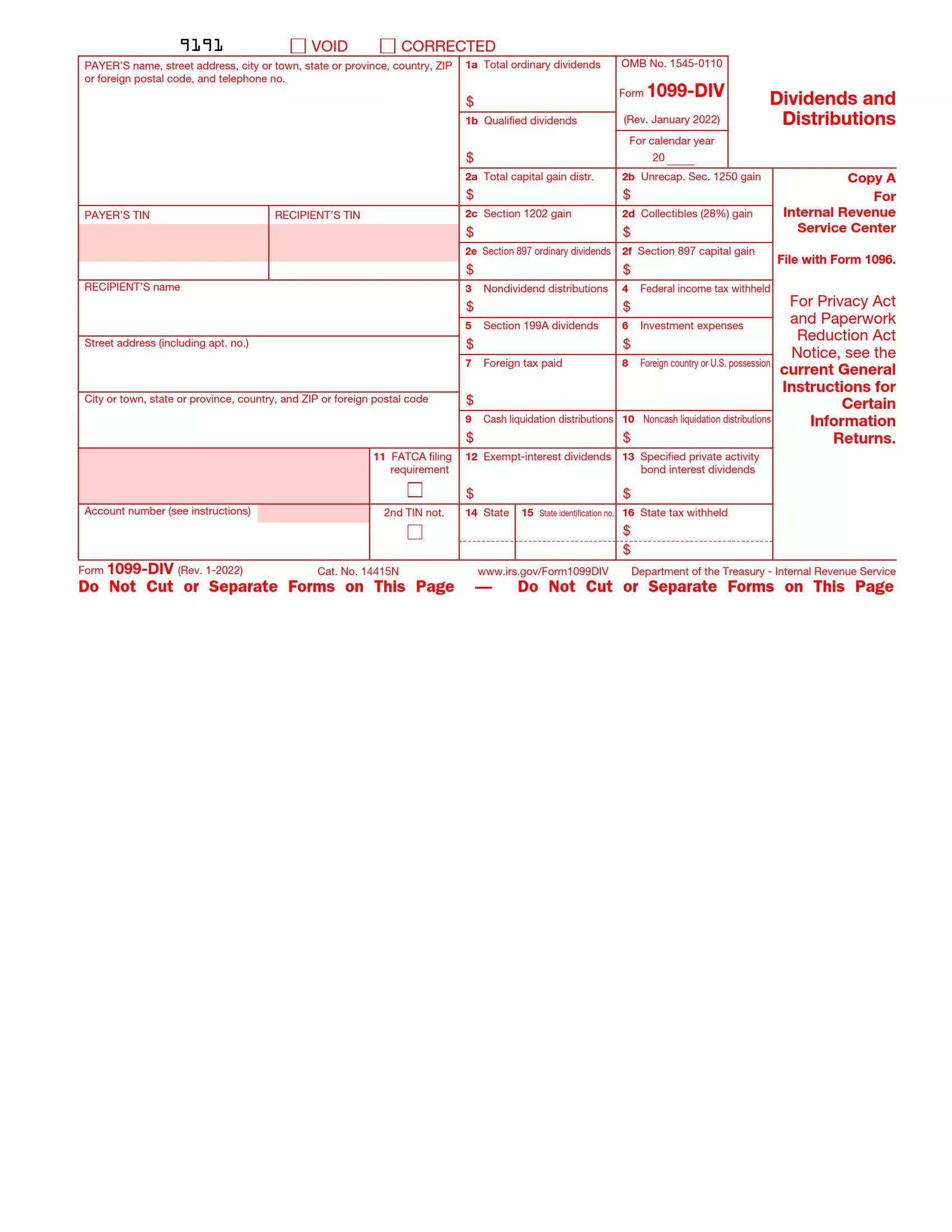

Form 1099-DIV is a tax form banks and financial institutions use to report dividends and distributions paid to investors during the tax year. This form is crucial for the Internal Revenue Service (IRS) to track income from dividends that must be reported on taxpayers’ annual income tax returns. The form details the dividends received, any capital gain distributions, non-taxable distributions, and federal income tax withheld.

This form is vital for individual taxpayers as it helps them accurately report their dividend income, which can affect their tax liabilities. It also includes details about the type of dividends paid, such as ordinary dividends (taxed at regular income tax rates) and qualified dividends (which may be eligible for lower tax rates). By providing a clear breakdown of dividend income, IRS Form 1099-DIV assists taxpayers in filing their returns correctly and ensures compliance with tax laws.

Other IRS Forms for Self-employed

IRS forms for businesses vary by the types of business and purpose of the form. Find out more about forms that businesses commonly file with the IRS.

How to Create a Form 1099-DIV

You can submit Form 1099-DIV online or on paper. At the same time, to fill out the paper, you need to use the form-building software. You cannot scan the paper, and on the IRS internet site, you will not find a form option that can be filled out online. Therefore, we recommend that you use our form-building software. This will help you create a correct and valid document and avoid paperwork.

Please note that the deadline for submitting the paper varies depending on the form of submission of the document. If you are submitting Form 1099-DIV for 2021 online, you can submit it by March 31st, 2022. If you are submitting a paper form 1099-DIV for 2021, the deadline is February 28th, 2022.

The American tax system is very complex and confusing, with dozens of different forms to fill out every year. To avoid confusion, we recommend that you hire a tax professional to help you figure things out.

Of course, we understand that not everyone has the financial ability to afford a tax specialist. If you choose to fill out the papers yourself, make sure that you are 100% clear on all wording and statements. If you have questions about any of the wording and statements, seek professional legal advice. In almost all states, this can be done for free.

A responsible approach to filling out and creating tax papers will help you avoid miscalculating taxes, which means you will not have to pay the penalty. Below you will find a few simple steps you need to follow to create a 1099-DIV form.

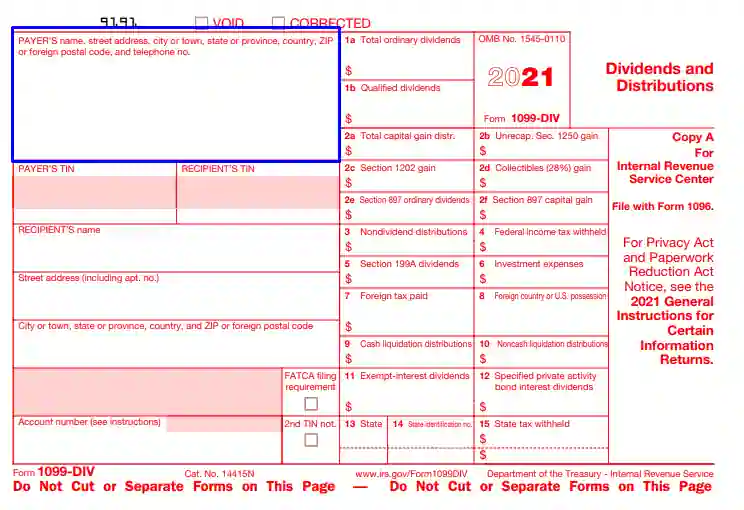

Enter The Payer info

First of all, when filling out the paper, you will need to indicate all this payer. To do this, you need to fill in the top left part. Please provide the payer’s full legal name and contact info. Contact info includes the state, city, street, and building number, as well as the payer’s phone number.

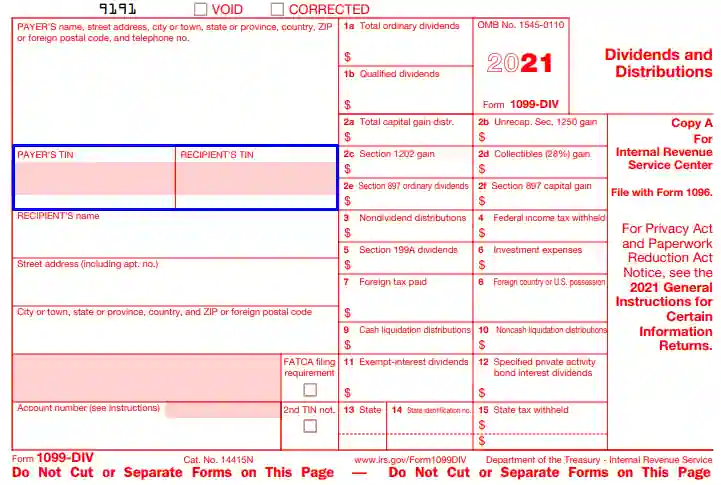

Enter the TIN of the Payer and the Recipient

Below you will need to indicate the taxpayer identification numbers. First, enter the taxpayer identification number of the payer, followed by the taxpayer identification number of the recipient of the paper. You can find out the taxpayer identification number through the IRS.

Fill in the Recipient’s Contact Info

The next step in filling out the paper is to fill out the next three parts. In the first of these parts, you need to enter the full legal name of the recipient, and in the other two – contact data. Specify the address, zip code, and phone number of the recipient as contaсt data.

Enter The Account Number (optional)

In the lower-left corner, you will need to indicate your account number. This part is optional. But if you checked the FATCA part, then you will need to fill in the part in the lower-left corner.

Check the part (optional)

If you have an overseas account or overseas bank account, you need to tick the FATCA part. FATCA stands for Foreign Account Tax Compliance Act.

Fill in partes 1a and 1b

In part 1a, you need to enter the total amount of dividends in dollars. To do this, you need to add up all the dividends you received over the past year. In part 1b, you need to indicate qualified dividends. Qualified dividends must be included in part 1b, as they are included in the general dividends.

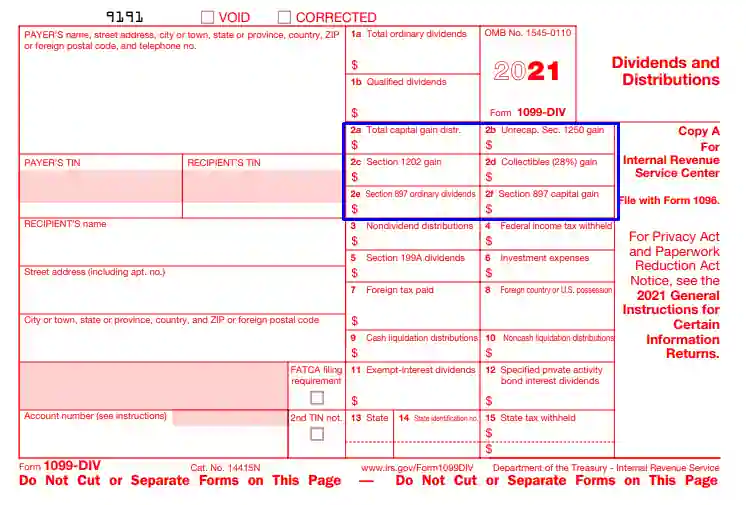

Fill in parts 2a-2f

In part 2a, you need to indicate the amount you earned on your investment. This amount will need to be indicated on tax reports. Note that the amounts shown in 2b-2e are included in the amount shown in 2a. In parts 2e-2f, enter the amounts for section 897.

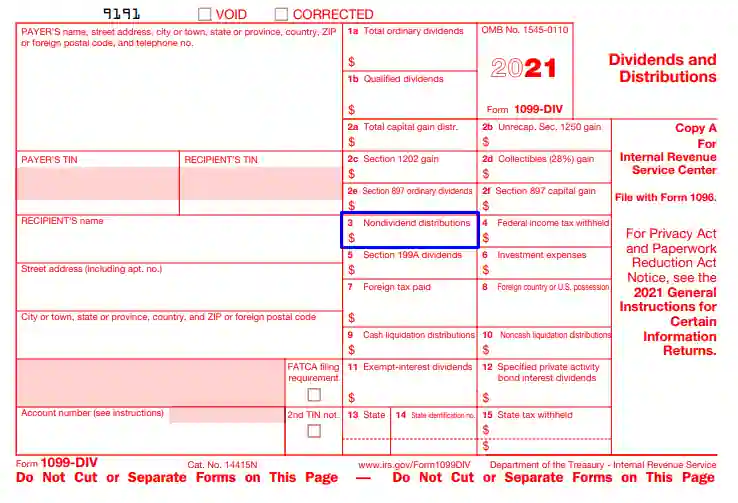

Fill in part 3

In part number three, you need to indicate the amount that does not bring you dividends.

Fill in part 4

Enter the amount of income tax that was calculated from your dividend.

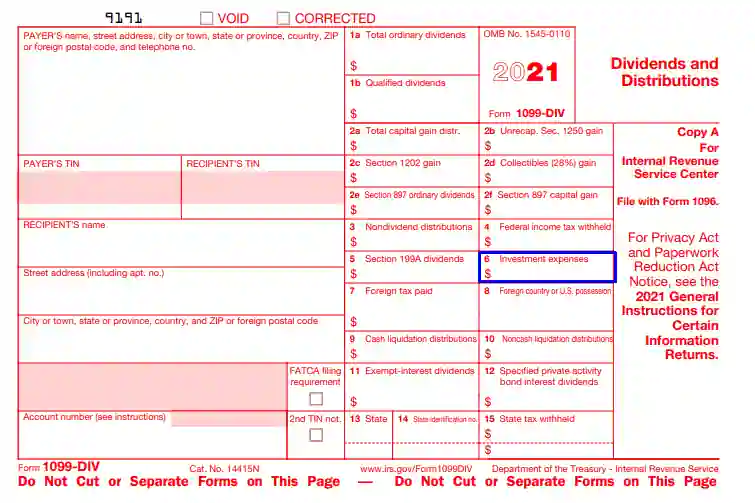

Fill in part 5

In the fifth part, you need to indicate the number of dividends of section 199A.

Fill in part 6

In the sixth part, you need to enter the number of your expenses.

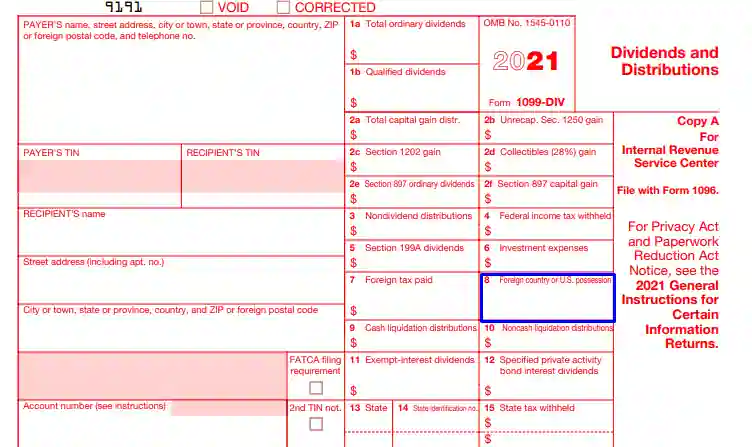

Fill in part 7

In the seventh part, you need to indicate the amount of all your foreign taxes on dividends.

Fill in part 8

In part number 8, list the countries whose taxes were listed in part number 7.

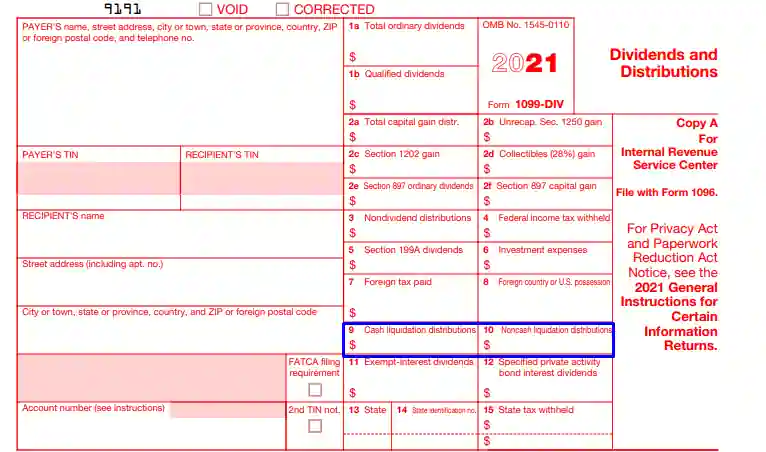

Fill in parts 9-10

In part number 9, you need to indicate the number of liquidations for cash, and in part number 10, indicate the number of liquidations for non-cash payments.

Fill in parts 11-12

In parts 11 and 12, list the dividends that are not taxed or are subject to the minimum tax. Include these amounts only if you have them. These fields are optional.

Fill in parts 13-15

In part number 13, you need to include the name of the state that withheld taxes. In part 14, list the state number. You can find the state number on the official state internet site. And in part number 15, write the amount of tax withheld by the state.