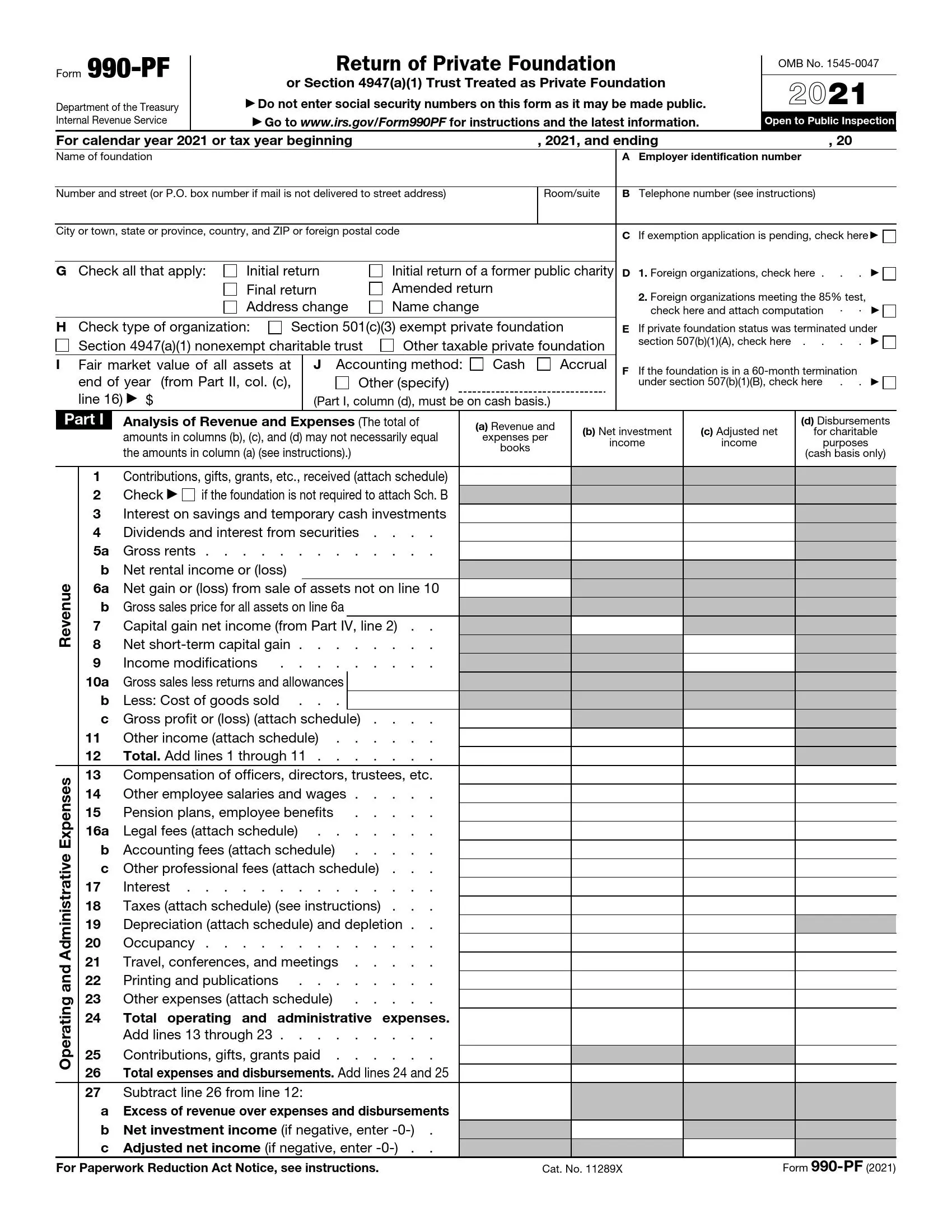

IRS Form 990-PF, titled “Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation,” is specifically designed for private foundations and certain charitable trusts to report their annual financial activities. This form is essential for these organizations to maintain their tax-exempt status and comply with IRS regulations. It provides a comprehensive overview of the foundation’s assets, receipts, expenditures, and grants distributed over the tax year. Key sections on Form 990-PF include:

- Analysis of revenue and expenses for the tax year,

- Statements regarding changes in net assets and balance sheets,

- Detailed lists of grants and contributions made during the year.

Filing this form allows the IRS to monitor private foundations’ operations and financial health, ensuring they meet the requirements for charitable distribution and financial accountability.

Other IRS Forms for Charities and Nonprofits

Along with charitable distributions and activities, there might be some other information you would want to report to the IRS. Check some other IRS forms for charities and nonprofits here.

How to Fill Out IRS Form 990-PF

You are empowered to generate and download essential PDF templates using our advanced software. Before you start completing the 990-PF, pay attention not to include the declarant’s social security number. Some sensitive data may be endangered by exposing the document publically.

Download an Updated Template

Use the PDF template relating to the period at issue. Do not mention the year of the pattern we provide in the supporting image, as the screenshot is used as an example only.

Specify the Foundation

Begin completing the paper by specifying the private foundation. Include the following data:

- Business name

- Mailing address (room number, street, city, state, ZIP code). If mail is not served to the address, enter the P. O. Box details.

- Contact phone number

If the foundation is recognized under another name, print the alternative after the legal data.

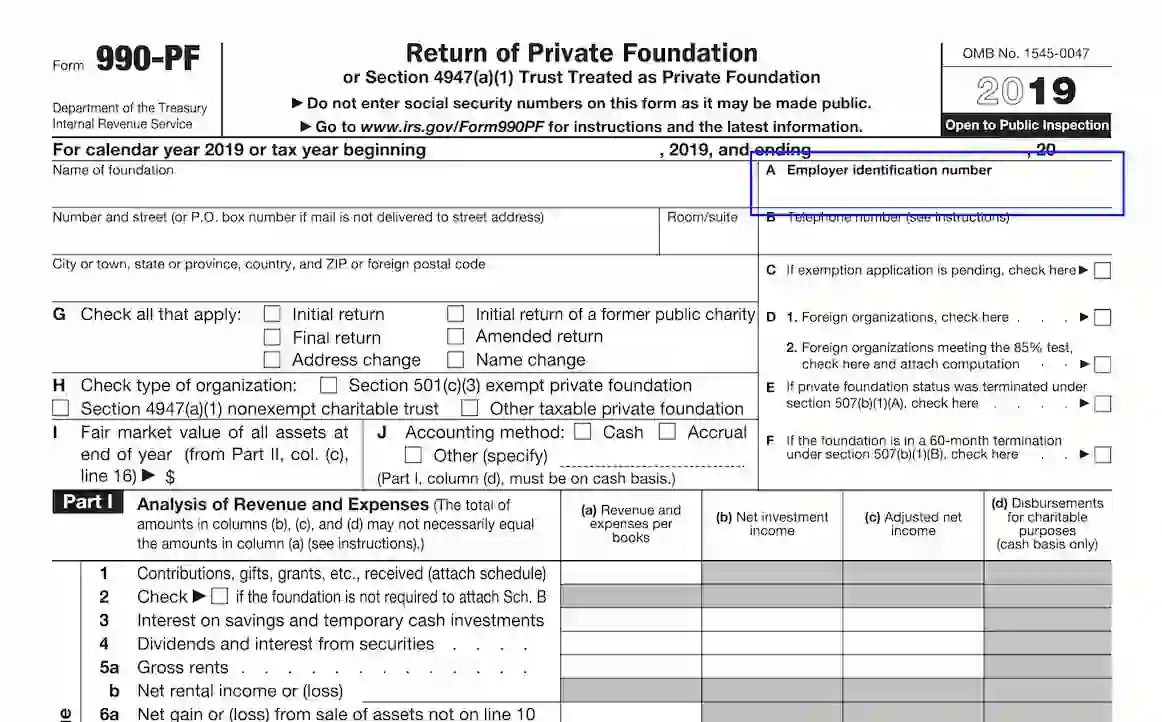

Submit the EIN

Fill in your employer ID number. Remember not to disclose your SSN.

Define If the Declarant Applied for Exemptions

If you have an active claim for tax privileges and are awaiting the response, checkbox Unit C.

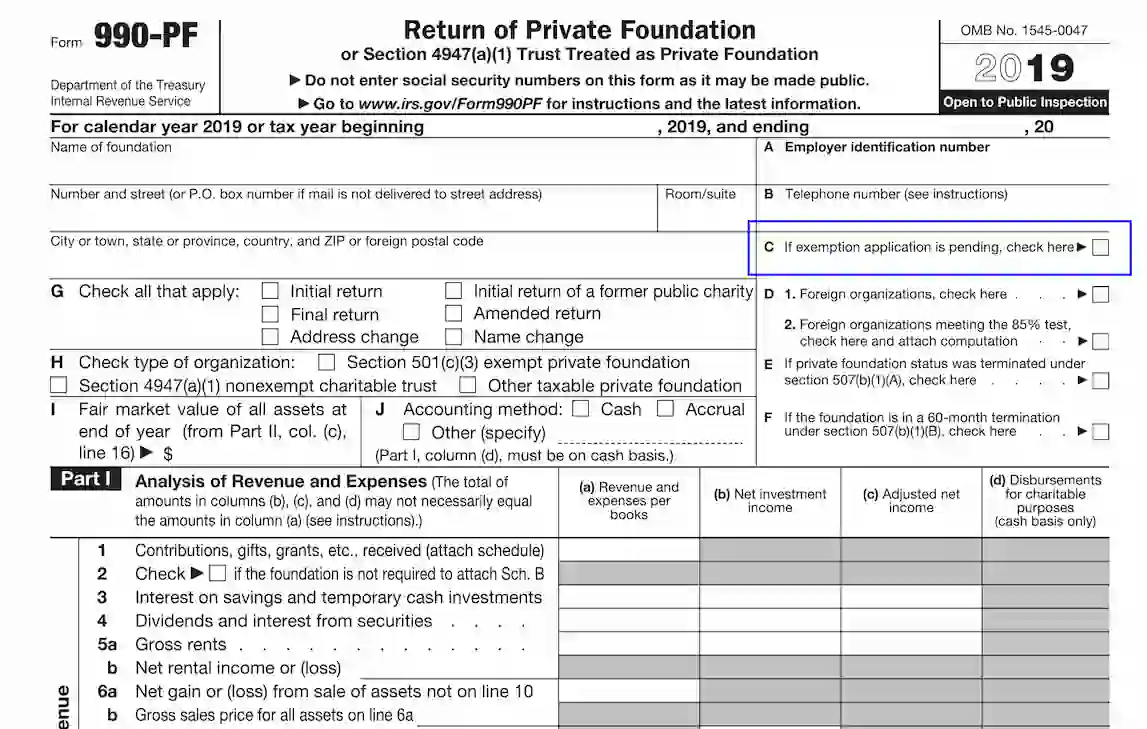

Determine the Foreign Status of Your Organization

If the foundation can be qualified as a foreign entity, complete Unit D (1-2).

Define the Private Foundation Status

Should the company terminate its private status, reflect the correct data in Unit E and F.

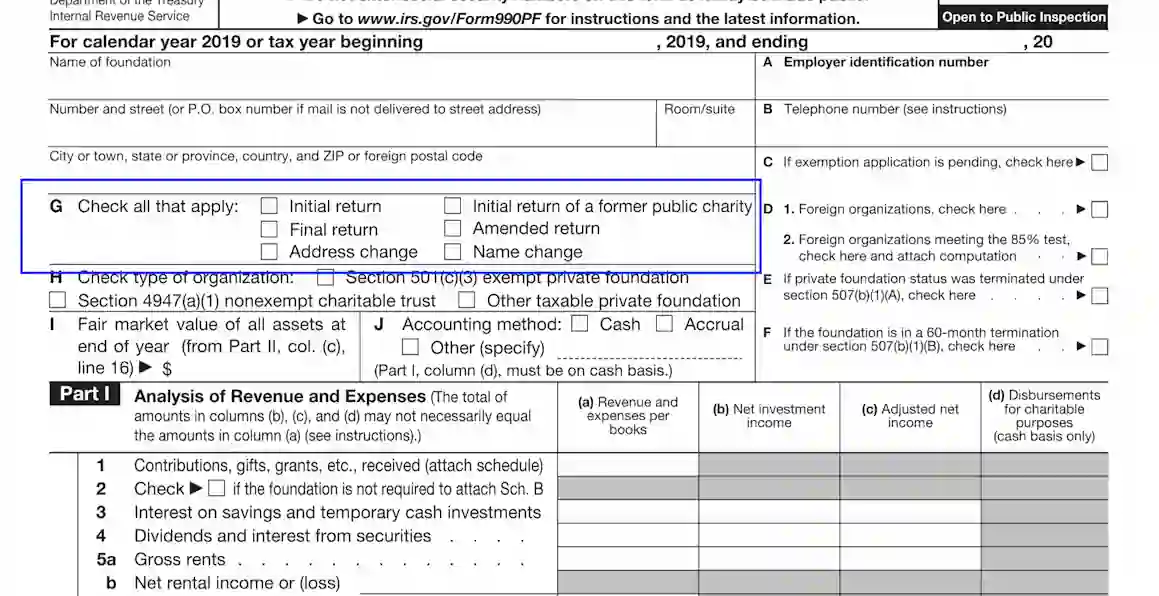

Clarify the Reason for Filling Out the Form

In Unit G, the preparer needs to check the box that reflects their initial reason for completing the 990-PF return.

Specify Your Foundation Type

Unit H is needed to define for what type your foundation is qualified. Select and tick the correct alternative.

Complete Unit I

Insert the needed amount relying on the data provided on line 16.

Determine the Accounting Method

Revise Unit J and select the appropriate alternative.

Complete Revenue and Expenses Part

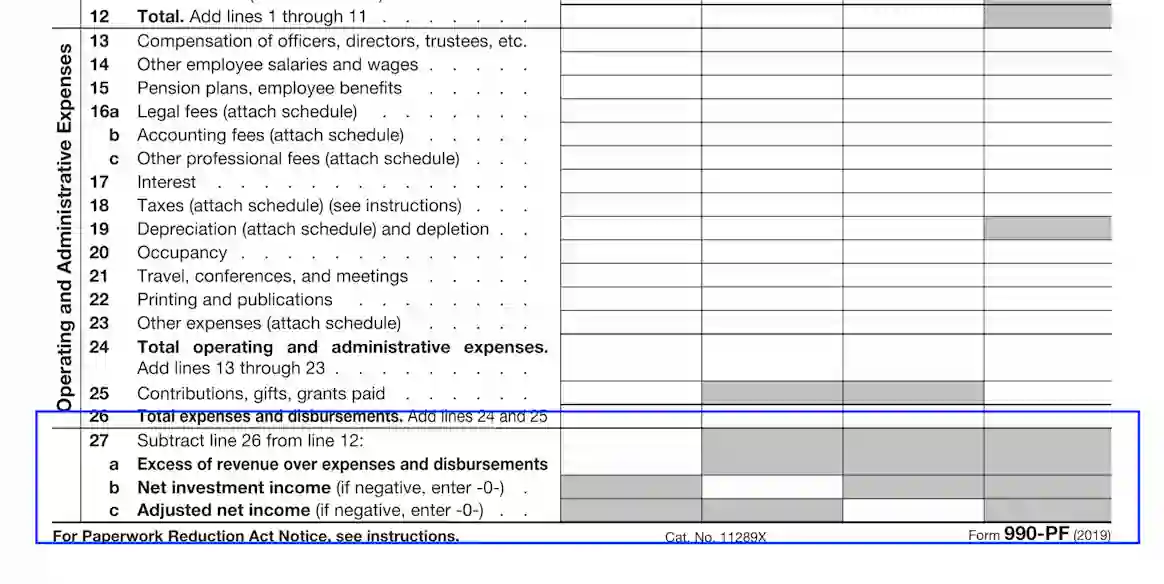

This section covers Units 1 through 27 (a, b, c) and is determined to clarify the income and losses during the reporting period at issue. Complete each line, specifying the needed info in the four columns opposite the units. Avoid grey-colored boxes and leave them empty.

Subtract Total Losses from Total Income

Use Unit 27 (a, b, c) to calculate and record the net investment and adjusted net gainings.

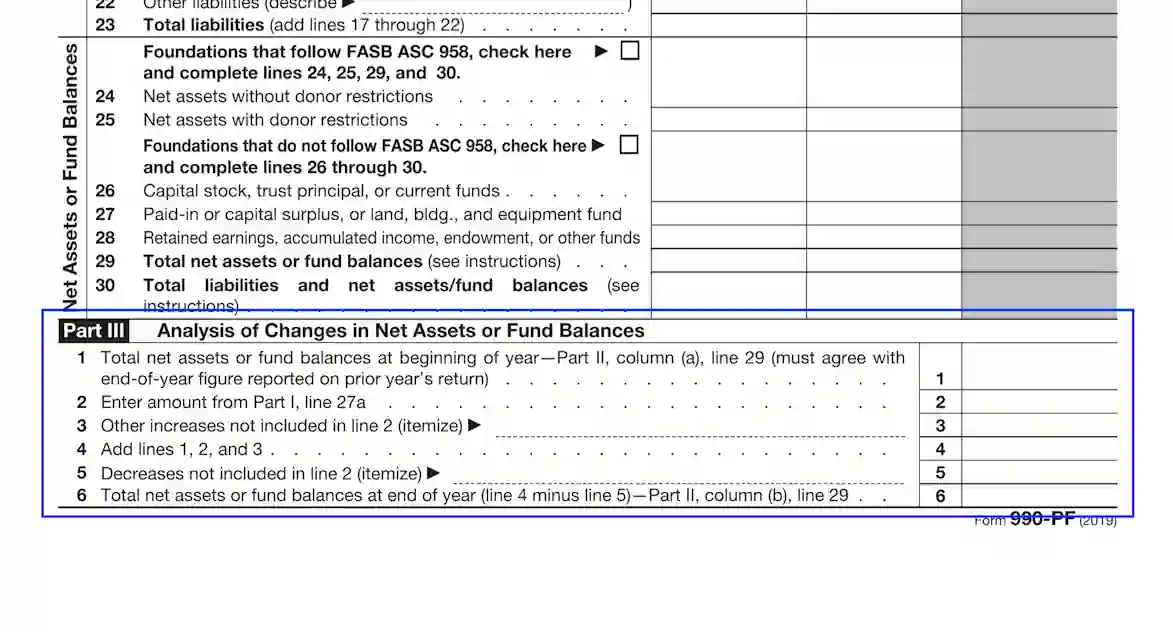

Clarify the Balance Data Section

In Part II, the preparer should enter the balance data referencing the beginning and the end of the taxation period at issue. Fill out the table listing the following:

- Property and funds

- Expenses and liabilities

- Net balances

Submit the Breakdown of Adjustments in Balances

Here, you should calculate and add the required info. Use the boxes opposite each unit to complete the breakdown.

Calculate the Capital Income

Part IV is meant to help preparers calculate the amounts of capital income submitted in Unit 7-8 of Part I. If you are a foreign organization, skip this section. Follow the instructions of each section to list and describe the traded assets. Use lines 2 and 3 at the end of Part IV to record the calculated amounts and report them in lines 7-8 of Part I.

Skip Part V

As § 4940 (e) was rescinded in 2019, you don’t need to fill out Part V. Leave the section blank and proceed to the next segment.

Provide Excise Tax Details

In Part VI, the declarant should give excise tax specifications relying on gains from investments. Calculate the tax and submit the data on the corresponding lines.

Complete the Statements Regarding Activities Poll

Provide positive, negative, or “not applicable” regarding each unit in Parts VII-A. Fulfill similar actions in Part VII-B. Should you answer positively to questions 1 (b, c), 2 (b), 3 (b), 4 (a, b), 5 (b), 6 (b), 7 (b), or 8, prepare and report Form 4720, if you have no exception status.

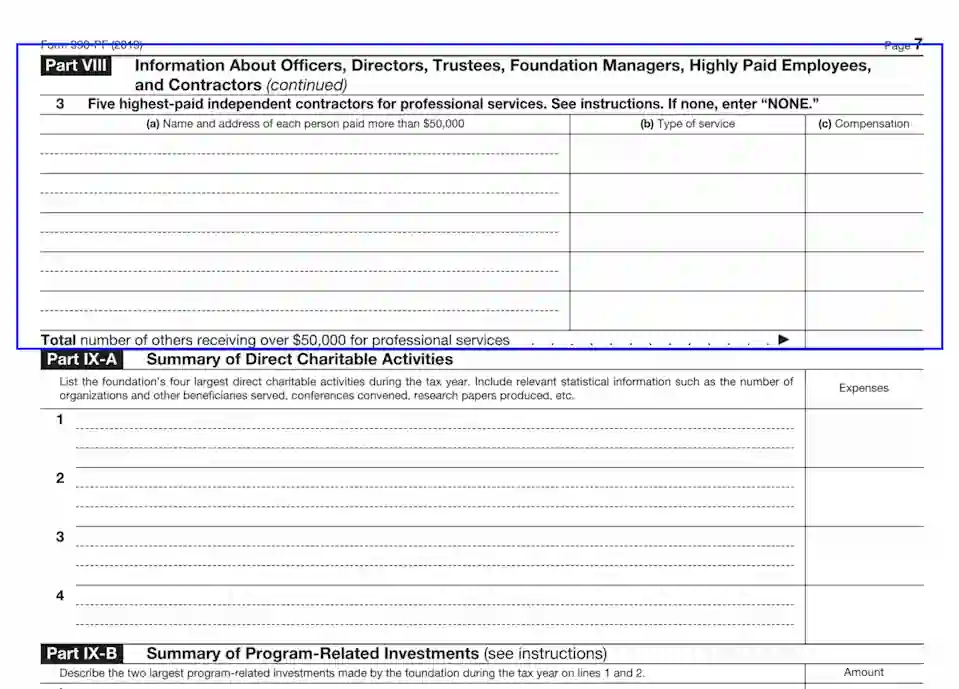

List the Authorized Directors, Foundation Managers, Trustees

Here, the preparer should enter the names, domiciliary addresses, title, and payments of all foundation managers, directors, and other employees and contractors of equally high positions.

List the Employees of the Foundation with the Highest Compensation

Fill out Unit 2 of Part VIII by identifying the highest-paid workers different from the individuals indicated in the previous section. If not applicable, enter “None” and proceed to the next part.

Identify the Independent Contractors with the Highest Payments

Here, you are encouraged to submit the names, addresses, type of service, and revenue amounts of the five highest-paid independent contractors who have earned over 50,000 USD.

Describe the Foundations Charity and Grant Programs

In Part IX (A and B), the preparer should list the essential charitable programs, grants, and other alike activities founded and operated by the foundation. Use section B to speak about educational and low-interest loans offered to other individuals and companies.

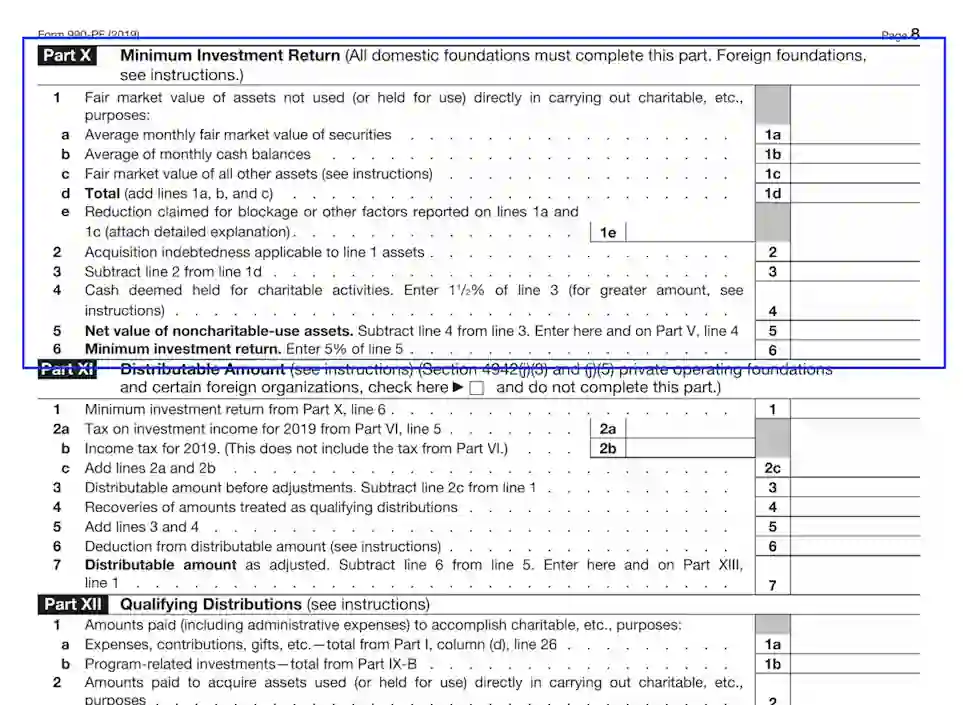

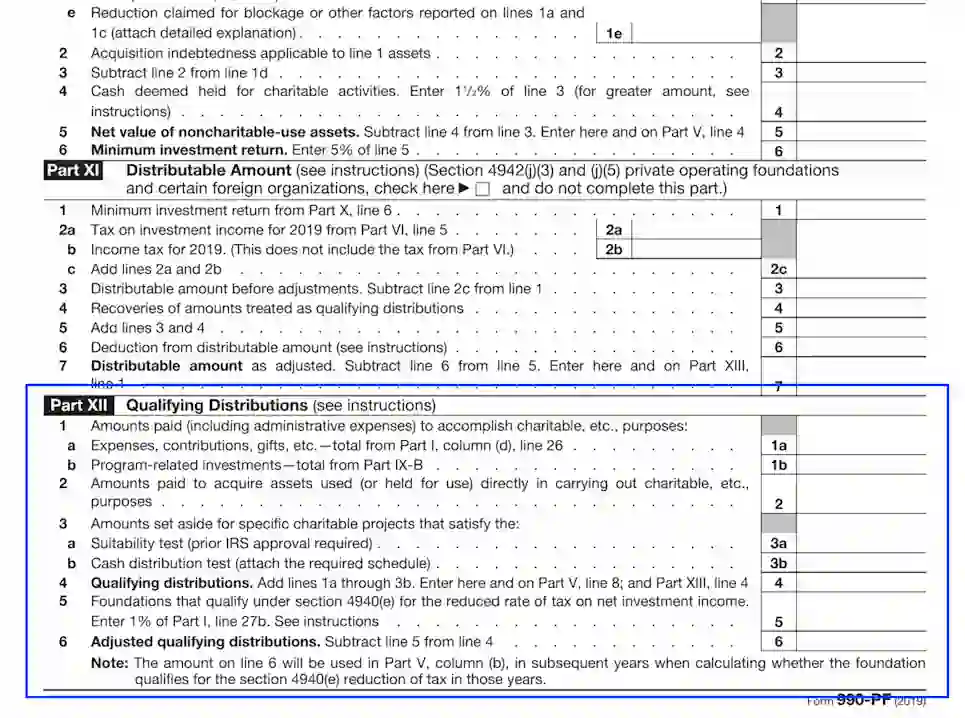

Calculate the Minimum Investment Return

All domestic organizations should fulfill Part X to clarify the minimum return from investments that are not engaged in charitable and beneficial programs.

Revise Distributable Amount Section

Pay attention to the preview of Part XI: if the foundation is qualifying to checkbox the referenced slot under § 4942 (j) (3) of the U. S. Code, you should leave this section blank and proceed to the next unit. Otherwise, ensure to submit the inherent data.

Specify the Foundation’s Qualifying Dispositions

In Part XII, the declarant should enter authentic data regarding amounts assigned to cover educational, charitable, religious, and other related targets.

Determine the Undisposed Gains

Skip this part if you have ticked Unit D2 at the beginning of the document. The major purpose of this section is to follow the directions for applying the organization’s qualifying distributions during the period at issue.

Fulfill Private Operating Foundation Part

Any company that challenges the private operating foundation rank should complete the referenced table, describing the tax period at issue, periods three years preceding it, and their total.

Furnish Supplementary Info Tables

Before you proceed to fill out the tables, ensure to complete the Part XV heading statements.

The preparers should fill out this section only if their corporation assets equal 5,000 USD and more at any time during the tax period at issue. In Unit 3 (a), enter the recipients, type of grants, and contributions invested during the year. In Unit 3 (b), specify the donations and grants that should be paid in the future.

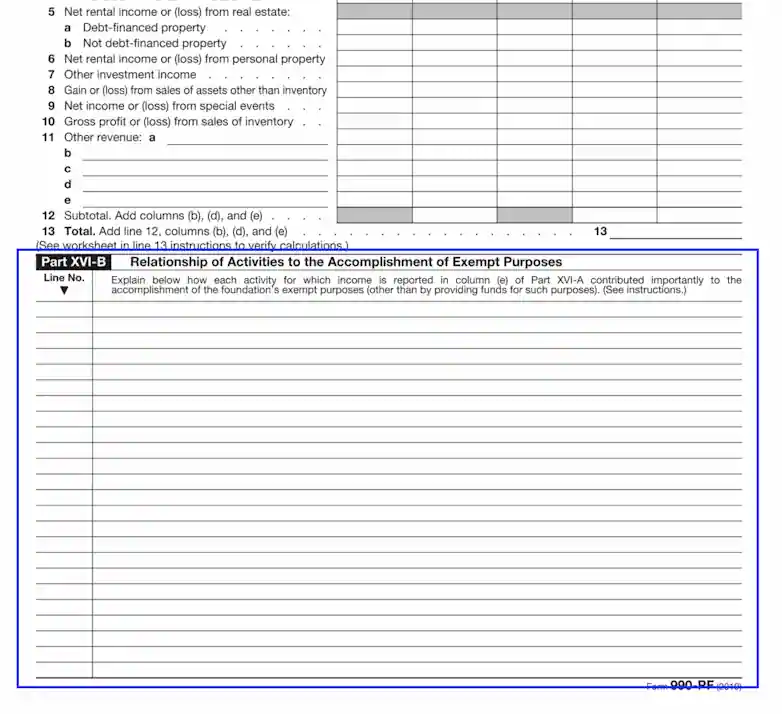

Analyze Income

In Part XVI-A, the declarant is empowered to provide an analysis of assets and activities that resulted in income during the taxation year. Use the IRS Code system to assign the correct abbreviation. Fulfill the table, indicating the unrelated, excluded, and related revenue.

Explain the Related Revenue Activities

Use section XVI-B to explain any exempt function or related revenue activities indicated in column “e” of the part above.

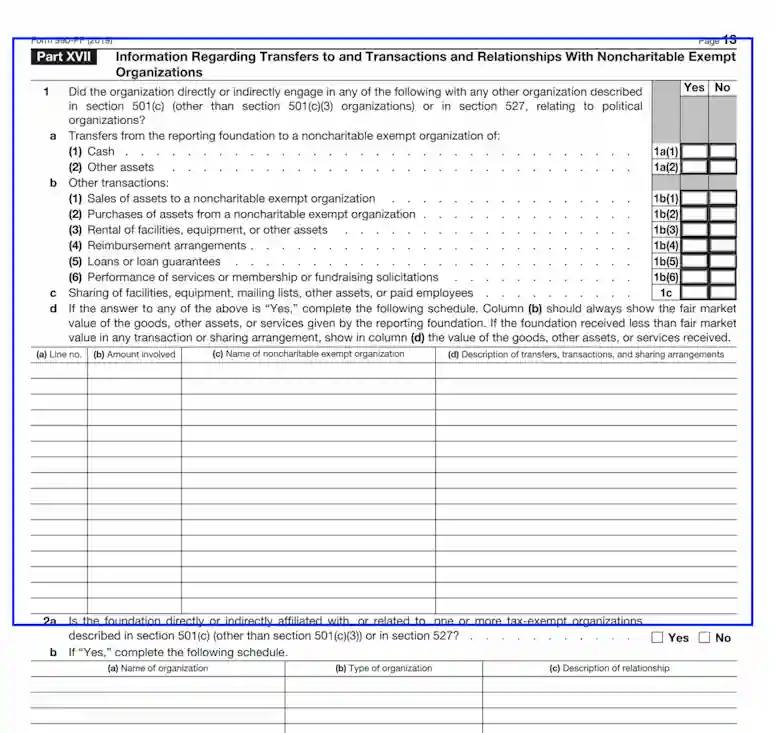

Specify Assets Transfers with Noncharitable Exempt Associations

Part XVII is devoted to covering the relationships with the noncharitable associations regarding any monetary and property transfers and transactions. Select “Yes” or “No” opposite each statement and explain each item in the columns below.

When completing Unit 2 (b) of the current part, ensure you have selected “Yes.” Enter the organization’s data:

- Name

- Type

- How it relates to your foundation

Otherwise, leave the segment blank.

Acknowledge the Paperwork

To authorize the form, the preparer (either the officer or trustee) must append their signature, date the document, and disclose the title.

Appoint the Paid Preparer

If the foundation hires a licensed specialist to fill out the form, submit their data as follows:

- Name (typed or printed)

- Signature

- Date

- Self-employment status (if applicable)

- PTIN

It’s vital not to submit the preparer’s SSN, as the document may be disclosed publicly.

- The preparer’s employer name, address, contact phone, and EIN

Once the document is ready and served, the paid preparer should provide the foundation with a copy.

Authorize the IRS to Discuss the Paperwork with the Preparer

If you wish to allow the IRS to negotiate any statements of the disclosed data, select “Yes.”