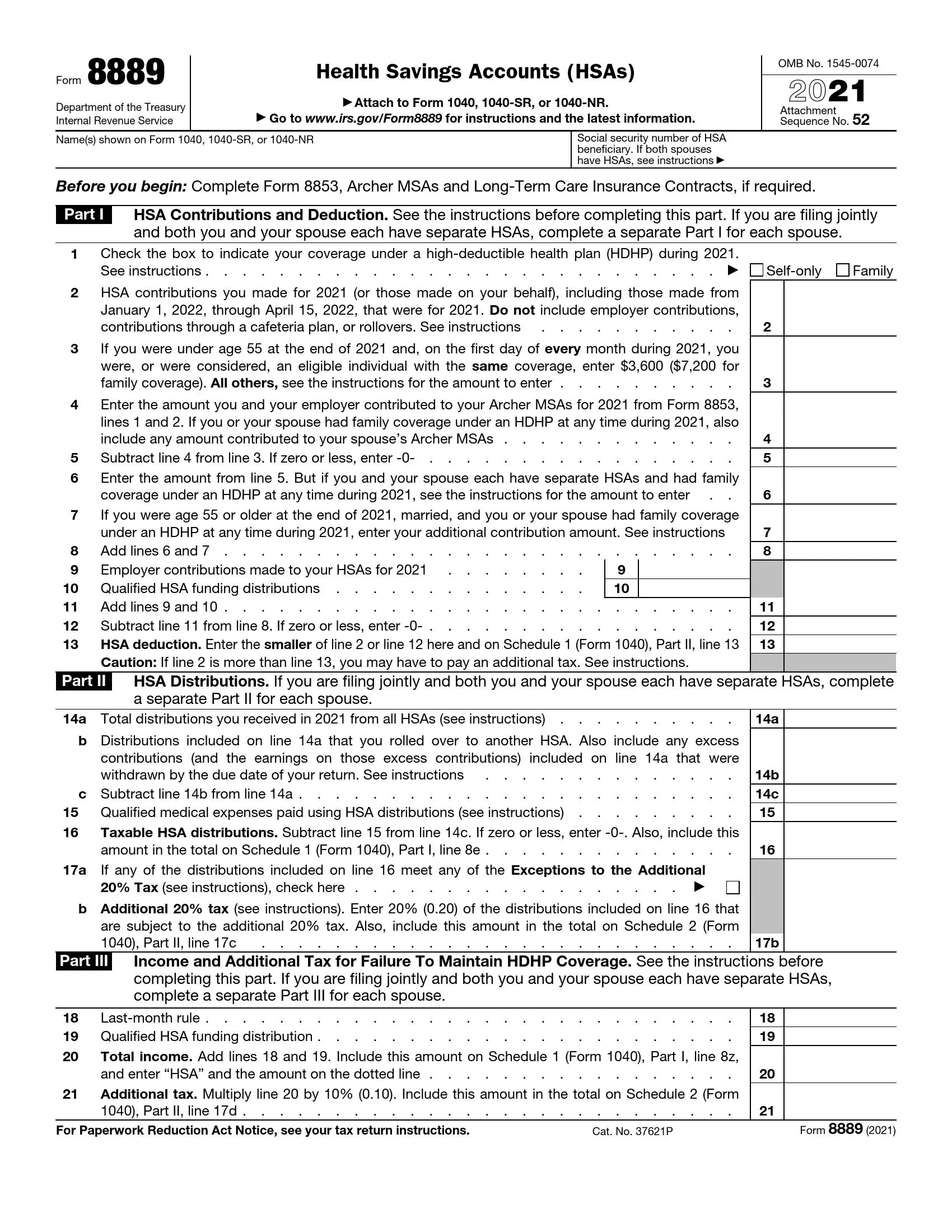

IRS Form 8889 is a U.S. tax form used for Health Savings Accounts (HSAs). This form is necessary for taxpayers with an HSA who must report contributions to the account, calculate the tax deduction, and report distributions (withdrawals) from the HSA.

Form 8889 also helps determine if the distributions were used for qualified medical expenses, which are tax-free, or for other purposes, which may be taxable and subject to additional penalties. By filling out Form 8889, taxpayers ensure that they comply with the tax rules related to HSAs, maximize their deductions, and accurately report any taxable distributions.

How to Fill Out IRS Form 8889

Form 8889 consists of only one page, so you will not spend a lot of time on its filling. Make sure you follow the steps that are described below or apply building software on our website to avoid some issues.

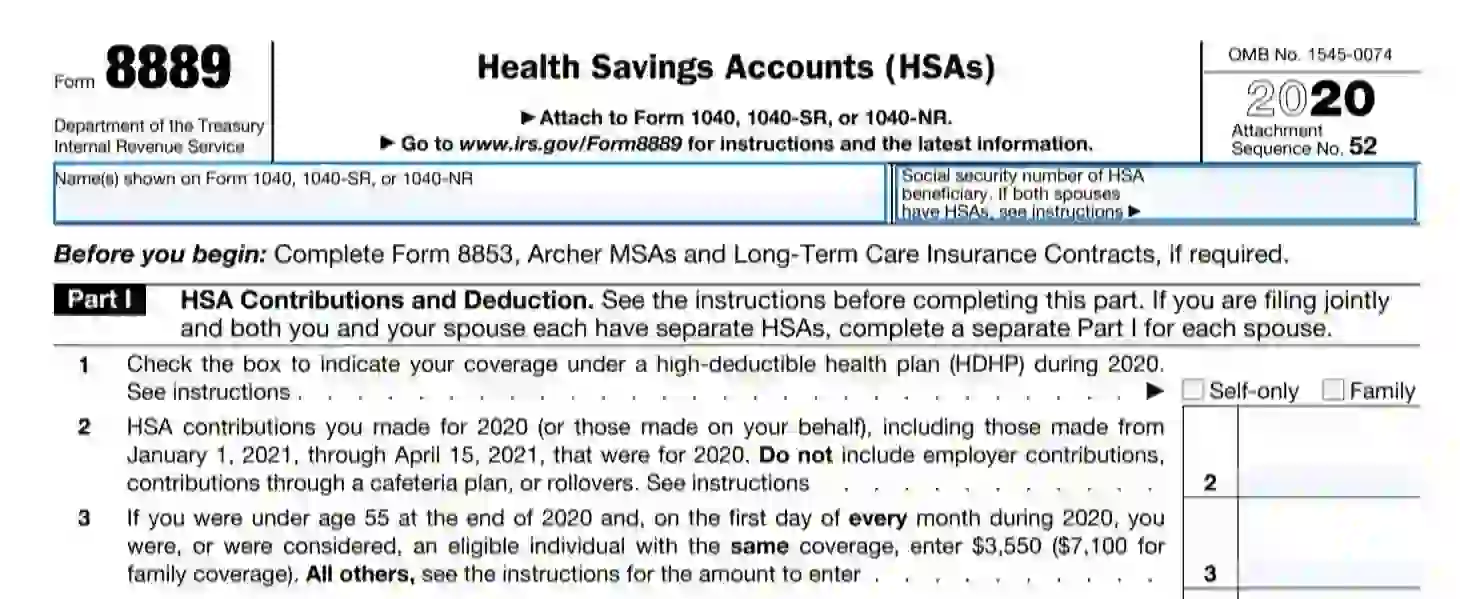

Introduce Yourself

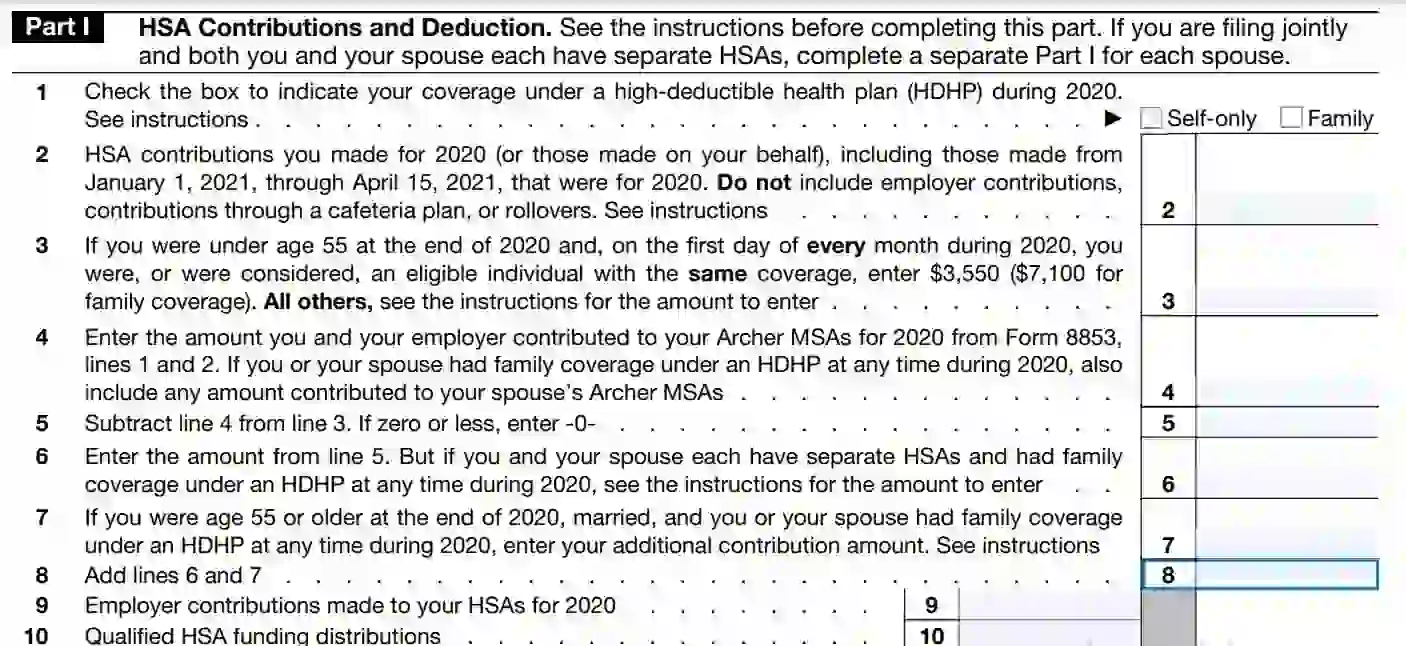

You need to enter your name as it is declared in your individual return 1040 and your identification number SSN in boxes on the top of the form.

Choose HSA Plan

You should mark the appropriate option in line 1 based on the type of your HSA: individual or family. If you have both of them, select the one with a longer validity period.

Clarify Your Payments For This Year

Write the amount you have paid during the period from January to April of the current year in line 2. Do not count fees made by your employer or other people and organizations here.

Report Contributions For The Last Year

You should include the amount you have paid during the last year in line 3. There are different options for the answer to this line. Enter $3,550 or $7,100 based on the type of plan you choose in line 1.

If you failed to be an eligible individual or your age became more than 55, or you have other special circumstances, you need to use the chart below.

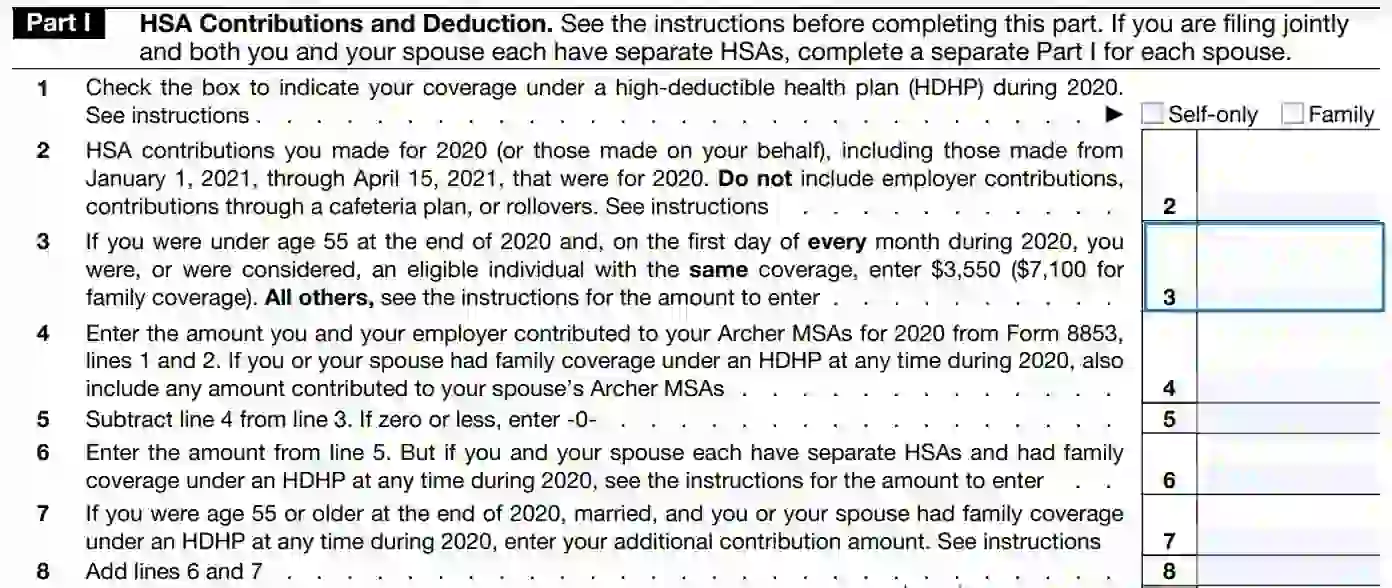

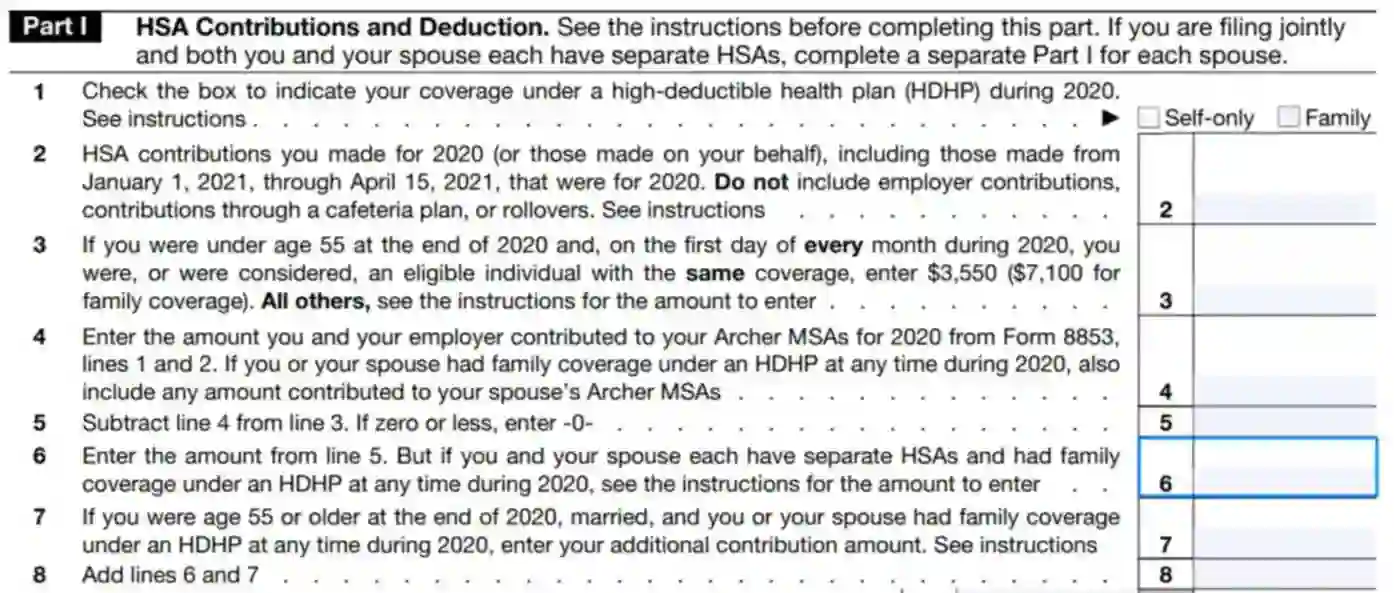

Provide Info About Archer MSA

You can skip line 4 if you or your spouse did not have Archer MSA during the last year. Otherwise, fill in the amount of contribution to this plan.

Perform Computations

Subtract the value written in line 4 from the value in line 3 and enter it to line 5. Do not fill the negative number here. Just put a 0 in this case.

Identify Contribution From Joint Coverage

Put the number from line 5 to line 6 if you do not have these conditions:

- Separate HSA but joint HDHP with your spouse;

- Separate HSA and coverage for some months.

In the first case, you should divide value from line 5 equally between spouses or apply other shares based on your agreement.

In the second case, you need to compute an additional number in such a way:

- Consider line 3 as the amount paid only for months with joint coverage.

- Subtract line 4 from updated line 3 and divide it equally or according to your agreement with the spouse.

- Subtract the result of the second step from the value of the first step.

- Include additional limits to value from the third step if they took place last year and enter the result in line 6.

Determine Additional Contribution

If you were an eligible person, were 55 or more years old, and had joint coverage last year, you should fill line 7.

To make this properly, you can use this worksheet.

Calculate Total Payment

Now you need to sum values from lines 6 and 7 and put the result in line 8.

Give Data About Employer Fees

Enter the total amount the employer has paid to your HSA for the last year in line 9.

Add Information About Qualified Distributions

If you transferred money from your retirement account to HSA, you must declare its amount in line 10.

Summarize Payments

You should sum values from lines 9 and 10 and put the result in line 11. Then subtract the number in line 11 from line 8 and enter it in box 12. To know your HSA deduction, you should select the smallest value among numbers in line 12 and line 2 and fill it in box 13.

Remember that if payments of other people to your HSA were bigger than yours, you will need to pay taxes for it.

Declare Your Expenses

The second part of the form is devoted to the distributions from your HSA. If you have joint HSA with your family members, you need to fill additional forms 8889 for them. So, you should write the total amount of expenditures from your account for the last year in box 14a. Then you should enter about distributions to another rollover HSA in line 14b. After that, you should subtract the results of line 14b from line 14a and put the number in box 14c.

Describe Expenses on Qualified Medical Services

In line 15, you should enter the amount spent on qualified medical services that were not covered by other insurances.

Calculate Taxable Part of Your Expenses

Once you fill lines 14 and 15, you should make some operations with them. Subtract the amount in line 15 from line 14c and write the result in line 16. Do not enter negative values but replace them with 0.

Clarify Additional Taxation

If the number in line 16 is more than 0 and you do not match the criteria below, you should pay 20% tax for expenditures:

- 65 years and older;

- Disability;

- Death.

Tick the box in line 17a and multiply line 16 or its parts that are not comparable to conditions above by 0.2 and put the result in line 17b. It will be the amount of your tax.

Add Information If You Are Not Eligible Individual

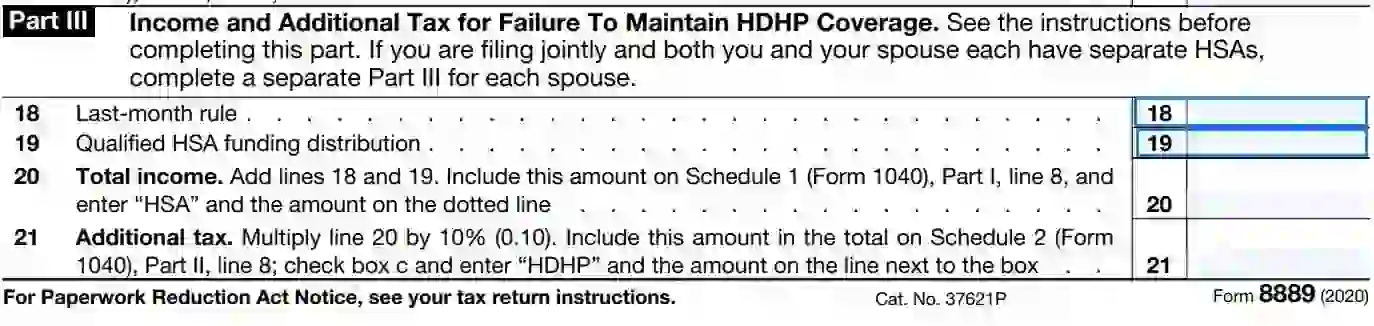

You should fill the last part of the form separately from your spouse as well as the previous one. If you used the rule of the last month, you need to enter expenditures for this month multiplied by 0.1 in line 18. The rule of the last month is for those who were eligible during the start of the December of the last year but then became not an eligible person. In this case, you will pay 10% additional tax for expenses from HSA.

Then you have to identify qualified expenses for the last month as you did for line 10 and put it to line 19.

Report Total Taxation

Include the sum of lines 18 and 19 to line 20. After that, multiply the result in line 20 by 0.1 and fill it in line 21.

Once you are ready with Form 8889, you should check and attach it to your individual tax return Form 1040.