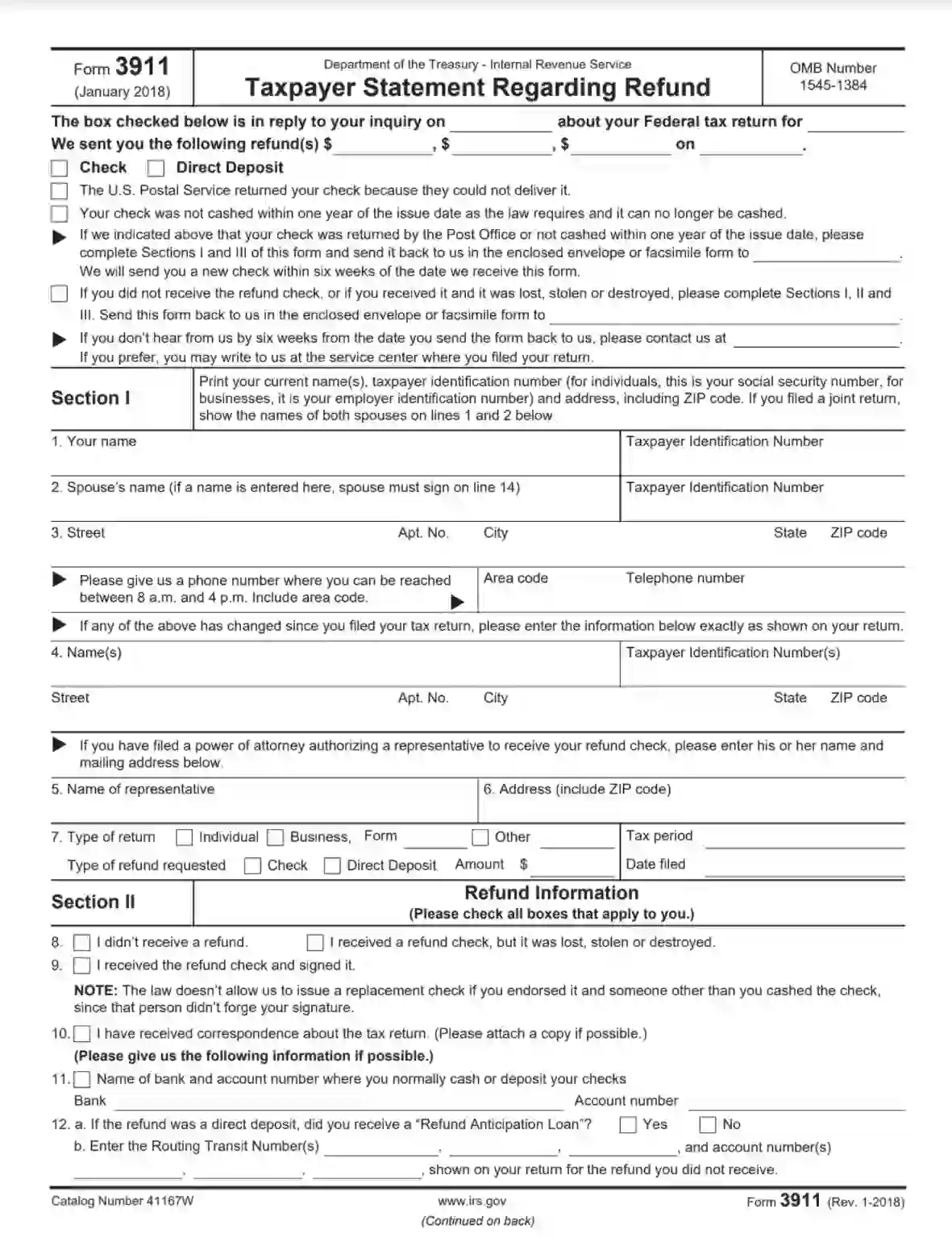

Form 3911 is a document taxpayers use to initiate a trace of a lost, stolen, or misplaced refund check from the Internal Revenue Service (IRS). This form is titled “Taxpayer Statement Regarding Refund” and helps the IRS investigate the status of a refund that the taxpayer expected but did not receive. When a taxpayer has not received their refund within the expected timeframe, and the IRS records indicate that it was issued, Form 3911 provides the necessary details for the IRS to track down the whereabouts of the funds.

Using Form 3911 is essential for addressing issues with undelivered tax refunds. The taxpayer fills out information regarding their identity, the type of tax return filed, and the expected refund amount. This information assists the IRS in locating the refund more efficiently and determining whether the check was cashed fraudulently. Once the form is processed, the IRS can reissue the refund if it was never received or provide information about the check’s status. This form is vital for taxpayers to ensure they receive the funds they are owed without undue delay.

Other IRS Forms for Individuals

In our collection of IRS forms, there are forms for various life occasions. Check if there is anything you might need to file along with the IRS Form 3911.

How to Fill out IRS Form 3911

To fill out the document correctly, you must use the original information from your tax return. It is necessary so that the Revenue Service could track the check, make a record that you have not received your tax refund, and help understand where it could have possibly gone (and if it actually got lost).

You can use our form-building software to create the necessary form template. Below we present you an illustrated step-by-step guide to help you complete this document.

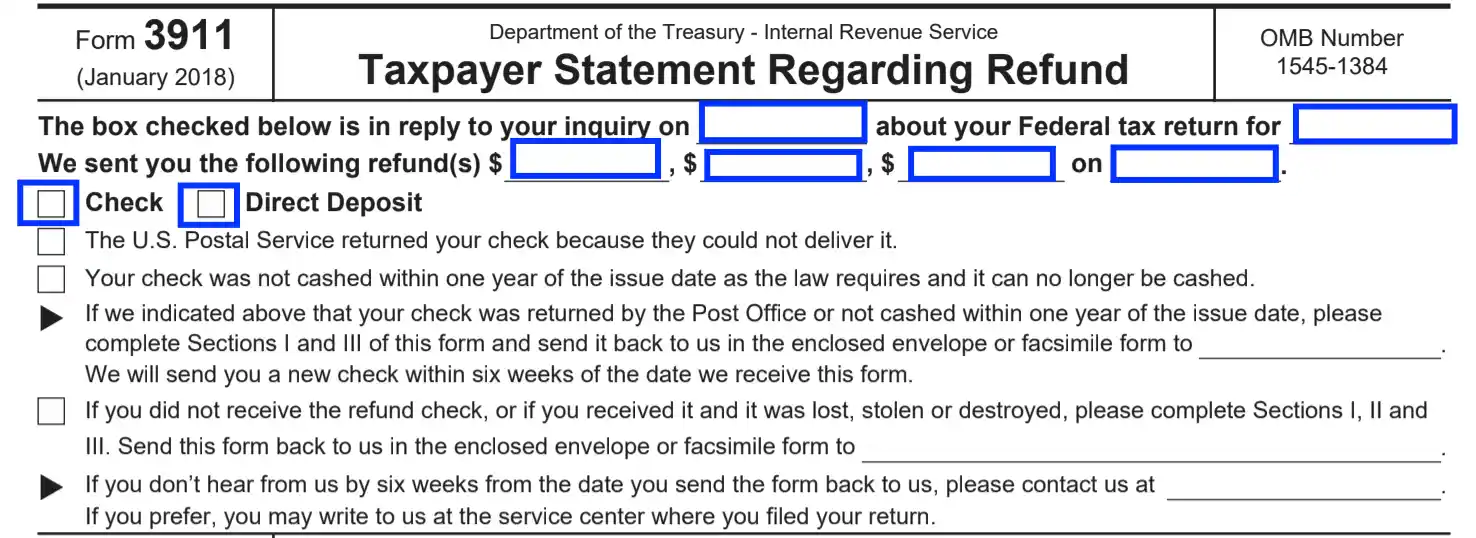

Check or Give the Information at the Beginning

Sometimes the Revenue Service will send you a form with the information already entered at the beginning. In this case, just check if the data is correct. If you are filling out the form by yourself, then enter the following information:

- The date of your appeal;

- The tax year for which the deduction should be received;

- The total sum of payments you should receive by check;

- The application return date;

- Choose the tax deduction refund method: by direct deposit or check.

Check the Status of Your Check

The service should also have identified the reason why you did not receive your refund. It mainly depends on the cause what sections you need to fill in:

- Enter the data in Sections 1 and 3 if the US mail has returned your paycheck, and it was not cashed;

- Fill in all three Sections if you have ruined the check or if you do not know where it currently is and whether it was lost or stolen.

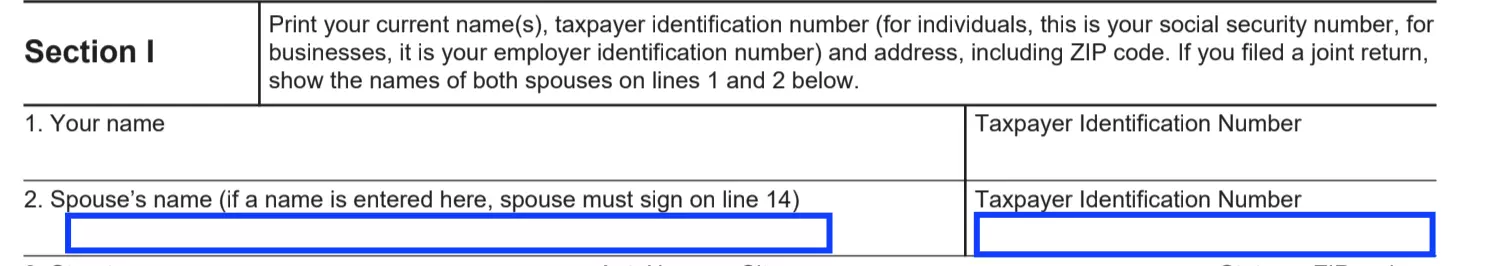

Complete Section 1

This section is to be filled out by everyone without exception. Enter your full name, TIN, physical address, telephone number, and the type of return, including expected amount, and tax year.

If you have a spouse, ensure to fill in their name and TIN. Also then they should sign the form in Section 3.

If your name, physical address, or TIN has changed after filing the tax return, then you need to indicate the renewed information in the first three lines. In paragraph 4, indicate the required information as it was stated in the initial tax return form.

If you indicated a trusted person to receive your check, then you should also enter their details.

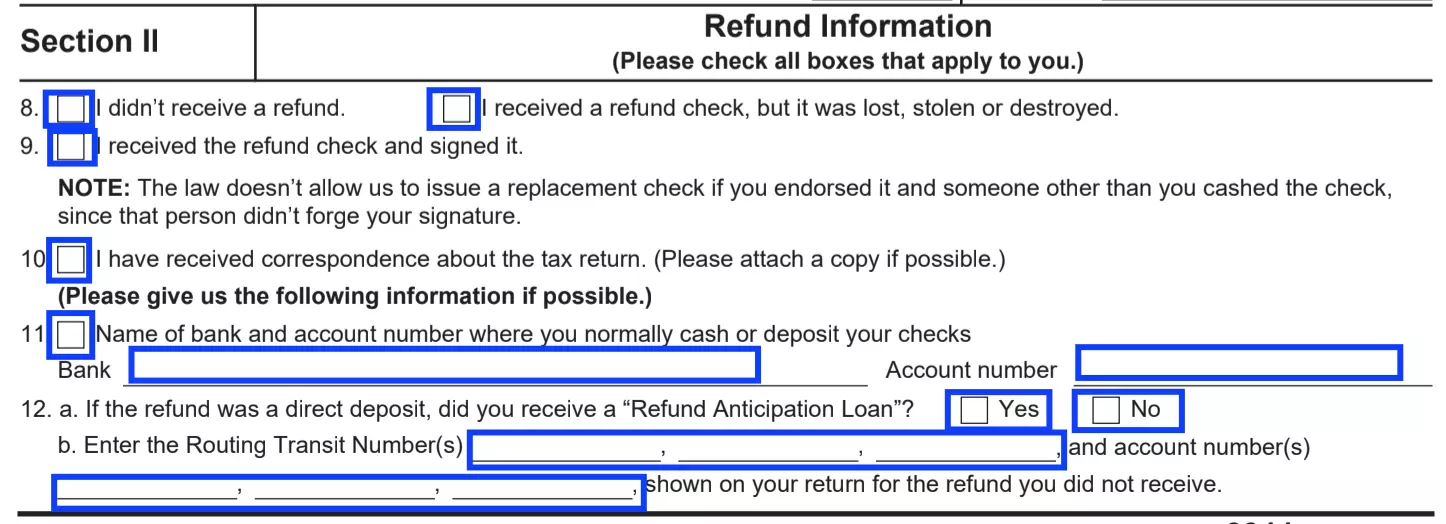

Complete Section 2

As a reminder, you do not need to complete this section if your check was returned by mail.

In this paragraph, you should note which points apply to your situation and provide information regarding the bank where you usually cash the check. This information may be able to help locate your paycheck.

Put Your Signs in Section 3

Date and sign the document. If you have filed a joint tax return with your spouse, then they must also sign the form and date in their own hand.

Do Not Fill in Section 4

This section is for use by the Service, so you do not need to complete it.

Submit the Form

If you have a self-addressed Revenue Service envelope, please send the document in this envelope to the specified contact details. If not, then just send to the same place where you send your tax returns.