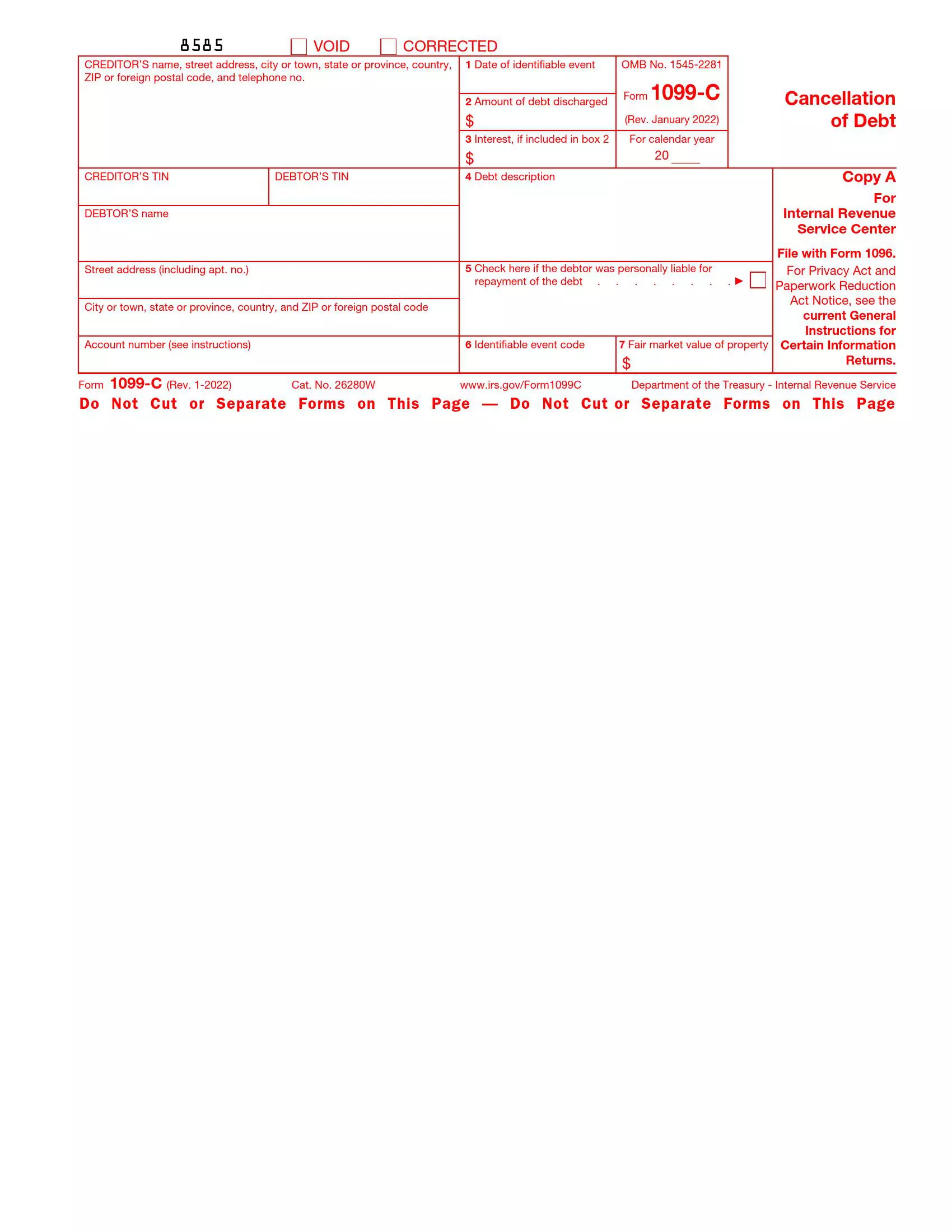

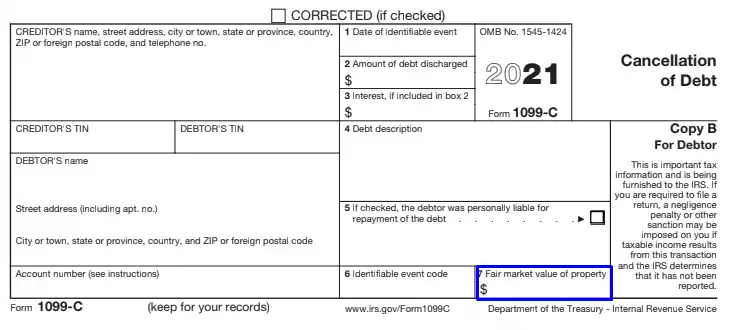

Form 1099-C is a tax form used by financial institutions to report the cancellation or forgiveness of a debt amounting to $600 or more. When a debt is forgiven or canceled by a lender, the forgiven amount can be considered taxable income by the Internal Revenue Service (IRS). This form, titled “Cancellation of Debt,” includes the creditor’s and debtor’s information, the amount of canceled debt, and the date of cancellation, among other details. It’s essential for taxpayers because it provides the information needed to report this income on their tax returns, potentially affecting their tax liabilities.

Handling Form 1099-C correctly is essential for taxpayers, as it affects how they report income and calculate their taxes. Any forgiven debt reported on this form may increase taxpayers’ taxable income, thus impacting their overall tax burden for the year. Taxpayers must include the information from Form 1099-C on their tax returns to comply with IRS requirements and avoid penalties associated with underreporting income.

Other IRS Forms for Self-employed

The Internal Revenue Service provides plenty of IRS forms that are expected to be filed by businesses. Learn what other IRS forms are commonly filed by US employers.

How to Create Form 1099-C?

We always recommend seeking professional help when submitting documents to the IRS. This is because there are many forms of the IRS type, and it is very easy to get confused filling them out. Each form has its own instructions for completing, signing, and submitting the document.

But the tax system in America can get confusing and complex, so it’s always best to seek professional help.

We understand that not everyone is financially able to hire an assistant to file all tax documents. In this case, you can use our form-building software. This will help you avoid mistakes when filling out the document. This means that it will help to comply with all the requirements for the correct payment of taxes.

Below you will find a step-by-step guide and information on how to create a 1099-C form. We will tell you in detail about each stage of document creation. If you have doubts or questions about any of the terminology used, it is better to seek professional legal advice.

First, you need to decide how exactly you want to have the document filled out. You can do it online or in a written form, printing the template out beforehand. The choice depends on how you feel more comfortable. If you want to fill out the document online, you need to download the PDF form on the official website of the IRS. After that, you can start filling out the form; for this, you need to follow a few simple steps.

Enter Lender Details

In the first box, you need to enter all the lender’s details and contact information. You need to fill in the full legal name of the lender, address, zip code. And don’t forget to include the lender’s contact number.

Provide the TIN

TIN is the taxpayer identification number. You need to provide the creditor’s taxpayer identification number and the debtor’s taxpayer identification number.

A lender is a company or person who lends money as a loan. A debtor is a person who borrows money from a creditor and is obliged to return it within the specified and agreed on terms. If the creditor cancels the debt, then the creditor is required to file Form 1099-C.

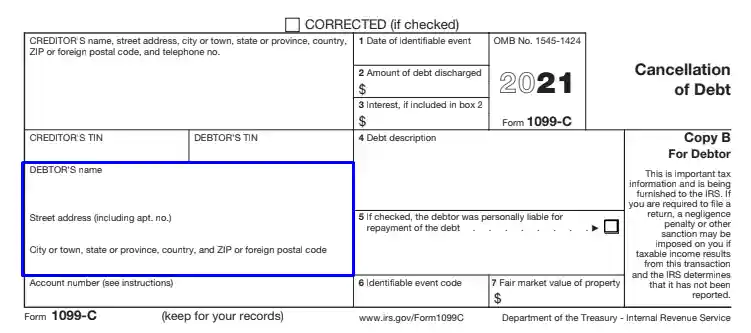

Fill in the Customer’s Details

You need to indicate the full legal name of the debtor and then enter the residential address and zip code.

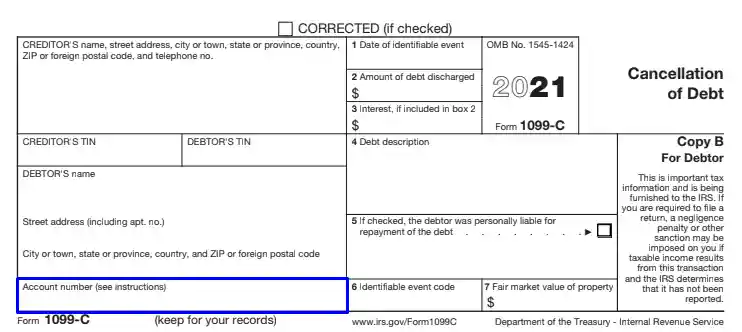

Enter your Account Number

After filling in the information of the creditor and the debtor, you need to indicate the account number. You can find the account number on the IRS website. It is very important to enter it correctly, so be careful at this stage.

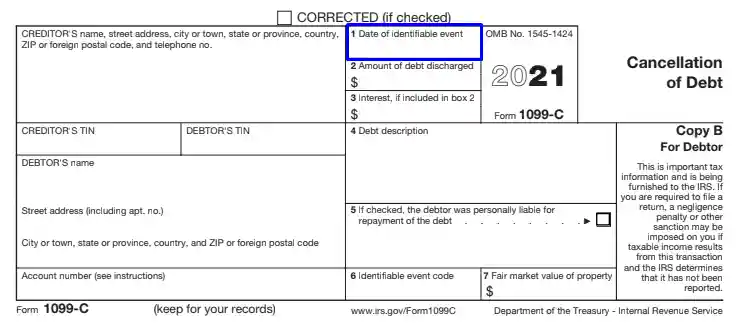

Complete Section Number One

In box number one, you need to indicate the date of repayment or cancellation of the debt. To do this, you need to specify the month, day, and year.

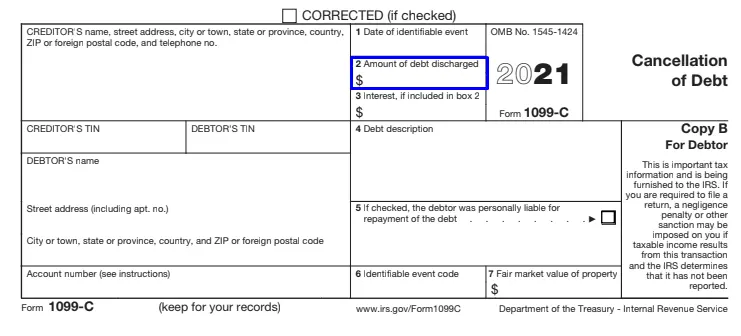

Complete Section Number Two

In the second section, you need to indicate the amount of debt canceled. To do this, you need to enter the amount that is to be canceled. This amount will be counted as your income.

Complete Section Number Three

Section number three is completed only if interest is included in the amount of the canceled debt. You need to enter your interest in dollars to complete section three.

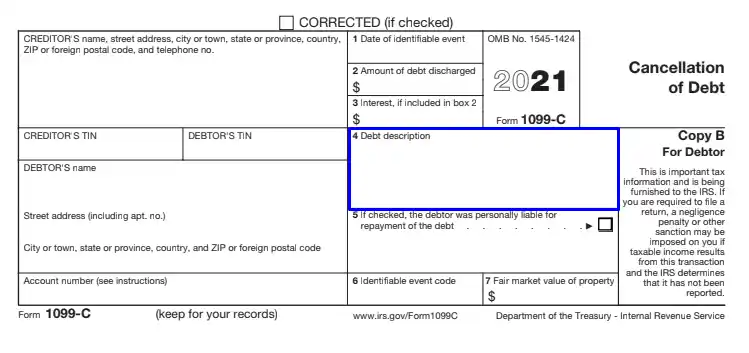

Complete Section Number Four

In the fourth section, you will need to describe the debt; you should also indicate the nature of the debt you imply. You can include credit card, student debt, medical debt, mortgage debt. If necessary, you can also describe the property in this section. It is best to describe the debt in as much detail as possible.

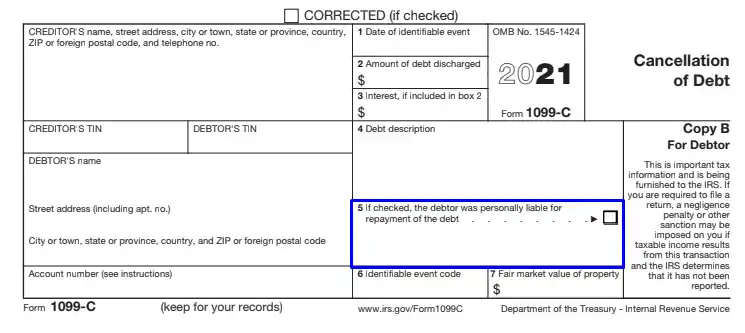

Complete Section Number Five

In the fifth section, you do not need to enter any information, and you just need to check the box. A checkmark is placed if the debtor was personally responsible for the payment of the debt. If this is not the case, you can leave the checkbox unchecked and skip this section.

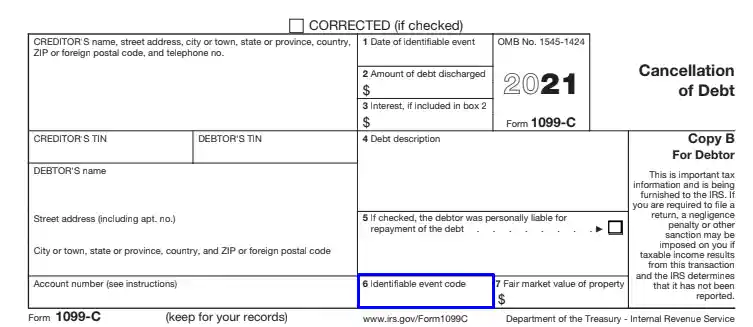

Complete Section Number Six

In section number six, you need to enter a code that describes the reason for canceling the debt. You can find a code that will indicate the reason for canceling the debt on the IRS website.

Complete Section Number Seven

In the seventh section, you need to indicate the fair market value of the property. But the seventh section is filled out only, provided that you submit the two following forms at once: 1099-A and 1099-C.

You can use the form-building software we provide on our site to simplify the procedure and ensure the best result.