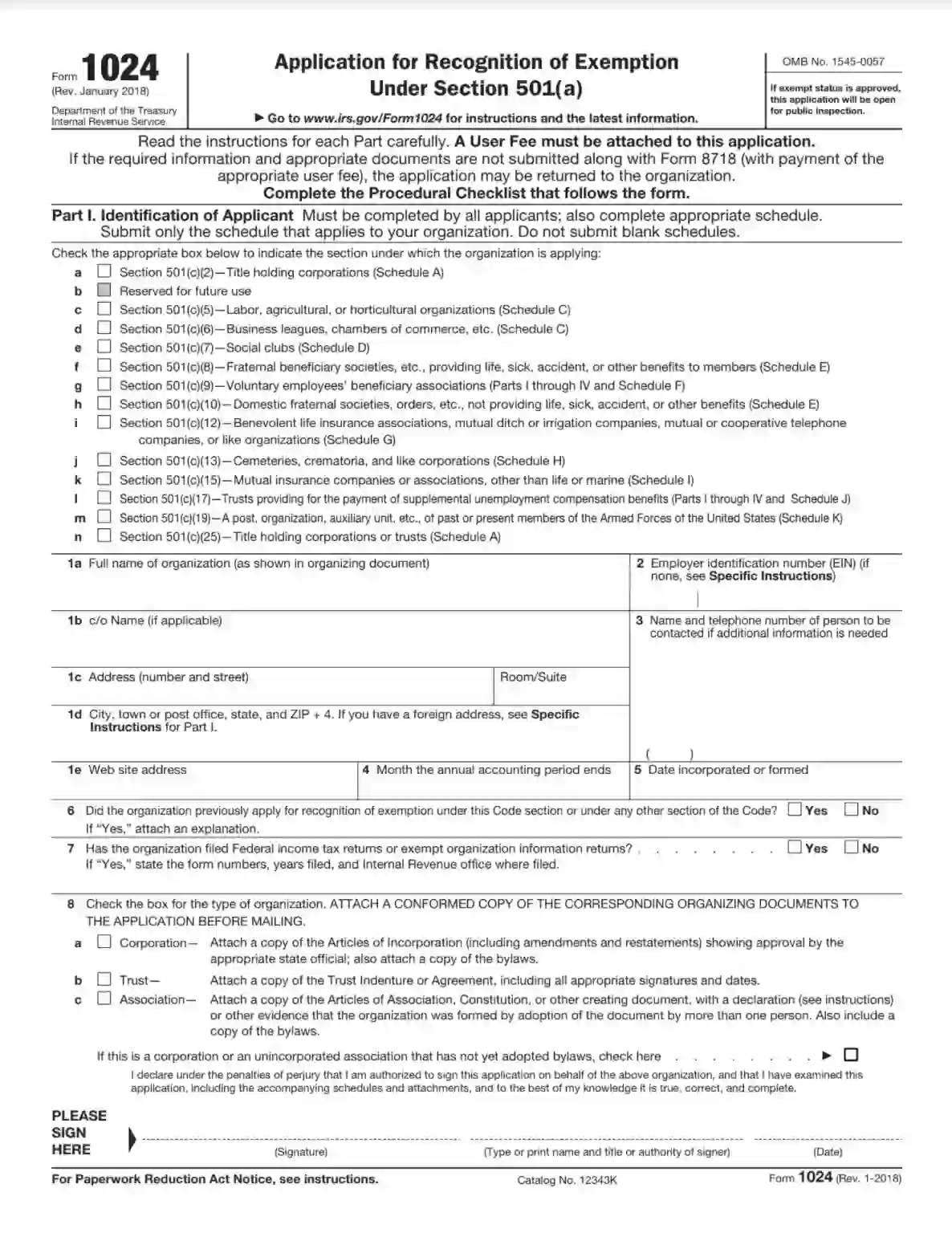

Form 1024 is an application used by organizations seeking tax-exempt status under sections other than 501(c)(3) of the Internal Revenue Code. Specifically, it applies to various types of organizations, including those exempt under sections 501(c)(4) through 501(c)(9), such as social welfare organizations, civic leagues, and local associations of employees. The form requires detailed information about the organization’s purpose, activities, and financial data to determine eligibility for tax exemption according to the specific section under which they apply.

Form 1024 establishes that an organization qualifies for tax exemption under its respective section of the IRS code, which is crucial for legally avoiding federal income tax liabilities. Successful completion and approval of Form 1024 grant an organization official recognition of tax-exempt status, which can be vital for its operations, especially regarding eligibility for certain grants, governmental legitimacy, and credibility with potential donors. Unlike IRS Form 1023, specifically for charitable organizations, Form 1024 covers a broader range of non-profit entities with different operational purposes and benefits.

Other IRS Forms for Partnerships

If you have already filed the Form 1040, you might need to file more forms, depending on the complexity of your finances. Check what IRS forms are often filled out by our users along with the standard tax return form for individual taxpayers.

How to Fill Out IRS Form 1024

Claim for Recognition for Exemption 1024 Form is rather complex, and the full variant contains more than 20 pages of statements to answer and schedules to complete. We encourage you to make use of our PDF templates generated through the latest online tools, checked by our specialists, and correctly updated. Also, you can find the referenced document on the IRS official website.

The preparer doesn’t need to complete all 20 pages. In the majority of cases, the organizations are expected to fill out the first three compulsory parts and a schedule, defined by the exemption code details indicated in the first section. The applicants should not file blank schedules; make sure to comply with this requirement.

Follow the guide below to learn how to fill out the 1024 application form.

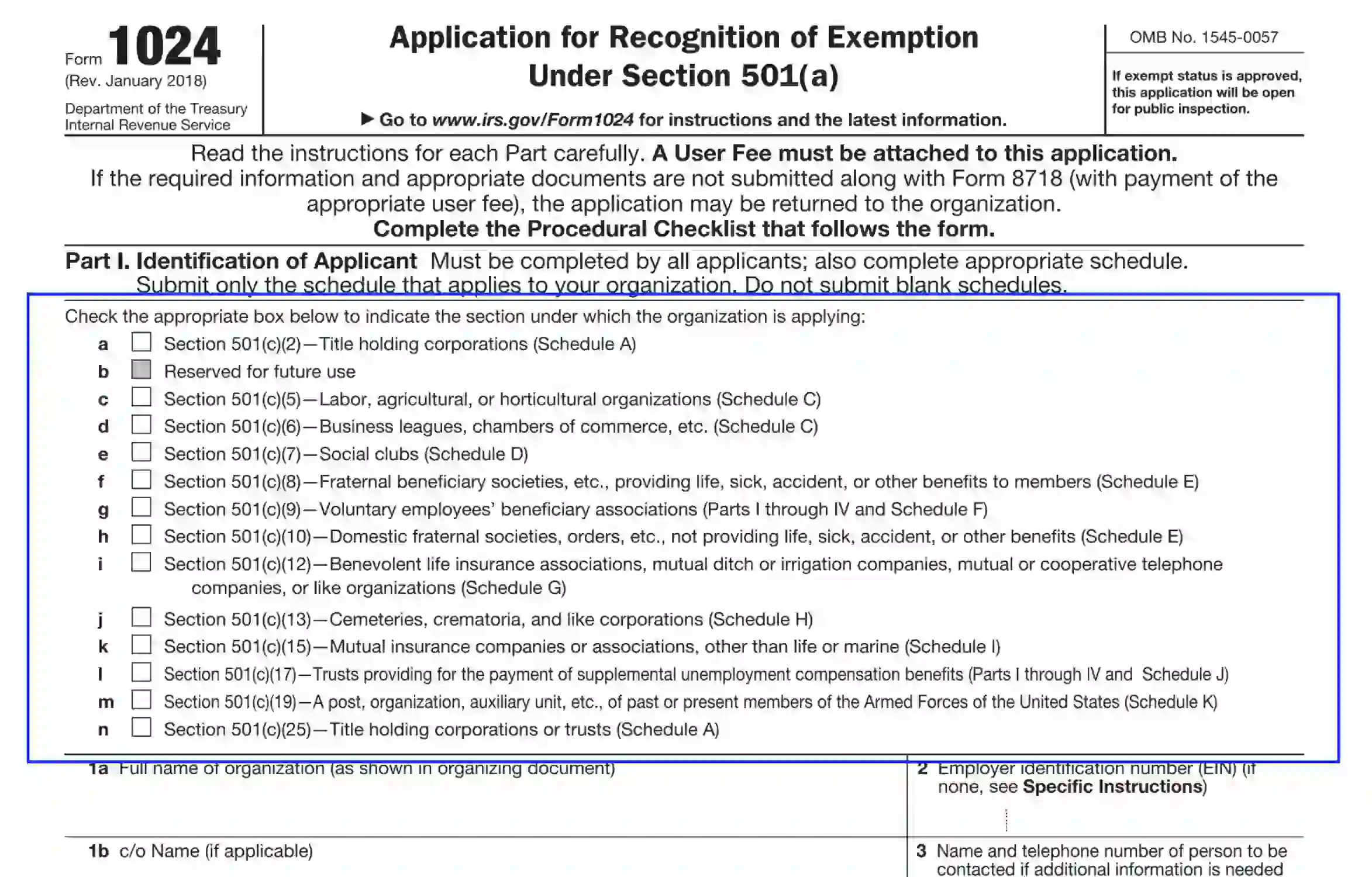

Specify the Law Criteria

In the heading Unit, the applicant must select the correct legal criterion which defines their exemption status and regulates the application procedure. Select one that applies and ensure to complete the corresponding schedule section requested by the law.

Identify the Claimant

Follow the requirements of Units 1a through 1e to introduce the applicant. Submit the correct info as follows:

- Organization’s full legal name as indicated in official papers

- Organization’s coextensive name under which the entity operates (if any)

- Address, including number and street, room, city, state, and ZIP data

If the organization is located in a foreign territory, submit the info as follows: city, region, country, postal code. Be careful not to subtract the foreign country name.

- Web page address

Submit the Tax ID Data

In Unit 2, the preparer should enter the organization’s employer ID number containing nine characters. If the entity doesn’t possess one, it must apply for the EIN at the IRS. The easiest way to comply with the demands is to apply online or by phone. The claimants can learn all the necessary details on the IRS official online portal.

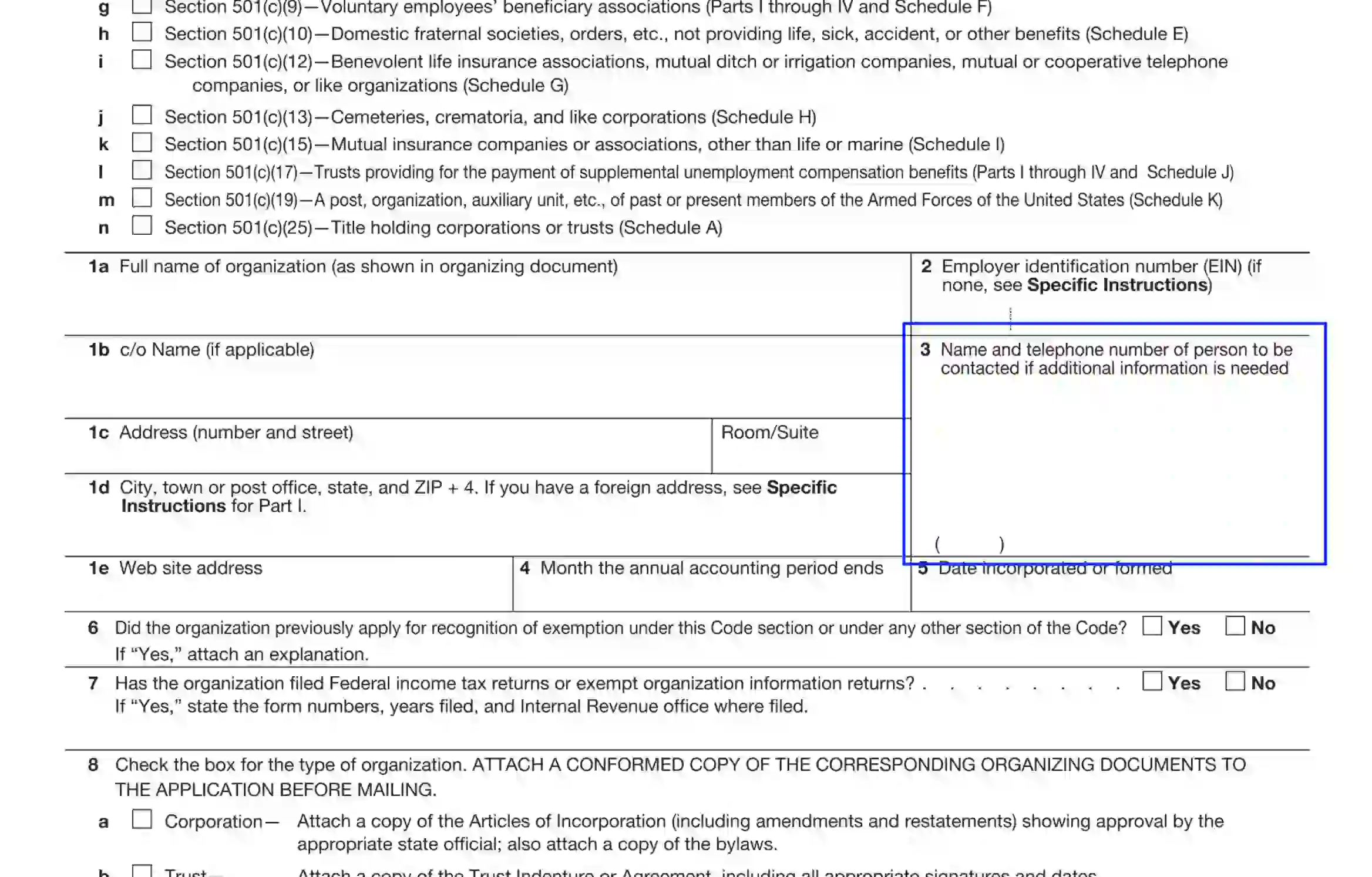

Designate the Contact Person

In Unit 3, the claimant should appoint the person responsible for contacts with the IRS in case it is needed. This could be the director, the officer, or the organization’s employee with the POA rights to be aware of the organization’s activity and be able to operate on the entity’s behalf. Enter the person’s name, title, and business phone number.

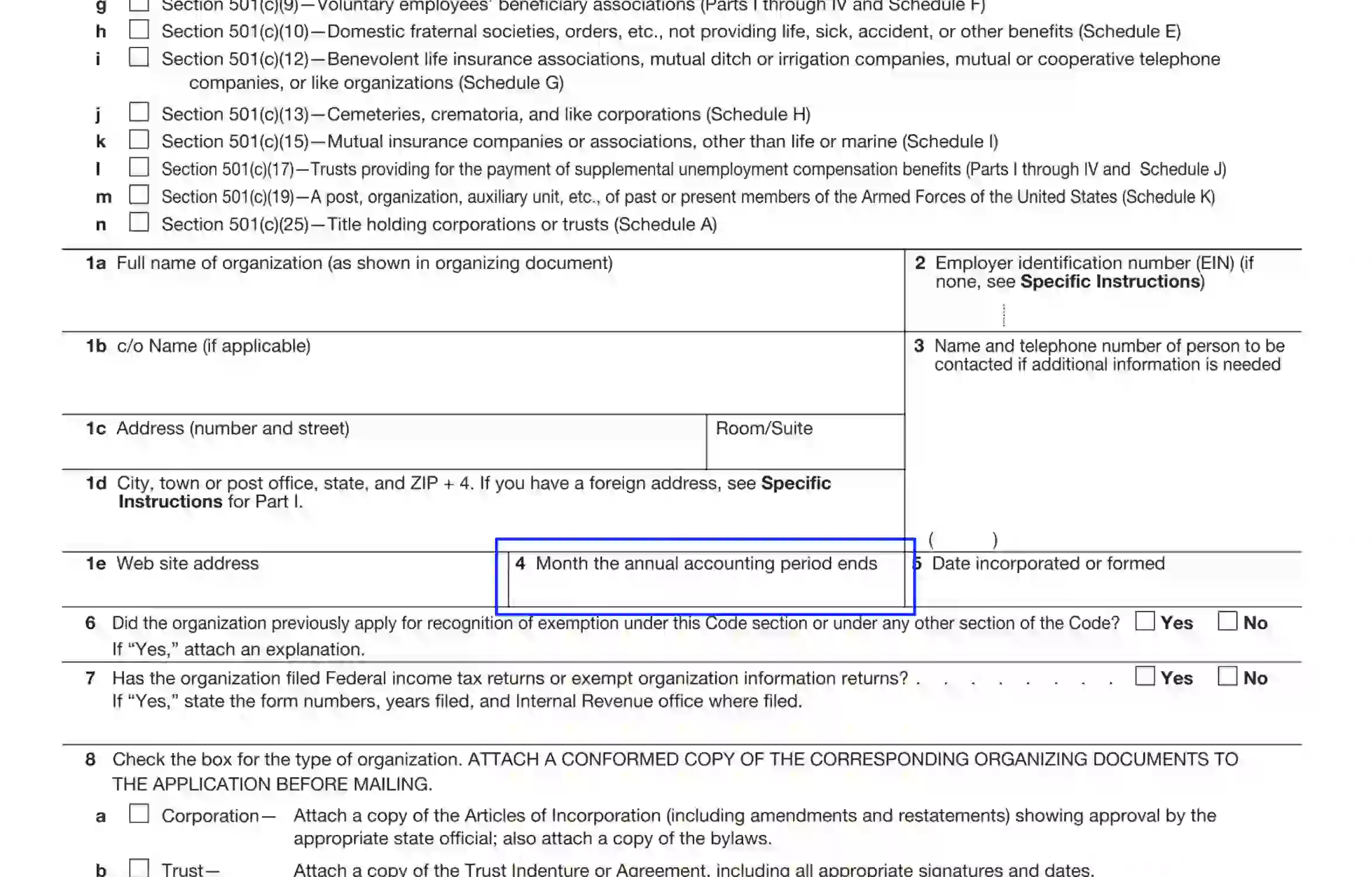

Specify the End of Accounting Cycle

In Unit 4, the preparer should enter the date when the corporation’s accounting period finishes annually. As a rule, most organizations have a 12-month cycle.

Specify the Date the Organization Was Formed

In Unit 5, the claimant enters the date when the corporation became legally recognized.

Clarify the Tax Exemption-Related Details

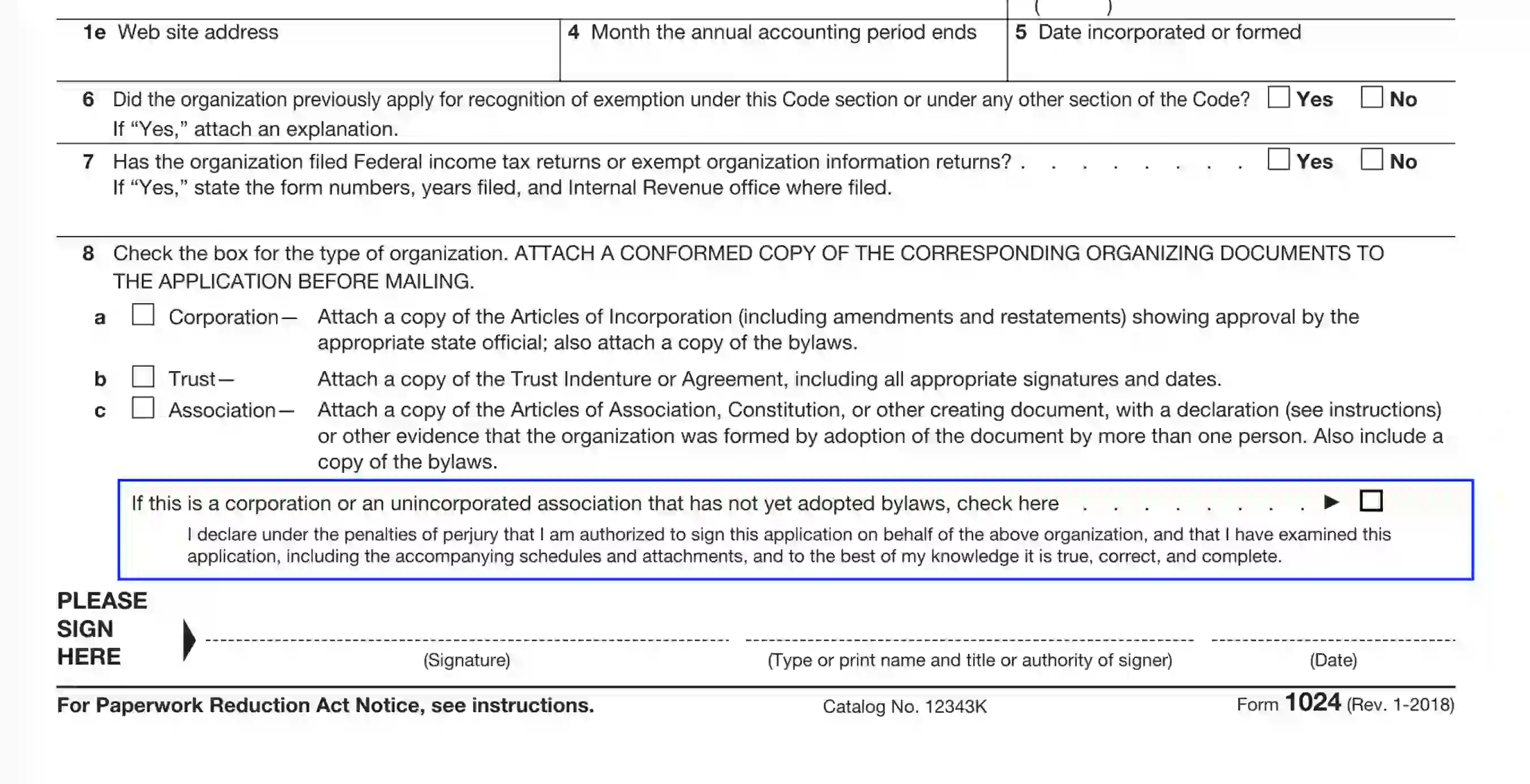

Units 6 and 7 are needed to clarify the tax exemption-related aspects. Line 6 defines if the corporation has previously applied for the tax exemption status. Line 7 specifies if the organization has previously filed tax returns under tax exemption status. Both units offer “Yes-No” polls.

Define the Organization’s Category

In Unit 8, the claimant must indicate which category the organization belongs to and provide appropriate proof of identification. Each alternative requires filing specific validation.

If neither 8a through 8c is applicable as the organization hasn’t worked out and signed bylaws, you need to check the corresponding box below the 8c line.

Authorize Part I Claimant’s ID

The organization’s authorized representative should complete Part I by appending their signature, printed name, and title. Also, the current calendar date must be indicated.

Submit the Activities and Operational Data of Part II

This section reveals extensive information regarding the organization’s activities and operations. There are 16 lines to be completed by all applicants. It is important to provide a detailed description of all required aspects. Therefore, follow each statement’s requirements and disclose the following info:

- Each activity should be listed separately in Unit 1. Also, data regarding the operating time and the recipient are required.

- Sources of financial assistance at the organization’s disposal are submitted in Unit 2.

- High penal identification, including the directors, officers, trustees, and other authorized employees, should be described in Unit 3. Also, include the compensation amounts.

- If there are any forerunner entities, name each organization and the reasons for its termination in Unit 4.

- Any collaborations and plans to merge with other organizations are disclosed in Unit 5.

- Stocks, shares, and dividend data should be listed in Unit 6.

- Membership requirements are defined by Unit 7.

- If terminated, describe how the organization’s property will be distributed. Make use of space provided in Unit 8.

- In Unit 9, specify if the organization programs to distribute the property among the shareholders. If the “Yes” alternative is selected, disclose the details in the provided space.

- If there are receipts to be disclosed, clarify the details in Unit 10.

- Arrangements to refund the services executed by the organization’s shareholders are described in Unit 11.

- Any insurance instructions should be stated in Unit 12.

- If the organization is superintendent by any public regulatory body, disclose the details in Unit 13.

- Leased assets and the estate should be listed in Unit 14 (if applicable).

- If the organization finances candidates and elections for state or federal positions include the info in Unit 15.

- In Unit 16, the preparer should specify if the organization is operating in any publishing activity.

If the claimant answers positively to any statement, they must provide a detailed description and attach requested copies of papers where appropriate.

Complete the Part III Financial Info

In this section, the preparer should fill out the financial data for the tax year at issue. Also, disclose the corresponding info for the three prior tax accounting periods. Should the organization be operating for less than 12 months, submit the potential expenses and income amounts. The claimant is expected to give comments regarding the below-listed aspects:

- Gains

- Expenses

- Properties

- Tax and Payments Liabilities

- Net Assets

In some situations, the organization might have adjustments to financial activities declared originally. If this is your case, check the box at the bottom of Part III and provide an extensive explanation in attachments.

Prepare Part IV Only If Qualifying

This sector is fulfilled only by organizations that are applying under Section 501(c)(9) or Section 501(c)(17) of the IRS Code. Answer the poll offered by the part and rely on the directions stated in each unit.

Organizations that apply under other statutes and regulations are expected to skip Part IV and proceed to complete the needed schedule indicated in the Part I Heading Unit.

Fill Out the Required Schedule

Once the organization is through the obligatory Parts I-III, the preparer must complete and attach the schedule defined by the IRS Section selected in the Heading Unit. There are ten documents to choose from. Each Schedule form contains short instructions. The paperwork must be filed with the 1024 Application Form.

The set of documents should be delivered to the IRS address shown on the introductory page to the 1024 form.