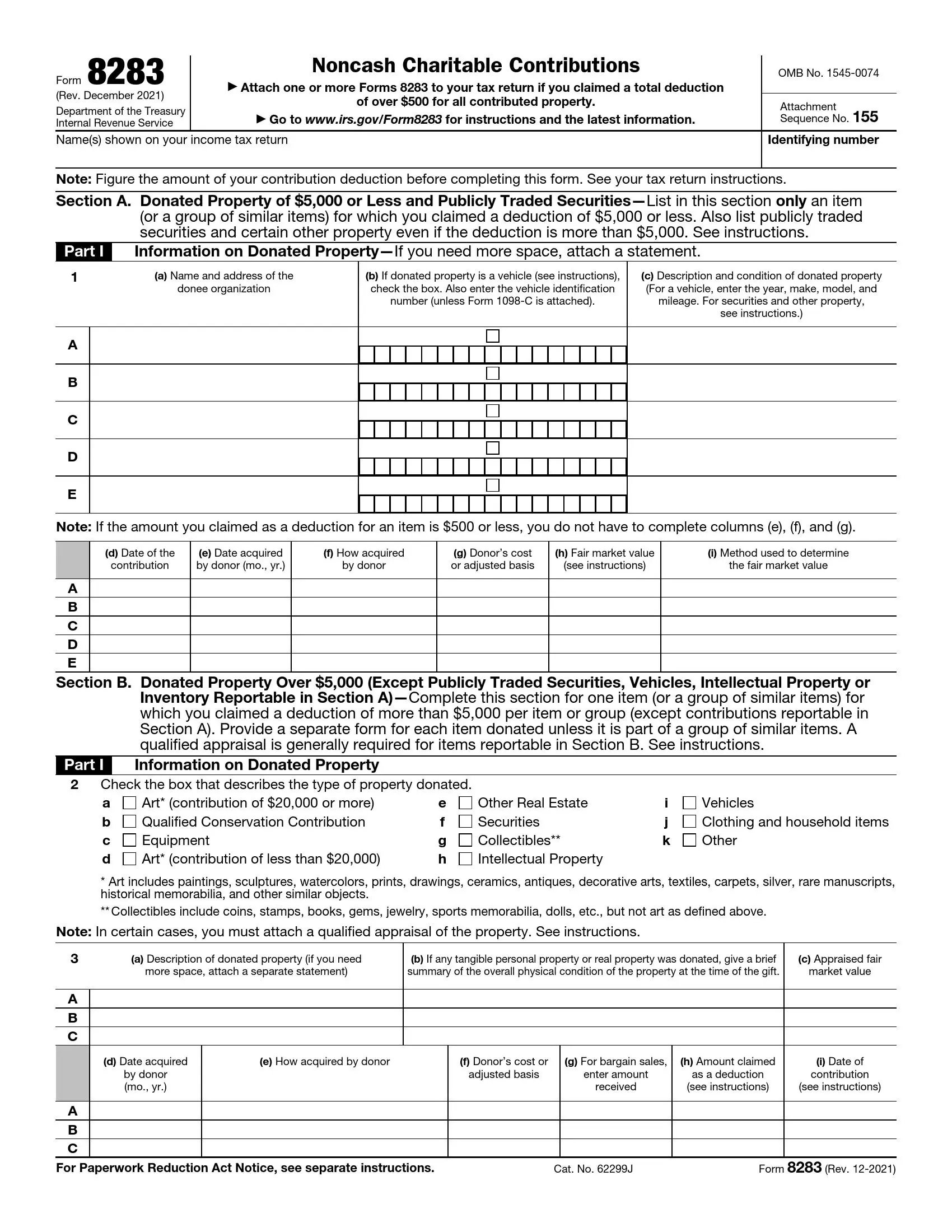

IRS Form 8283 is a tax document used by individuals and organizations to report non-cash charitable contributions to the Internal Revenue Service (IRS). If the total deduction for all non-cash gifts over the course of the year exceeds $500, this form must be filled out and attached to the tax return. It provides detailed information about each donated item, including a description, the fair market value, and how it was determined.

Form 8283 is essential for substantiating charitable contributions claimed as deductions on a tax return, ensuring that donors properly report significant non-cash gifts, and complying with federal tax regulations.

Other IRS Forms for Corporations

IRS forms are intended to be used for various purposes. Check what other forms you might need.

How to Fill out Form 8283

There are two primary sections in the form template the applicant needs to fill out. But before completing them, we encourage you to gather as much information and details on the granted property and assets so that you do not spend your time searching for the rewards of the necessary document or discover that you lack information. Focus on the property type and its primary deduction-related features when filling out the form.

We encourage you to use our form-building software to build and customize any legal form you need. Below, you will find comprehensive instructions on filling out the form.

Insert the Identification Number

Insert the SSN here if the applicant is a private individual. Other applicants (specifically if they are entities) are expected to present their employer ID number.

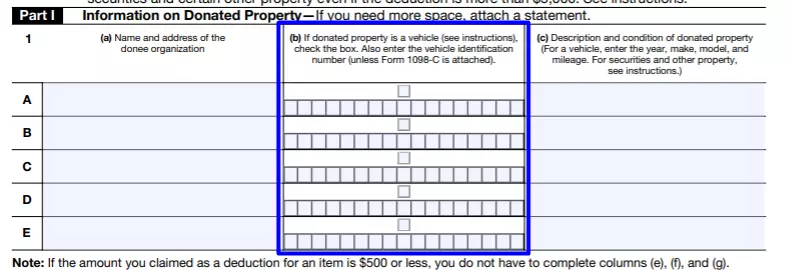

Provide the Donated Property Info

You need to Identify the granted property (or qualified vehicle). Check the corresponding box in Column B to do so. If you do plan on supplying Form 1098-C or other related documents with the application, write down the VIN of the wheels below in the relevant blank boxes.

The vehicle ID number is given after its registration. It consists of seventeen characters. If it is not a standard number, we recommend putting zeros in each of the spare boxes left unused.

Specify the Property’s Additional Details

Specify the property in as much detail as possible. The particularity of the information depends on the estimation of the property. If you are unsure about something, in particular, use an objective assessment based on any official proof.

For securities, please indicate the following clauses in Column C:

- A company’s name;

- Security provision type;

- The shares’ quantity;

- Mutual fund share (if applicable);

- Constant tradings (if any) on the stock.

It is worth mentioning that any individual granting their tangible property for charitable reasons needs to indicate whether the beneficiary has confirmed the purpose of using the granted premises or assets. Otherwise, the transaction may and will be considered illegal.

Enter the Deal Dates Respectively

Enter the date when the transaction was sealed. If there were multiple transactions, enter all their dates on each particular line. If the value specified as a deduction does not exceed 500 US dollars, the preparer can easily skip Columns E, F, and G.

If the property being granted consists of several similar objects and you purchased them at different times, indicate the date in section “Various.”

Provide Info on the Property Acquisition

Here, the applicant must specify the way of how they had acquired the property unit(s) originally (for instance, inheritance, buying, present, swap).

As mentioned earlier, this column does not need to be filled in if the object is tradable securities you have held in possession for more than one calendar year. If you have a real reason not to present detailed data in the mentioned columns, please provide a written explanation for it.

Insert the FMV Data

Fill in the FVM of the property on the benefaction date. The application is attached when the size of the FVM is reduced when calculating a deduction or if a qualified environmental contribution is performed (with a charitable deduction of up to 5 000 US dollars).

Here you must show how the FVM was calculated. There are several methods suggested in the form already, so you only need to pick the one that suits your case most. Please note that each category of items has a different evaluation method applied.

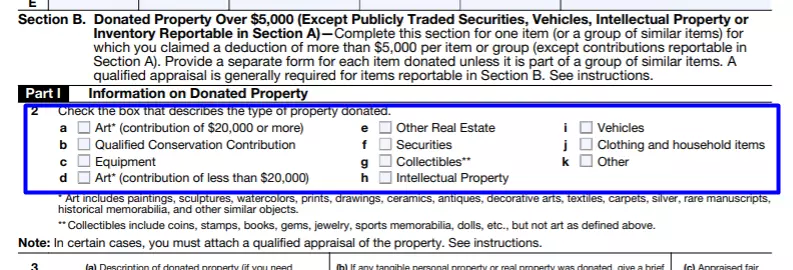

Proceed to Fill in Section B

Section B deals with items, the deduction for which is below or equals 5 000 US dollars. If you are granting a dwelling unit or other asset that is in a somewhat poor condition (meaning the tax deduction will not exceed 500 US dollars), you need to complete this section.

Before you start adding your items to the list, you need to get the conclusion of a qualified appraiser to build a legally accurate Part 1 section. No tax return records are required while adding a qualified estimate to your account.

Get Familiar with the Exceptions

It is not necessary for you to have a written qualified appraiser’s assessment if the granted property is:

- Previously defined intellectual property;

- Qualified transport (almost all types of personal transport), the deduction for which is the gross revenue from the trade of this transport and you have a one-time written confirmation;

- Securities (publicly traded or traded on the open market);

- Business or property for sale.

Please note that you have to fill out different columns and sections depending on the category of the asset you are granting. The IRS currently recognizes the following ones:

- Art in cost over 20 000 US dollars;

- Clothes and household items in disrepair;

- Easements on buildings in historic districts;

- Deduction of amounts over 500 000.

Learn about the Evaluation Demands

There are universal evaluation standards accepted and applied on the United States territory. So, if you are to perform the legal procedure of appraisal, you must comply with the terms and conditions outlined in the Uniform Professional Standards of Appraisal Practice.

The final evaluation document must only be signed and dated no earlier than 60 days before you want to bestow the goods, before the expiration of the retrieval and renewals for which you require the deduction.

Each piece of property needs independent qualified appraisal and a completed form. Yet, the appraiser can group related objects with a total value of 100 US dollars or less. If the total value of the deduction for a collection of identical objects is more than 5 000 US dollars, you need to attach an individual form for each person to whom it was bestowed.

Only one piece of property must be indicated on this part of the form. If you bestow two or more objects, then you need to build its individual form so that in Section 2, only one option is marked.

Column (a) must be completed for the form to be valid and legally applicable for the self-explanatory for completion. Column (b) is filled in if applicable.

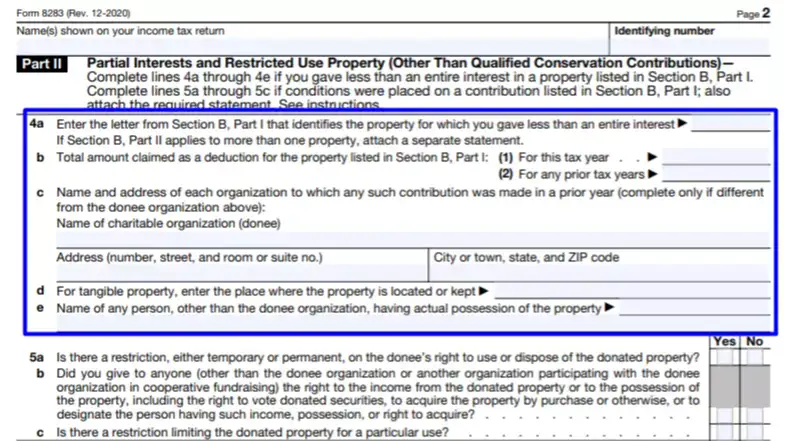

Indicate Interests and Restricted Use Property

If you bestow several pieces, please describe them in an individual document. Classify the property in Section B, Part I, to which the information correlates.

Complete lines A through E in Section 4 only if the share contributed is less than the property specified in Section B, Part I. Register a sum corresponding to the deduction for that tax year and any previous tax years for contributions of a partial interest in the equivalent property on line 4b.

Fill in lines A through C in Section 5 if you have restricted the right to income or disposal of the property being donated. Attach the required statements of the agreement by the parties understanding the limitations.

Fill in the Taxpayer (Donor) Statement

Give information about the endowment in this part if its estimated value is less than 500 US dollars. It is necessary to register the exact price of the object in Section B, Part III.

In Section B, Part III, limn the object using the data from Section B, Part I. If you are itemizing it as “Property A” in Part I and the object appraised at 500 US dollars or less, then simply list it as “Property A.” All elements of any set that are not traded on the exchange are recognized as one piece.

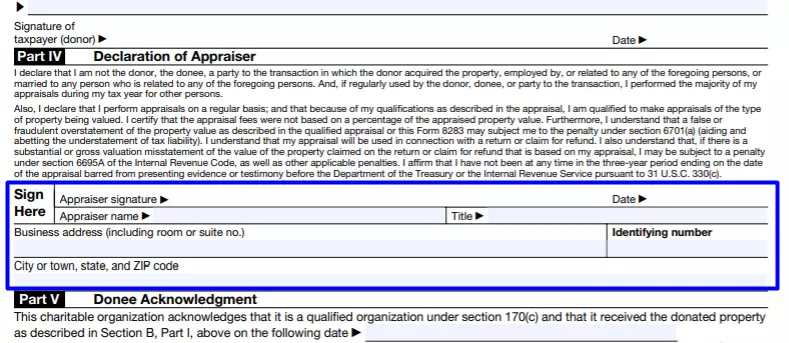

Complete the Appraiser’s Declaration

This part must be performed by a qualified appraiser. Furthermore, if you accept the help of several appraisers, each of them must sign this section and the relevant appraisal document. The property appraisal is not considered qualified if you present distorted data to the professional you hire. Moreover, the estimated fee cannot be based on the appraised amount’s percentage. Thus, it is in your interest to provide only accurate info.

In the “Identification number” field, the evaluator must enter their tax ID number.

Provide the Donee Acknowledgment

Part V is to be filled out by the party that receives the donation, so if you are the applicant, you do not have to bother completing it. Before presenting Section B to the donee for confirmation, ensure to put your full legal name, ID number, and a detailed description of all the donated assets.

It is also crucial that the donee gives you a written confirmation required under Section 170 (f)(8). This confirmation can only be signed by a designated official and authorized individual. Make sure they obtained the form’s copy later.

If there is a suggestion that the granted property will be utilized for something other than the doe’s aim or function, the donee should mark the “Yes” box in Part V. In this case, your deduction will be bounded.