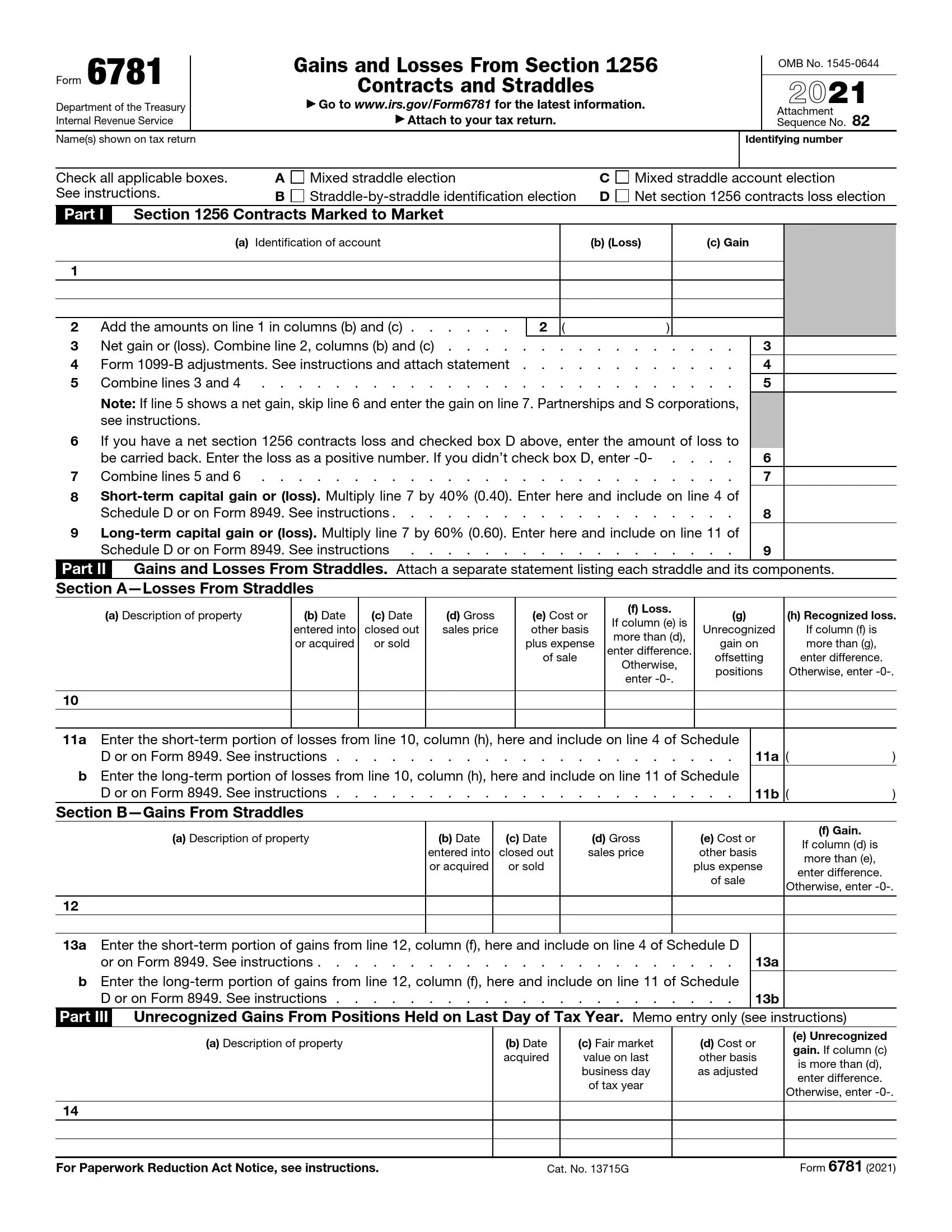

IRS Form 6781, titled “Gains and Losses From Section 1256 Contracts and Straddles,” is used by traders and investors to report gains and losses from section 1256 contracts. Section 1256 contracts include regulated futures contracts, foreign currency contracts, non-equity options, dealer equity options, and dealer securities futures contracts. These contracts are marked to market at the end of each tax year, meaning they are treated as sold for their fair market value on the last day of the year, and any gains or losses are reported at that time.

The form helps calculate the taxable gain or loss that should be included in the taxpayer’s income. One significant feature of Form 6781 is the tax treatment of gains and losses from these contracts, as they are split into short-term and long-term capital gains regardless of the contract’s actual holding period. Specifically, 60% of the gain or loss is treated as long-term and 40% as short-term, regardless of how long the contract has been held. This mixed-straddle accounting method affects the tax rate applied to gains and can be beneficial in managing a taxpayer’s liability.

Other IRS Forms for Individuals

There might be some other financial information you might want to report to the Internal Revenue Service. Check other IRS forms we collected for you.

How to Fill out Form 6781

This document may be found on any source page you consider reliable. We recommend choosing to use our form-building software to get yourself a free downloadable file.

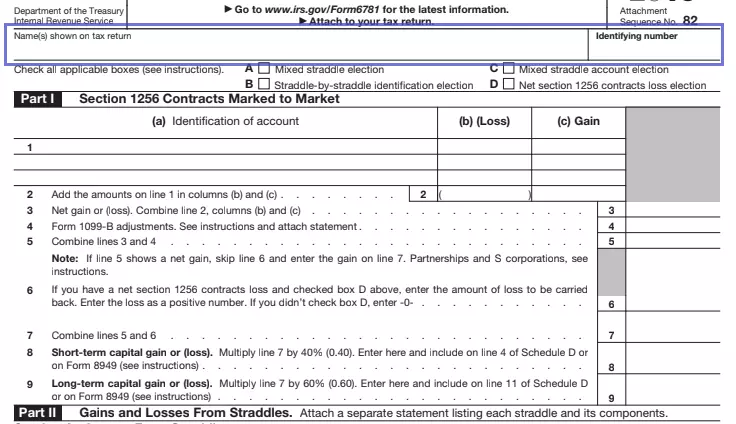

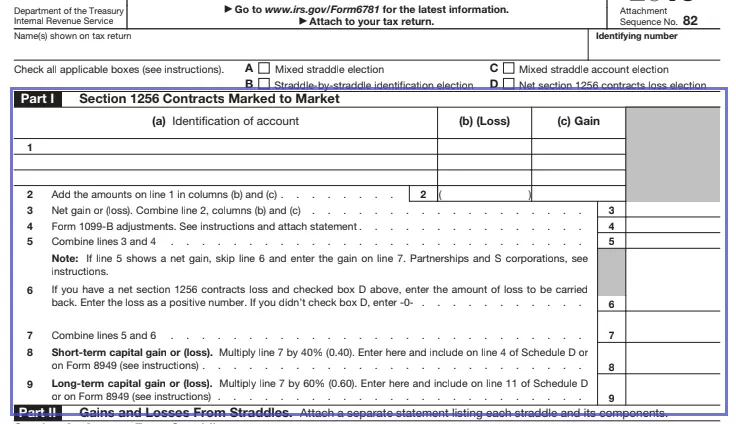

Insert Your Full Name

First, provide your full name, copying it from the tax return you are attaching.

Choose the Corresponding Boxes

There are several options presented underneath your name. More than one may be checked, depending on your particular tax case. If you are unsure about which box to check, do not hesitate to look into more specific instructions on the IRS official web page.

Complete the Gains and Losses

You will figure out Section 1256 gains and losses herein. Follow the instructions concerning each line completion to see how much short-term and long-term capital gain (or loss) has occurred during the financial period.

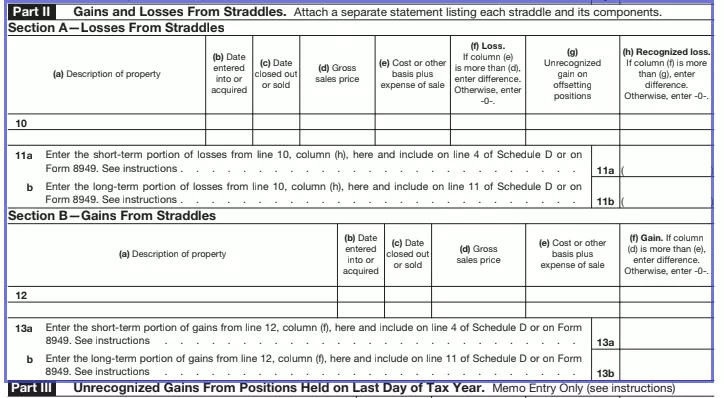

Fill in the Computations

This section will contain computations related to gains or losses from straddles. Do not forget to attach all appropriate documentation so that the IRS staff could check the numbers you are indicating.

Enter the Info on Your Positions

This section is filled out in case you held any positions at the end of the tax year. Depending on whether you have recognized a loss on a position, you will be required to input data or leave this part blank.