of your share from the business’s income, credits, deductions, and other items. Here, you might need the help of your accountant, your old records (including various IRS forms), and a completed Form 1065 because you will have to insert various numbers.

Step by step, you will add ordinary business income or loss, net rental income from various sources, guaranteed payments, interest income, dividends, royalties, deductions, self-employment earnings (or loss), credits, foreign transactions, distributions, and other info. Follow the template to understand what numbers go where.

If you are missing some numbers or cannot define what to write in the form, we advise asking for professional help. You should always remember that providing untruthful or incorrect information in such forms is illegal, and you may get in huge trouble for that.