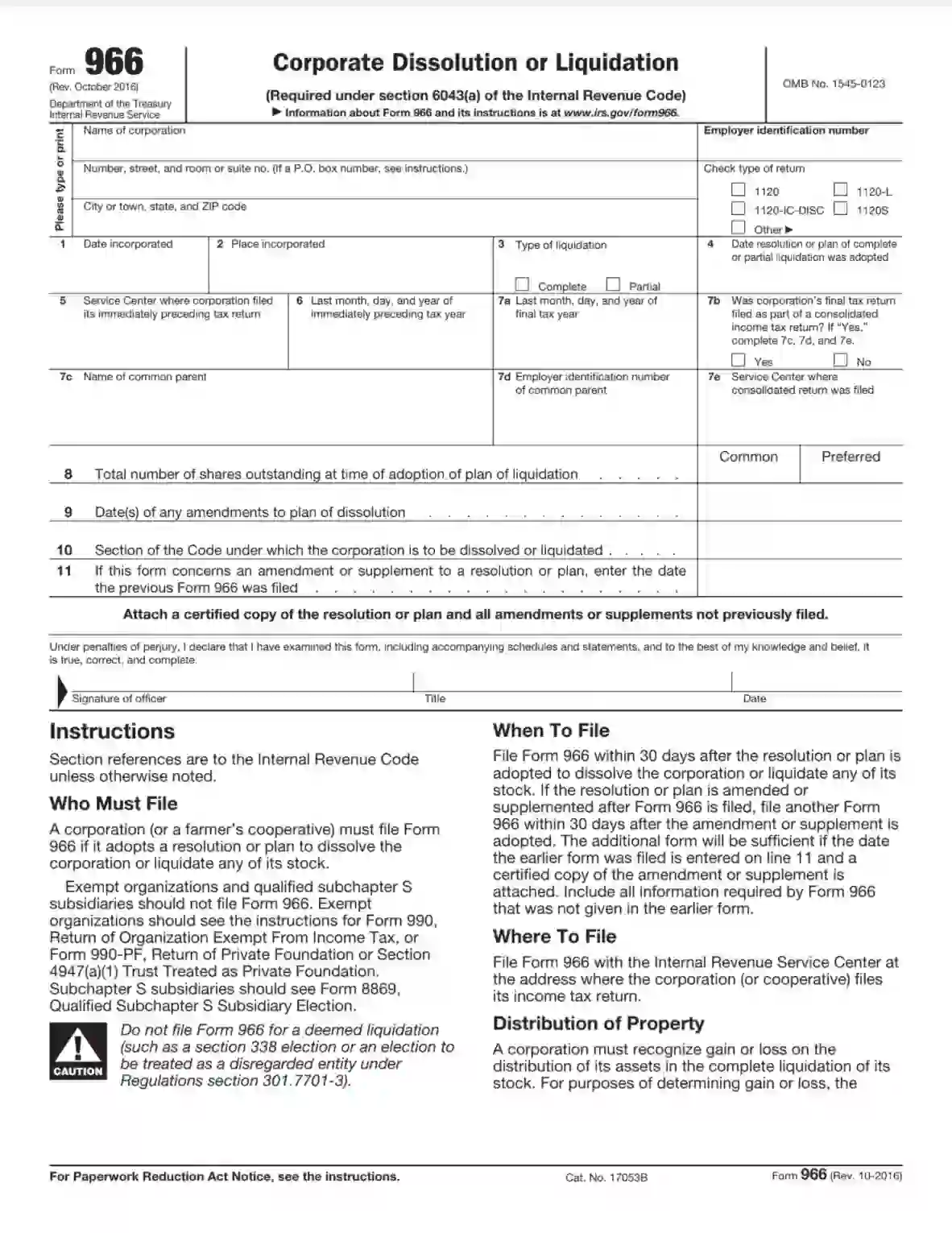

IRS Form 966, titled “Corporate Dissolution or Liquidation,” is used by a corporation to report the adoption of a resolution or plan to dissolve the corporation or completely liquidate any of its stock. This form is part of the formal process of winding down a corporation’s affairs, which includes notifying the IRS of the intent to dissolve and settle the corporation’s tax responsibilities. When filling out Form 966, corporations need to provide:

- The date of the corporate resolution authorizing the dissolution or liquidation,

- The effective date of the dissolution or liquidation,

- Details regarding any final corporate tax returns that will be filed, such as Form 1120.

This form must be filed within 30 days after the resolution or plan is adopted. It serves as a critical step in ceasing operations, allowing the IRS to monitor the corporation’s compliance with tax obligations as it concludes its activities.

Other IRS Forms for Corporations

Dissolving or liquidation of a corporation might require filing some other legal documents with the IRS. Check what other forms your corporation might need.

How to Fill out Form 966

We present our illustrated tips for completing the document.

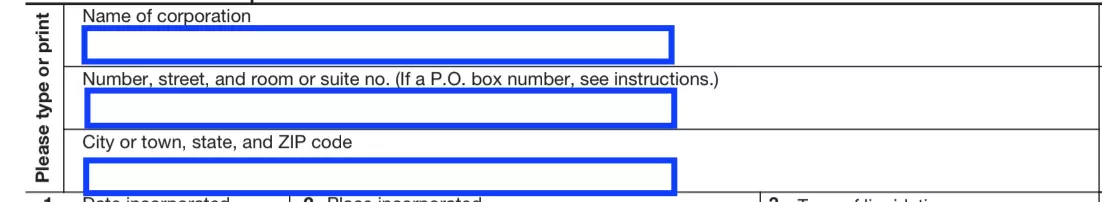

1. Identify the Company

First, you need to provide identifying data:

- Name of the company

- Full address

This information should be entered in block letters or printed.

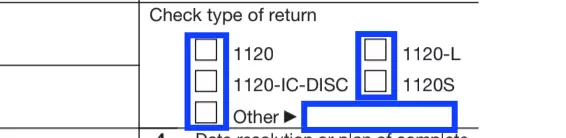

2. Select the Type of Return

In the upper right corner, you need to check the box next to your return type. If there is no suitable option, then mark “Other” and enter the required number.

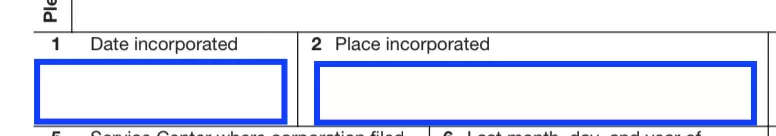

3. Indicate the Details of the Company’s Incorporation

You need to enter the data regarding the registration of the company, where and when it was registered.

4. Give the Details of the Solution

In point 3, check the box next to the appropriate option whether the liquidation of the company will be full or partial.

In point 4, put in the date when the decision was documented.

5. Provide Information about Immediately Preceding Tax Return

You must enter:

- Center name and address

- Date

If you submit the form electronically, in paragraph 5, enter “e-file.”

6. Date the Last Tax Year

Enter the date on which the corporation’s last tax year will come to an end.

7. Check Box 7b

If the corporation’s final tax return was filed as part of a consolidated income tax return, check the appropriate box and proceed to fill in the following items.

If not, then check “No” and skip steps 7c-7e. In our guide, skip straight to point 9.

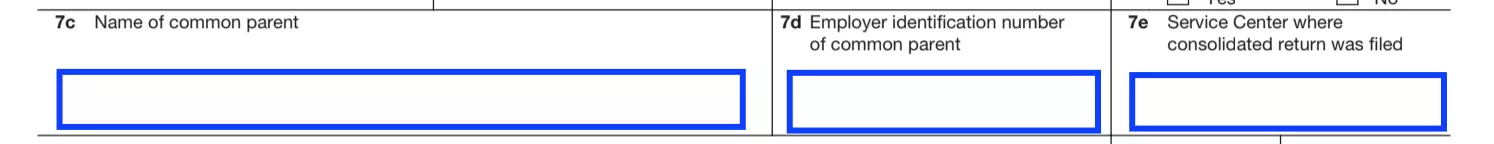

8. Give Data About Consolidated Return

If in the previous question you marked “Yes,” next you need to indicate:

- Name of a common parent

- EIN of a common parent

- Name and address of Service center (if there was an electronic submission, then put “e-file”)

9. Specify the Number of Shares

You need to indicate the amount that is current on the date of the plan.

10. Date All Changes

If any amendments or additions were made to the adopted plan, you must indicate the dates of all adopted changes in point 9.

11. Identify the Code

Provide the number of the Code valid for liquidation.

12. Enter the Date of the Previous 966 (if Any)

If an up-to-date form is generated to enter data on changes to the plan, and another form has already been drawn up, you need to indicate the date of the previous form.

You must also attach a copy of the plan, which includes all decisions and amendments. The copy must be certified.

13. Sign the Document

The Form must be signed. It is necessary to put:

- Signature

- Title of the signer

- Date

The signature must be affixed by a person who has the appropriate rights.

14. Send the Document

Once the document is properly completed and signed, send it to your IRS office.