IRS Schedule 1 for Form 1040 or 1040-SR is a supplementary form used by taxpayers to report additional income and adjustments to income that are not directly entered on the main Form 1040 or 1040-SR. This schedule is part of the individual income tax return and provides more detailed information on specific types of income or deductions.

The form includes sections for reporting types of income such as business income from Schedule C, rental real estate, royalties, partnership, S corporation, and trust income from Schedule E, as well as farm income from Schedule F. It also covers other income such as gambling winnings, prize money, and unemployment compensation. Additionally, Schedule 1 adjusts income, including deductible parts of self-employment tax, self-employed health insurance deductions, and contributions to traditional IRAs and health savings accounts (HSAs). This form helps to adjust the taxpayer’s gross income to arrive at their adjusted gross income (AGI), which is used on the main tax form.

Other IRS Forms for Individuals

Schedules are used to provide more financial information to the Internal Revenue Service. Make sure to get familiar with other schedules and forms you might need as an individual taxpayer.

How to Fill Out the Form

Even though Service’s forms might scare people and sometimes seem way too complex, all of us have to complete some of these templates every year and file them. Once you have done it for the first time, it will get easier every following year.

You can use our simple guidelines below to understand how to create your Schedule 1. However, remember that if something bothers you and you are not sure what to write in the template, do not hesitate to ask professionals for help. You will be punished if you provide incorrect or fake data in your documents.

Get the Schedule Template

All IRS templates can be found on the Service’s official website; however, you can also download one here using our form-building software that offers all legal templates’ relevant and timely versions. Schedule 1 of Form 1040 (1040-SR) is among these templates, too. It might be more convenient than switching between your browser’s tabs.

Write Your Name and SSN

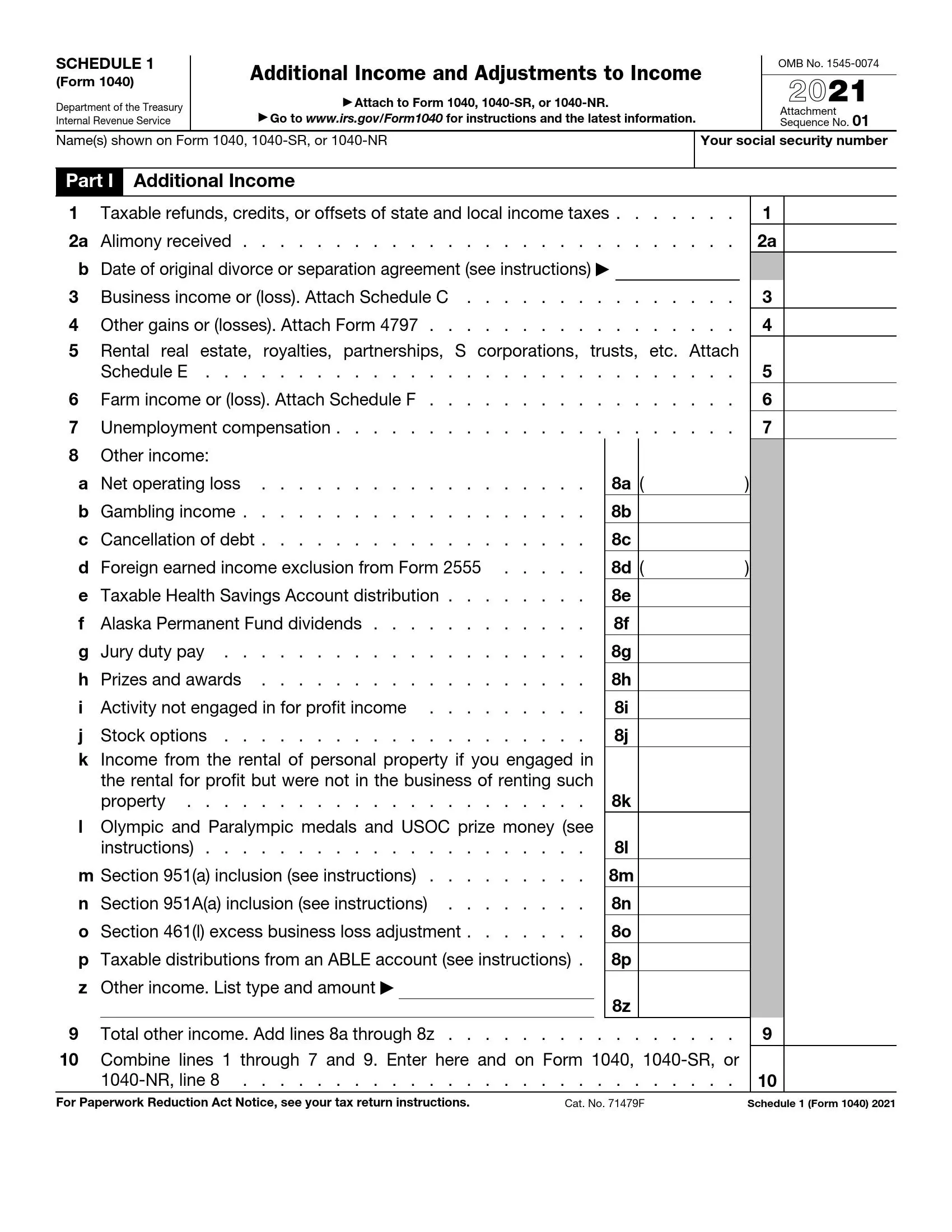

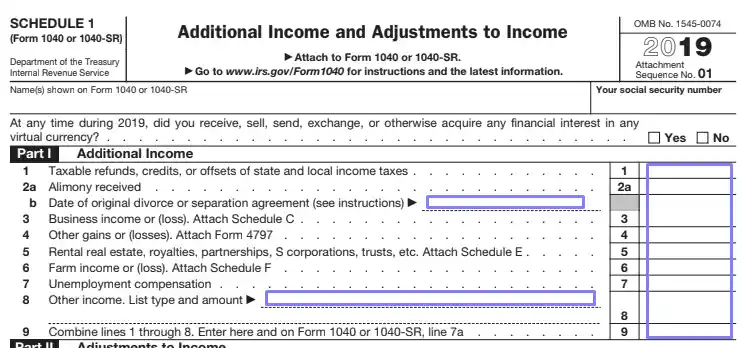

The form begins with blank fields for your name and social security number (or SSN). The name you enter must coincide with the one you have written in your initial tax return. Then, answer if you conducted any operations with virtual currency this year. It is a “yes or no” question, and you do not have to write any additional info regarding this matter.

Choose a Part to Fill Out

Previously, we have explained how Part I and Part II differ. You can complete both parts if needed.

Specify Your Additional Income

In Part I, you can insert the sums you got beyond your regular income. The first line is for refunds, credits, or tax offsets. The second line is for alimony received (if you fill it out, indicate the divorce or separation date below).

The third line is for income or loss that your business demonstrated. If this line is relevant for you and you add anything there, you must also fill out at attach Schedule C. The fourth line is for other losses; if filled out, it requires an additional form, 4797.

In the fifth line, you can indicate revenues from rental real estate and various entities (partnerships, for example). You must file Schedule E if this line is filled out. Farming incomes and losses go to the sixth line; they should be accompanied by Schedule F. The seventh line is for your compensation for unemployment if you had any.

The eighth line is for other revenue sources. You should specify the type and received sum.

Finally, in the ninth line, you must write the overall additional financial profit. Pick the lines you have filled out and combine all the sums from there. Insert the result in this line. Besides, duplicate this result in the designated line of your tax return.

Proceed to Adjustments

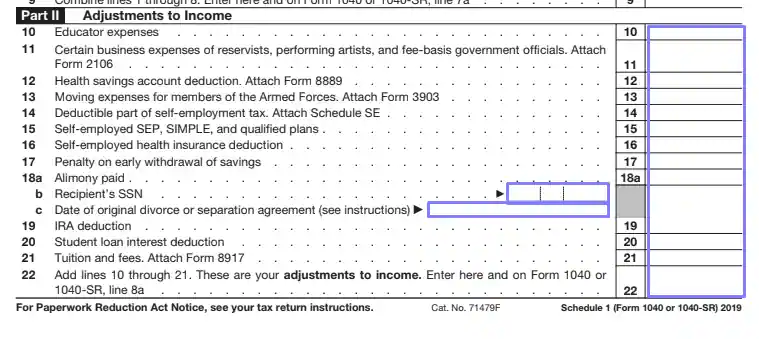

If you have any deductible items, you can include them in Part II. In the tenth and eleventh lines, you can insert your educator costs and specific business costs (for these, you will need a Form 2106). Deduction for your health saving account may go to the twelfth line, and you should prepare Form 8889 for it.

Armed Forces members might need to use the thirteenth line for their expenses (with Form 3903). The following three lines are for self-employers and their deductions; for some, you will need to attach Schedule SE.

The seventeenth line reflects penalties caused by early savings withdrawal. In the following line, you can indicate the alimony you have paid. If this is a relevant line for you, write the payee’s SSN and date of divorce (or separation).

Individual retirement account (IRA) deduction goes to the following line. Deduction for a student can be added to line 20, and the next line is needed to write the tuition and fees (provide Form 8917, too).

In the last line, write the sum you get if you add all the written numbers together. You should incorporate it in your tax return as well.