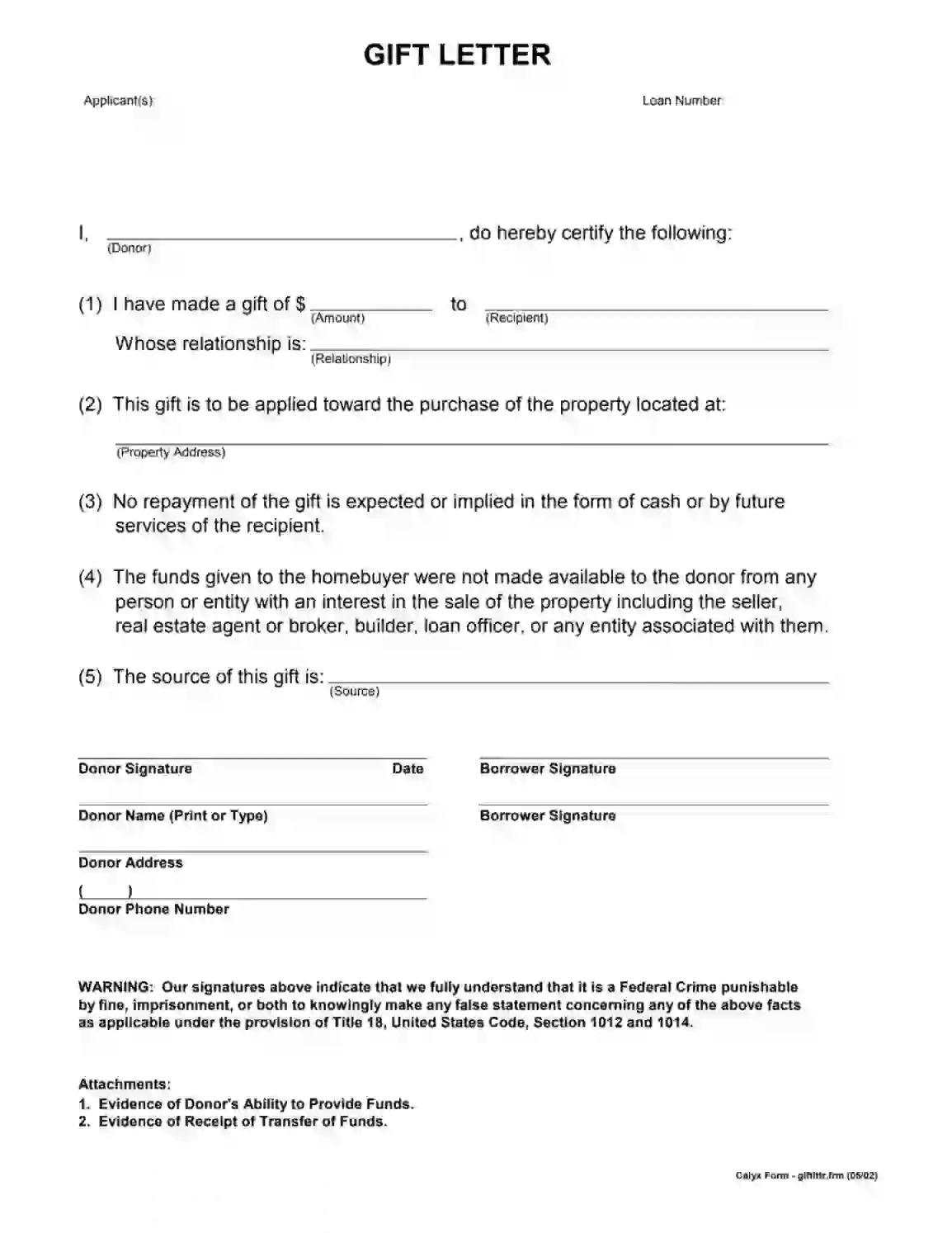

A Gift Letter is a formal document used to confirm that a sum of money has been given as a gift and that this gift does not require repayment. The letter typically includes details such as the donor’s name, the amount gifted, the recipient’s name, their relationship to the donor, and the purpose of the gift — often for helping purchase a property.

The form clearly states that the gift is not a loan and no repayment is expected, either in money or services. Additionally, it asserts that the funds were not sourced from anyone involved with the sale of the property, ensuring there is no expectation of financial return to the donor. This document is crucial in financial transactions involving gifts because it verifies that the funds are genuine gifts, not an additional loan, which could affect the recipient’s ability to secure financing.

Other Business Forms

Do you require other business PDF forms? Look at the selection just below to see what you can fill out and edit with our tool. Moreover, keep in mind that you are able to upload, fill out, and edit any PDF at FormsPal.

How to Fill Out a Gift Letter

To make it easier for you, we introduce our detailed instructions regarding the Gift Letter creation. With our guide, you can complete the Gift Letter template quickly and effortlessly.

Hereunder, we will take a closer look at an example of the Gift Letter designed to give a certain sum in US dollars to someone, so they can use the money to buy real estate. Please note that the structure and data you include are more or less the same for all Gift Letter types.

- Download the Relevant Template

Before you start completing the Gift Letter, use our form-building software to get the proper letter template. You will receive the needed file in seconds.

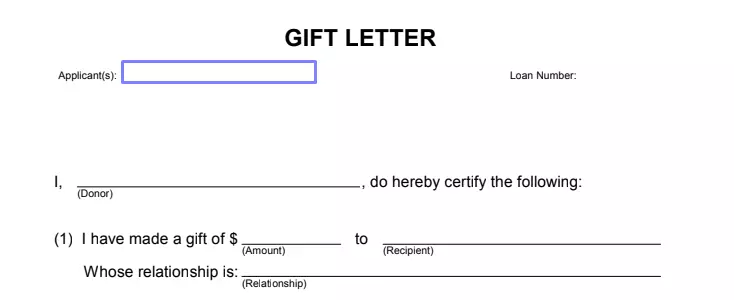

- Name the Applicant(s)

You have to introduce the recipient of your gift. It should be the same person that applies for the loan to purchase real estate.

- Insert the Loan Number

On the right-hand side, enter the loan number that belongs to the applicant.

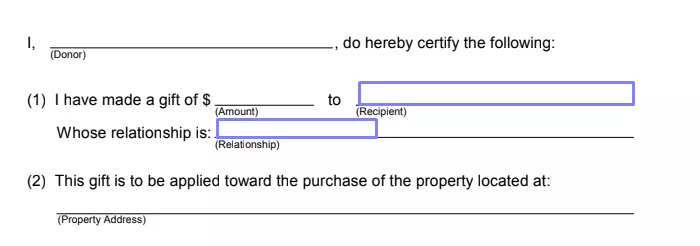

- Introduce Yourself (as a Donor)

As the person who gives the money (or a donor), you have to introduce yourself. Write your full name in the designated blank space (as shown in the picture).

- Add the Given Amount

Indicate the total amount of money in US dollars that goes to the recipient.

- Define the Recipient and Relationship

You should write the full name of the recipient. Then, describe your relationship with that person (whether you are their spouse, parent or child, brother, sister, friend, and so on).

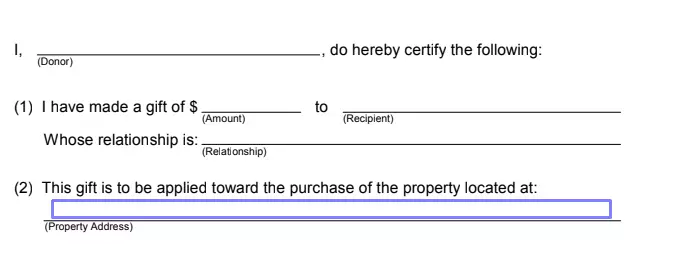

- Write the Subject Property Address

As you hand your money over to cover a real estate loan, you should specify the location of the subject dwelling property. Add its full physical address, including the state, city, and postal code.

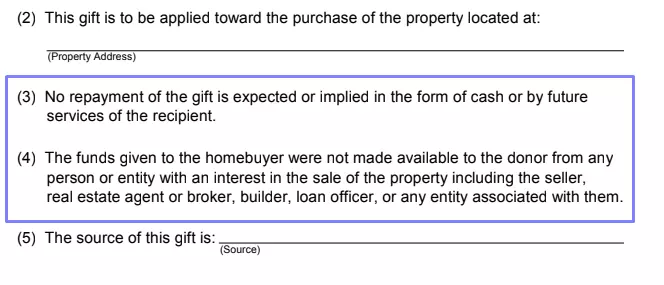

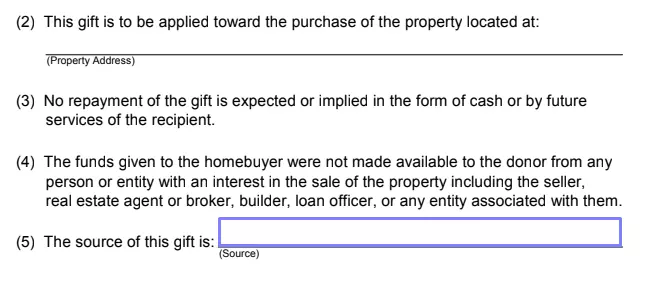

- Read the Following Statements

After filling out the property address, you will see two statements that describe the gift. For instance, you should confirm that you do not expect the recipient to return the money. Read both statements attentively and accept them.

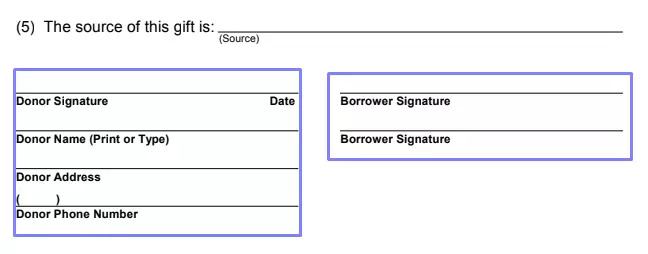

- Define the Gift Source

In this section, you have to explain how you obtained the money that you’re handing over as a gift. Write the income source in the relevant blank field.

- Sign the Letter

Both the donor and the recipient have to sign the Gift Letter.

On the left-hand side, the donor leaves the signature and dates the letter. The giving party should also insert their full name, address, and contact details (a valid phone number will be enough). On the right-hand side, the recipient (or the borrower, as stated in the Gift Letter template), has to put the signature.

This document does not require notarization. However, notarizing or witnessing legal forms in the United States ensures the paper’s validity. Thus, it is a good idea to notarize it.