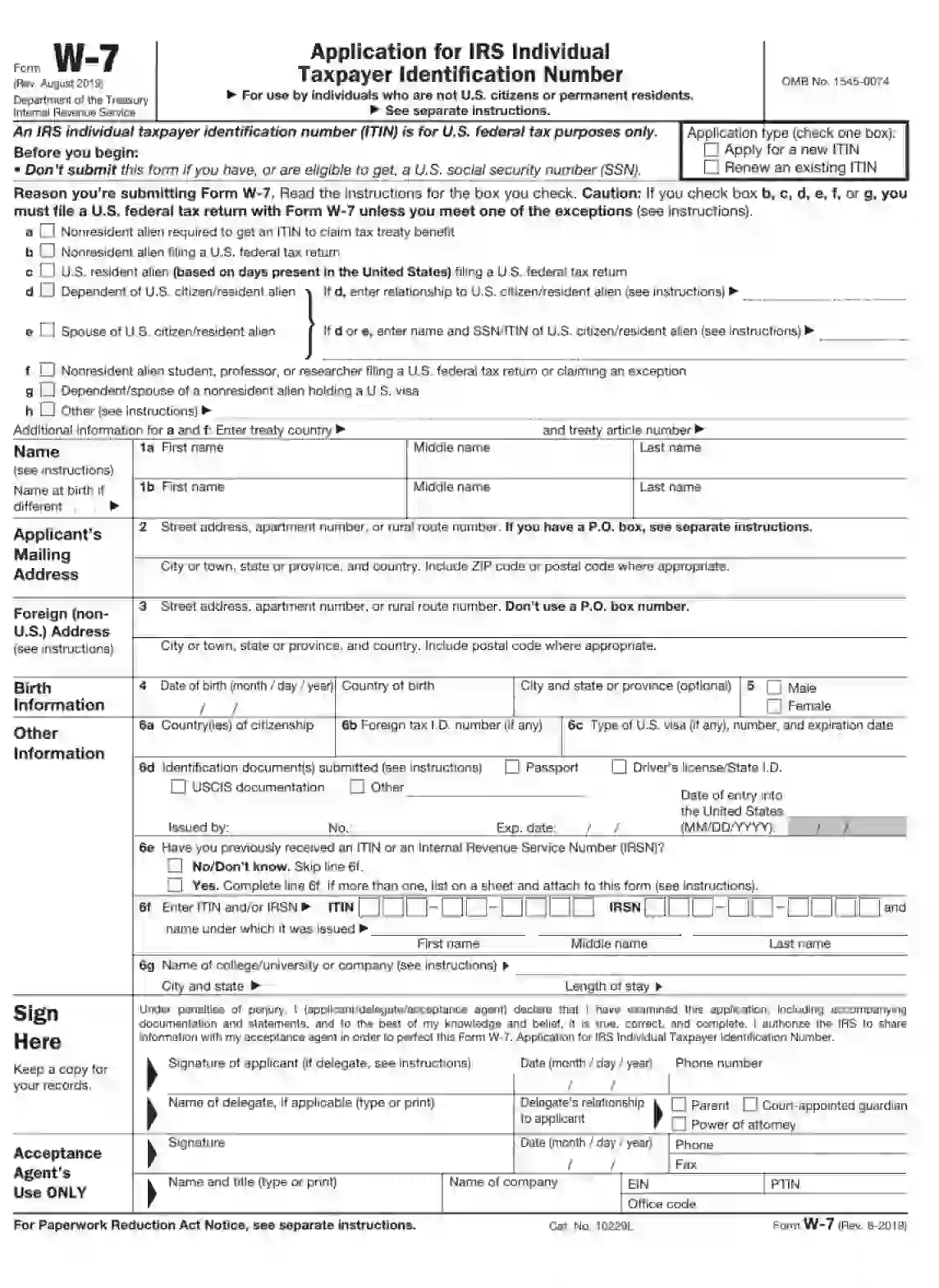

IRS Form W-7 is a document used to apply for an Individual Taxpayer Identification Number (ITIN). This form is specifically for individuals who are required to have a U.S. taxpayer identification number but do not have and are not eligible to obtain a Social Security number (SSN). ITINs are issued regardless of immigration status because resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code.

Individuals typically need to fill out Form W-7 when they need to file a U.S. federal tax return or are claimed as a dependent on a tax return but cannot get an SSN. The form requires detailed documentation to prove identity and foreign status, including original documents or certified copies from the issuing agency. ITINs enable non-SSN holders to comply with U.S. tax laws and potentially receive a tax refund if they overpay their taxes.

Other IRS Forms for Individuals

IRS forms are used to report financial information, calculate taxes, and apply for tax relief. Learn what IRS forms might be needed in your specific situation.

Filling Out the Form

This document consists of several sections presented on one page. You may decide to find the template anywhere on the Net or use our form-building software to create your own Form W-7 form online.

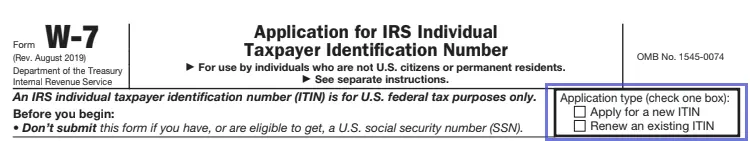

Choose Application Type

You will begin by checking a corresponding box in the top right corner. Indicate whether this is your initial ITIN application or you are willing to renew the code you have already received.

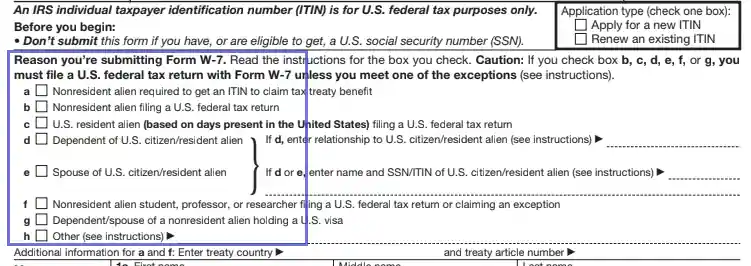

Select the Reason for Submission

Eight options are presented herein. Choose one unless yours is other — exceptions are described in the detailed set of instructions that you can look into on the IRS official web page.

Provide Additional Data (Boxes D and E)

If you have checked box d, enter the complete name (last name, first name, and middle initial) and SSN or ITIN of the US citizen or resident alien. Input the date when they have arrived in the USA (unless several exceptions). If you have checked box e, providing the US citizen or resident alien’s full name and SSN (ITIN) will be enough.

Provide Additional Data (Boxes A and F)

Enter treaty country and article number if you have chosen boxes a or f.

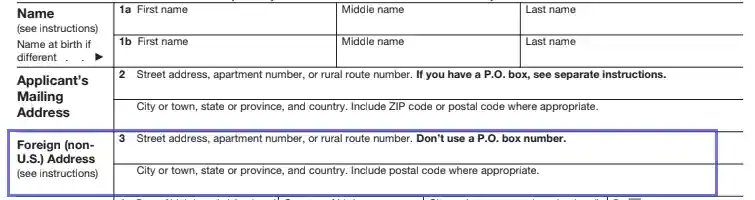

Insert the Name

You are required to fill the fields out with your last, first, and middle names, if applicable. In the cases when your current name differs from the one given at birth and written on the birth certificate, complete line 1b. If you are renewing your ITIN and your name has changed since your last application, attach proof.

Enter Mailing Address

Fill in the address you are expecting to be mailed back — the IRS will return your original papers there.

Submit Foreign Address

Even if the address you have indicated above is the same, complete line 3. In the event of having left your previous residence to move to the USA, enter the last foreign address where you used to live.

Write Down Birth Info

The date and place of birth are provided herein. Select appropriate sex in the “Male/Female” box.

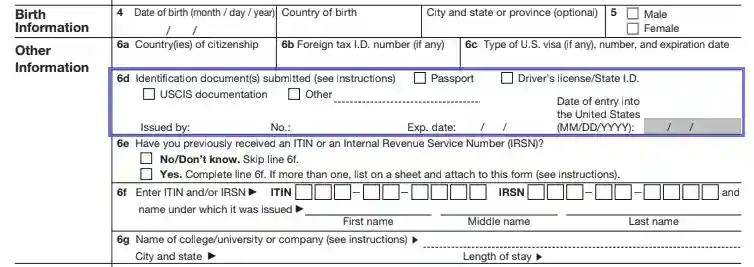

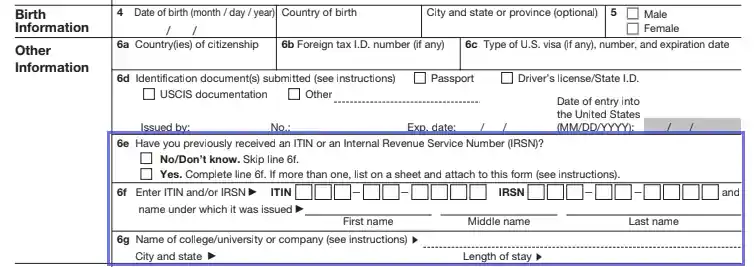

Complete Other Data (Lines 6a-6c)

First, establish each of the applicant’s citizenships. Then, if applicable, insert the foreign tax ID number that belongs to you and details about your current US visa.

Complete Other Data (Line 6d)

Check the box that shows what original documents attached serve to prove your identity. Provide more info about them.

Complete Other Data (Lines 6e-6g)

Indicate whether you have ever received ITIN or IRSN and enter these codes, if yes. In case you study or work for an educational institution in the US, write down what it is called and input its address. Remember to establish the expected duration of your stay.

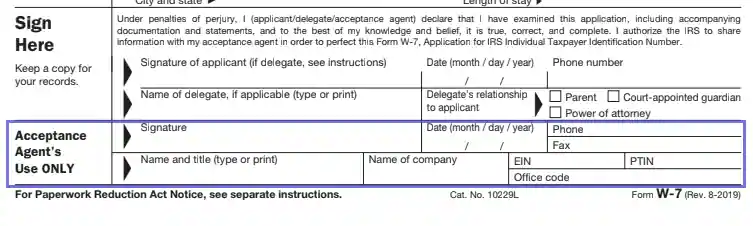

Sign the Form

Applicants append their signatures, affirming that they have been notified: making false statements and providing misleading information may lead to penalties. Date the paper and submit your contact phone number herein as well.

If you are representing the applicant, indicating some details about you is required.

Input AA’s Info

The fields of this section are filled out by an AA only.