The HUD-1 Settlement Statement is a standard form used to itemize all charges imposed upon a borrower and seller during a real estate transaction. This form is used primarily for transactions not involving a sale, such as refinancing and reverse mortgages, and was required for all federally related mortgage loans.

The HUD-1 Settlement Statement form provides detailed information about the transaction, including the buyer’s and the seller’s financial obligations, fees paid to various entities, and adjustments between the buyer and seller for items such as taxes and utilities. The purpose of the HUD-1 is to give both parties a clear understanding of the charges and adjustments, ensure the transaction’s legality, and provide a detailed receipt of the settlement costs and loan terms.

Other Business Forms

Check a few other business PDF files readily available for editing via our tool. Additionally, do not forget that it is easy to upload, fill out, and edit any PDF form at FormsPal.

Filling Out the Form

If you are the purchaser, our guide might help you understand what legal specialists include in the form when they create it. We would also like to remind you that you do not have to fill anything out, but it is crucial to figure the form’s content out in advance not to be misled and to avoid any possible faux.

If you are an agent who lacks experience, you can check our instructions below. Although they might seem a bit overly simplified, they contain the basics. But we also recommend consulting your colleagues or mentors at work before you deliver the prepared document to your clients and their lenders.

Initially, it would be best if you got the template to fill out. Because HUD is the author of the form, you can get it at their website. However, our form-building software is developed specifically for generating any legal templates you need, and we suggest you use it to get the document without leaving our guide. After you find the template, move to the completion steps below.

Outline the Deal Parties and Basic Info

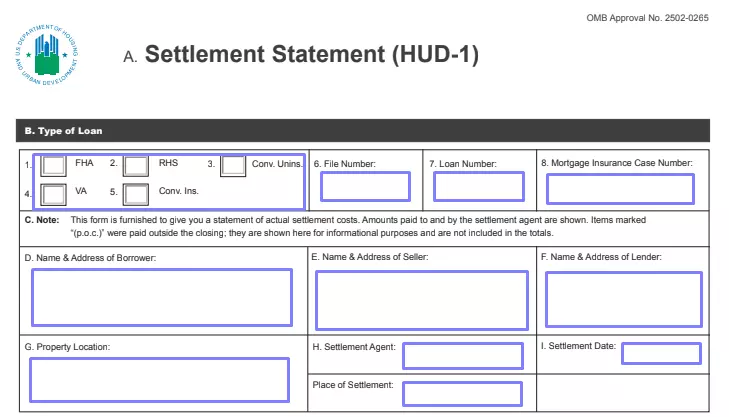

The form’s pages contain various charts that you have to fill out. The first chart you will see consists of sections from A to I. These sections tell about the deal parties and settlement.

Choose the applicable loan type in the first field. Then, insert three numbers step by step: file number, loan number, and the number of the mortgage insurance case.

Read the note in box C. It warns you about the certain sums you will include in the form to inform the client but will not add them to the total amount to pay.

Write the names and full addresses of all three parties: borrower, seller, and lender. Define the real estate’s location (if there is no address yet, you must provide at least a postal code). Lastly, add the place and date of settlement alongside the agent’s name (your name).

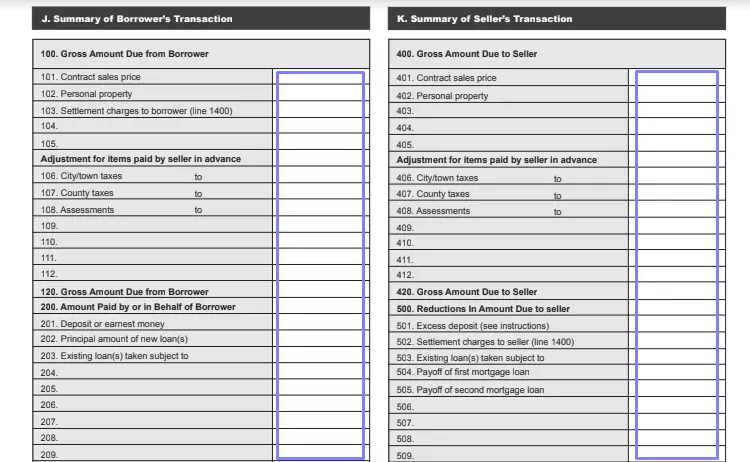

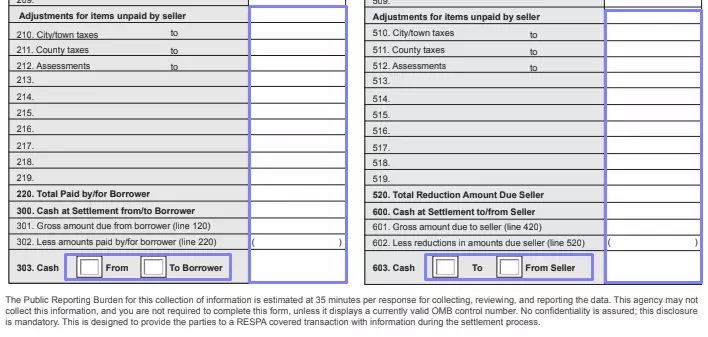

Complete Summary for the Loaner and the Seller

There are two charts with the same lines: one for the borrower, another for the seller. You do not have to complete both of them: it is enough to complete the borrower’s part on their copy and the seller’s part on the other copy separately.

Add the contract sales price, personal property costs (if there is any tangible item sold separately), settlement charges (for the borrower only, taken from the next page). Define the taxes, amount paid by the borrower, and other figures entered in both charts for the borrower and the seller. There are also empty lines you can use if you have additional relevant points to include.

If you have any concerns regarding the numbers you should write, remember to consult with your colleagues or HUD personnel. The Department also offers its instructions on the form.

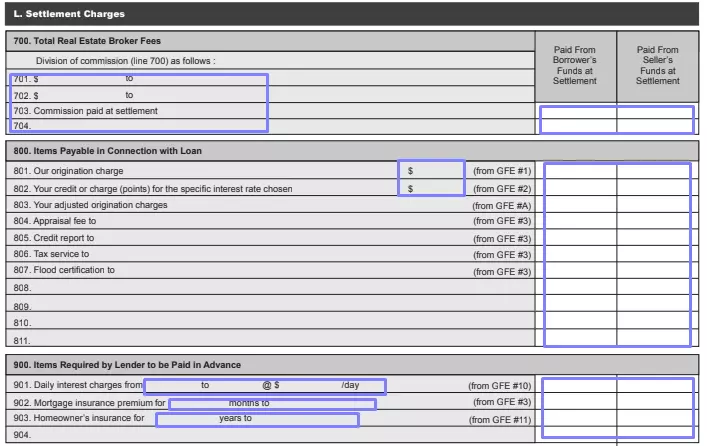

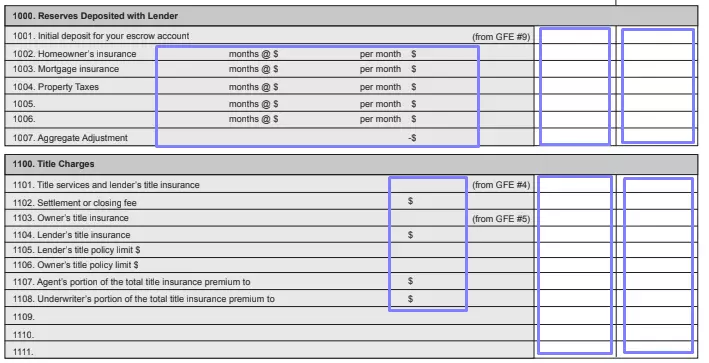

Enter the Settlement Charges

Then, you must include the fees for the deal settlement: real estate agent fees in total, payable items tied to the loan, items required by the creditor (that loaner must pay in advance), sums to pay for the government recording, title fees, and reserves deposited with the creditor.

If you have some more items to include, there is a special section for additional items at the end of the chart. Sum all the items you have inserted, put the result in line 1400 and designated lines of the “borrower” and “seller” charts above.

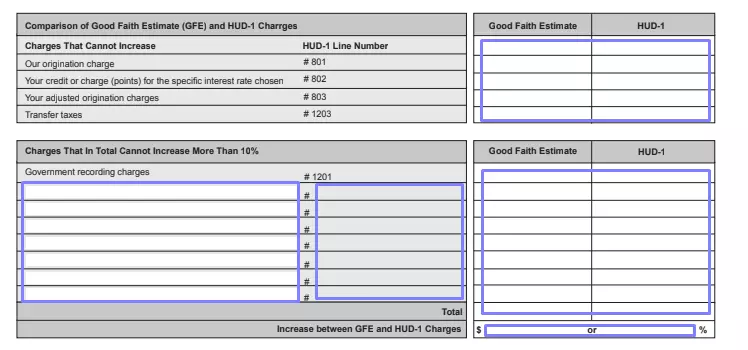

On the third page of the form, you shall state which settlement charges may change in the future (increase or decrease).

Define the Loan Conditions for the Loaner

The form’s last section describes the primary loan conditions the borrower should know. Write the initial sum given to the loaner, term (in years), the interest rate at the beginning of the deal. Insert the initial amount per month that the borrower owes for principal, interest, and insurance.

Answer if the interest rate can increase: if no, mark the relevant box; if yes, mark the box and describe the conditions nearby. Then, reply to other questions about the loan sum for the borrower to help them understand all the loan details.

Issue the Form to All Concerned Parties

After the document is ready, give the copies to every party mentioned there. Borrowers and creditors will need to check all data you have written.