Form 1099-B is a document issued by brokers or barter exchanges that summarizes the proceeds of all stock transactions. The Internal Revenue Service (IRS) uses it to track individuals’ gains and losses from selling stocks, bonds, mutual funds, and other securities throughout the tax year. This form includes information such as the date of sale, the cost basis of the securities sold, the amount of proceeds from the sale, and whether the gain or loss was short-term or long-term.

This form is essential for taxpayers to accurately report their capital gains and losses on their tax returns. It ensures that all necessary details about each transaction are available for accurate tax calculation, helping to prevent errors and possible audits. IRS Form 1099-B is also essential for preparing accurate tax returns for individual investors, as it helps them determine the precise amount of capital gains or losses for the year.

Other IRS Forms for Self-employed

There are a lot of IRS forms businesses need to use to report financial information to the IRS. Look through some other commonly used forms.

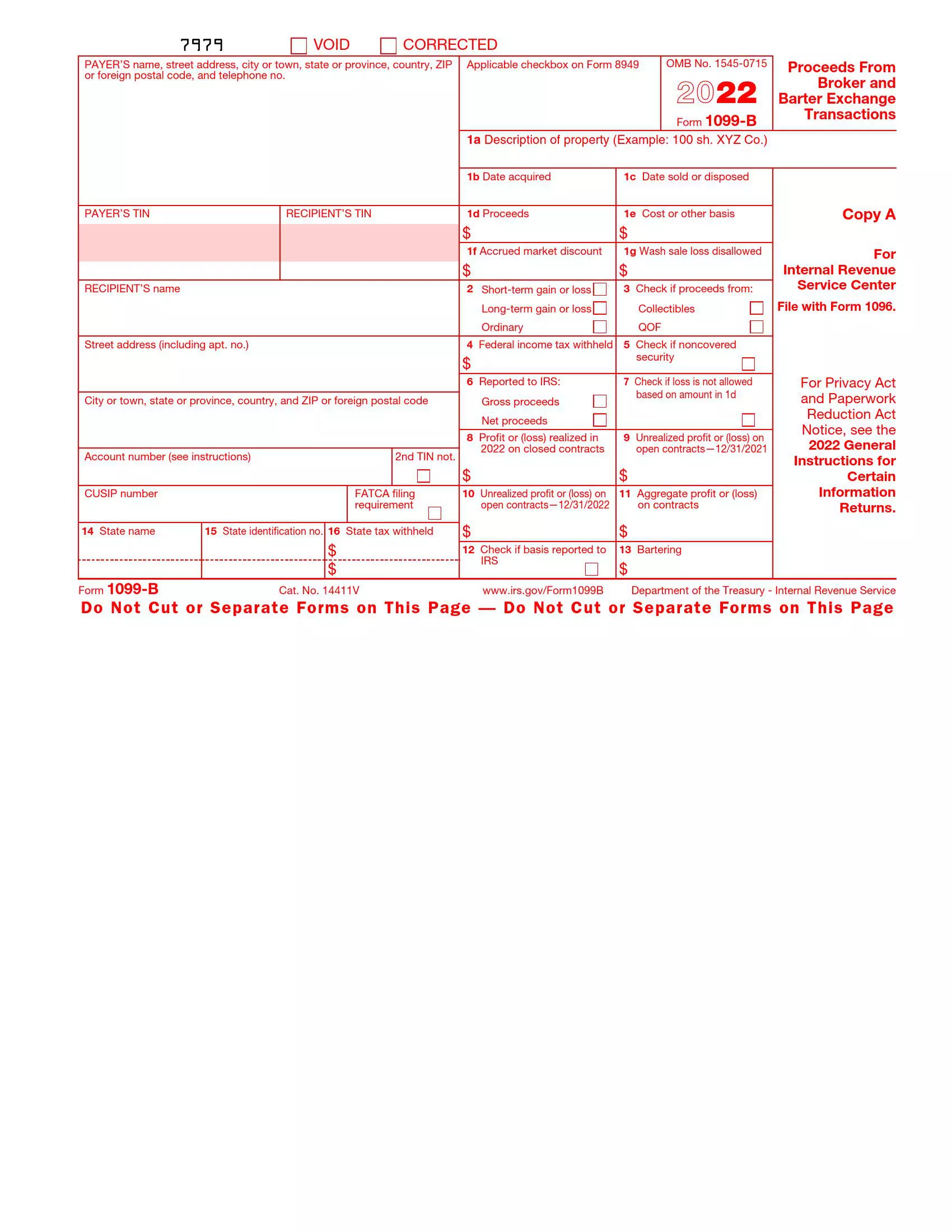

How to Fill Out the 1099-B Form

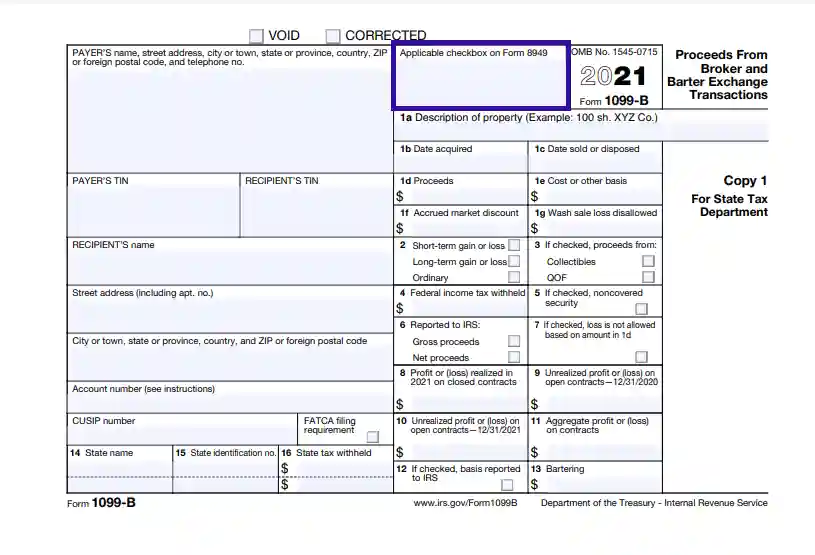

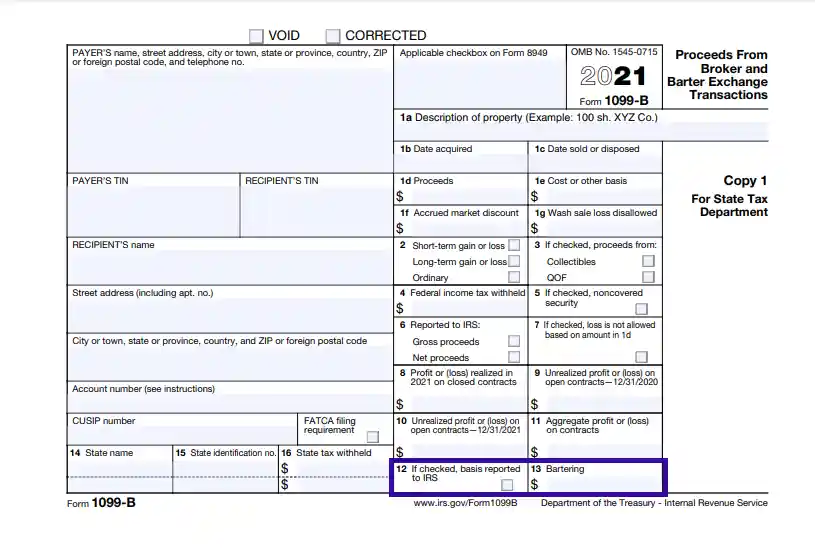

This Form consists of several copies, and while Copy A is only available for information purposes, other copied of it may be filled out and filed online. We encourage you to use our latest software developments to create a customized legal form you need and edit the PDF document online, which is very convenient. Copy A is filled out by the broker and goes straight to the IRS for record and information purposes. So, keep that in mind when filling out the Form.

Below, we suggest you a comprehensive guide that you can use to fill out the form accurately and effortlessly. Read the compilation instructions on the official website to get acquainted with the specific terms and definitions before you proceed to fill out the Form. Once you do, ensure to follow the guide below step-by-step.

Checkbox the Form Status

At the very top of the Form, you will get two options to designate its current status: Void or Corrected. These are the options you get, as the first copy will already be at the IRS office once you receive yours. Copy A is the one that has to remain scannable. If you have noticed some miscalculations in the original Form, you can make your corrections or request to recognize it as void and send it to the Revenue office.

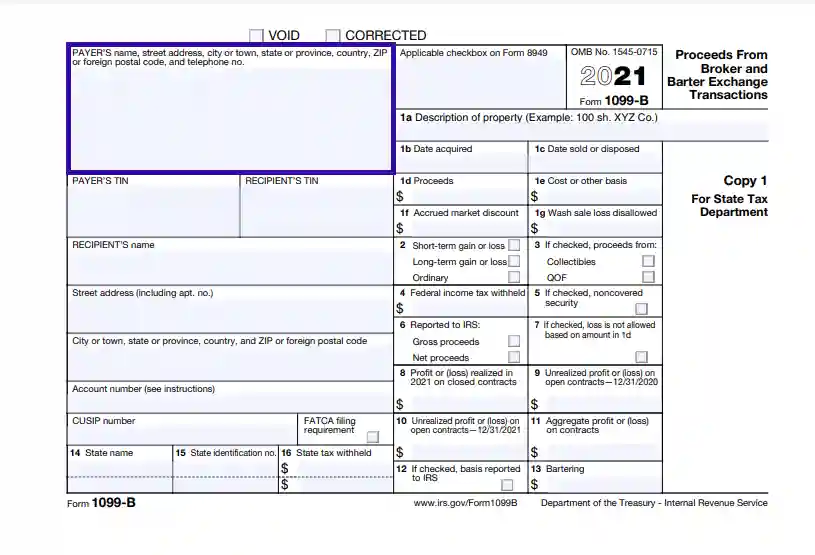

Indicate the Payer’s Name, Address, and Contact Info

In the first section of the form, you need to provide the full legal name and address of the Payer (the one that held the sales transaction and the one that received gains or losses from it). Include the payer’s contact information in this section as well (usually, a daytime telephone number is enough).

Provide the TIN of the Payer and the Recipient

Enter the TIN of both parties of the sales transaction in the respective blank boxes.

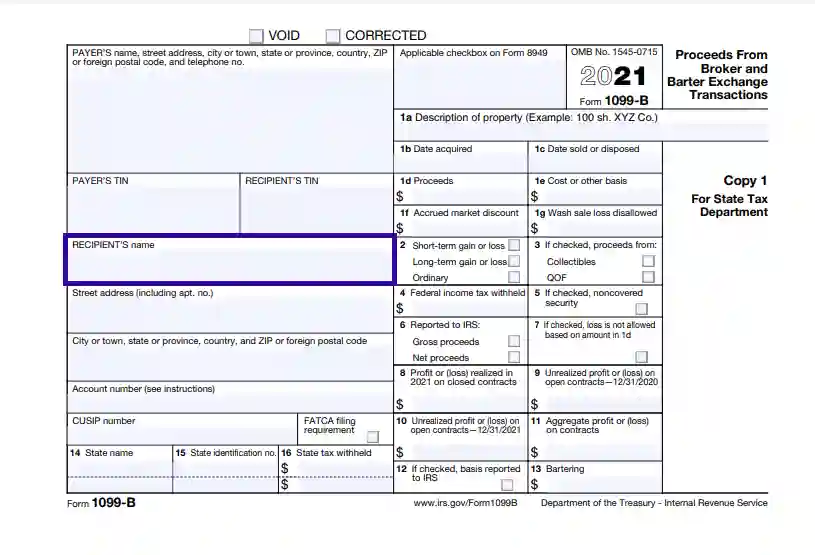

Enter the Recipient’s Name

Now, you need to provide the recipient’s data. Start filling it out with the recipient’s full legal name and then proceed to the next boxes.

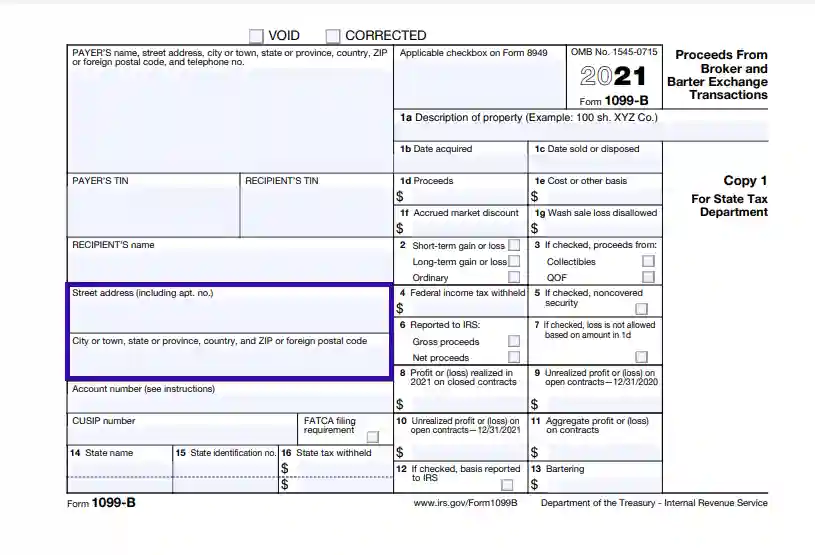

Insert the Recipient’s Address

Provide the address of the payment recipient. Enter the street and building and apartment number in the first blank section and then indicate the state, ZIP, city/town, province/county, and other applicable information.

Provide the Account Details

Here, you need to designate the customer’s account info. Be careful when filling out this section and ensure that the broker has filled it out correctly. The information that goes here depends on the kind of sales and the recipient; it may be a cash-on-delivery account, for example.

The next couple of fields also require that you enter the Committee on Uniform Security Identification Procedures number (shortly CUSIP) and FATCA. The first one is a digit that only brokers use for transactional reporting, while the latter has an external macroeconomic impact and is used by foreign entities for tax reporting.

If you obtain exhaustive information, you may fill this field out by yourself. If not, you may go with the broker’s information or ask for the tax adviser’s assistance.

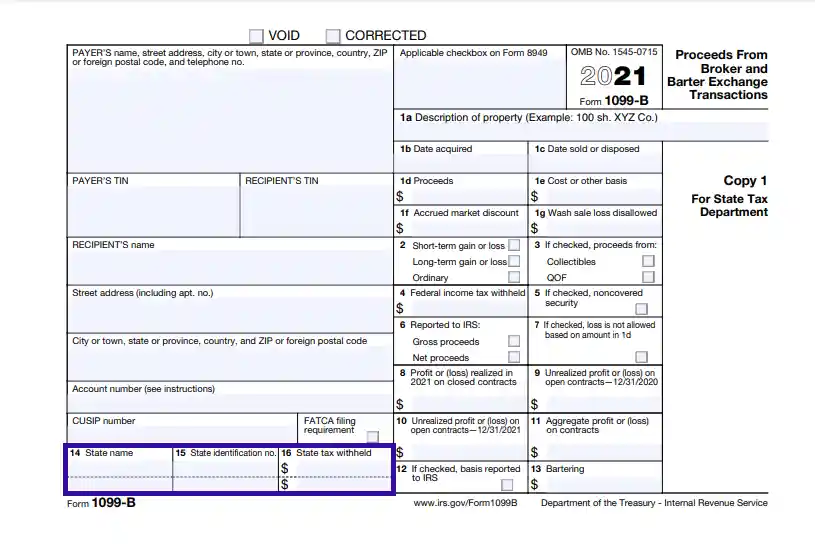

Define the State Data and Tax Amount

Provide the name of the state, the authorities of which have withheld the taxes for the subject sales transaction, its tax identification number, and the tax amount withheld.

Enter the Property or Stock Data

In these couple of sections, you need to provide a detailed description of the property that took part in the sales transaction. First, define the property, then insert the date you acquired it and the date when you sold it in the corresponding boxes.

Describe the Proceeds

For Section 1 D through G, you need to provide the details on your proceeds. Enter the amount in US dollars in section D, then insert the cost or other basis (typical for a short-term transaction), acquired market discount, and the wash sale loss disallowed. The wash sale loss amount is counted in accordance with the CUSIP data.

Define if that is a long-term or short-term sales transaction; checkbox the most suitable option out of the three given to do so.

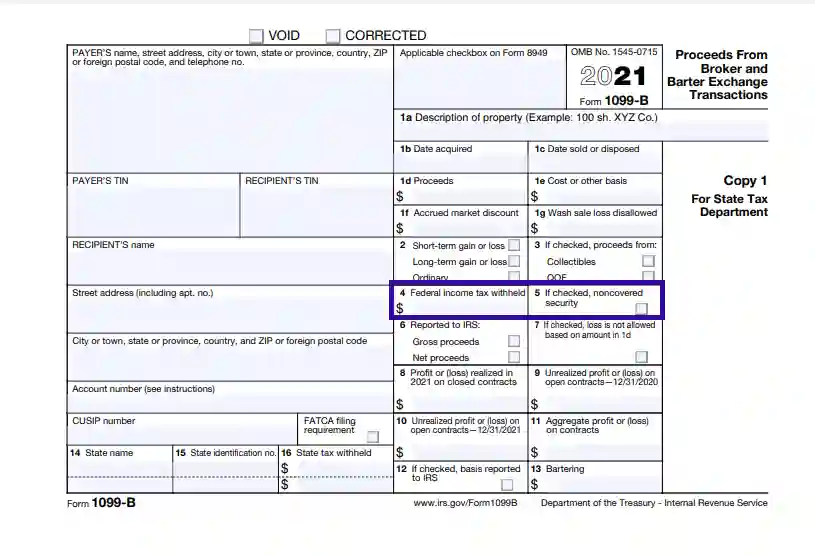

Define the Federal Income Tax and other Details

Enter the federal income tax amount withheld in US dollars. Ensure the check the corresponding box if there was an uncovered security amount.

Tick the boxes of the corresponding proceeds type that either you or the broker have already reported to the IRS.

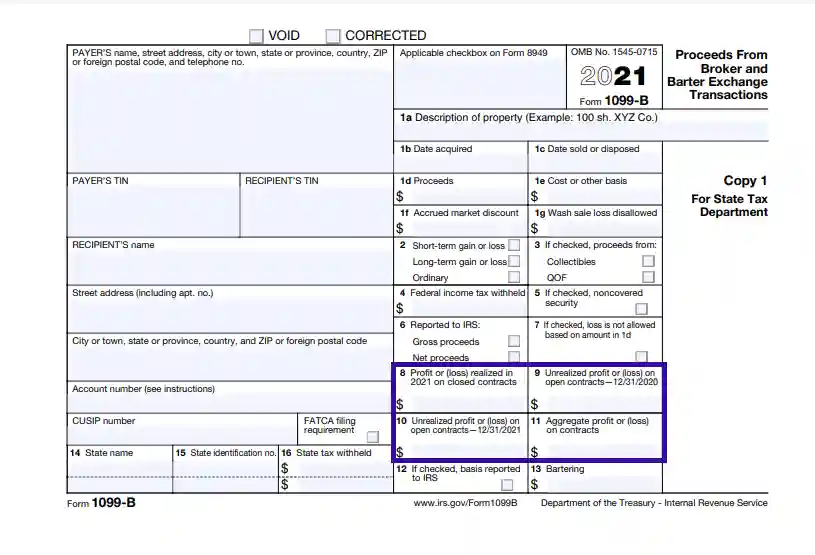

Describe the Profit (if applicable)

In the next couple of sections, you need to enter the respective amounts of realized and unrealized profit or loss acquired from the transaction and the aggregate proceeds on contracts (if applicable). Please pay attention to the dates indicated in the document.

Check if There Was a Barter Condition

Ensure to tick the box in the next section if there was bartering involved. If so, define the exact amount in US dollars below (as shown in the picture).

Fill Out Form Reference

There also is a specific field at the top of the form (right next to the payer’s data) that refers to Form 8949. As we have mentioned above, these forms are filled out by the payer in combination, so all the data that you insert in Form 1099-B shall comply with the info designated in Form 8949. Leave a mark if you have adjusted your version, changed the amounts, and want to provide your information and calculations in the supplements.