IRS Form 8453 is a U.S. tax form specifically designed for taxpayers who file their tax returns electronically but must submit certain paper documents that cannot be electronically filed. This form is a transmittal document for these paper records, ensuring they are properly linked to the electronic submission.

Common attachments that require this form include forms related to elections made by the taxpayer, supporting documentation for a tax credit, or schedules for certain types of income. By using Form 8453, taxpayers can maintain the advantages of electronic filing, such as faster processing and receipt confirmation, while complying with the requirement to provide documentation in paper form.

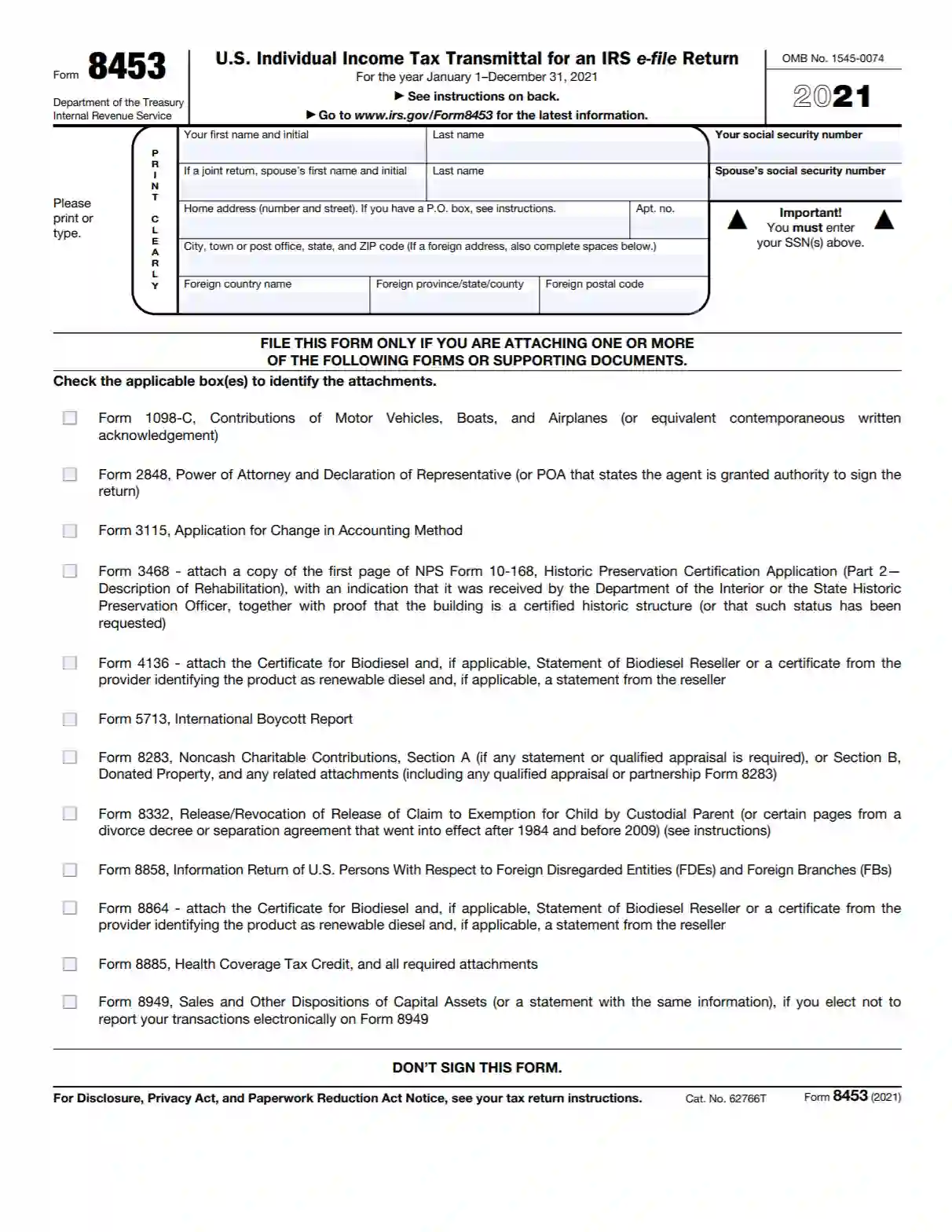

How to Fill Out IRS Form 8453

IRS Form 8453 is easy to fill out because there, you should enter only personal data and attach some documents. If it is complicated for you to complete IRS Form 8453, you can use this step-by-step guide or apply special software from our website. Following one of these algorithms, you will be sure that no issues will appear.

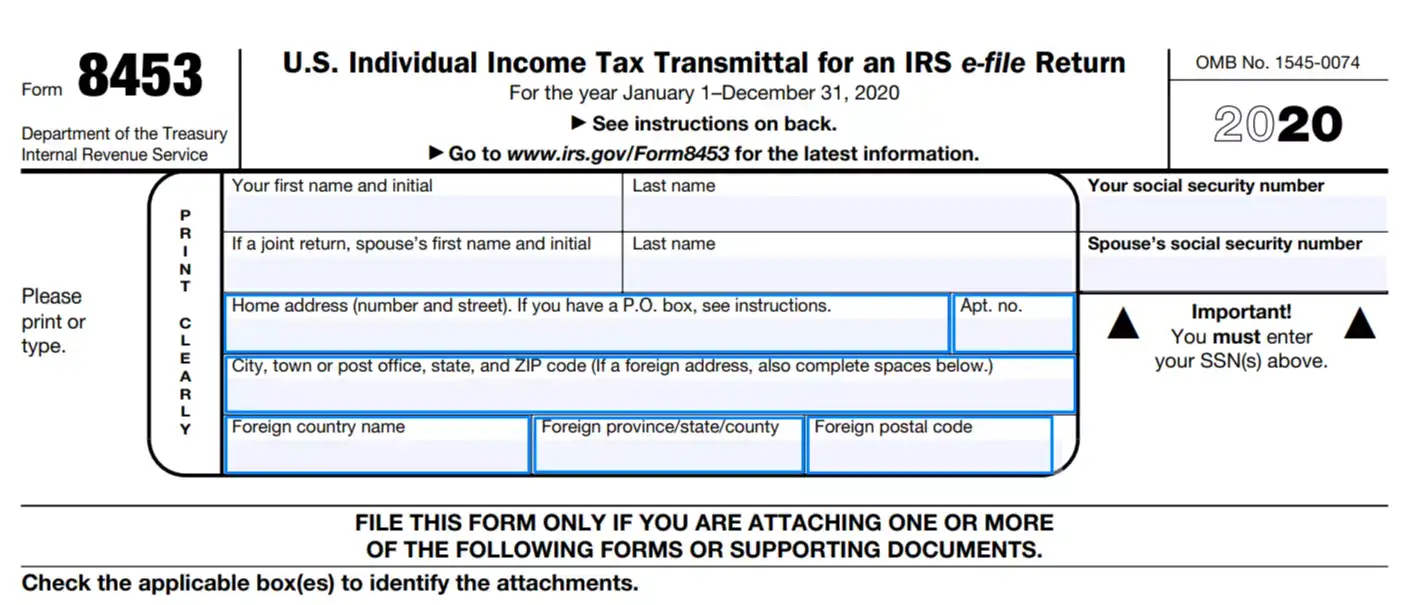

Introduce yourself and your spouse

You should enter your first and last names in the fields on the top of the form. Include the same data for your spouse if you have a joint tax return.

Write in the detailed address

Then you need to fill fields with your address, including apartments, street, city, state, and ZIP code. Make sure that the address is similar to the one you specified in return. Also, add a PO box number if the post office does not offer a delivery service.

You can use a foreign address, but you should fill boxes about the foreign country accurately without abbreviations.

Provide your social security number

Write in your SSN in the field on the right and add the SSN of your spouse if your return is joint.

Mark selected forms

In the second part of the form, you should put checkmarks in the boxes near to forms that you will attach to it. IRS Forms should be similar to those that you sent online to the office.

There is the only exception about Form 8332 — you can replace it with scans from a decree about divorce only if it was signed between 1984 and 2009 years.

Attach forms and file IRS Form 8453

Once you have filled out all the fields, you do not need to sign this document, but just send it to a proper mail address.

Where and When to Send IRS Form 8453

You must file the form to the IRS office, its address you can find below.

Be careful with the terms of filing because you have only three days to send the form from the moment when you receive an acknowledgment from the IRS. If there is no answer to your electronic request from the IRS office, you should contact the transmitter.