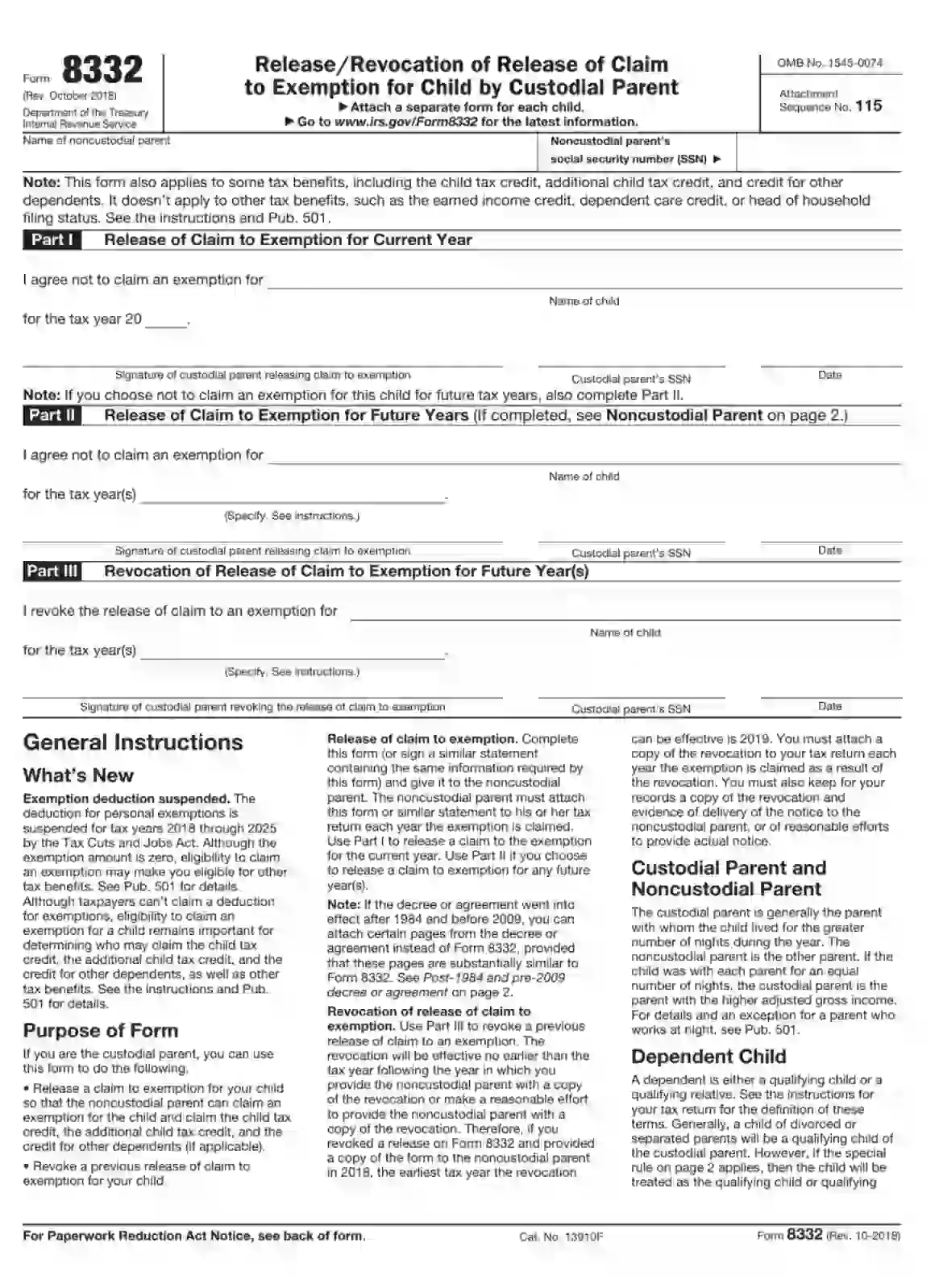

IRS Form 8332 is a tax form used by custodial parents to release their right to claim a child as a dependent to the non-custodial parent. This form is particularly relevant for separated or divorced parents. It allows the custodial parent to transfer the tax benefits associated with the dependency exemption to the non-custodial parent for one or more tax years.

By signing Form 8332, the custodial parent enables the non-custodial parent to claim the child tax credit, additional child tax credit, and other tax benefits that require the dependency exemption. This form ensures that the IRS acknowledges and accepts the arrangement without disputing the claim at the time of tax filing.

Other IRS Forms for Individuals

The form for custodial parents might be not the only one you need to fill in when it comes to taking custody of children. Check what other forms might be necessary for you in this situation and in general.

How to Fill Out a Document

Please note that the document is to be completed by the custodial parent and must be attached to the noncustodial parent documents.

To fill it out, we advise you to use the form-building software on our website. Filling out the document will not cause you any difficulties, and you can print it and attach it to other important papers.

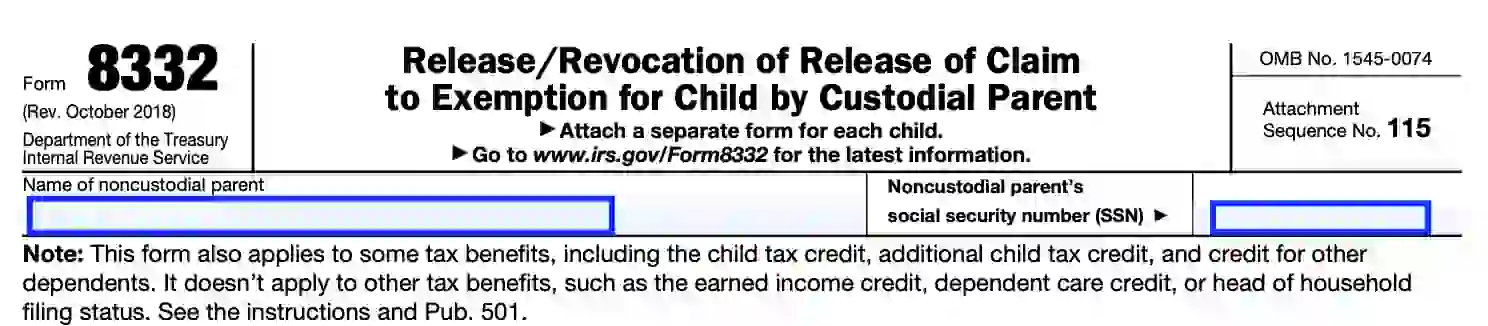

Enter the name

Enter the name of the noncustodial parent and its number of social security. Do not confuse or enter your details by mistake.

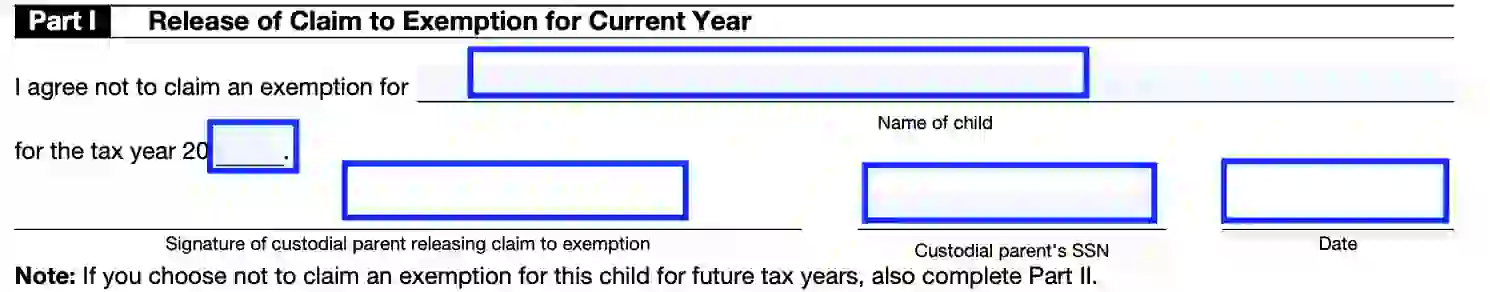

If you want to release a claim only for the current year, then fill out the first part of the document.

Complete Part 1

Write in the child’s name, put in the year. Here you already need to indicate your social security number, put your signature and date.

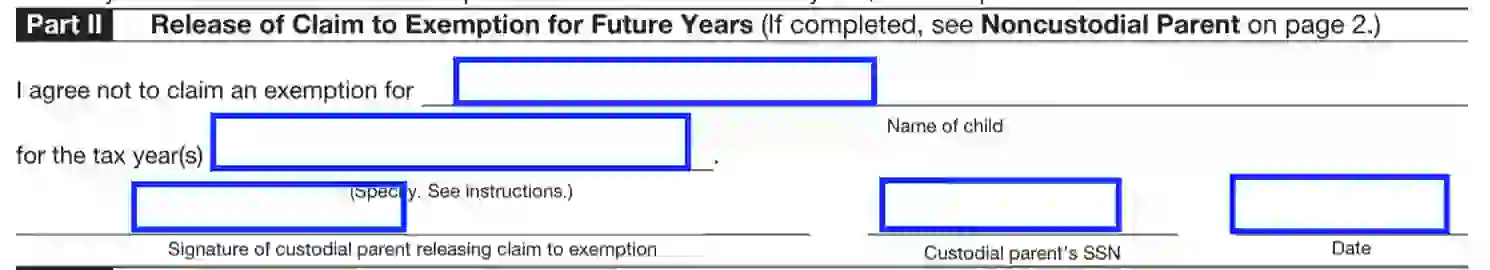

If you want this document to be valid for several years, then fill out the second part.

Complete Part 2

Here you act in the same way:

- enter the child’s name

- put your signature

- SSN

- date

In the field where you need to put down the year, you either write a certain period of years or put “all future years.”

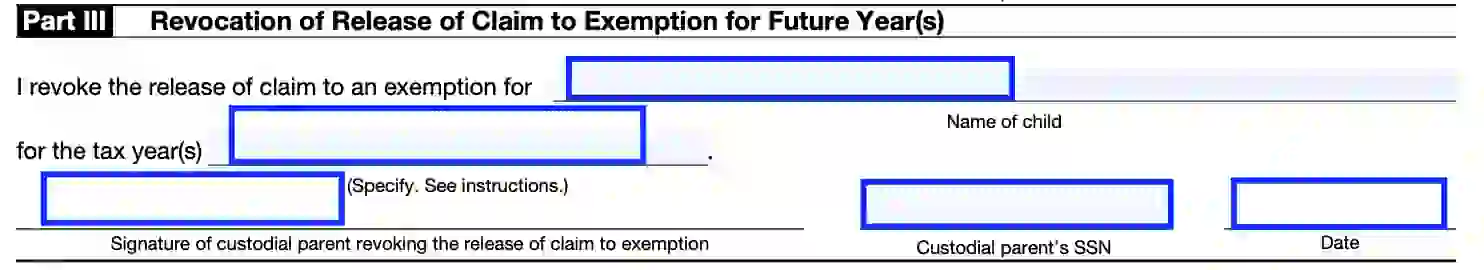

If you are filling out a document to cancel the action of the previous application, then fill out the third part of the form.

Complete Part 3

Filling in this part is also very easy. You should only fill in:

- child’s name

- the time period or all future years

- your signature

- social Security number

- the date

You just need to take into account that the revocation will take effect no earlier than the next tax year.

You will need to provide a copy of the revocation to the other parent and attach it to your tax return. You will have to do this every year of the validity of your renouncement.