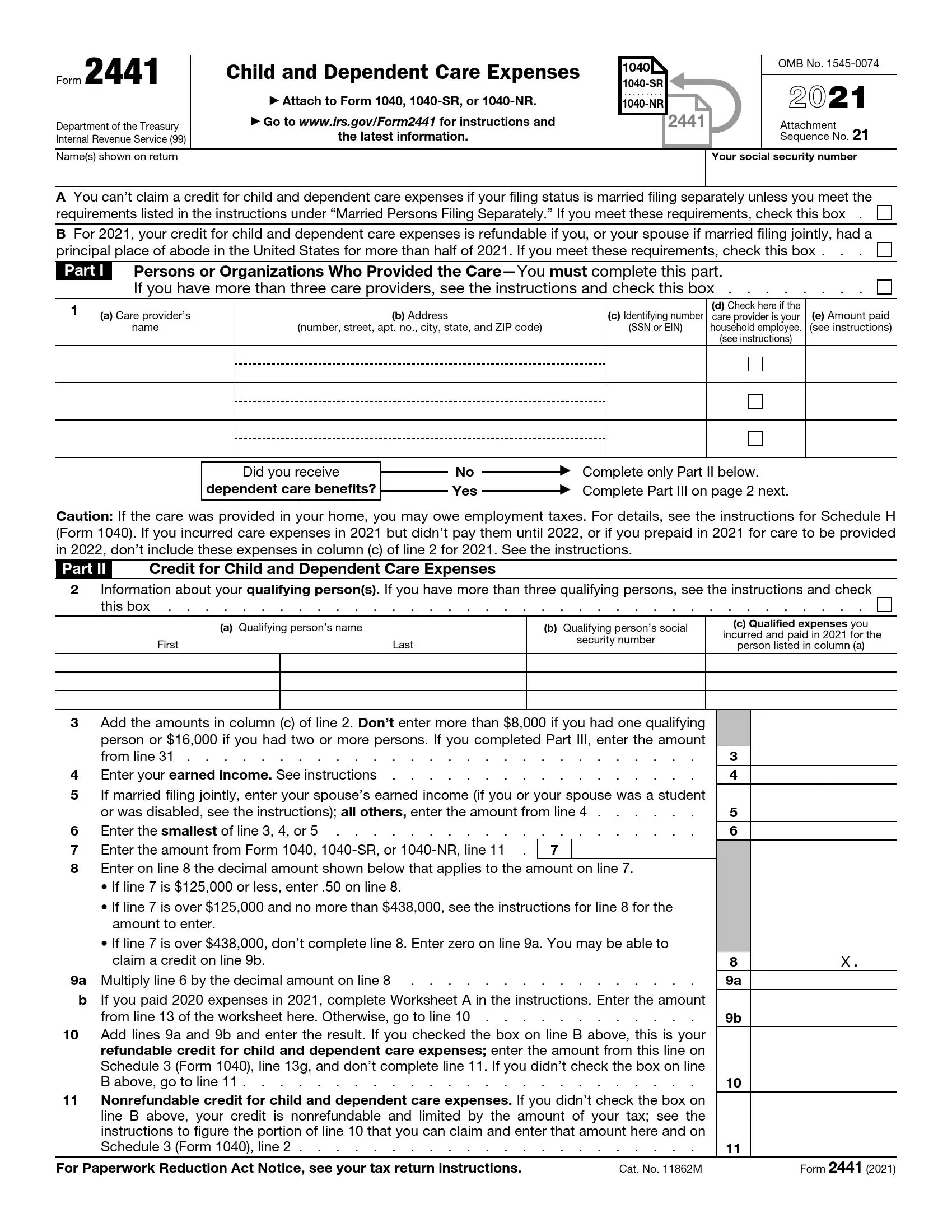

Form 2441 is a tax form taxpayers use to calculate and claim the credit for child and dependent care expenses. This form is essential for individuals who have paid for care for a qualifying child under the age of 13, a disabled spouse, or a dependent, enabling them to work or actively look for work. The expenses eligible for this credit include daycare, babysitting, summer camps (excluding overnight camps), and other forms of childcare.

By filing Form 2441, taxpayers can reduce their tax liability based on the amount spent on eligible care expenses, subject to certain limits. The credit amount is a percentage of the allowable expenses determined based on the taxpayer’s adjusted gross income. This form requires detailed information about the care provider, including their name, address, taxpayer identification number (TIN), or social security number. Proper completion and submission of this form can significantly impact a taxpayer’s overall tax situation by providing substantial tax relief for those with considerable child and dependent care expenses.

Other IRS Forms for Individuals

The IRS Form 2441 gives you an ability to take the credit for child and dependent care expenses. Learn what other forms might be of use to you and your children.

Filling Out the Template

When you see the form for the first time, you may find it quite difficult to complete the template without any mistakes. Although we have prepared a set of instructions for you, it is always a smart move to consult tax professionals if you feel like you need additional help. Bear in mind that providing incorrect or untrue data in any form you send to the Service may lead to various penalties and problems.

You will have to do a lot of math when completing this form. Some numbers you will use must be taken from other documents (forms 1040, W-2, and so on). Prepare them to have at hand when creating the 2441 form.

Also, always remember to check if you have the current template (issued by the Service for the current year). Although the content usually does not change from year to year, you must ensure that you are filling out the proper form. You can get the right version on the Service’s website or use our advanced form-building software and download the IRS Form 2441 right here.

Enter Your Name and SSN

You shall begin by entering your name. Write the same name as provided in your tax return. On the right-hand side, insert your social security number (or SSN), so the Service can identify you correctly.

Check If You Meet the Requirements

You will see a statement below your name that asks checking additionally if you can complete this form. See if you meet the requirements by checking the indicated Service’s instructions; check the box if you do.

Name Everyone Who Helped You

You should name all care providers from whom you received help during the considered year. For each, you must write their name, address, ID number (either SSN or EIN, employer identification number), and paid sum. The chart allows you to include two people (or entities); if you have more, check the Service’s guidance to find out your further actions.

Read the Following Question

The question you see below the chart will let you understand what form parts you must complete. If you did not get any dependent care benefits in the past year, you should fill out only the document’s second part. Those who answer affirmatively should also provide a completed Part III.

List Your Qualifying People

In Part II, you should talk about your children or dependent people, or “qualifying people.”. Again, the chart lets you add only two people, and you have to check the official instructions if there are more.

For each person, enter their first and last names, SSNs, and your costs during the year. Your costs are limited: you can state no more than 3,000 US dollars for one person or 6,000 dollars for two people. Insert the sum of costs for two people (or one number if you have one person) in the line under the chart.

Enter your earned income below. In the United States, your income is “earned” if you get it as a salary from your employer or if you are self-employed. Other revenues do not count (social benefits, retirement plans, and so on). If you are unsure what to write, check the official guidelines that the Service provides.

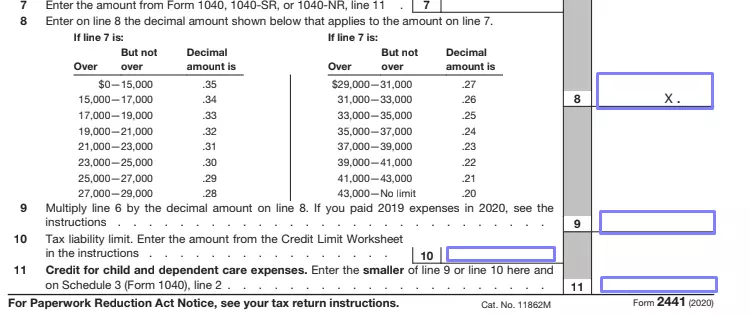

In the next line, write either your income again or your spouse’s income if you plan to submit this record together. Then, pick the smallest number from previous lines and add it to line 6. In line 7, write the required number from your tax return.

Further, do some math as the template demands. After you write the results, use your tax return once again and Credit Limit Worksheet to provide additional required numbers.

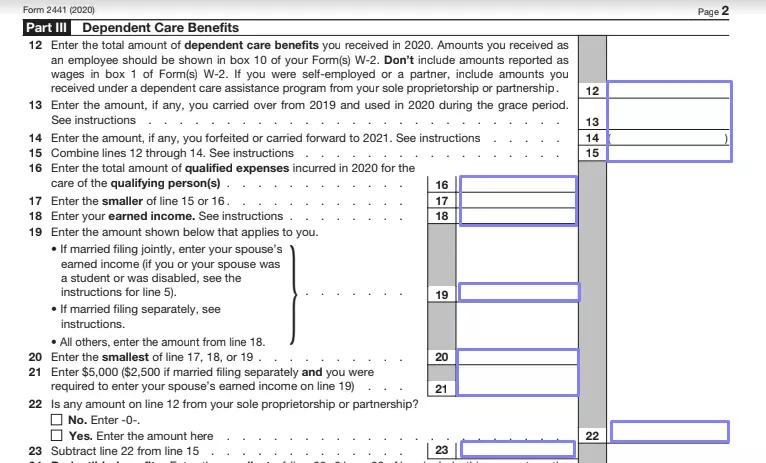

Complete Part III (If Applicable)

As we have already stated, you need Part III only if you got some benefits. Here, you will have to indicate the received sum, your income, and your spouse’s income and count the numbers again. Line by line, complete this block with the needed numbers.

Besides your tax return, you will need to use Form W-2 and extract some rates from there. To claim credit, do not forget to reply to the last portion of the questions at the bottom of the form.

Filing the Form

You have to attach this form to your tax return and deliver both to the Service by either mail or online services. It is preferable to send your documents via the website because they will be processed much faster. However, the Service allows using any of those methods.

Every year, there is a different deadline for these forms submission. In 2021, it is set on April 15: do not forget to complete the paperwork and send everything before this day.