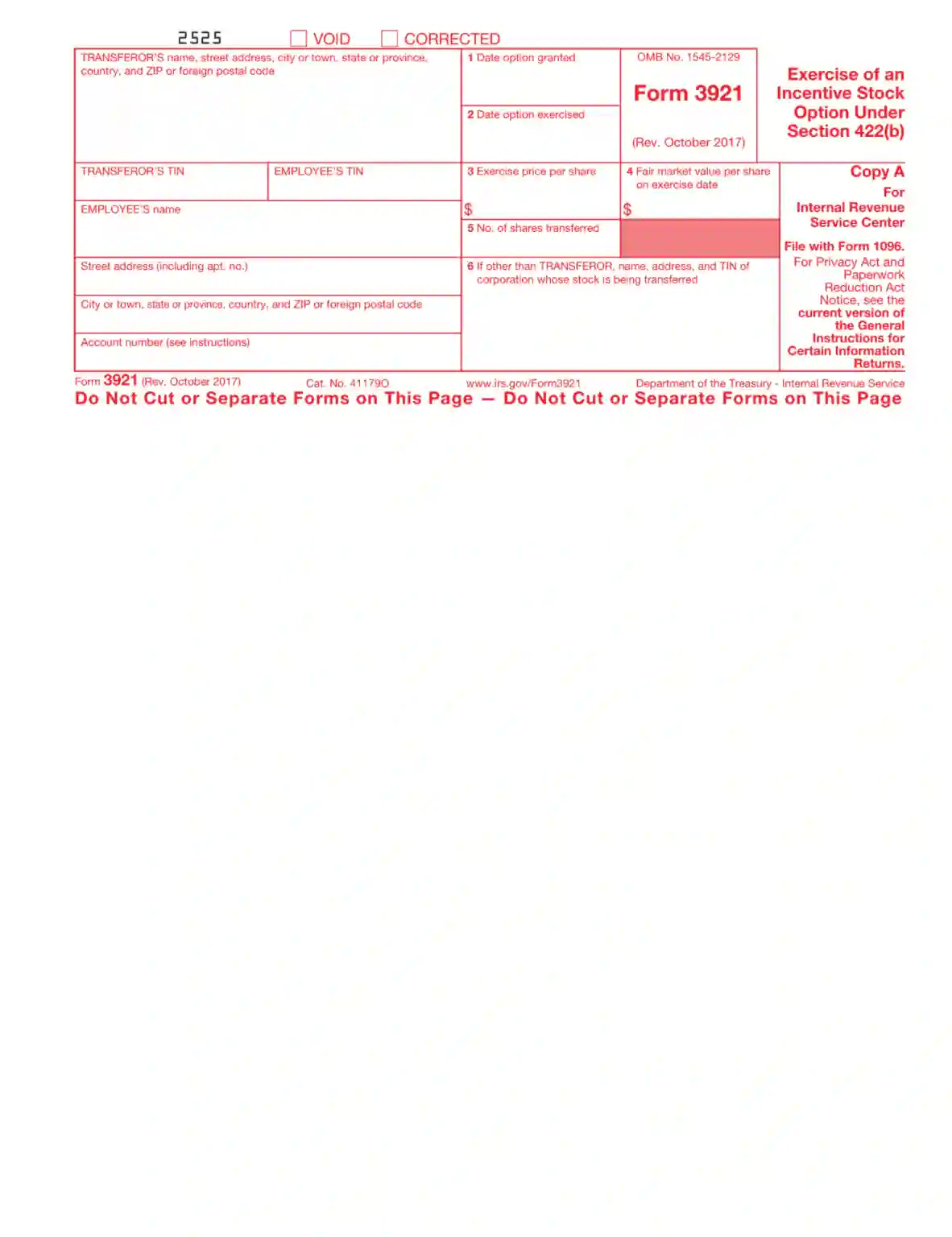

IRS Form 3921 is a tax form specifically designed for corporations to report the transfer of stock options to employees. This form is titled “Exercise of an Incentive Stock Option Under Section 422(b).” It records the exercise of stock options that meet the incentive stock options (ISOs) criteria under section 422(b) of the Internal Revenue Code. Companies issue Form 3921 to employees who have exercised their ISOs during the tax year.

The purpose of Form 3921 is to report information to both the employee and the Internal Revenue Service (IRS) regarding the exercise of incentive stock options. It includes details such as the exercise price per share, the stock’s fair market value at the time of exercise, the date of grant of the option, and the date of exercise. This information is crucial for employees to accurately report their income and potential capital gains related to exercising stock options. Additionally, the IRS uses Form 3921 to monitor compliance with tax laws related to stock option exercises and ensure taxpayers report their income correctly.

Other IRS Forms for Corporations

Companies have to prepare different IRS forms depending on their structure, conducted transactions, and many other factors. The more you learn about IRS forms for businesses, the easier it will be for you to file the required documents with the IRS.

How to Fill out IRS Form 3921

The form consists of four parts: A, B, C, and D. Copies B through D can be completed online in pdf format. The online version of copy A is not scannable, so it is forbidden to print it out from the website. Better to request it from the Revenue Service and they will send printed copies on a special paper. All four copies are the same; the only difference is that:

- Copy A is used for the IRS;

- Copy B is given to the employee;

- Copy C remains with the company;

- Copy D is used for Transferor.

We will show you how to fill out the form using the example of copy B. Please see our illustrated guide below.

Start Filling out by Entering Company’s Data

Fill in the company’s details, including its business name, complete physical address, and the TIN.

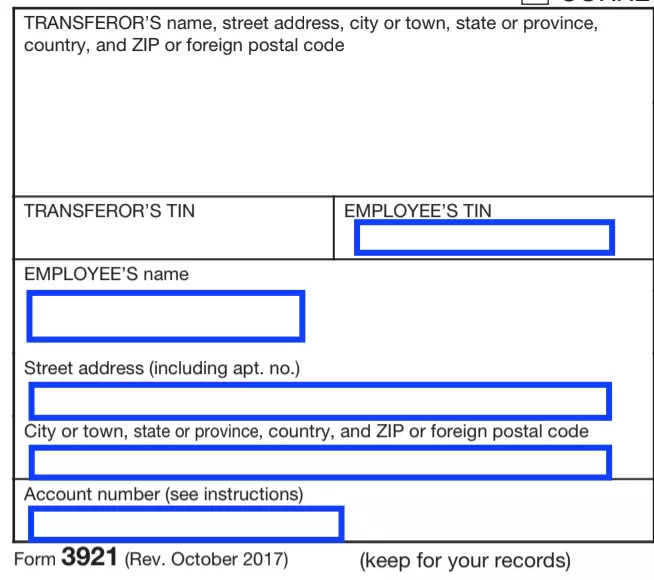

Enter Employee’s Details

You need to enter the employee’s data as well, including their TIN, legal name, physical address, account number.

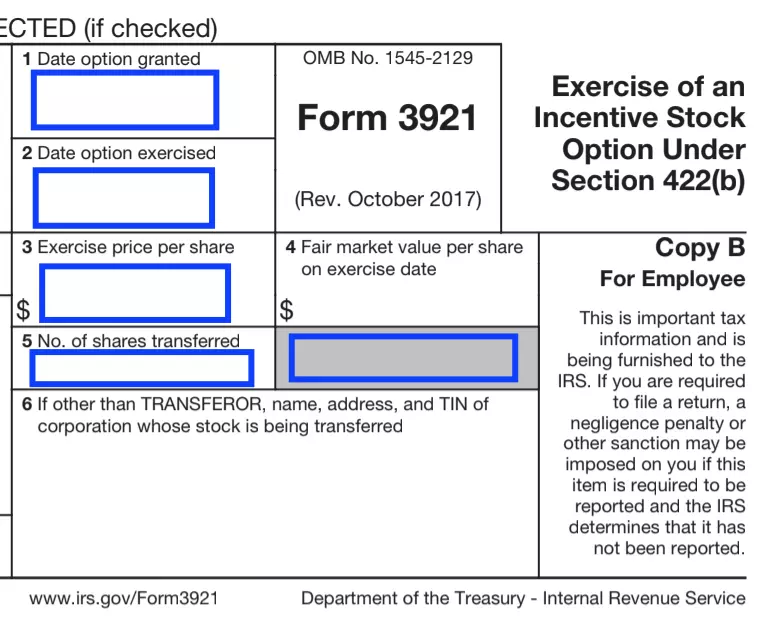

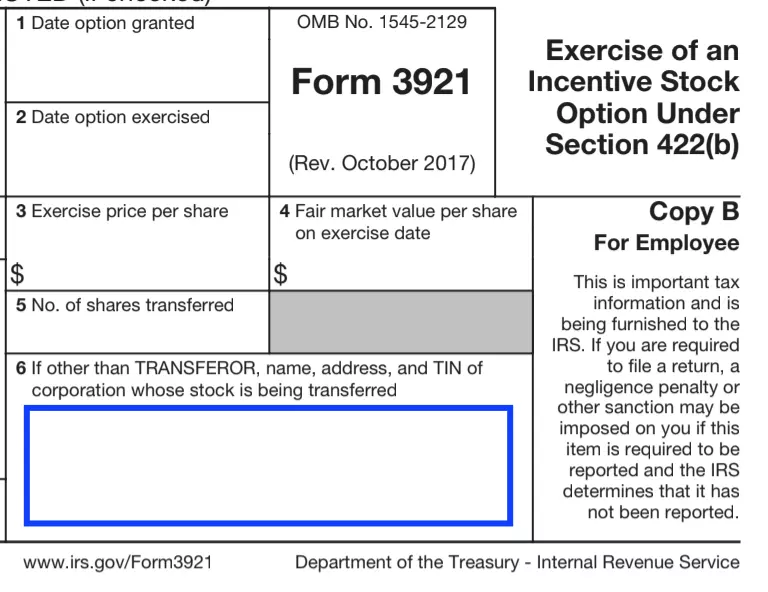

Complete Items 1-4

Fill in all the necessary information regarding the directly exercised ISO.

Fill in Box 6 (If Applicable)

If another corporation whose stock is being transferred appeared in the Transferor’s Box, then complete this step. Submit its business name, complete physical address. and the TIN.

The information provided in the document is used by the Revenue Service, among other things, to verify the claim for preferential tax treatment.