IRS Form 6251 is a tax form certain taxpayers use to calculate their alternative minimum tax (AMT). The AMT ensures that individuals and corporations who benefit from certain exclusions, deductions, or credits pay at least a minimum level of federal income tax. This form assesses potential income and allowable deductions adjustments, comparing standard tax calculations with AMT provisions. The taxpayer must pay the difference if the AMT is higher than the regular tax liability.

The purpose of Form 6251 is to identify items that are treated differently for AMT than for regular income tax purposes, such as state and local tax deductions, certain mortgage interest, medical expenses, and miscellaneous itemized deductions. By completing this form, taxpayers can determine whether they owe AMT and ensure compliance with tax laws, thus avoiding potential penalties for underpayment. This process helps maintain fairness in the tax system by minimizing the chances that individuals with higher incomes can significantly lower their tax obligations through various tax benefits.

Other IRS Forms for Individuals

We offer you to look at more IRS forms to make sure you didn’t miss out on any form you need to file with the Internal Revenue Service.

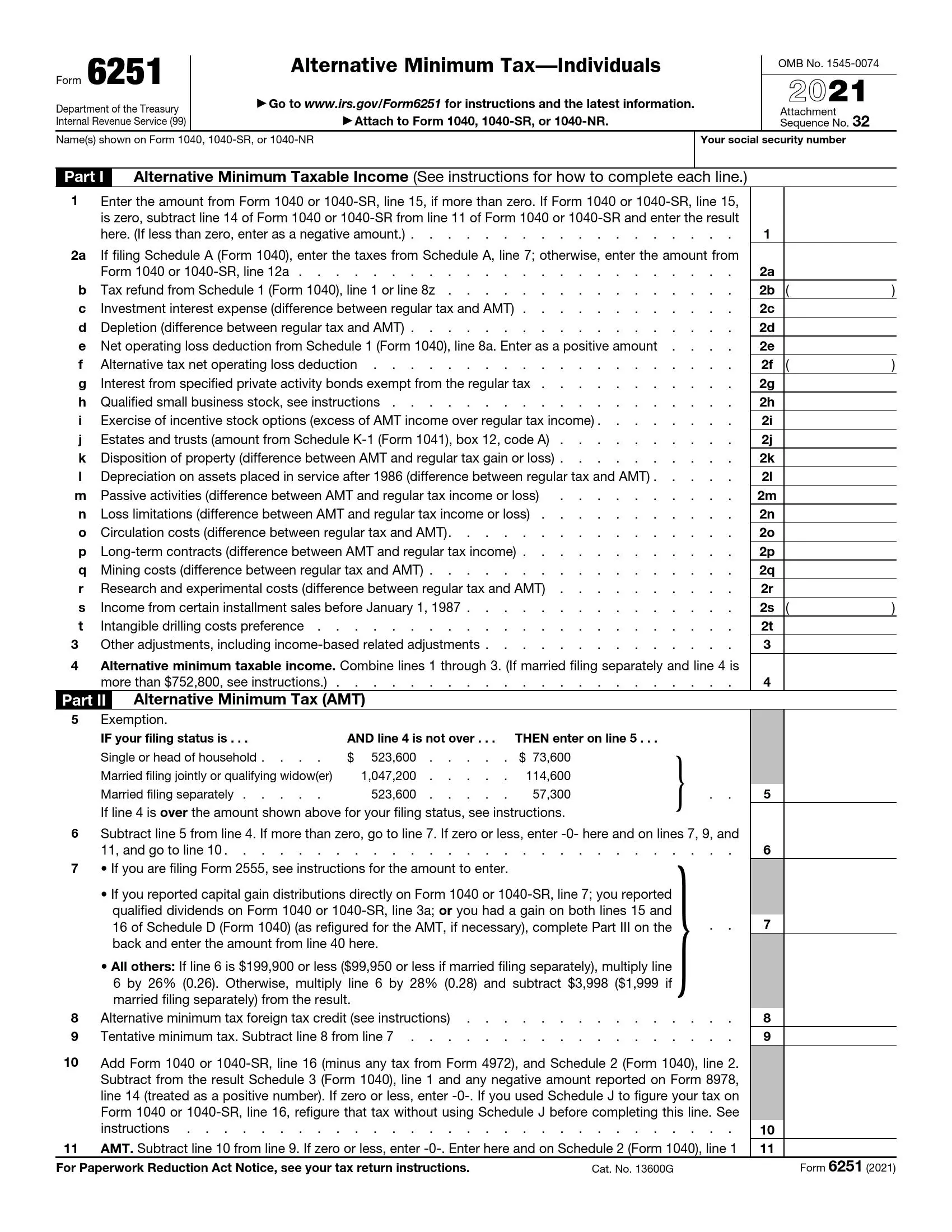

Completing the Paper

Form 6251 consists of three fillable parts and 40 lines. Each requested applicable piece of information has to be submitted. To obtain the customized downloadable document, use our form-building software.

Insert the Amount From Form 1040 or 1040-SR (Line 11b)

Follow the instructions on line 1 and input the number (even if negative).

Complete the Info About Certain Taxes

As well as interest expense, deductions, loss limitations, and other data, which helps to compare AMT and regular tax numbers.

Indicate the Adjustments You Have Not Mentioned

If there appeared to be any other adjustments, apart from the ones you have described above, enter the total on line 3.

Compute the AMT

All of the numbers you have written down should be added. If the total is greater than the sum indicated on this line, include 25% of it.

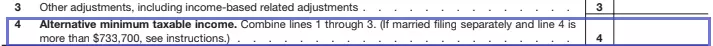

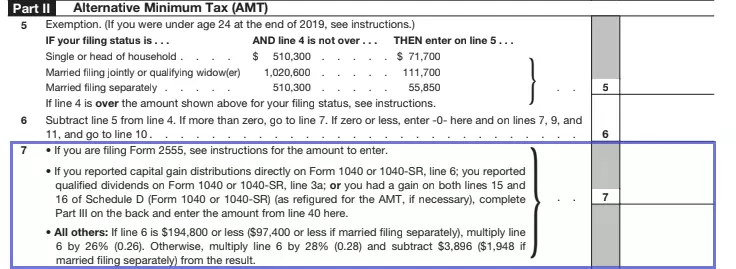

Enter the Exemption

Follow the instructions provided in this line. In some cases, you will have to write down “zero” or the amount presented on line 4 herein.

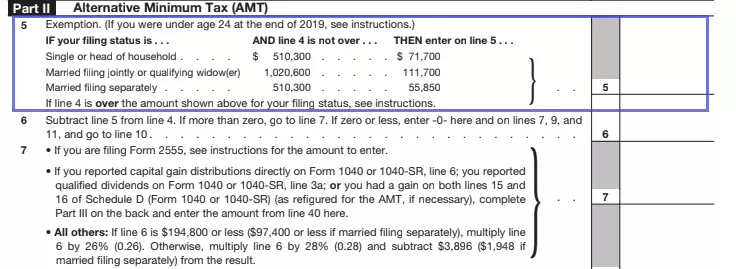

Subtract Line 5 From Line 4

And either proceed to the next line or to line 10.

Complete Line 7

With the information required. Those who use Form 2555 have to use the Foreign Earned Income Tax Worksheet.

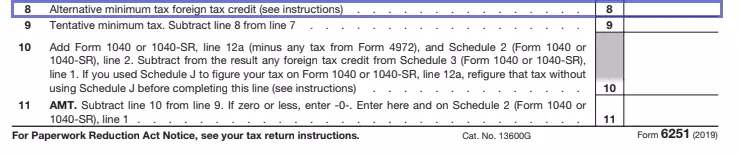

Indicate the AMTFTC

Not everyone must fill out this line. If you appear to get a bigger number on line 10 than on line 7, or they are the same, leave this blank.

Figure Out the Tentative Minimum Tax

The number you receive after subtracting line 8 from line 7 is the one you need.

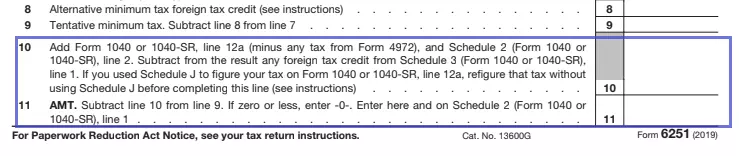

Complete lines 10 and 11

With the info that you get after requested calculations. If you are also filing Schedule J, refigure the tax prior to completing and signing it.

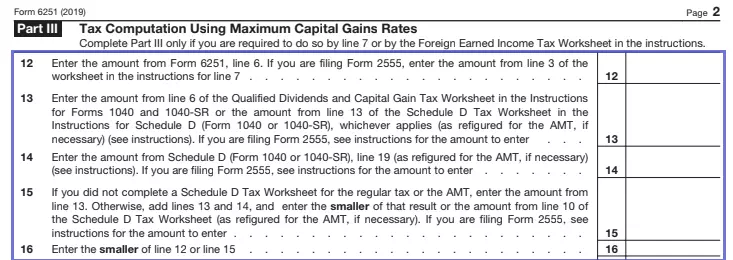

Fill Out Lines 12-16

Depending on whether you are filing any other documents, complete these lines, figure out the smallest number, and enter it in line 16.

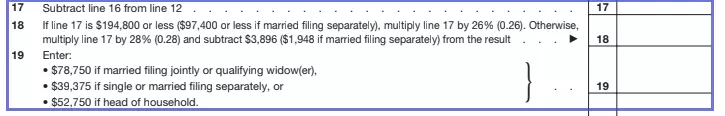

Complete Lines 17-19

First, subtract line 16 from line 12 and input the result on line 17. Then, depending on your relationship status, fill in appropriate numbers on lines 18 and 19.

Insert the Smaller Numbers

Presented on lines 12, 13, 21, or 22.

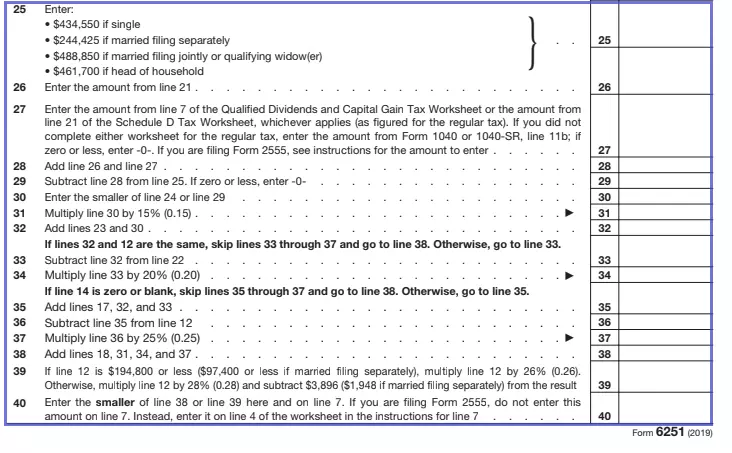

Complete the Lines Left

With the numbers requested after all necessary subtractions, additions, and multiplications. Do not forget to take the info you are submitting in Form 2555 into account if you are using one.