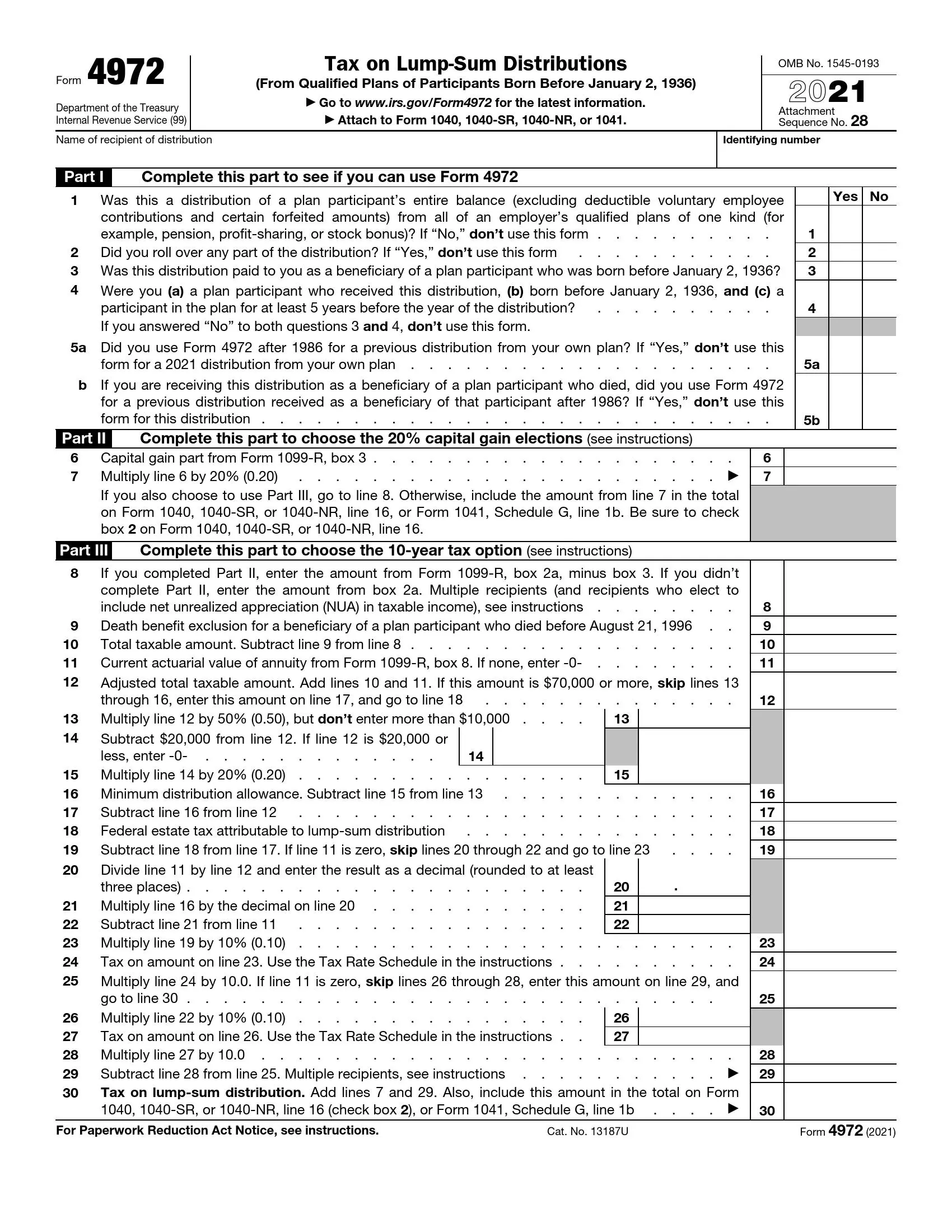

IRS Form 4972 is a tax form used by individuals in the United States who have received distributions from certain retirement plans before reaching the age of 59½ and wish to calculate the additional tax on early distributions. This form helps taxpayers determine the additional tax owed on early withdrawals from retirement accounts, such as traditional IRAs, qualified employer plans, and other qualified retirement arrangements. Form 4972 provides taxpayers with a structured method for calculating the additional tax liability resulting from early distributions, which the IRS imposes to discourage premature withdrawals from retirement savings.

When filling out Form 4972, taxpayers must provide information about the early distributions they received during the tax year, including the amounts withdrawn and any exceptions or special circumstances that may apply. The form guides taxpayers through calculating the additional tax owed on early distributions, considering any exemptions or adjustments the IRS allows.

How to Fill Out the Template

You will probably not require any help when completing the form; however, it is always a bright idea to consult with experts if you have any questions. The form consists of one page to fill out and a couple of pages where you will find all the needed guidelines. You can add some numbers to the second page, but keep it in your archive and do not file it anywhere.

All in all, the form has three parts, and you have to see the Service’s guide and know certain details about your plan to define which parts you should complete. So, it is crucial that you read the governmental instructions before you work on your document.

Anytime you need to create a legal document in the United States, it is necessary to have a template you can use as a sample to create your own from or fill it out with your data and make it a full-fledged document. We offer our advanced form-building software to get a convenient file with IRS Form 4972 that you can fill out. Another way to get the form is to go to the Service’s official site, but you may spend some time searching for the document there.

When the download is complete, open the file and read our general instructions below. If you lack information, you may always turn to the Service’s guide provided on the form’s second, third, and fourth pages. If neither our manual nor the official guide satisfies your needs and answers your questions, use the help of professionals to prevent making mistakes in your template and facing penalties in the future.

1. Introduce Yourself

You, as a taxpayer, must tell who you are so the Service can identify you when it receives your document. This form does not require much data because it goes together with your tax return. So, you should only insert your name (it should be the same as in your return) and your identifying number on the top of the form’s first page.

2. Answer a Set of Questions

You will see a set of questions added here to define whether you can or cannot submit this document. It will help you understand right away if you should or should not keep completing the template.

Near every question, you will see the answer’s definition. For example, if you reply “no” to the first question, you do not need to use this document. Answer each question step by step by marking the relevant “yes” or “no” box on the right. Then, check all your answers to determine whether you are qualified for this document or not.

3. Complete Part II (If Applicable)

Your distribution might presume a capital gain amount, and if this is your case, you may select this method by completing the form’s second part. Insert the required number from the 1099-R Form in line 6; then, multiply it by 20% and insert the result in the following line.

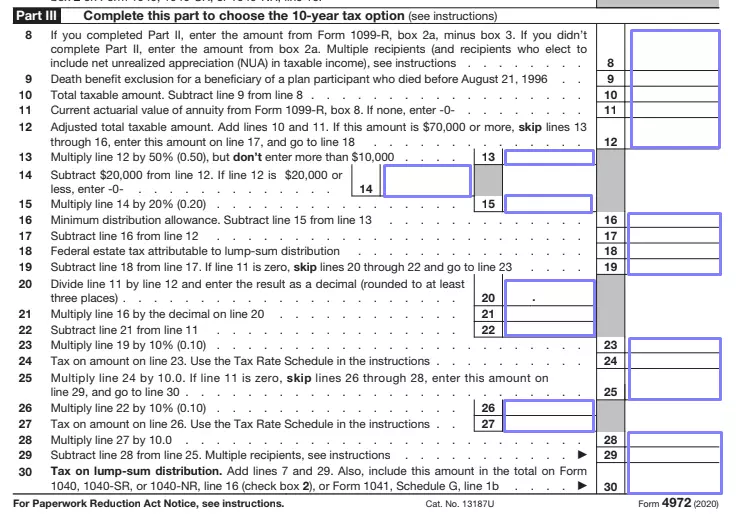

4. Fill Out Part III (If Applicable)

If you have followed our recommendations and read the Service’s info on the form, you already know that you can use both parts of the form. If needed, complete the third part: enter all the numbers and make calculations the way described in the template.

In the form’s last line (30), you will define your total tax on the lump-sum distribution. After you have gotten the result, do not forget to insert it in your tax return as well.

5. Provide Data to Worksheets (Page 3)

On the form’s Page 3, you will see a couple of worksheets you will later store in your archive. You will need your Form 1099-R and a calculator to count all the numbers. Enter the results in the designated line and keep this page for yourself.