IRS Notice 703 accompanies Form SSA-1099, which reports Social Security benefits received during the year. Notice 703 provides instructions to help recipients determine if any part of their Social Security benefits is taxable. This determination is crucial because it affects how much of the benefit needs to be included in the taxpayer’s gross income on their federal tax return.

The notice includes a worksheet to calculate the taxable portion of the Social Security benefits. This calculation is based on the recipient’s total income and filing status. By carefully following the instructions and completing the worksheet provided in Notice 703, recipients of Social Security benefits can accurately assess the tax implications of these benefits and report them correctly on their tax return, thus ensuring compliance with federal tax laws.

Other IRS Forms for Individuals

The IRS Notice 703 might be not the only notice you might want to read about. Check what other IRS forms our users most often use.

How to Fill Out the Notice

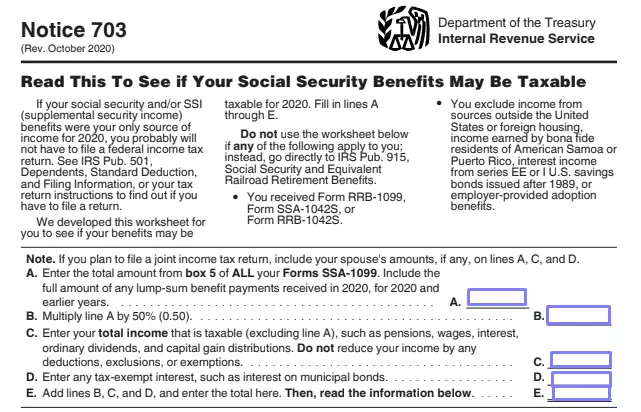

Basically, the template is one page where you have five lines asking you to provide certain numbers. Besides these lines, you have a detailed guide explaining what you should do with the results. You have to prepare your SSA-1099 form: you will take some figures from this document and insert them into the notice.

If this is your first year when you get any governmental perks in frames of the social security program, you should know that every year in January, you will be furnished with the completed SSA-1099 form. This document demonstrates how much did you get throughout the last year. It is sent to every single recipient of the benefits.

You can feel unconfident while filling out tax forms or just have no desire to do this job. There is a solution: you can contract a specialist who works with such documents regularly and can complete the template for you. It will be, of course, quick and easy; however, prepare to pay a certain sum for such services if you prefer them. If you already have your personal accountant, do not even bother with reading the notice’s instructions — just pass the template to your expert.

If nothing of the above-mentioned solutions apply, you should create the document individually. It is possible with the help of our guidelines below. Also, the IRS guide will be a useful thing to read. Prepare both and proceed to the form completion.

Find the Template

You cannot create any legal form without a template you can use. With our exemplary form-building software, you will easily get IRS Notice 703. Try it to obtain the form’s current version. Also, you can switch to the Service’s webpage and get the document there, but it might take a bit more time.

Read the Instructions

Remember we have mentioned that not all your benefits require paying taxes? This is what the initial instructions tell about. Read them thoroughly before you complete the form. If you have received some other forms (like SSA-1042S, RRB-1099, or RRB-1042S), you can completely omit this worksheet.

Provide Computations

There are five lines to fill out (A, B, C, D, and E). Line A demands that you take all your SSA-1099 forms and insert the total sum from line 5 there (if you have more than one form, add all the numbers from line 5).

In line B, you have to multiply the line A number by 0,50 (or 50%). Write your total taxable income in line C (you will understand what to write because the items you should count are listed here). If you have any tax-exempt interest, enter it in line D.

Finally, in line E, you will add the sum you have gotten when you add numbers from B, C, and D together.,

Read Another Set of Instructions

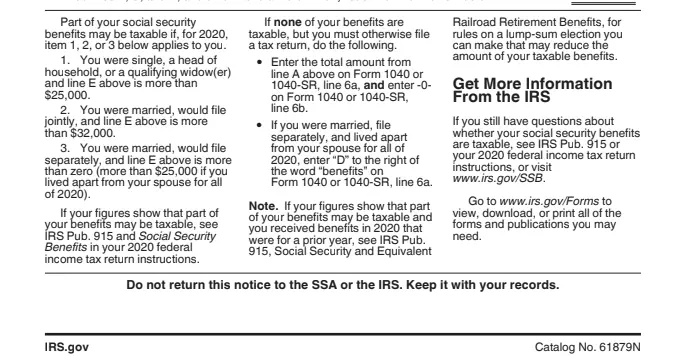

Below the calculations, you will see guidelines that help to interpret the numbers you have gotten. The list contains three conditions that define whether your benefits require paying any tax or not. It depends on the sum you have obtained and on your marital status. You might have to pay taxes on your perks if:

- You are married and submit tax forms together with your spouse, and the result is over 32,000 US dollars.

- You are married and file forms individually, and the result is more than zero (even 1 dollar counts)

- You are single, or a qualifying widow or widower, or manage a household on your own, and the result is over 25,000 dollars.

If you realize that you might need to pay, check Publication 915 issued by the Service. If not, keep reading the provided instructions to understand what you should do next.

Keep the Filled-out Form

As we have already told you, you are not required to send the document after you complete it. Add it to your archive, where you keep other essential forms. Do not lose it because sometimes such worksheets might be needed, and public authorities can demand them at any moment.