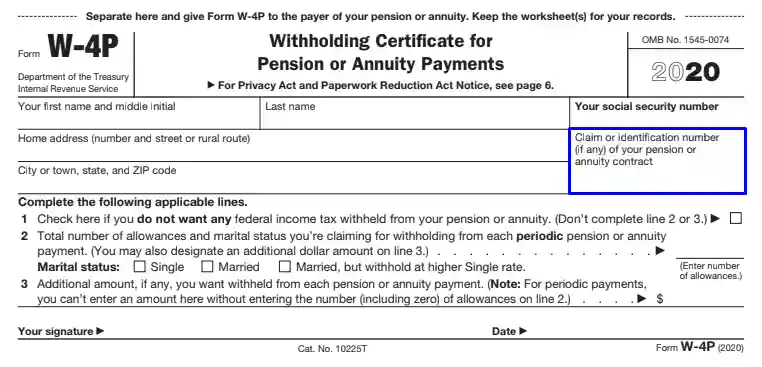

IRS Form W-4P is a tax document used by recipients of pension or annuity payments to specify the amount of federal income tax to be withheld from their payments. It is typically completed by individuals who receive distributions from pension plans, annuities, individual retirement accounts (IRAs), or other similar retirement arrangements. Form W-4P allows recipients to adjust their withholding to ensure that the correct amount of federal income tax is withheld from their payments based on their individual tax situation and preferences.

By completing Form W-4P, recipients of pension or annuity payments can manage their tax liabilities and ensure that they meet their tax obligations throughout the year. This form helps recipients avoid underpaying or overpaying taxes on their retirement income and ensures compliance with federal tax laws and regulations.

Other IRS Forms for Trusts and Estates

On our website, you can familiarize yourself with other IRS forms that are in the category of Most used forms by individual taxpayers.

How To Create a W-4P Form

It is very important to understand all terminology and wording when creating documents. The tax system in America is quite complex; there are many forms and nuances in which you can get confused. That is why we always recommend that you seek professional help when you need to create tax forms.

A responsible approach to creating and filling out a form will help you avoid many of the difficulties associated with incorrectly completed documents and incorrectly calculated taxes. You can be fined for not paying taxes, and sometimes you can be sued.

We understand that not everyone has the opportunity to pay for the services of a tax specialist or a lawyer. But you can always use our form-building software for assistance and convenience. It will help you minimize potential mistakes when filling out the documents and significantly reduce the time you spend on paperwork.

Before you start filling out the form, you need to download it. You can do this on our website. Then you can fill out the form online or manually. To fill out the form, you need to make a few simple steps, which we will list below.

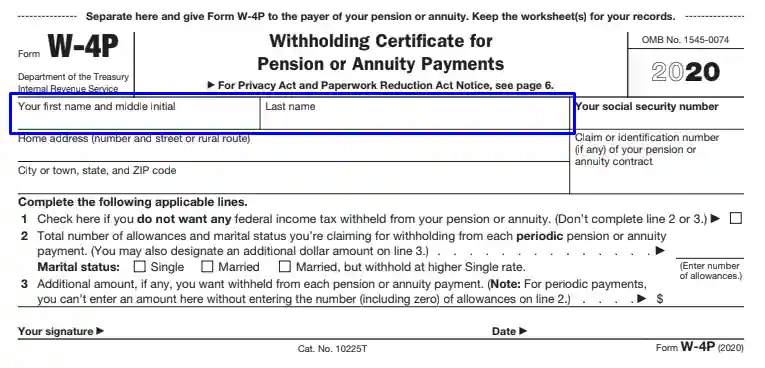

Enter Your Full Legal Name

In the first part of the form, you need to enter your first name and the middle name’s initial. And in the next box, you need to enter your last name. All data must correspond to your data specified in the passport.

Write Down Your Social Security Number

In the top right box, write your social security number. You can find your social security number on your social security card. It is a nine-digit number that every US citizen has.

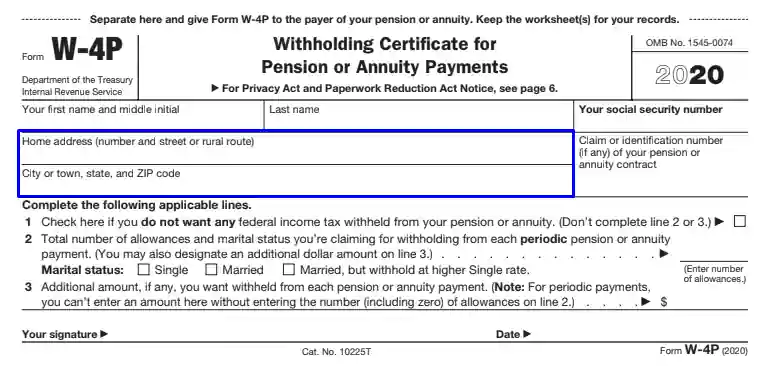

Enter Your Address

In the dedicated boxes, you need to write your exact address. In the top line, enter the building number and street name. On the bottom line, you will need to enter the zip code, state, and city.

Enter Your Pension Contract Number (Optional)

If you have a pension contract number, please include it in the dedicated box. A pension contract is a special type of contract by which a person regularly pays pension contributions and in exchange for which they receive payments when they retire.

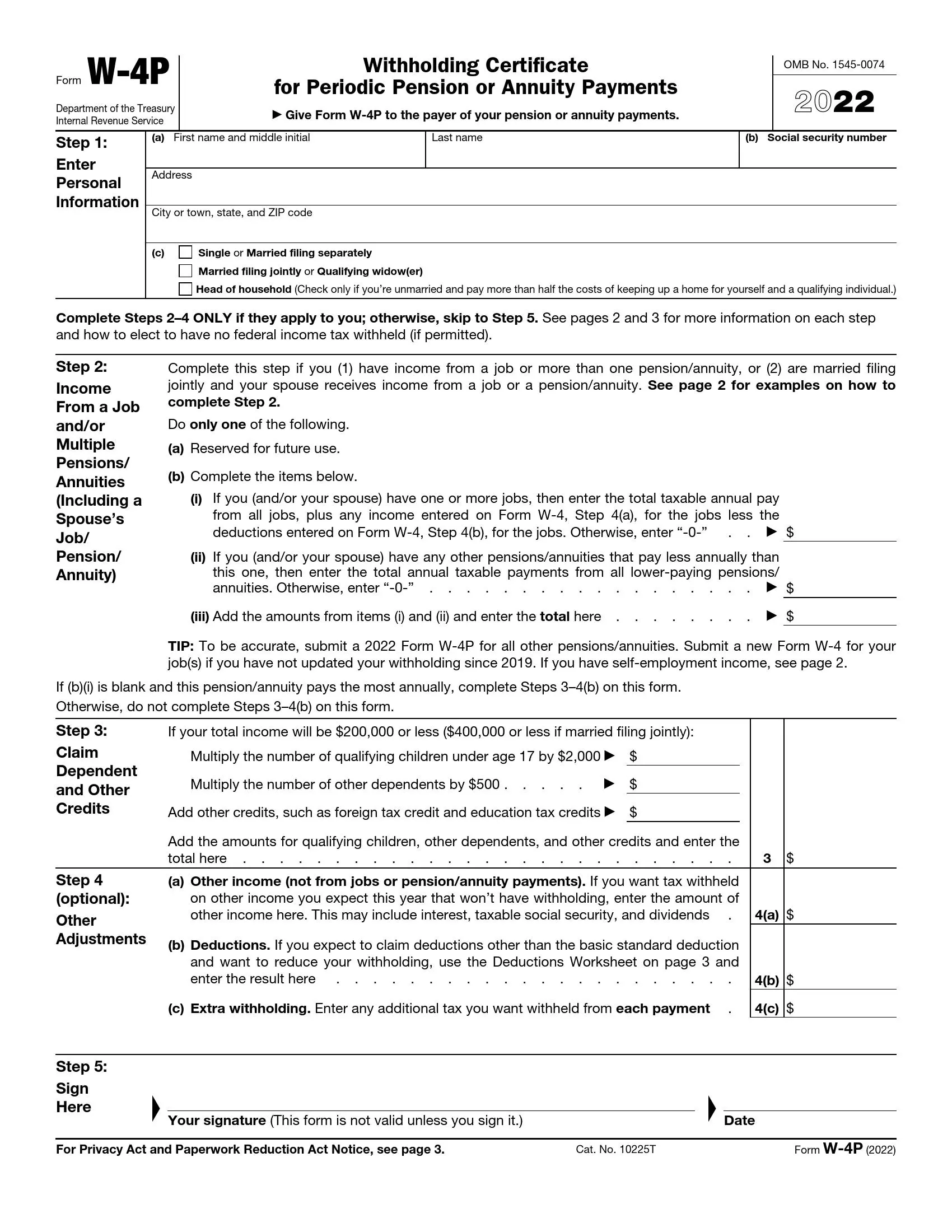

Complete The Following Applicable Lines (1-3)

If you do not want income tax to be withheld from your pension, you need to tick the first line. If you checked the first line, you don’t need to fill in lines two and three.

When completing the second line, indicate the amount of benefit (in dollars) that you expect to receive with each payment. When filling out the second line, you also need to indicate your marital status. You will have three options: married, single, or married, but withholding at the single rate.

When filling outline number three, indicate the number of additional deductions from the pension. Keep in mind that you cannot complete line three without completing line two. You can fill in line two by typing in zero.

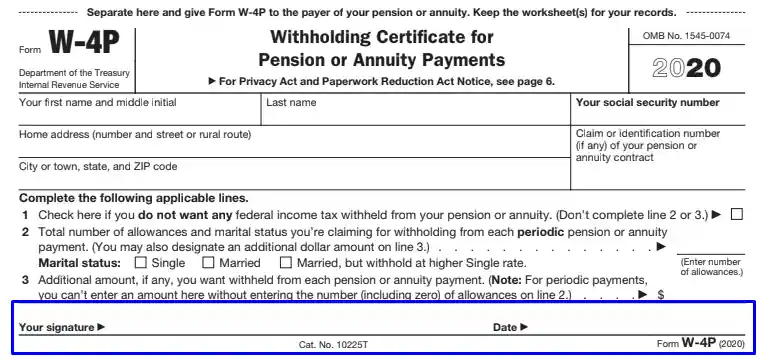

Sign and Date Form W-4P

Put your signature on the bottom line of the form on the left. On the same line, but on the right, you will need to put the date of filling out and signing the form. Then you can give the completed form to the payer of your pension.