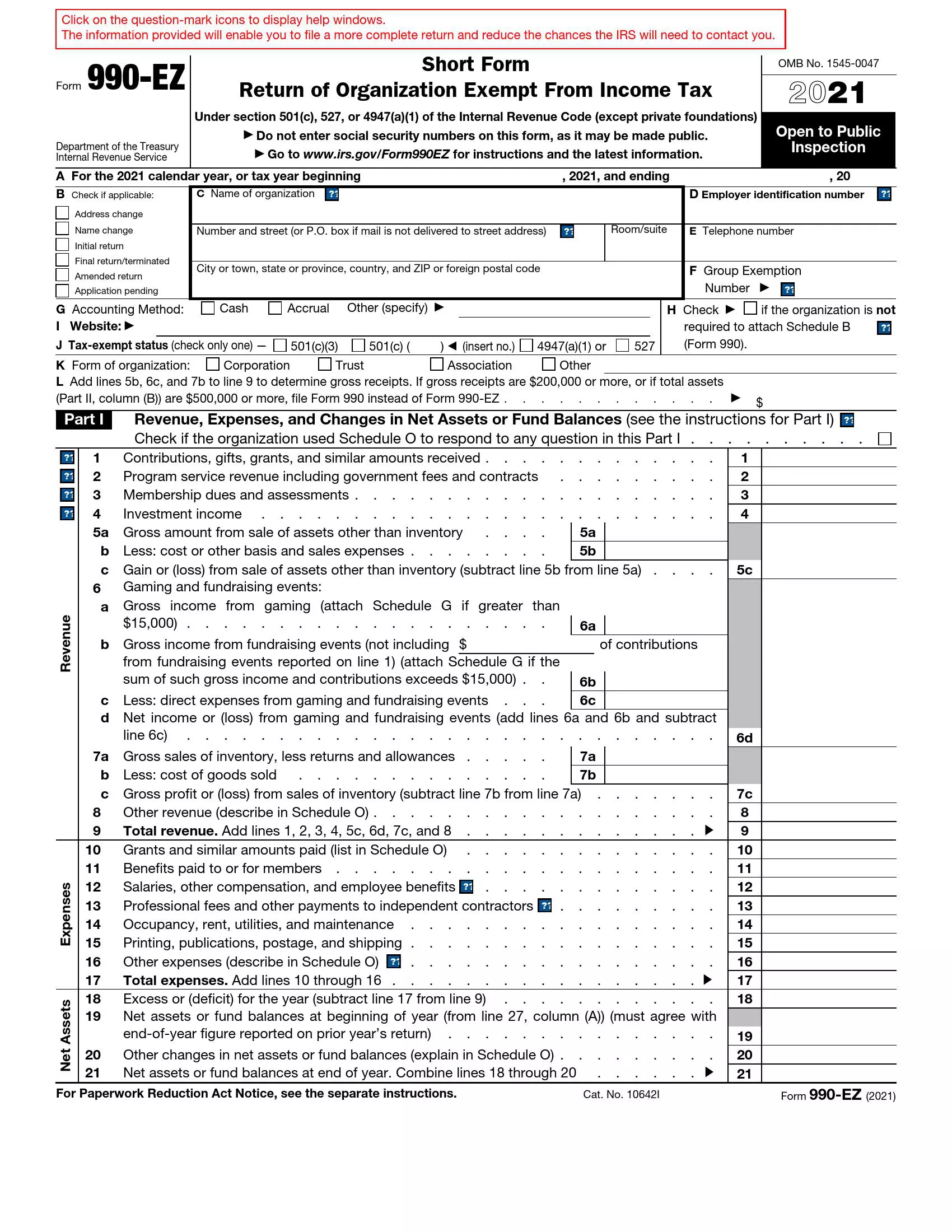

Form 990-EZ is a simplified version of IRS Form 990, designed for smaller tax-exempt organizations. It provides the IRS with annual financial information about the organization’s operations, helping maintain tax-exempt status. Eligibility to file Form 990-EZ is generally determined by the organization’s gross receipts and total assets; typically, those with gross receipts less than $200,000 and total assets less than $500,000 may use this form. The form requires details such as:

- Revenue, expenses, and changes in net assets,

- Information about the organization’s leadership, such as officers, directors, trustees, and key employees,

- A breakdown of program service accomplishments and the organization’s mission.

By filing Form 990-EZ, organizations comply with federal regulations and provide transparency to donors, members, and the public about managing their funds and achieving their mission.

Other IRS Forms for Trusts and Estates

If your organization is exempt from income tax, there might be some other IRS forms you need to send to the Service. Check some related forms here.

How to Fill Out IRS Form 990-EZ

Traditionally IRS forms consist of several parts. IRS 990-EZ template contains six sections required to be completed and authorized. You are welcome to use our latest software and generate a needed PDF file. Our technologies help create updated templates convenient to fill out instantly.

Before you start entering the needed info, make sure not to submit your SSN data. Many organizations are obliged to openly disclose yearly data returns, and sensitive information may be jeopardized on publicly open portals.

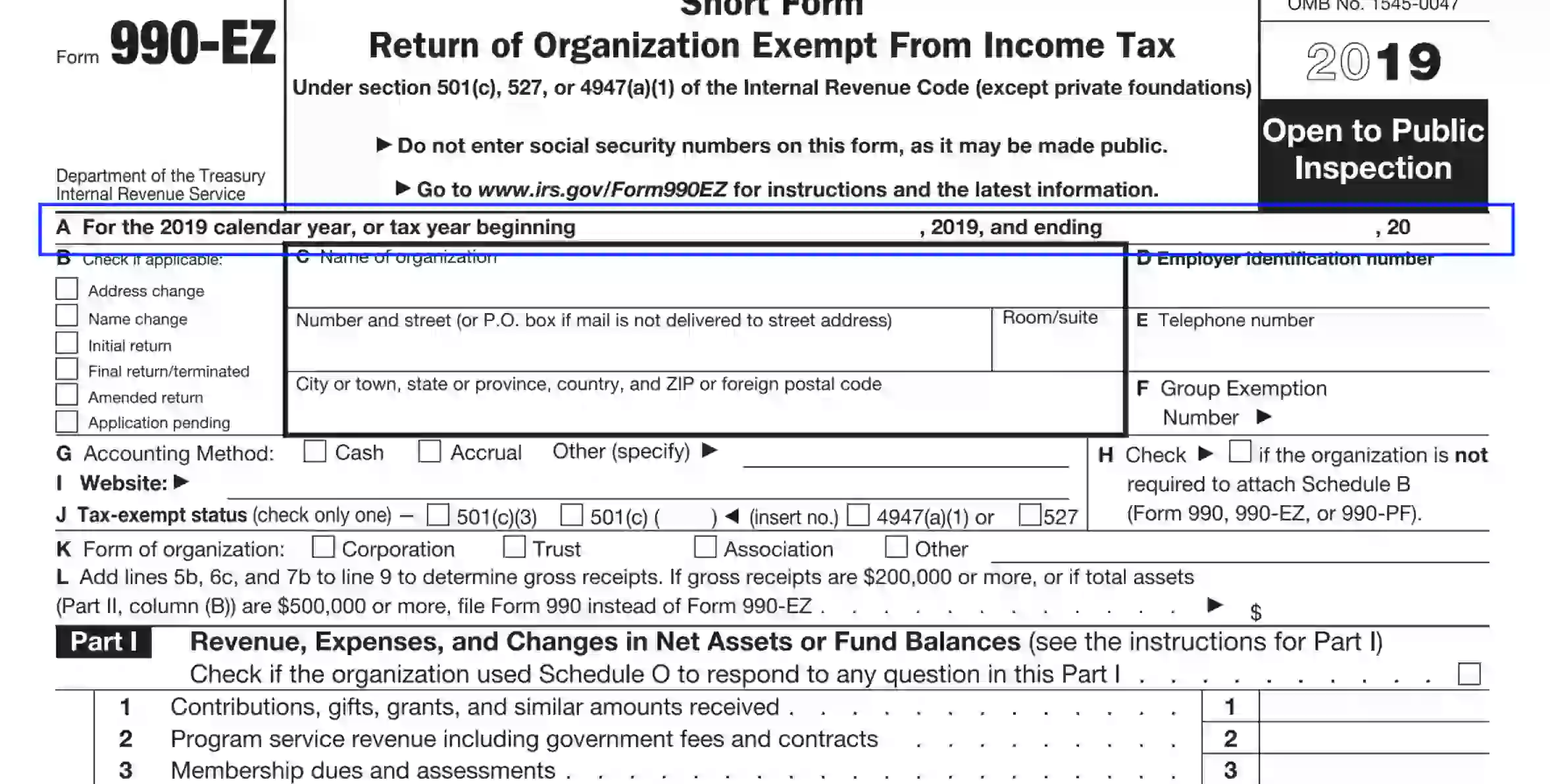

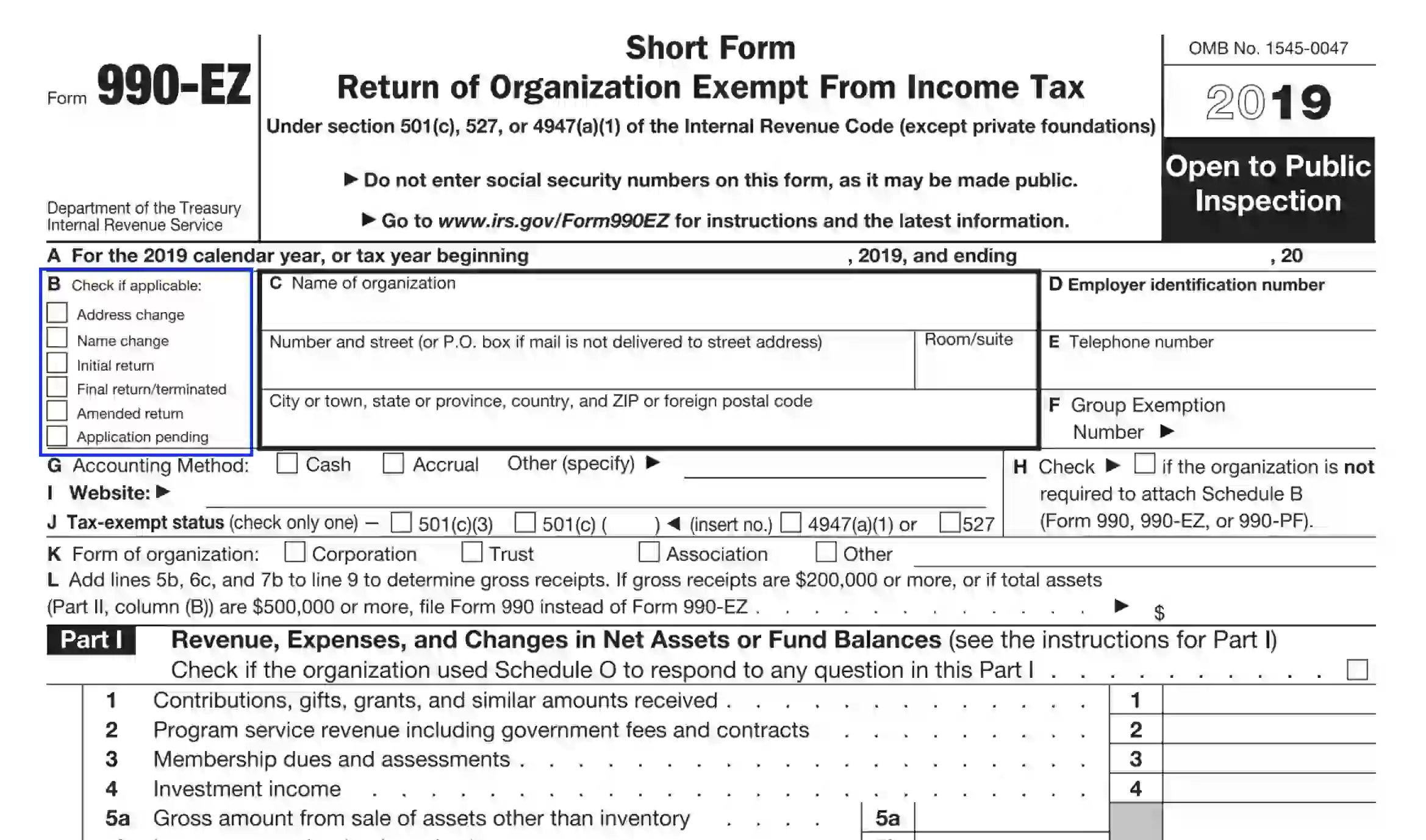

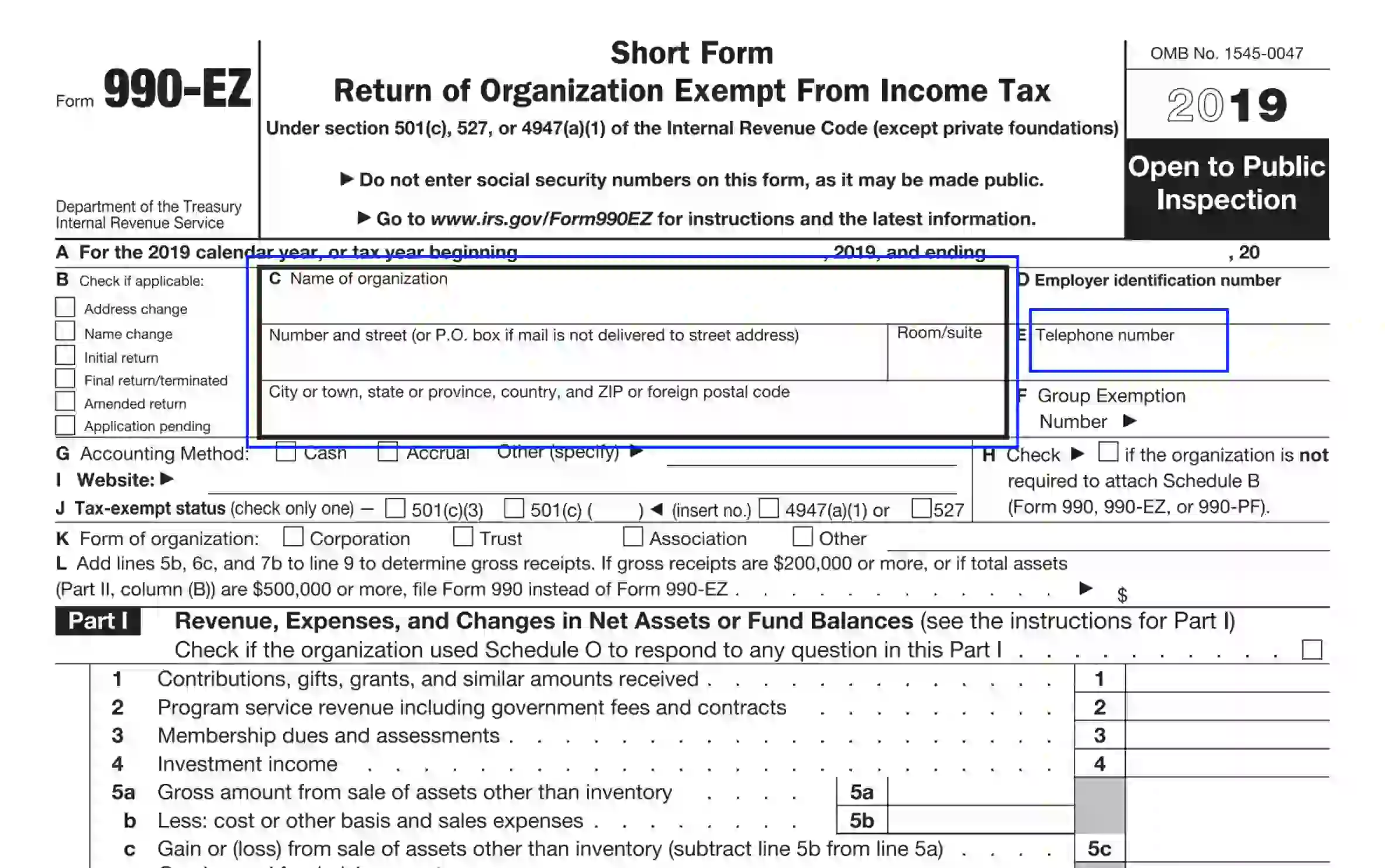

- Specify the Accounting Period

In Block A, you need to enter the correct accounting period. Thus, for example, if you need to provide return info for 2020, use the 2020 IRS 990-EZ template.

- Select the Appropriate from Block B

Here, you need to checkbox the alternative that suits your situation:

- Address change — indicate the unit if your organization has another address.

- Name change — tick the box if the organization name is modified.

- Initial return — this option is indicated if it is the first time when the entity is filing Form 990-EZ.

- Final return or terminated — checkbox the unit if the entity has closed or merged with another organization.

- Amended return — This option is necessary if the entity has already reported a tax return for the year, and the current document serves to introduce some amendments.

- Application pending — select this unit if the entity has applied for tax exemption status and is expecting a response from IRS. Also, you should checkbox the alternative if the entity has previously filed form 1023-EZ, 1023, 1024-A, or 1024.

- Provide General Data About Your Organization

This block is offered to fill out some general data about the entity filing the respected tax return form. Here, you should specify the following:

- Entity’s name

- Entity’s address, including street, room number, city, province if applicable, state, and ZIP. Entities located in the territories of foreign countries should also submit the country’s postal code.

- Entity’s contact phone number

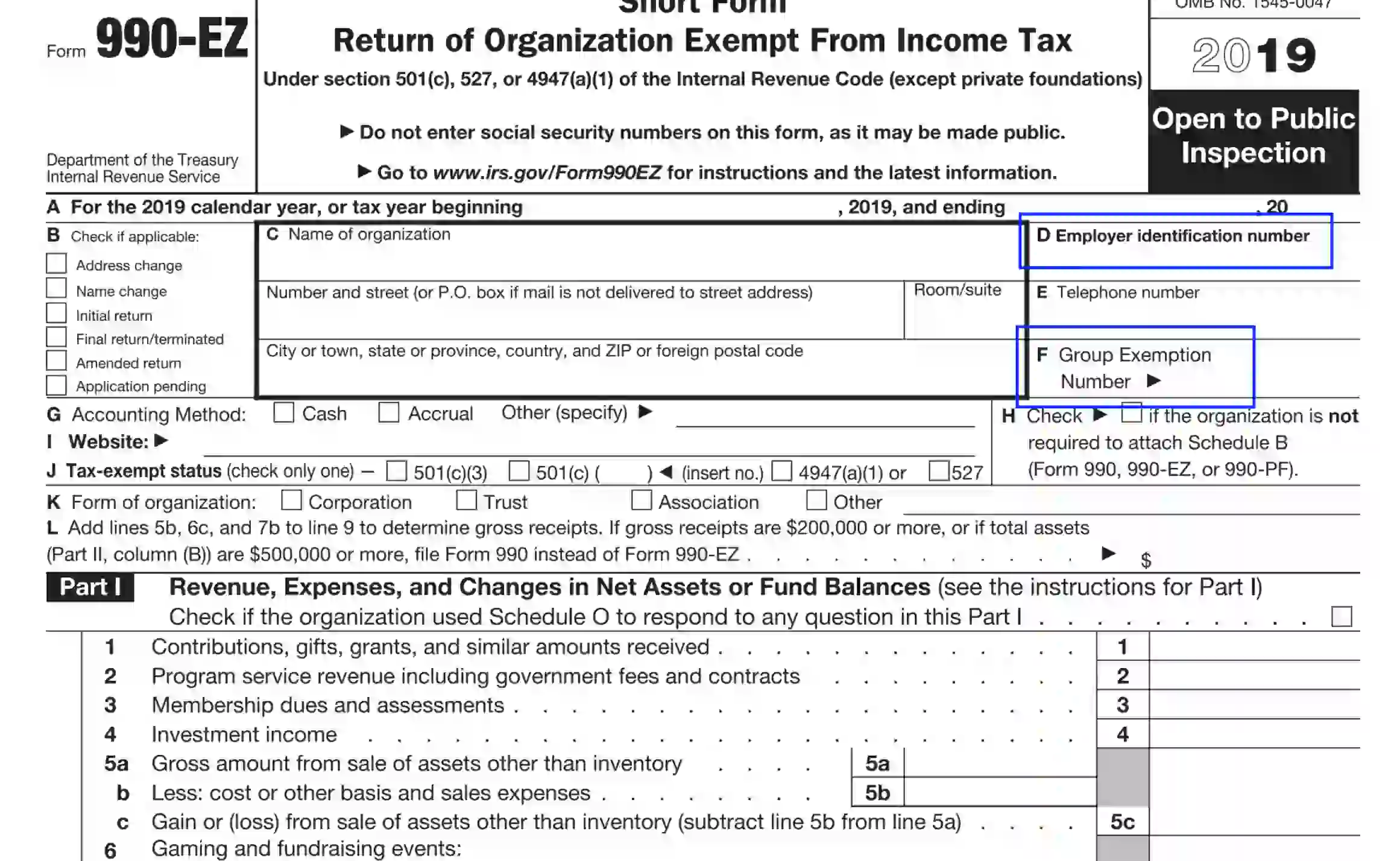

- Specify the Entity’s Tax Identification Info

Here, you need to provide the employer ID. Also, if the company is privileged to have GEN (Group Exemption Number), include it into Unit F. GENs consist of four digits and are appointed by IRS.

- Select the Accounting Method

Here, the declarant should specify the accounting method that the organization used during the reporting.

- Fill Out Block H

Make sure to checkbox this section if you do not include any amount on line “1” of the respected form. Otherwise, the company needs to prepare and serve the Schedule B attachment and leave the box blank.

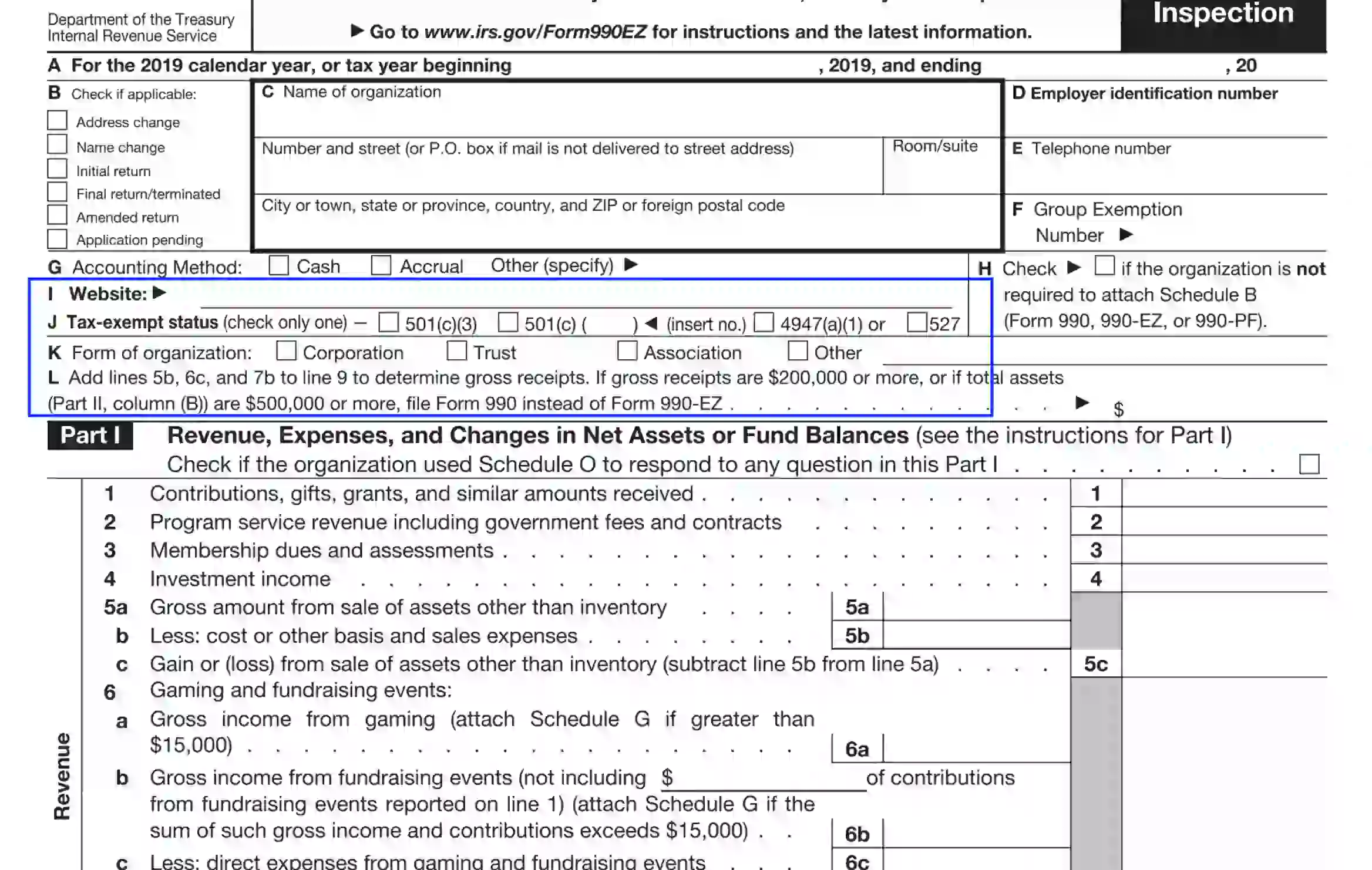

- Complete the Introductory Part of Form 990-EZ

Follow the requirements of the blocks I-L and fill out the needed data:

- Entity’s website, if applicable

If the company has no web address, please, fill out “N/A.”

- Tax exemption privilege (if any)

- Entity’s form

- Gross receipts specification taken from Part One of the respected form.

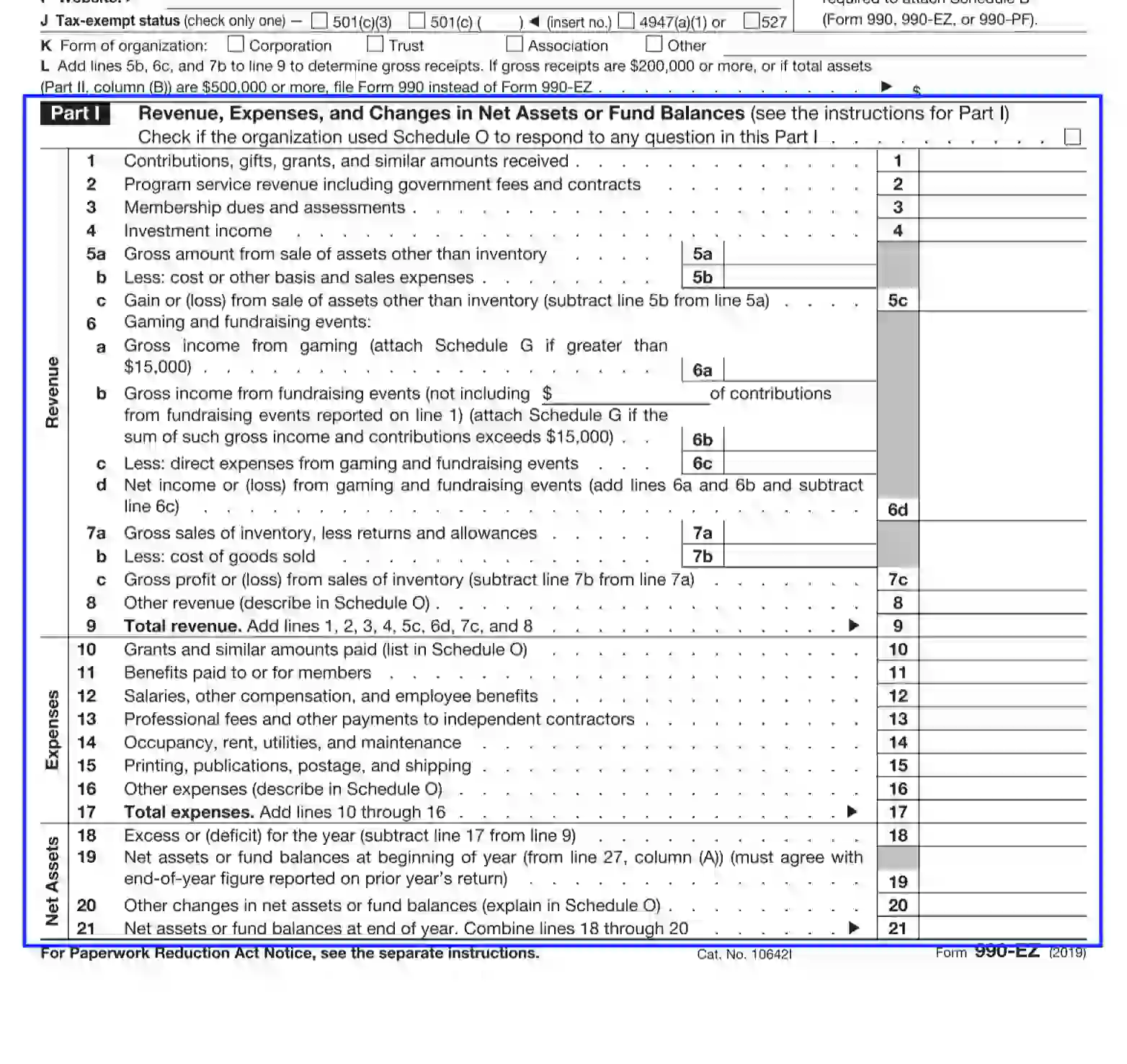

- Complete Part One — Units 1-21

Once the introductory information is entered, the entity can proceed to fill out Part One of the form providing the required data next to each unit. Here, the declarant must include the following aspects:

- Revenue data

- Expenses

- Net Assets or balances

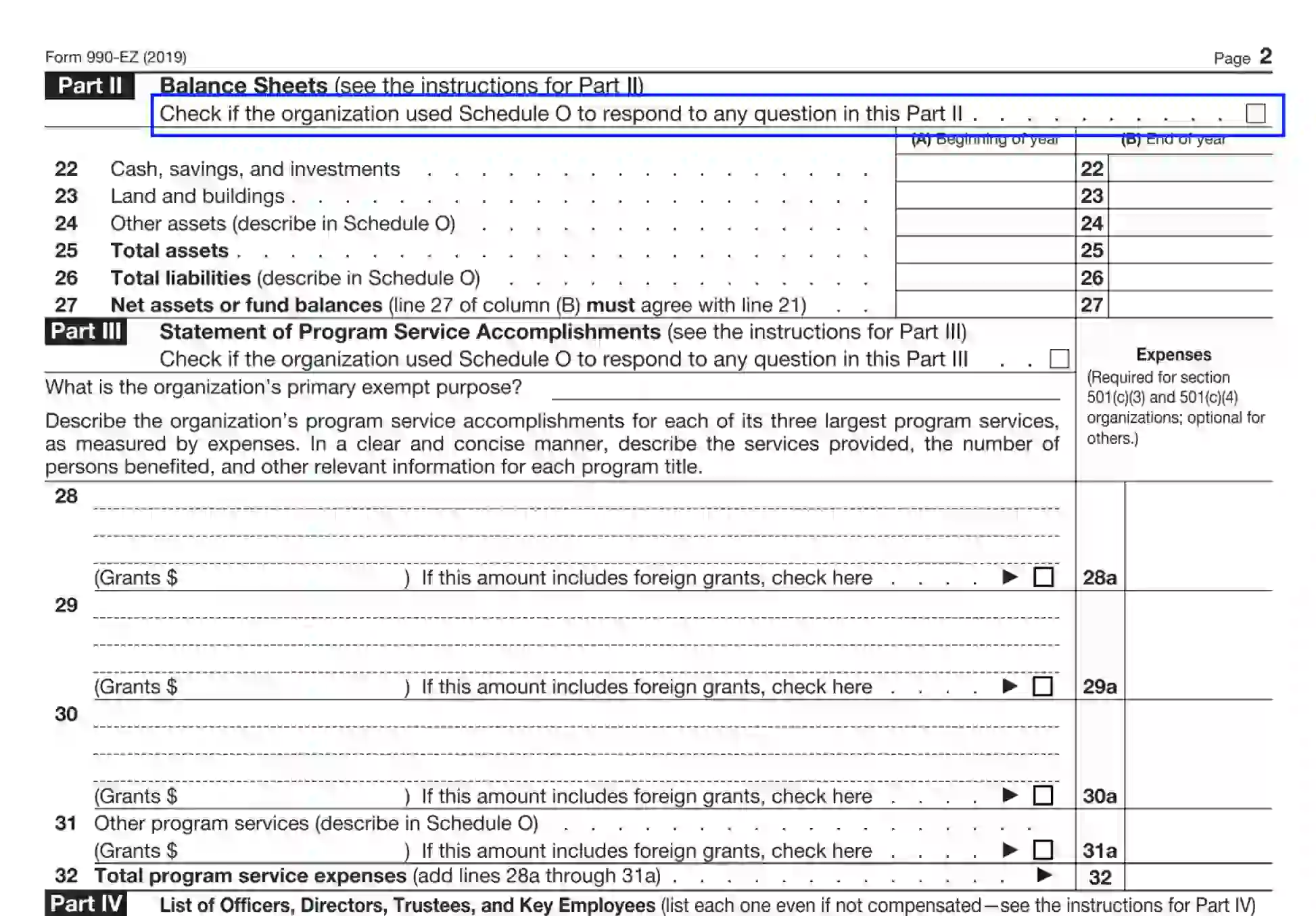

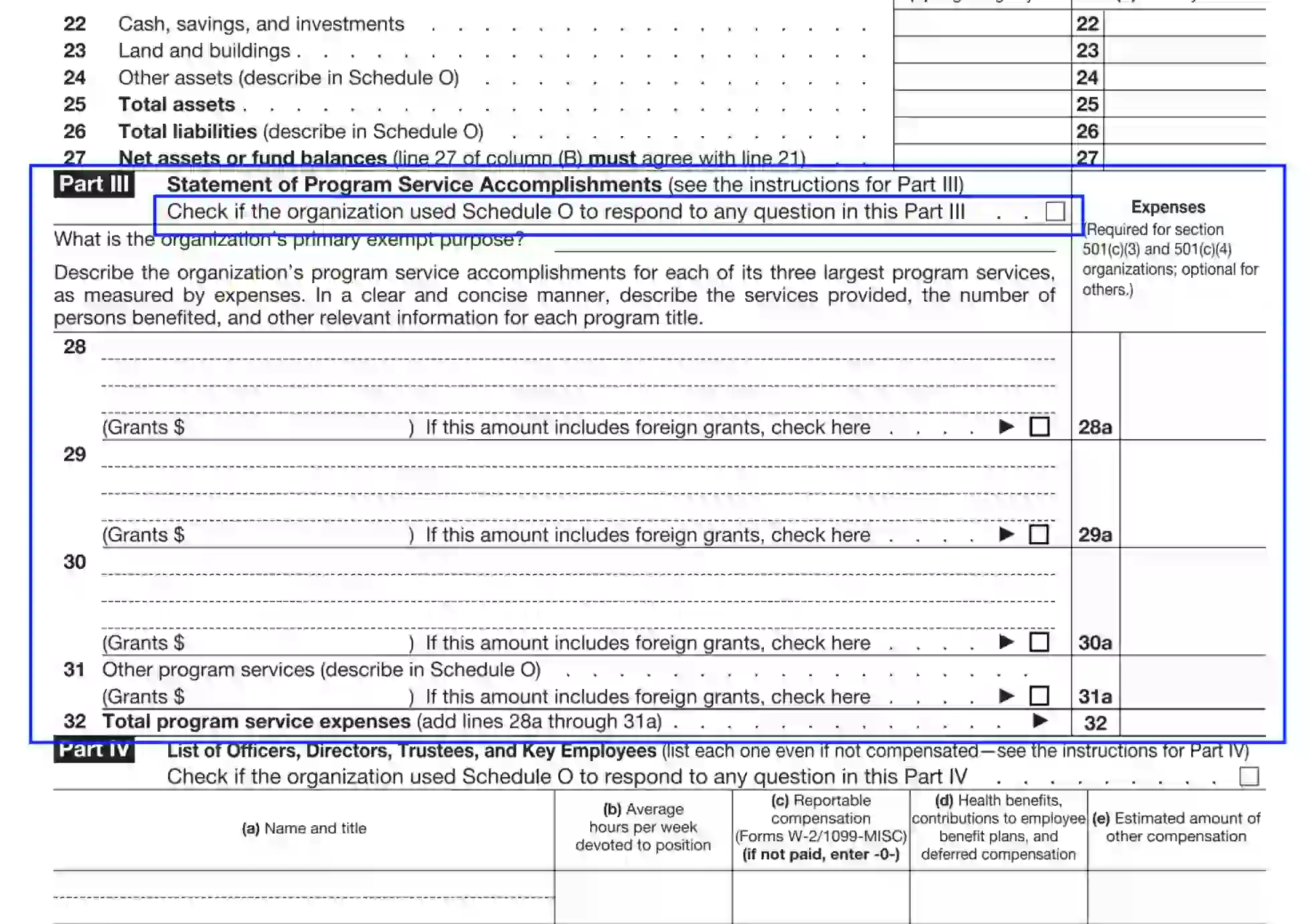

- Submit the Balance Sheets Part

This section comprises units 22-27, which the declarant should fill out considering both the “beginning of the year” and “end of the year” columns. If the declarant fails to report the A and B sections correctly, they can be accused of non-completion of the form and providing insufficient information. Make sure to avoid these unfavorable situations as they may result in penalties.

If the declarant uses Schedule O to fill out the Balance Sheet section, please checkbox the corresponding slot.

- Specify the Entity’s Participation in Program Service

Begin entering the data by selecting if the declarant uses Schedule O info to complete the section. Program service includes such aspects as adoptions, rehabilitation, recreations for the elderly, publications.

Specify your entity’s purpose for tax privileges and program service accomplishments.

- Complete the Table of the Officers, Directors, Trustees, and Key Employees Unit

Enter the necessary info for each of the listed positions, including:

- Person’s name and post

- Working hours weekly

- Reportable payments or absence of compensation

- Benefit programs

- Other payments amounts

Use the same type of compensation only once in the table.

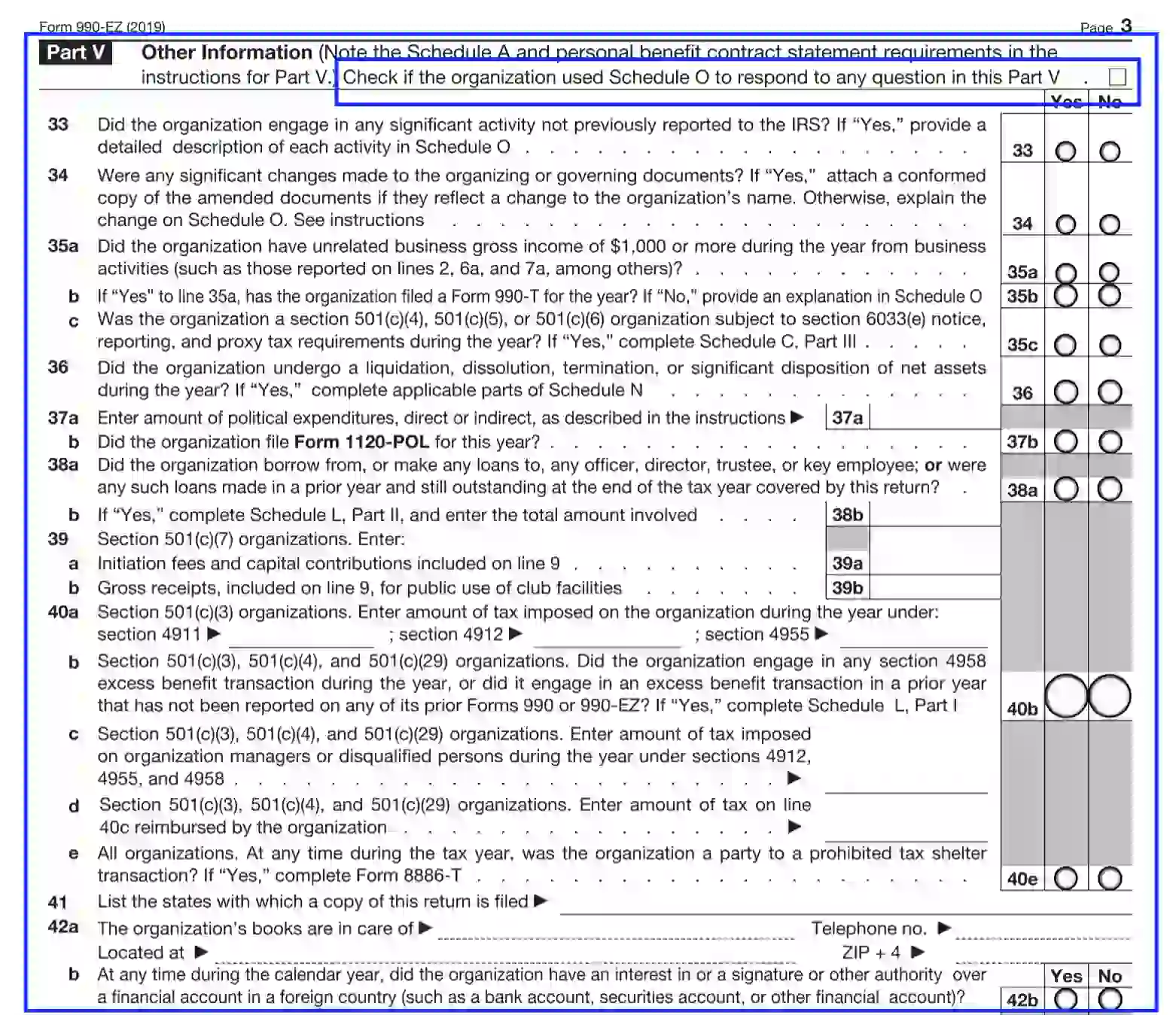

- Select the Appropriate in Part Five Poll

This section consists of units 33-46. Each statement offers two alternatives. After completing the “Yes-No” poll, the declarant can proceed to the next part of Form 990-EZ.

If any statement appears to be challenging, the declarant should visit the IRS official website for further instructions and advice.

- Complete the Sections 501(c)(3) Organizations Only Part

The section consists of lines 47-52. All companies recognized in Section 501(c)(3) should complete the poll and fill out the tables offered in units 50-51.

Use the table in unit 50 to list five employees that have been compensated over 100,000 USD. The declarant should indicate the following data for each person listed:

- Name and position

- Hours weekly

- Reportable payments

- Beneficial programs

- Amounts for other payments

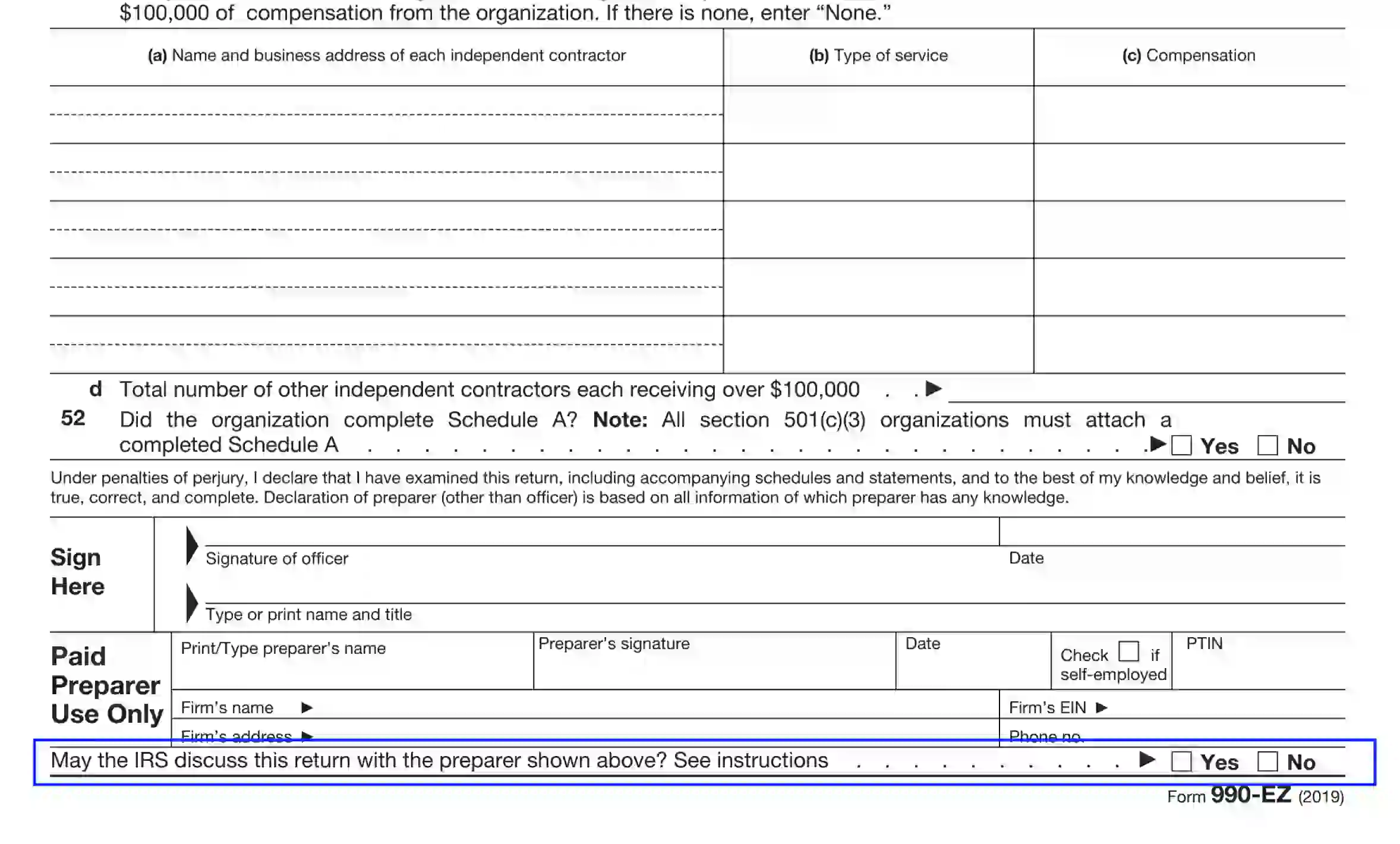

Complete similar actions in unit 51 to list five independent contractors that have gained over 100,000 USD from the entity. The declarant needs to provide the following info for each name or entity listed:

- Name

- Business address

- Type of service

- Payments

- Authorize the Document

The organization’s representative authorized to sign tax reports should append their signature, place the current calendar date, and provide their name and title in a print or type format. Before acknowledging the document, the preparer needs to re-check the data submitted to avoid mistakes and penalties.

If the organization hires a person to prepare Form 990-EZ, the contractor should provide the following info to prove their license:

- Name and signature

- Current date

- PTIN

- Firm’s name, address, EIN, and contact phone number

If the preparer is self-employed, they should check the corresponding box.

- Specify the Preparer’s Authority to Discuss the Document with IRS

Select between Yes and No to authorize the appointed preparer for negotiations with IRS regarding Form 990-EZ provided by your organization.