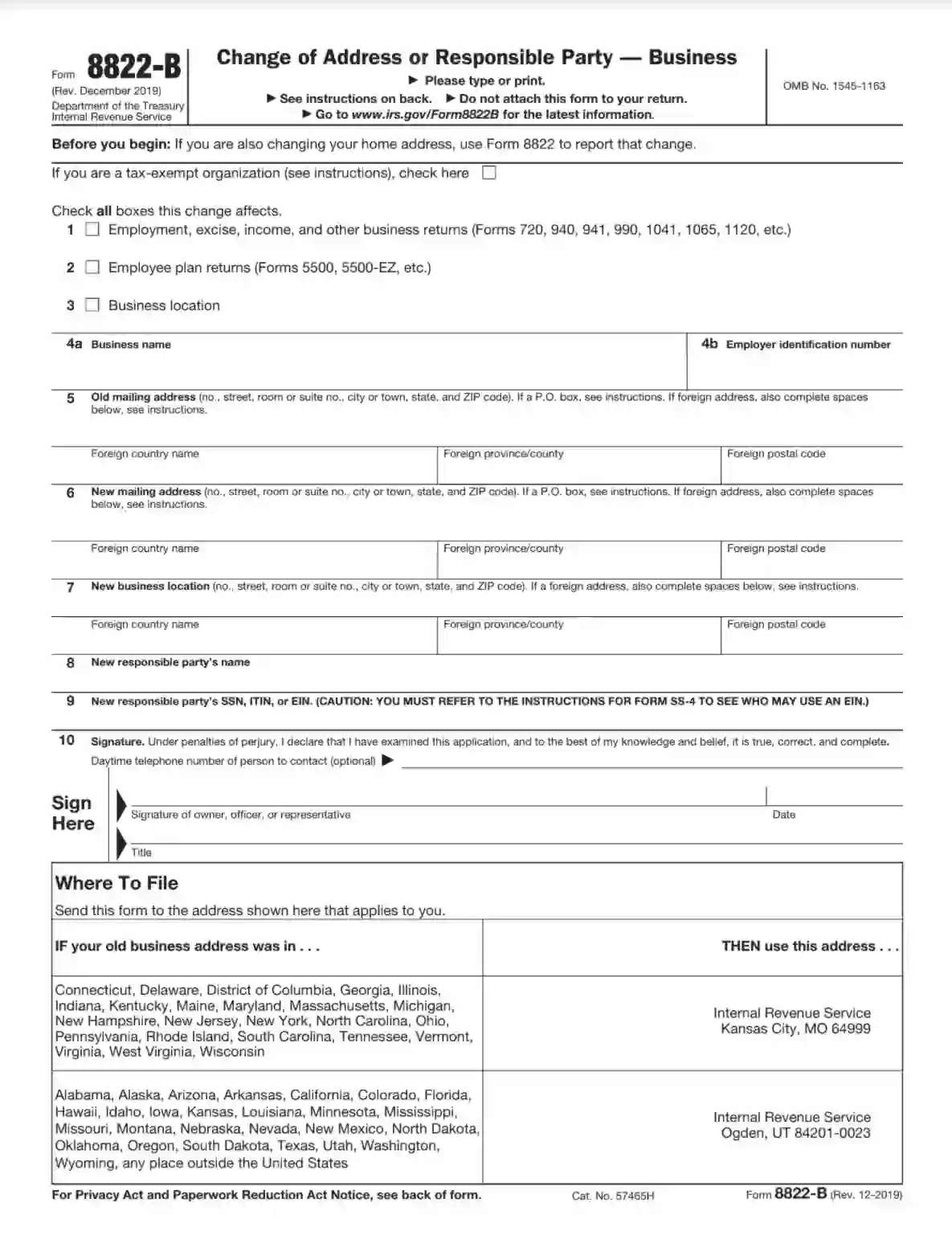

IRS Form 8822-B is a document used by businesses to report a change in their mailing address or location and a change in the identity of the responsible party. This form is essential for businesses to ensure that all correspondence and official communications from the Internal Revenue Service (IRS) are sent to the correct address. Businesses must keep this information up to date, as it helps them receive tax-related notices and maintain compliance with tax obligations.

The main purpose of Form 8822-B is to notify the IRS about any contact details or changes in the person who has the authority or responsibility to act on behalf of the business regarding tax matters. This includes changes due to restructuring, ownership changes, or management personnel.

How to Fill Out the Template

In many cases, we recommend business people to ask their accountants for help or even hire a freelancer or agency that specializes in taxes and related documents. However, the IRS Form 8822-B completion is quite a feasible task even if you are not sure about your tax knowledge.

The document just requires basic information about your company and a description of changes: its previous location, new address, a new representative (depending upon what is new). Moreover, you can find some guidelines prepared by the Service on the form’s second page.

If you have never seen the form and do not know anything about its content and lines to fill out, check our comprehensive guide below. You can create your document step by step using it.

Get the Template

Anytime you need to create a legal document, the question is where to find the proper template. Obviously, you can get one on the IRS official website. However, our form-building software was developed especially for such templates’ generation, so you can get yours in a couple of seconds here. When you are done, you can begin to draw your own form.

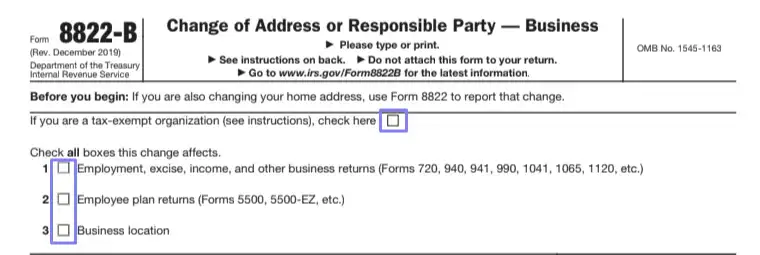

Check the Relevant Boxes

The document starts with several options to check. If you represent a tax-exempt entity, check the suitable box. Then, you will see three various options describing what exactly is changing in your company. Pick all applicable boxes and mark them with a tick or cross.

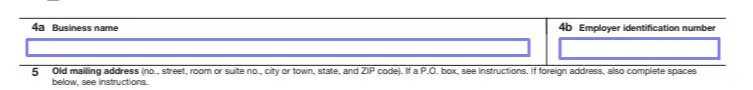

Introduce the Entity

As usual, you will start with the basic details about your entity: its name and EIN (employer identification number). Write them in the designated lines.

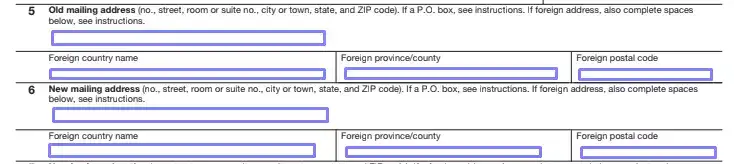

Describe the Changes

Then, you can see several fields that will help you describe what has changed. They start with address: you can indicate your old and new address, respectively. If your previous or new address is outside the United States, you can add the name of the country, province, and postal code in the designated fields.

After the address fields come the location fields. If your entity has changed it, enter the new data (address) in the fields. Again, if it has become foreign, insert the country’s and province’s name below, along with the postal code.

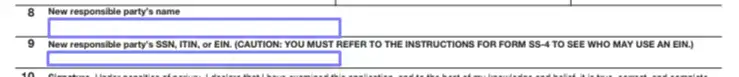

If your entity has obtained a new responsible representative, the next fields are for you. Write the new representative’s name (some entities are allowed to have an entity as a representative; we suggest checking with the Service’s guide to see if your company fits requirements). In the line below, enter their SSN (or social security number), EIN, or ITIN (or individual taxpayer identification number).

Sign the Document

After you have stated what has changed, you must sign the form (as an owner or a current representative).

Leave your signature, date the form, and write your title. You can also enter your phone number (however, this line is optional).