IRS Form 8379 is used by married taxpayers who file joint returns and are known as “injured spouses.” This form allows them to request their share of a tax refund that was or is expected to be applied to their spouse’s past-due obligations, such as federal tax, state income tax, child or spousal support, or federal non-tax debt, like a student loan.

By filing Form 8379, an injured spouse can protect their portion of the refund from being intercepted for debts they are not legally responsible for. The form can be filed with a joint tax return or separately after the joint return has been filed. It requires detailed information about each spouse’s income, deductions, and credits to determine the refund portion that may be rightfully allocated to the injured spouse.

How to Fill Out IRS Form 8379

There are two main ways you can fill Form 8379: you can either do it on your own, relying on the guidelines provided below, or you can utilize a form-building software and a PDR editor, which perfectly work together. By choosing the second option, you may be sure you save yourself from the headache caused by the form implementation.

But if you choose the first option, you still have the chance of skipping that headache, as you will have detailed guidelines as the guidance.

Study the General and Specific Guidelines

Before moving to the form completion, it’s advisable to check carefully general and specific guidelines referring to Form 8379. Don’t be lazy to check on them as it’s essential not to make a mistake while filling the form out as even one small mistake will lead to the remaking of the whole form. It means your request for the tax refund will be delayed or, what worse, declined, and you’ll have to go through the whole form completion process all over again.

That’s why spending half an hour on the examination with guidelines is nothing compared to the time on the correction of errors in the completed form.

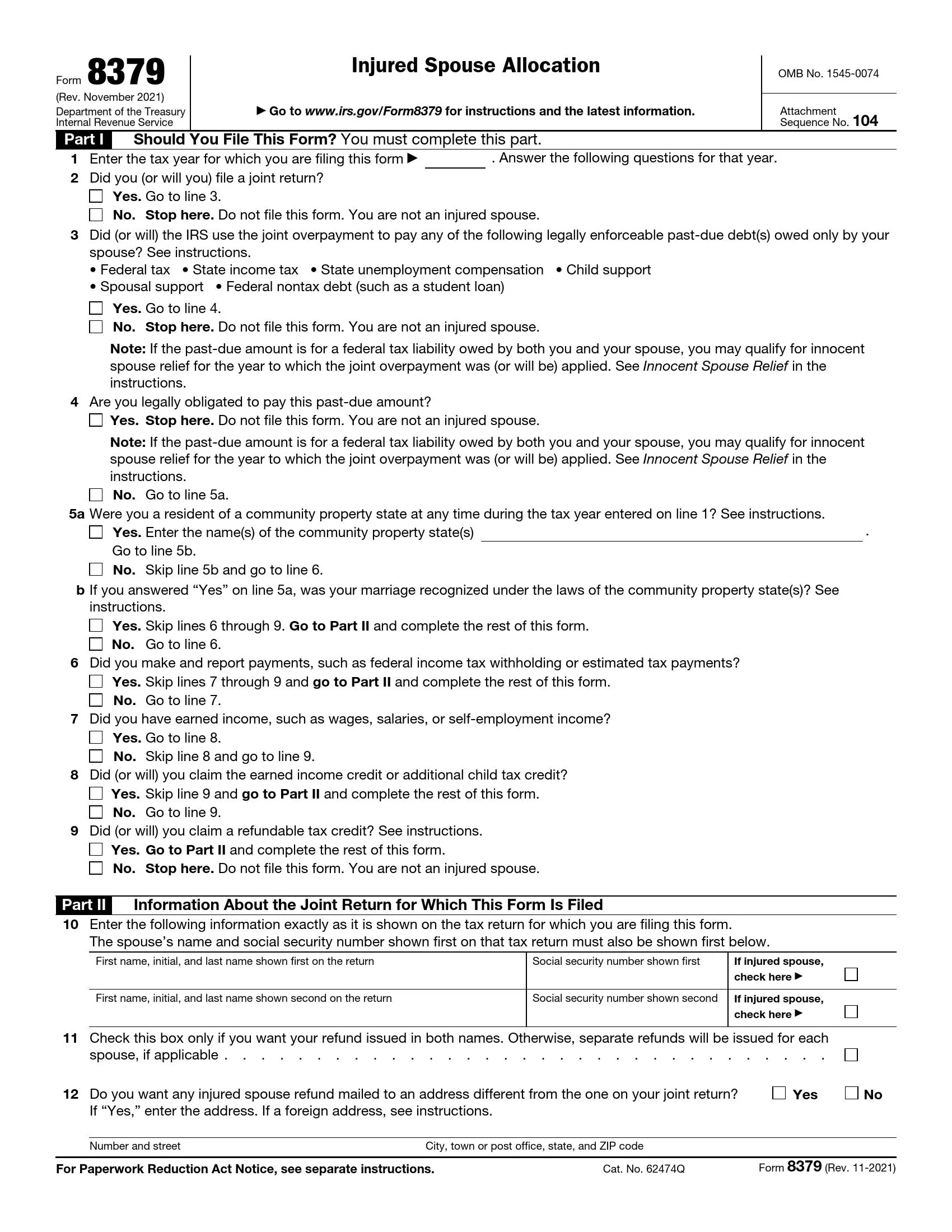

Answer the Basic Questions

After you got acknowledged with guidelines, answer the basic questions in the first part of the form. Answer the questions relying on your situation and according to the regulations which you can find in the questions themselves.

Don’t forget to enter the year in which you fill Form 8379. After that, state if you, as an injured partner, request for a joint return, have to pay the overdue amount of money, and if you paid such taxes as a federal income tax and reported that.

Also, check the right box answering the question of whether you reported the supervising body about your income credit or child tax credit or not. State if you’re requesting a refundable tax credit, as well. Check the box with the right answer.

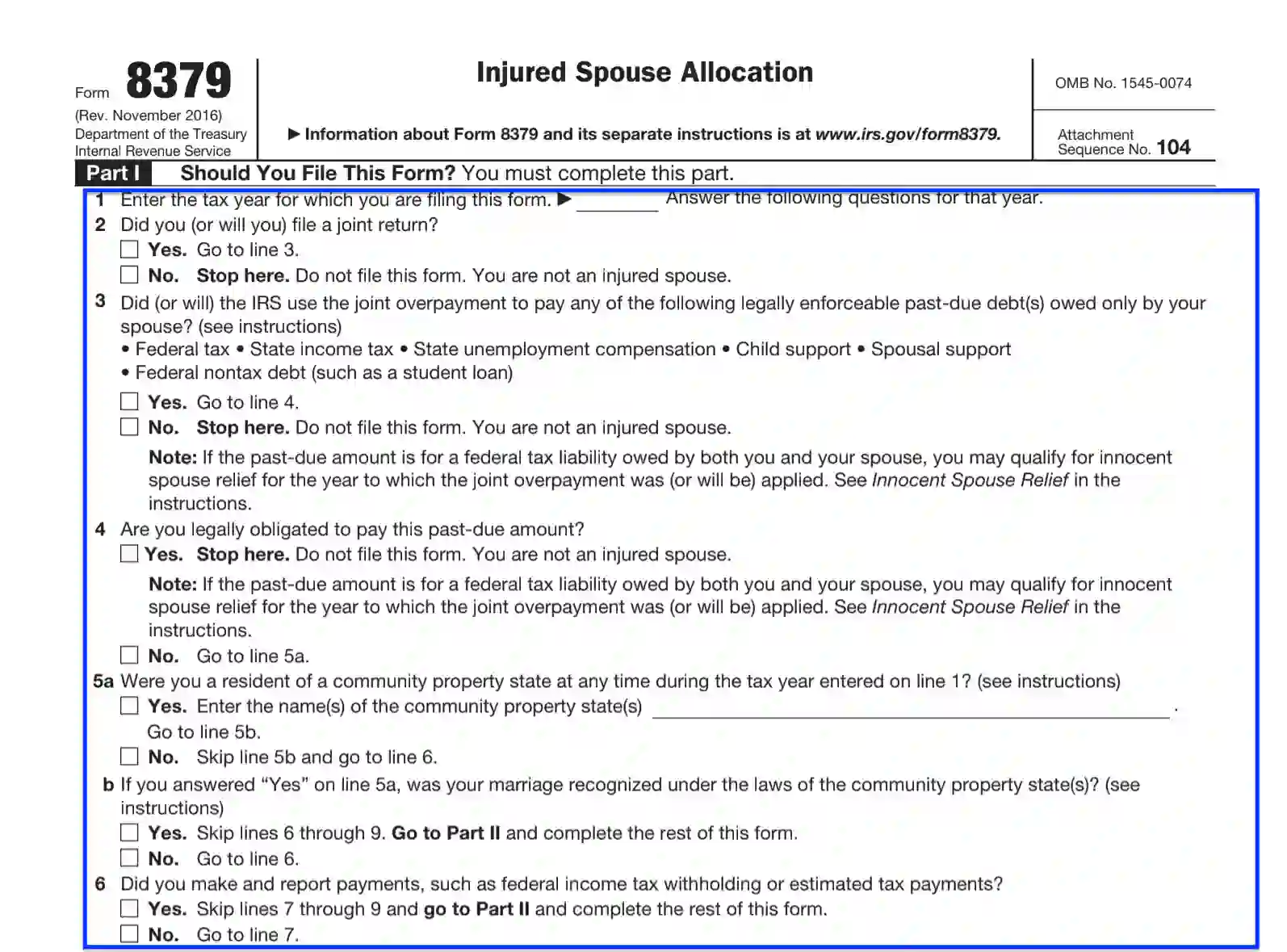

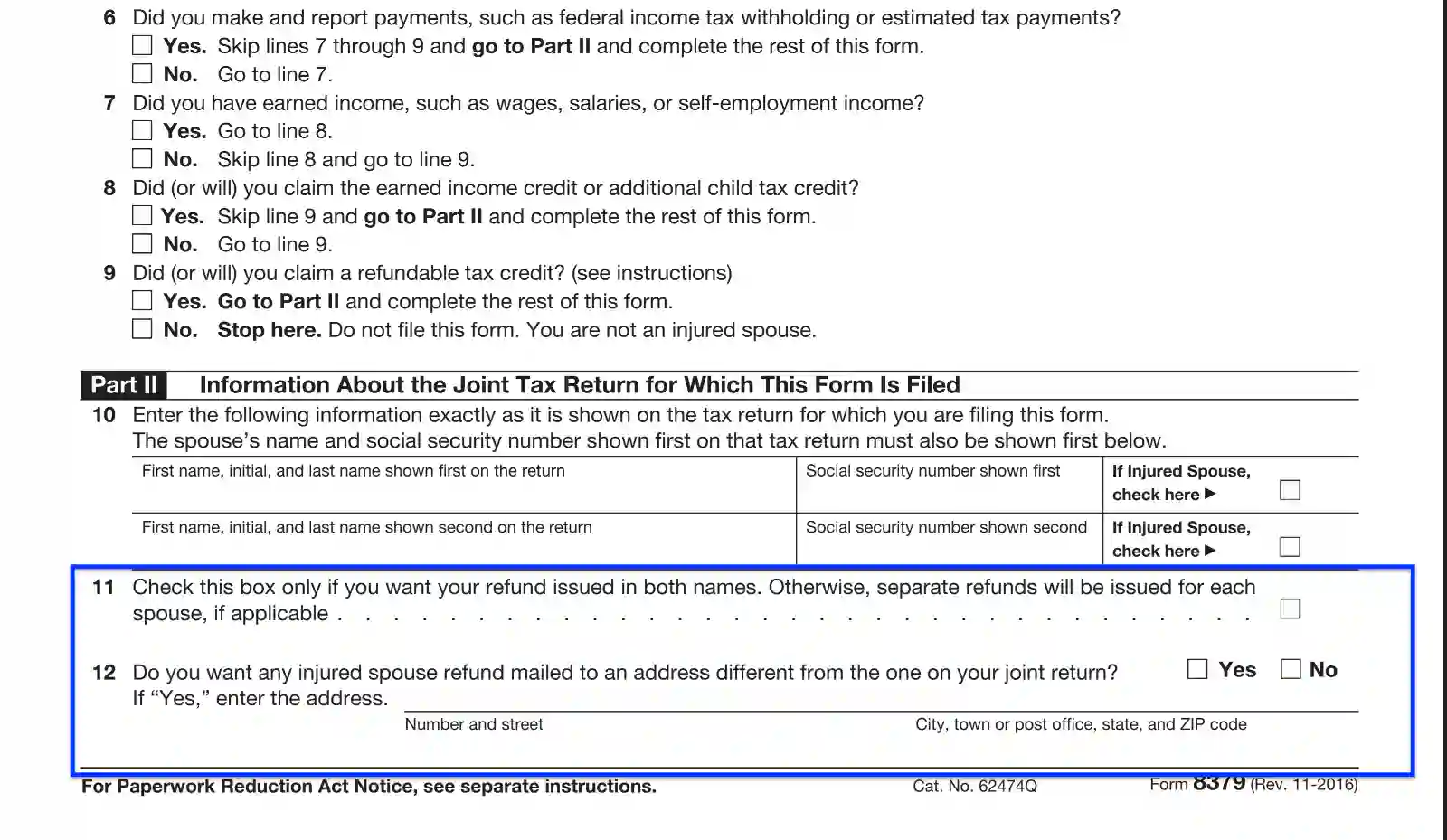

Provide the General Data on the Joint Tax Return

Note you have to write down the data according to the way it’s written on the tax return.

Write down initials, correct first and last names (which go first and second on the tax return), and social security numbers. Register who’s writing down the necessary data in the form.

Type if you want to receive separate refunds or refunds issued in both names. Enter if you need to receive the refund at the address that differs from the one you’ve already mentioned in your joint return, as well. If you choose a different address, write it down in the form.

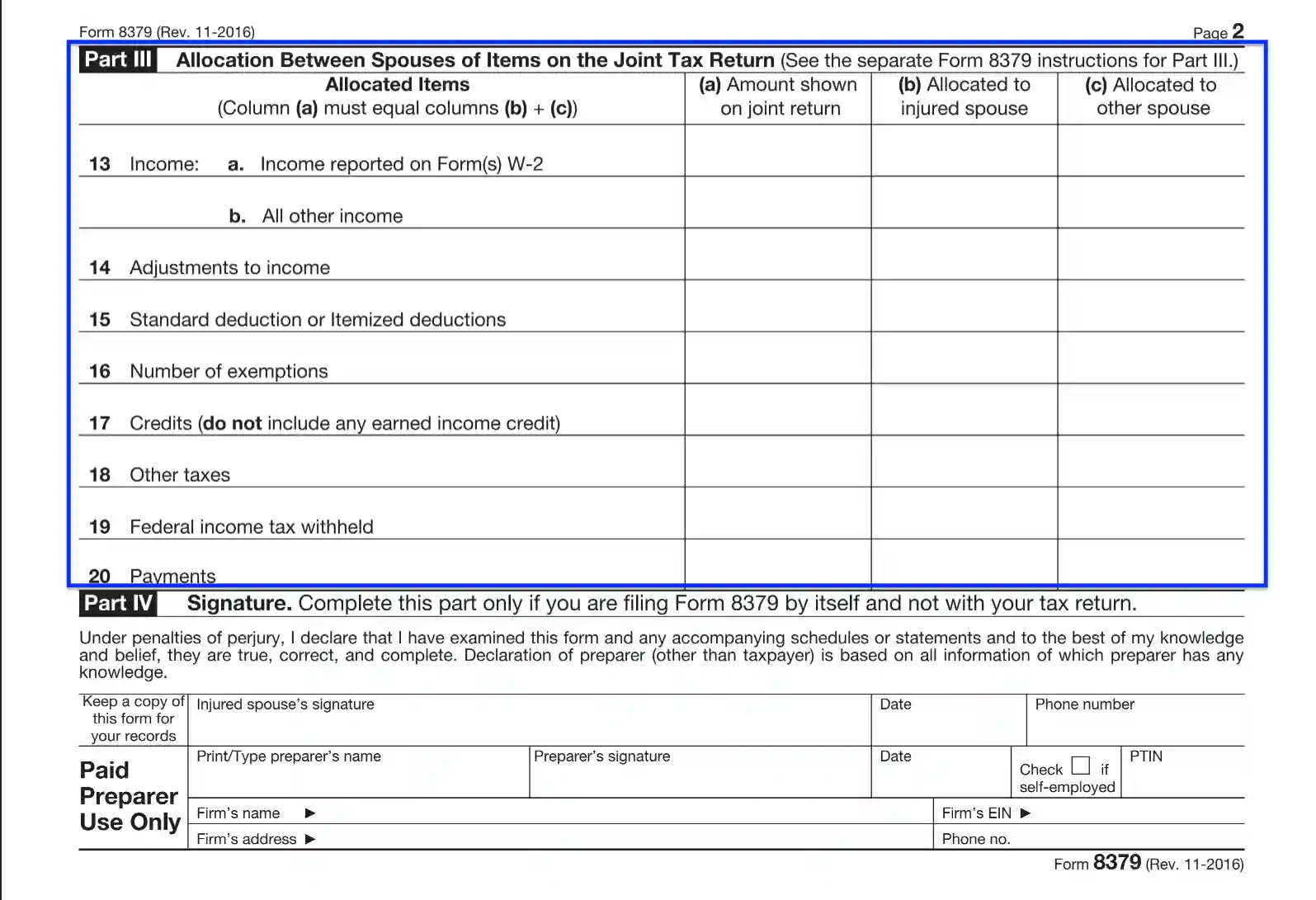

Give the Data on the Allocation Between Partners

In this section of the form, you have to give detailed data on the distribution of items on the joint tax return between two partners. Give as many details as possible, and mind answering all the questions necessary for the form implementation.

Ensure the Signing of the Form

The aggrieved partner has to sign the form, enter the signing date and their phone number. After that, the person preparing the form completion (an injured partner can be this person) must type their full correct name, signing date, PTIN and sign the form afterward. If a person preparing the form is self-employed, they need to check the box.

Also, there must be data on the name of the company, correct address, phone number, and EIN.

Transfer the Form to the Supervising Body

After the form is finished and has all the necessary signatures, you need to transfer it to the Internal Revenue Service Center, where workers of the center will file your form and register your request.