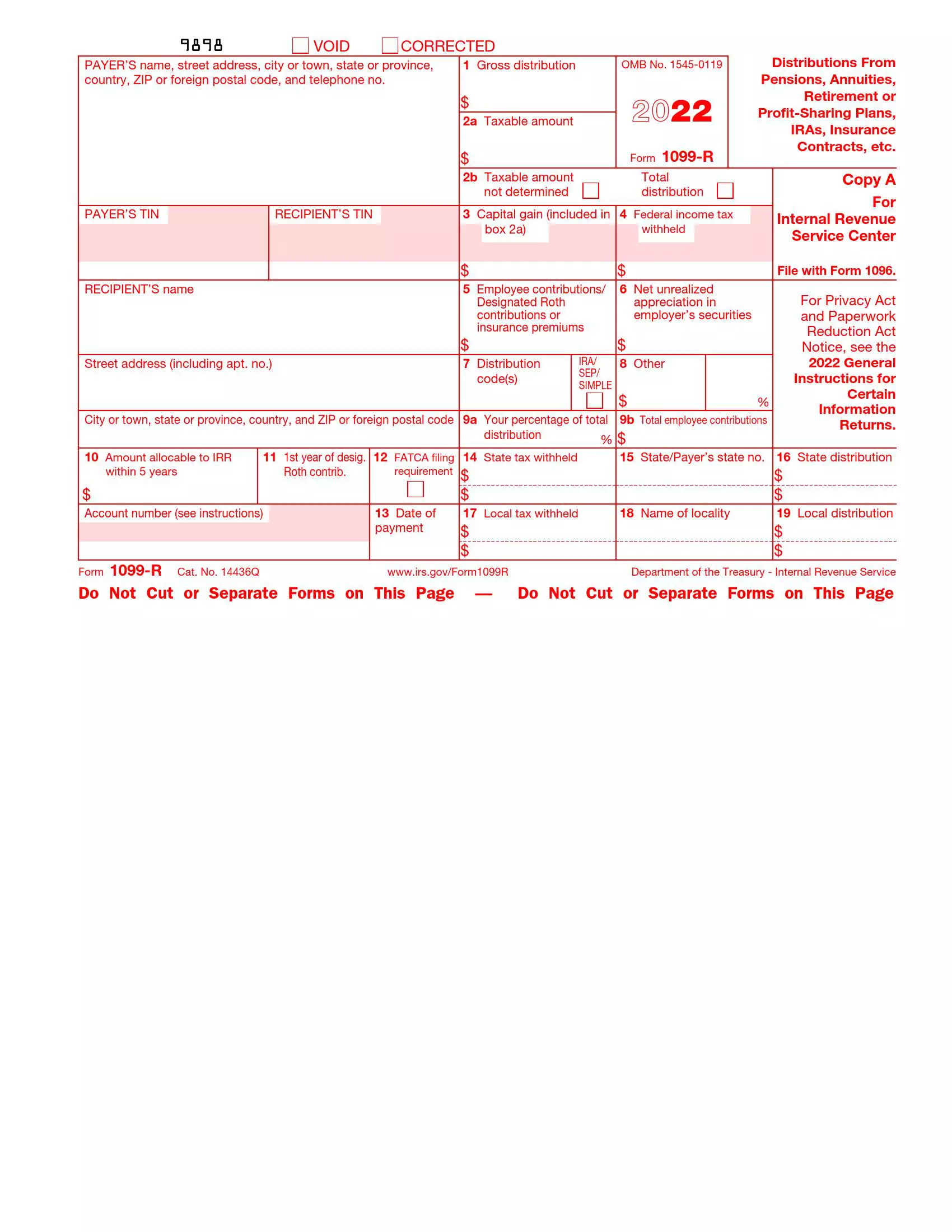

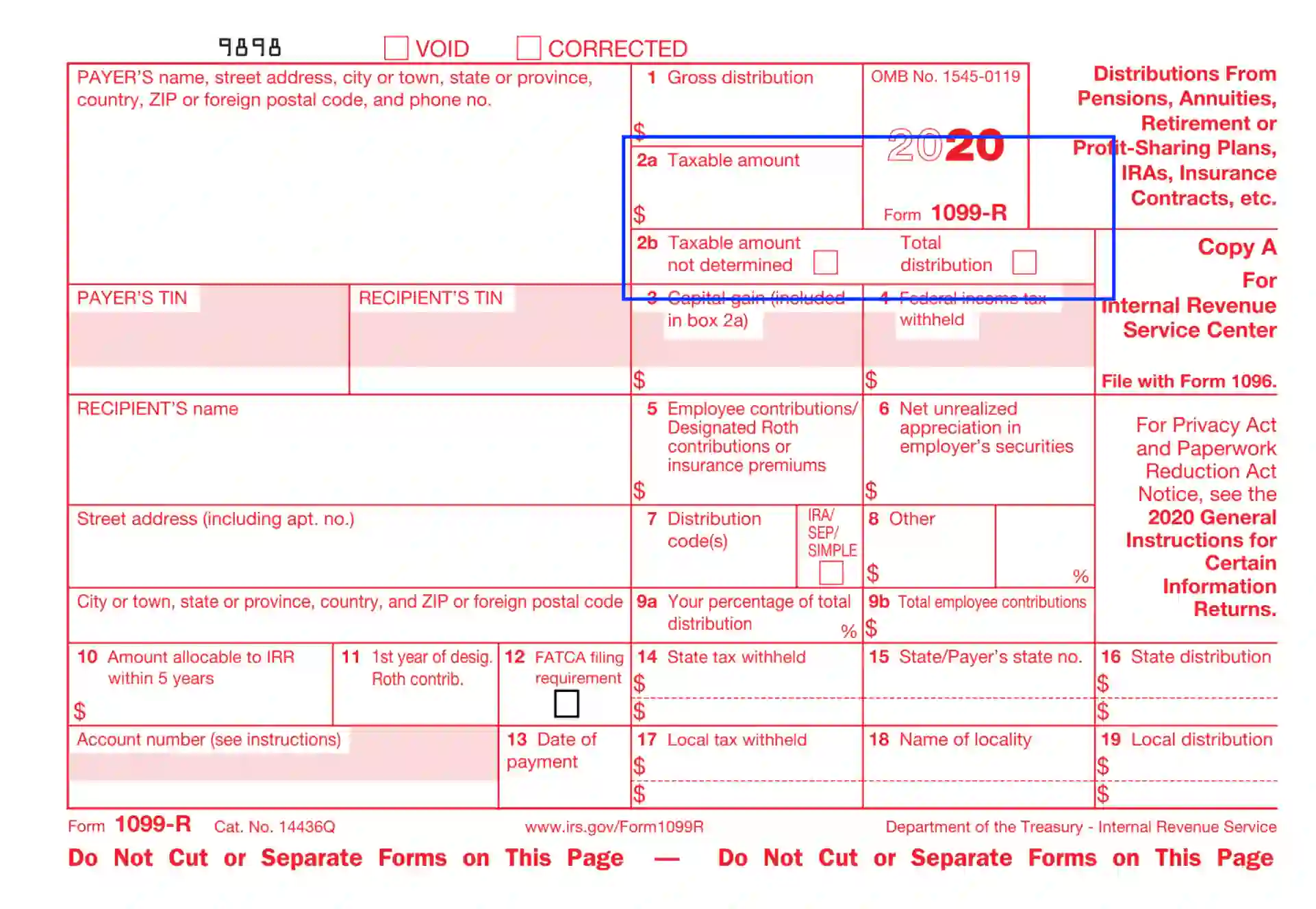

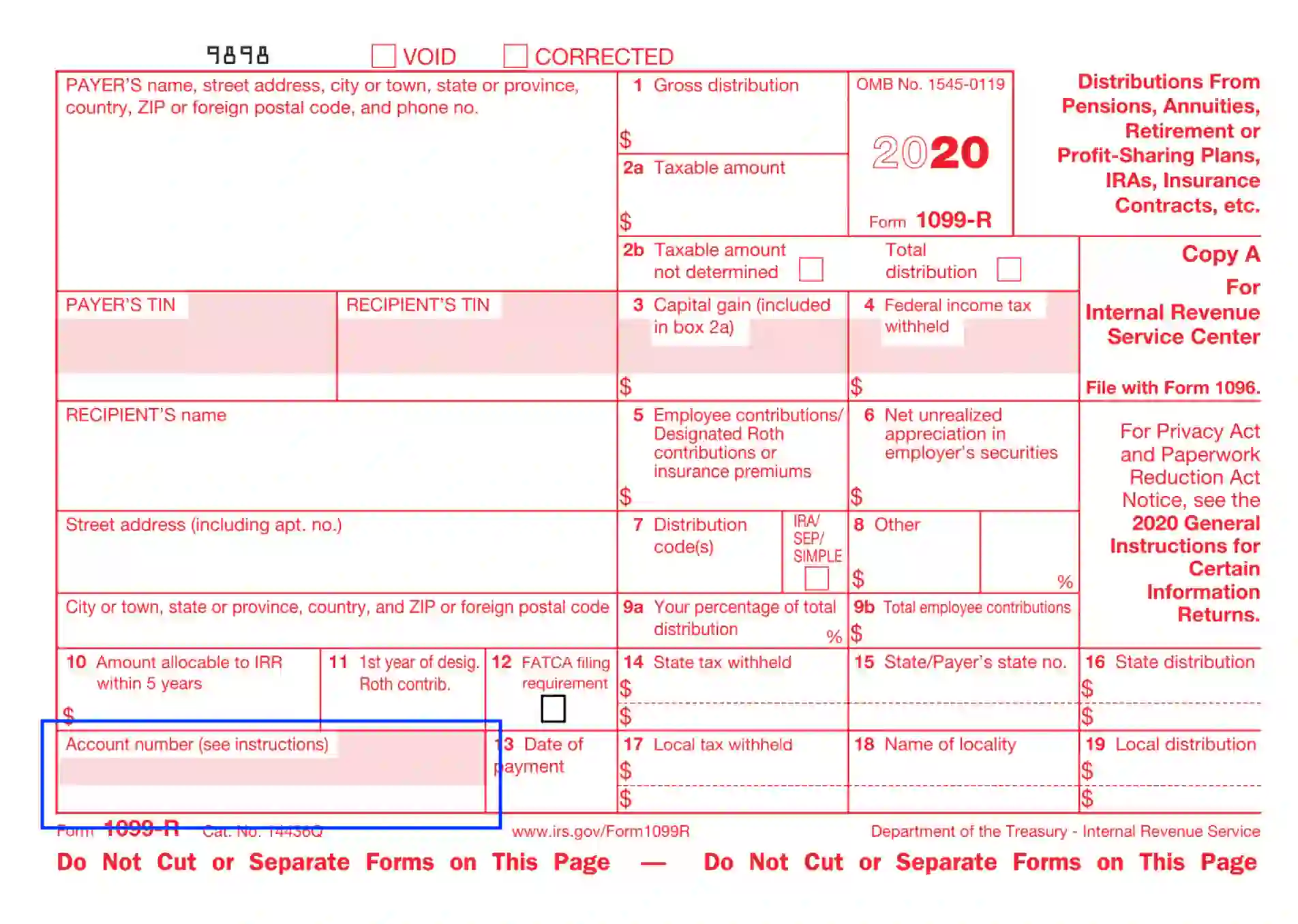

Form 1099-R is a tax document that reports distributions from retirement or profit-sharing plans, any IRAs, annuities, pensions, insurance contracts, and survivor income benefit plans. This form is essential for tracking money withdrawn from these sources, which often has tax implications. Form 1099-R typically includes:

- The total amount distributed to the taxpayer during the year (might be taxable or nontaxable).

- Taxable amount (portion of the total distribution subject to income tax).

- The amount of federal tax withheld from the distribution (similar to withholding on a typical paycheck).

- The type of distribution received (e.g., early distribution, normal distribution, rollover).

- The total employee or insurer contributions and premiums paid over the years (affects the taxable amount).

Individuals who receive a Form 1099-R must report this information on their federal income tax returns. The form helps determine if any part of the distribution is taxable. It’s essential for retirees and others who have received distributions from any retirement-related account during the tax year.

Other IRS Forms for Self-employed

An individual taxpayer has to file different IRS forms depending on the complexity of their finances. Here might be some other forms that can be of use to you.

How to Fill Out IRS Form 1099-R

We have already mentioned in the previous parts of our review that only official IRS forms are scannable. Therefore, use the PDF files generated via our software only for informative goals and personal records.

Follow the pattern below to complete the 1099-R report.

1. Identify the Preparer

In this section, the preparer should specify the employer’s identification details, including these data:

- Legal name

- Domiciliary address — street, city, state, and ZIP

If the payer is residing abroad, please, define the foreign country, region (or county), and a foreign postal code.

- Contact phone number

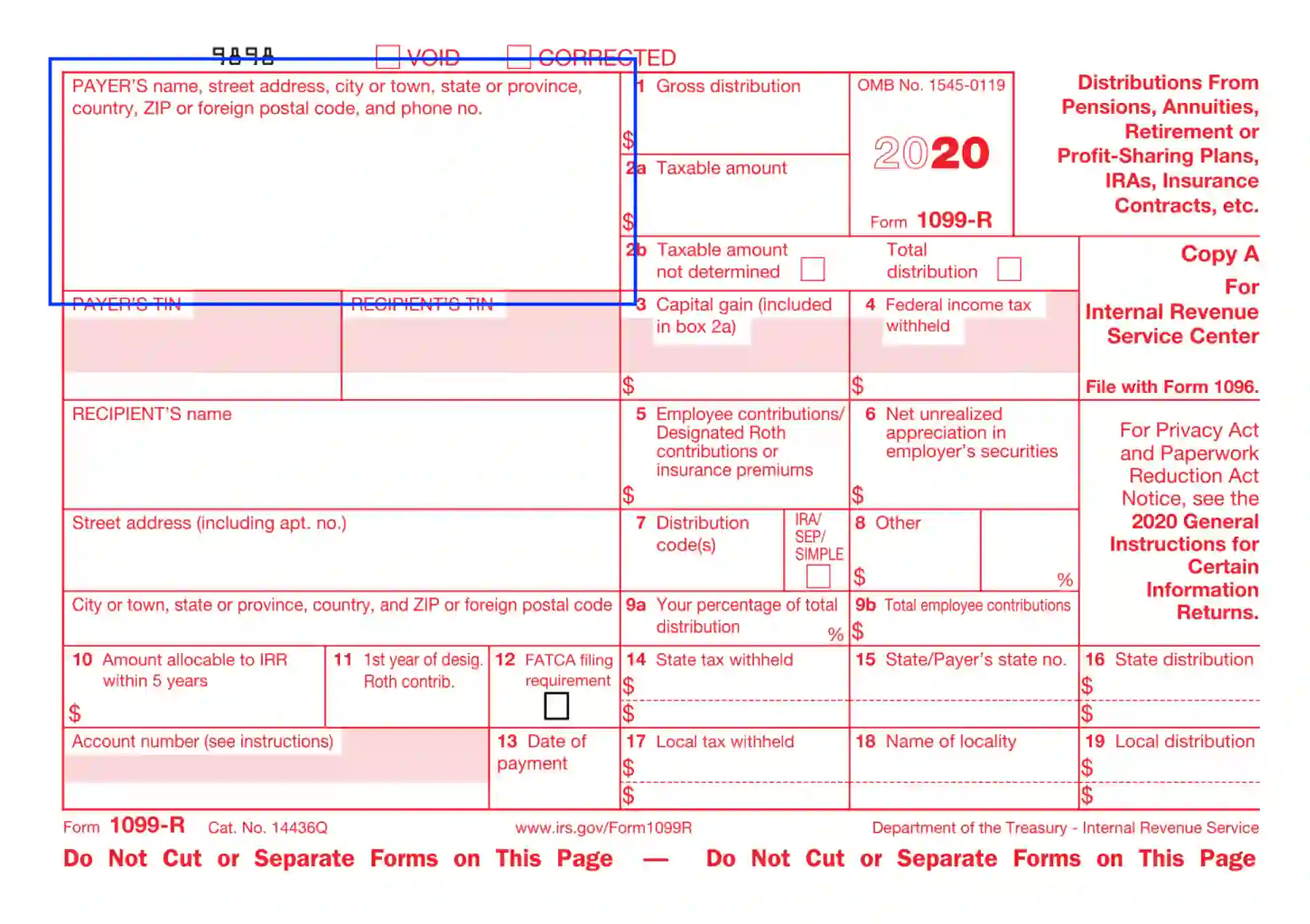

2. Put the Payer’s and the Recipient’s TINs

Insert the payer’s and the recipient’s tax ID numbers separately using the corresponding boxes.

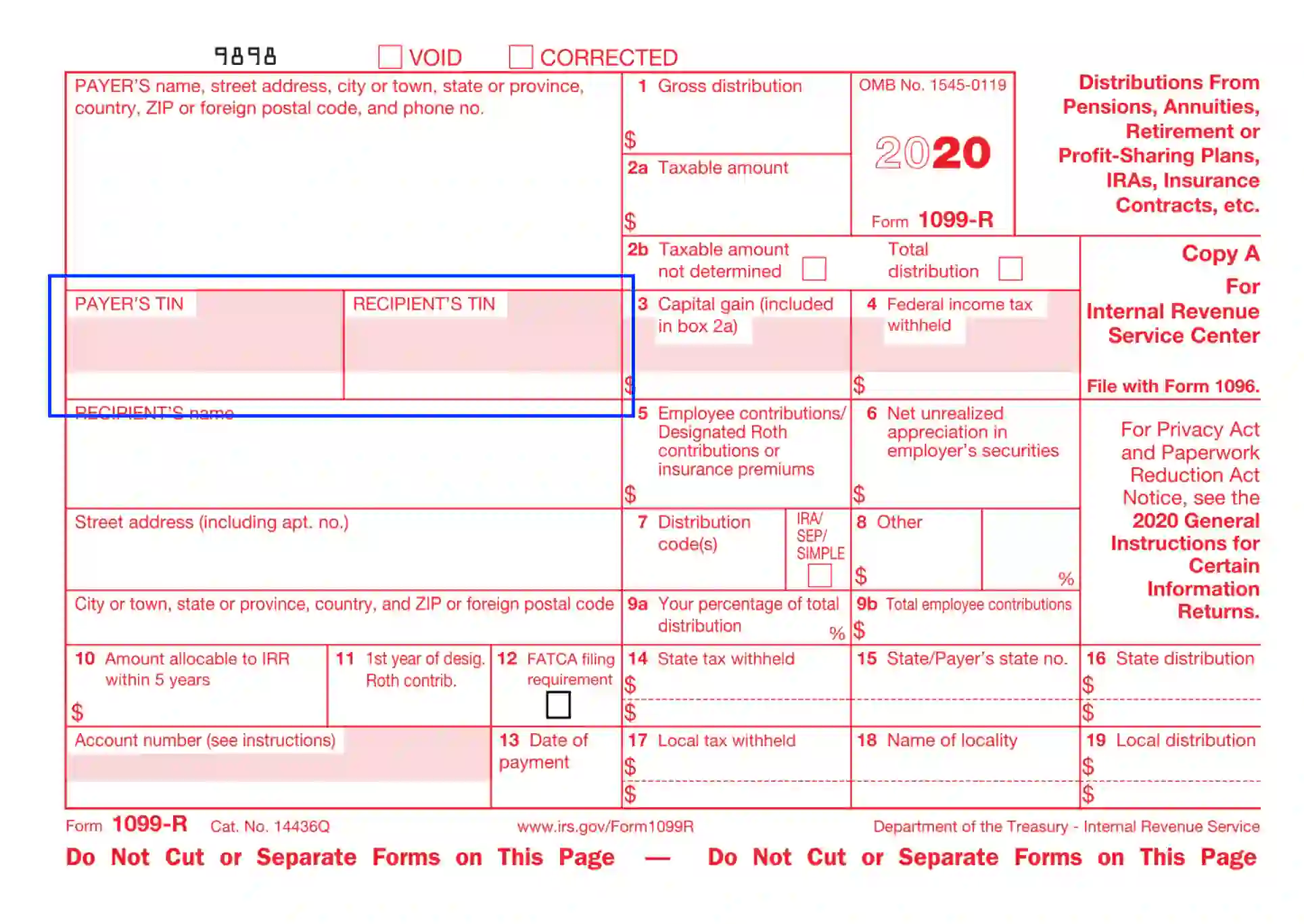

3. Identify the Payee

Complete the demanded info about the payee, including the following aspects:

- Payee’s legal name

- Mailing address — street and unit (apartment) number, city, state, and ZIP code. If the domiciliary location is out of the US, specify the foreign country, province (region), and foreign mail code.

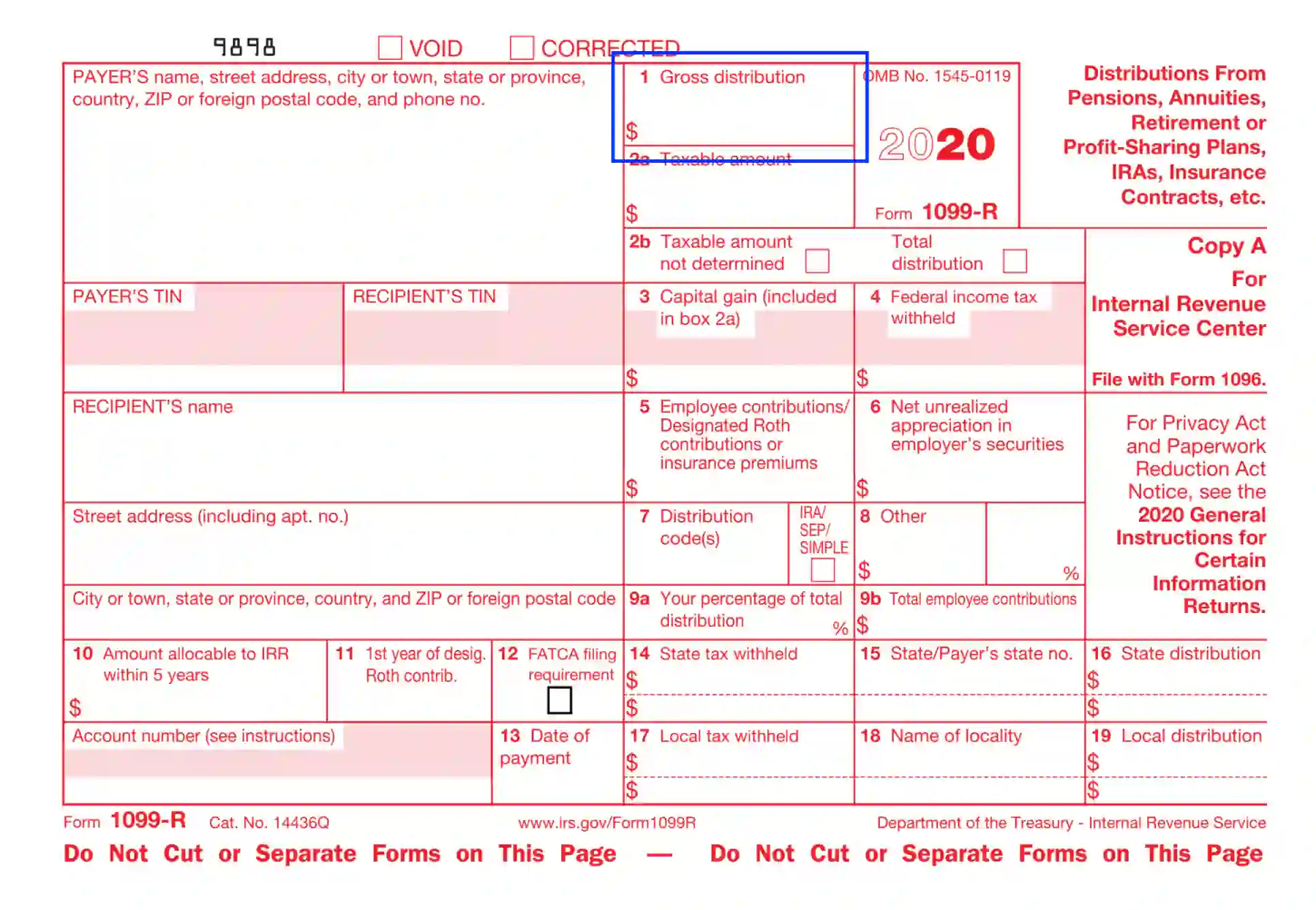

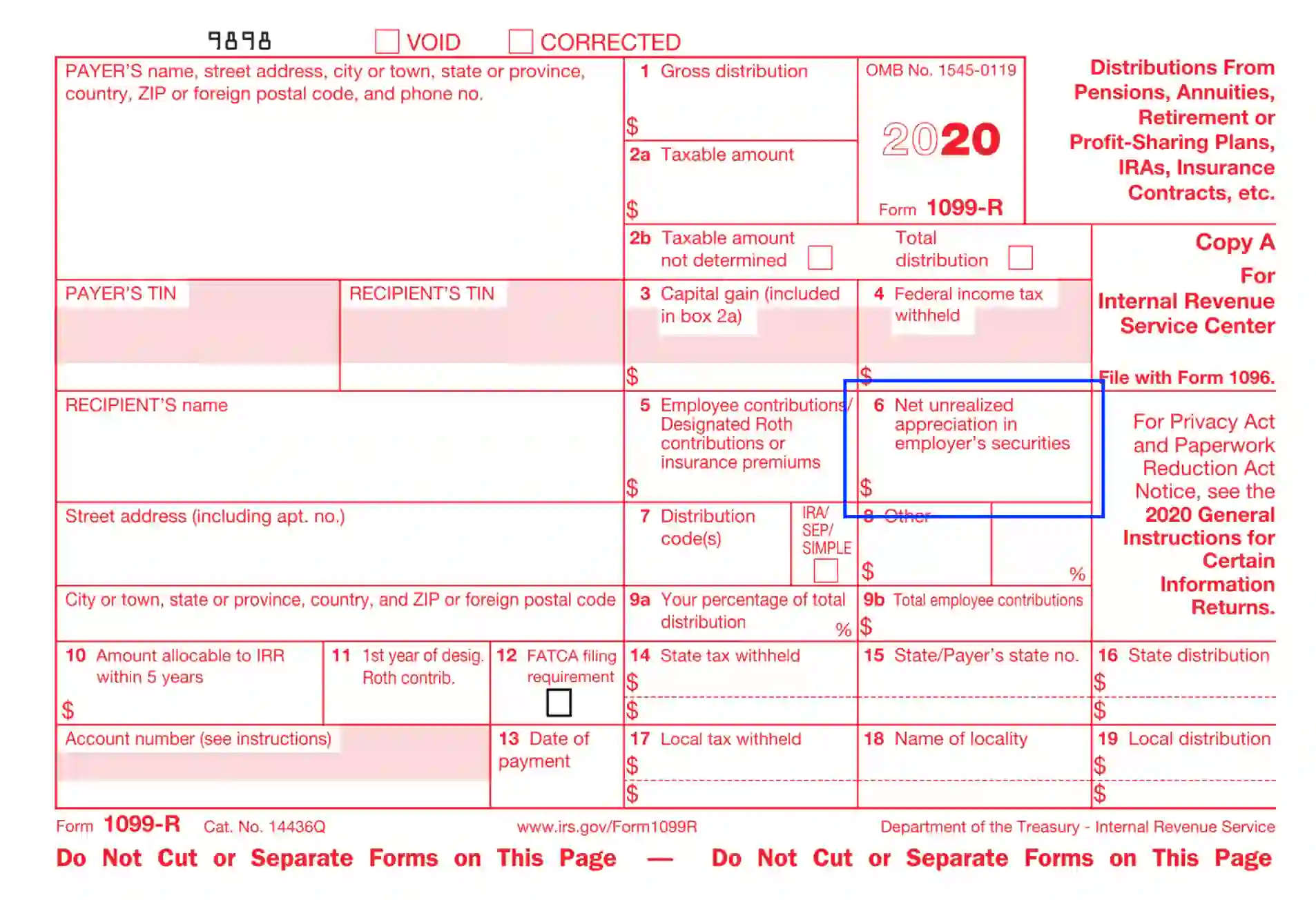

4. Enter the Amounts for Units 1 Through 19

Once you have identified the payer and the payee, proceed to the centerpiece of the 1099-R statement and provide the report regarding these aspects:

- Gross distribution of funds in slot 1

- Amounts that are subject to taxes are added to slot 2a if the funds are non-taxable or assigned fully; checkbox the correct variant in slot 2b.

- In slot 3, the preparer needs to enter any taxable capital income gained from trading bonds, estate, or stocks (if included in gross distribution amount). Define the correct sum in USD.

- In unit 4, submit the amount of federal income tax that the payer withholds from the payee’s earnings.

- In slot 5, the preparer enters the amounts that the payee has invested into a licensed Roth IRA.

- In unit 6, specify the amounts from the payee’s unrealized gains in the employer’s securities program.

- In unit 7, you need to assign the distribution code. IRS provides an official Guide to Distribution Codes on pages 15 through 17 in their 2021 Instructions for Forms 1099-R and 5498. Utilize the table to qualify the contents of section 7 correctly.

- In slot 8, the payer enters any extra income amounts.

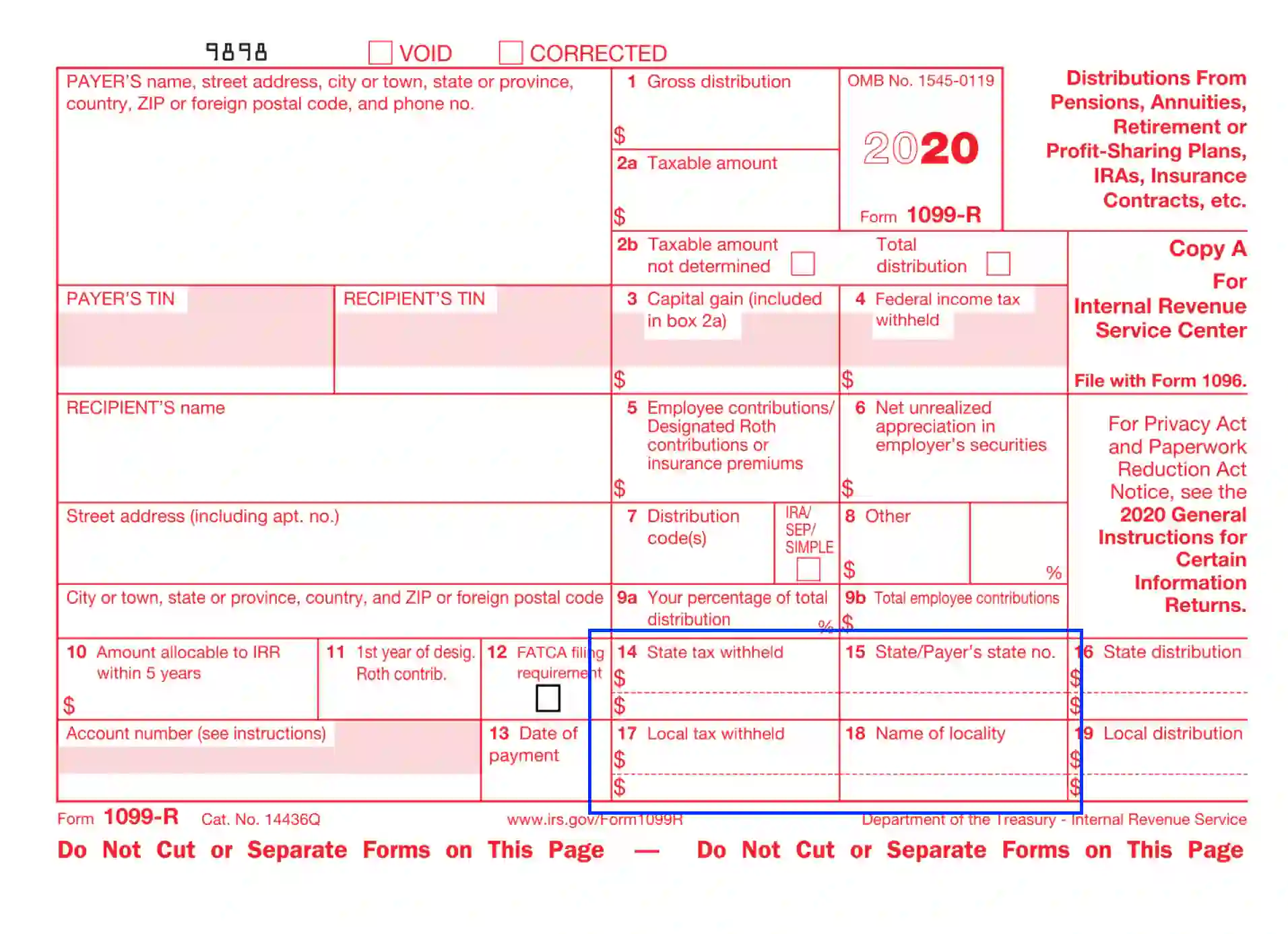

- Box 9 contains two subsections that are filled in as follows: specify the total distribution rate in slot 9a and use 9b to indicate the total payee contribution in USD.

- Unit 10 is filled out only if § 72(t) of the US Code does not apply. Enter the amounts assigned to IRR for the period of five recent years.

- In slot 11, specify the year when the payee made their first Roth investments.

- If qualifying for FATCA requirements regulated by § 6047(d) of the US Code, check the box in unit 12.

- Section 13 is referenced to date the amounts contributed for reportable death benefits and regulated by § 6050Y of the US Code.

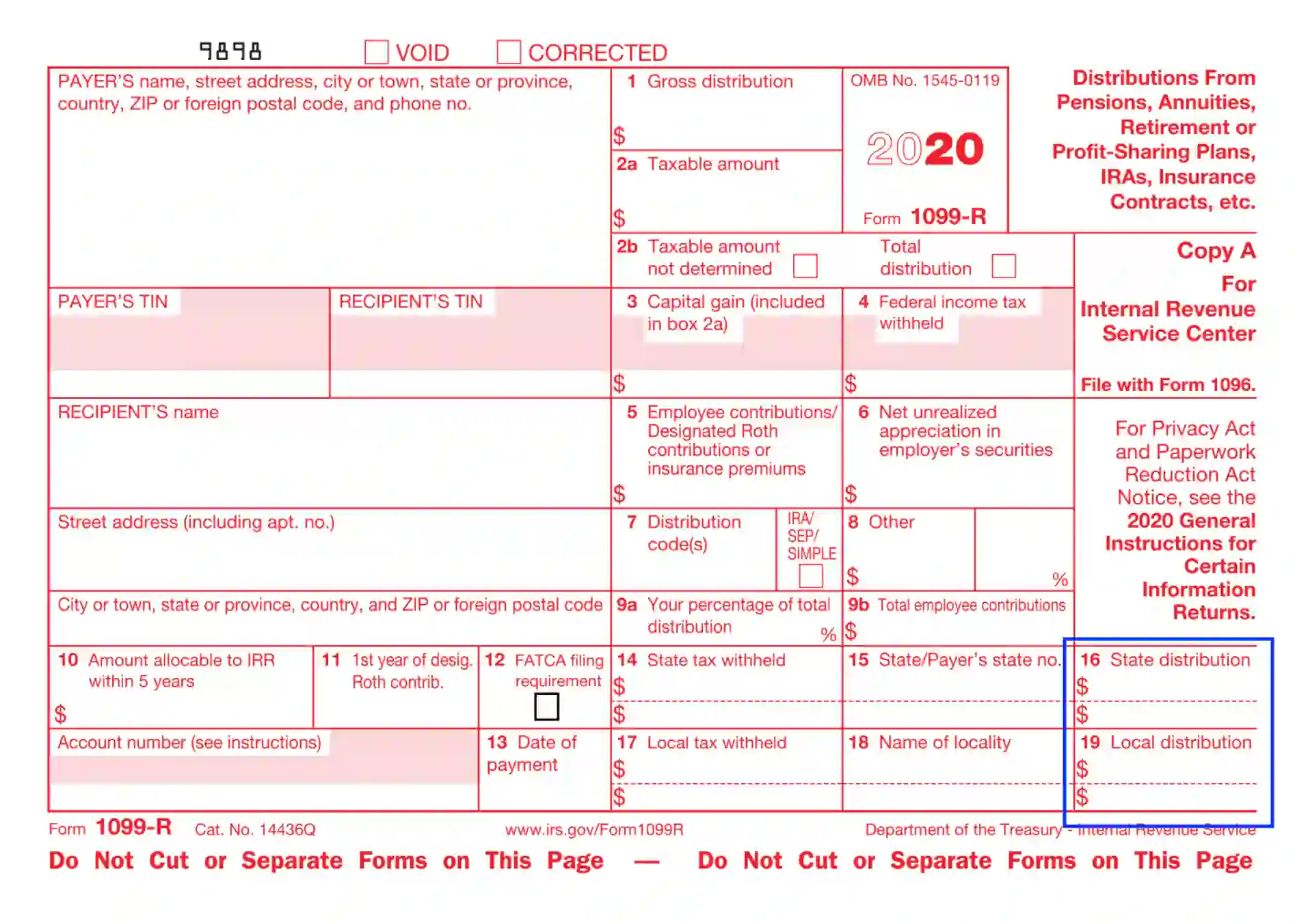

- In Units 14-15 and 17-18, the preparer enters the amounts of state and local taxes withheld for the earnings introduced in this 1099-R report. Also, you are empowered to indicate the payer’s (state) number and the locality specifications.

- In boxes 16 and 19, you need to enter the state and local distribution separately.

5. Provide Account Specifications

In case the payer has several accounts for the payee, they are filing the respected report form, give account specifications in the left bottom box of the 1099-R form.

Once the required data are rendered to the form, you are empowered to file the red copy with the IRS, leaving one black copy for personal records and providing the third copy to the recipient.