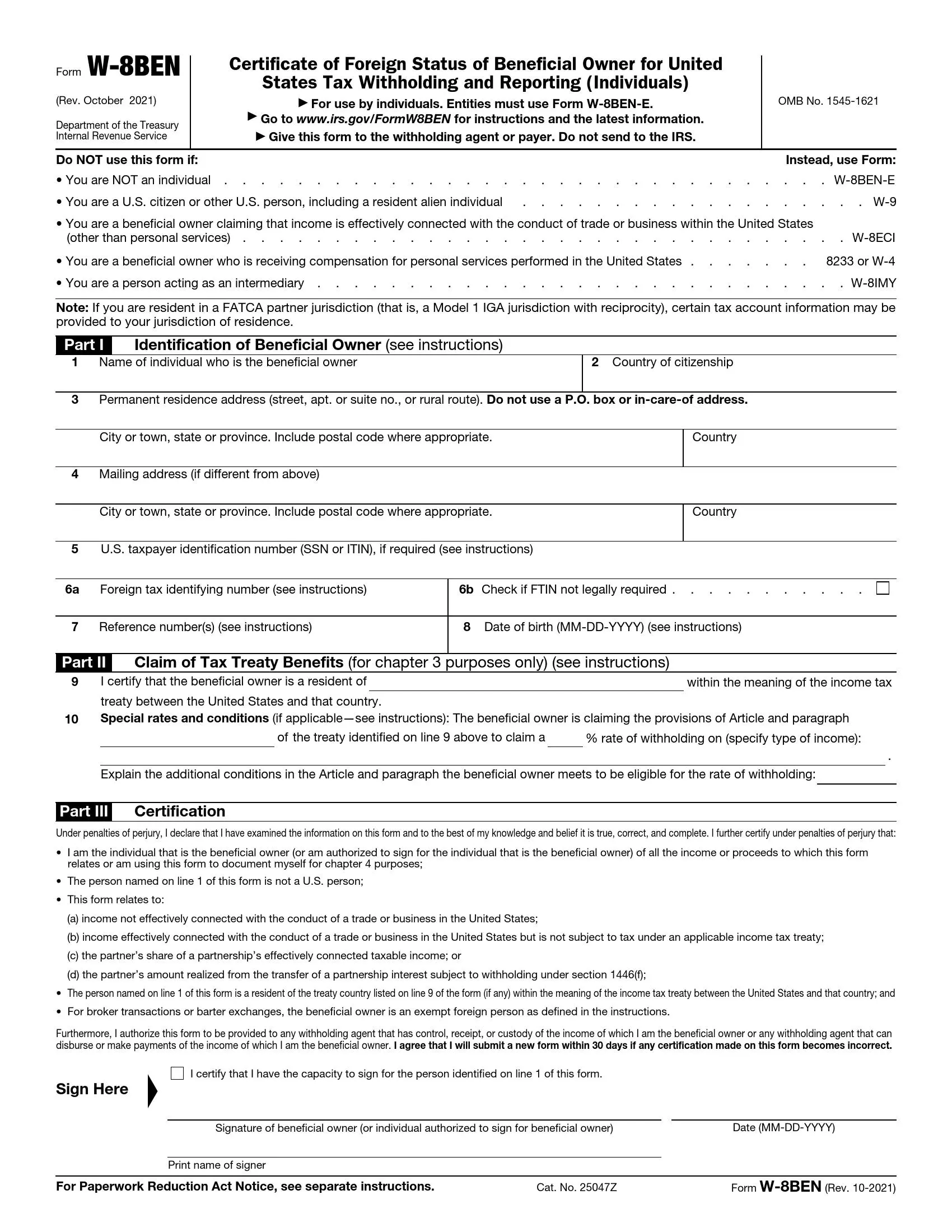

IRS Form W-8BEN, titled “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting,” is used by non-U.S. individuals to certify their foreign status. This certification helps to ensure that the correct U.S. tax withholding and reporting requirements are applied to income paid to these individuals, such as dividends, interest, rents, royalties, and compensation for services. Key aspects that need to be provided on Form W-8BEN include:

- The individual’s name and country of citizenship,

- Their foreign tax identification number and U.S. tax identification number (if applicable),

- Certification that the individual is not a U.S. person and is the beneficial owner of the income for which the form is provided.

By submitting Form W-8BEN, non-U.S. individuals claim tax treaty benefits, if applicable, reducing the tax rate withheld by U.S. payers on their U.S.-sourced income. This form is crucial for non-U.S. persons who earn income from U.S. sources to avoid unnecessary withholding and ensure compliance with U.S. tax laws.

Other IRS Forms for Corporations

Foreign people in the US might need to be familiar with some other IRS forms. You can read more about them on other pages with IRS forms.

Filling Out IRS Form W-8BEN

This section of our review is dedicated to the filling out process and includes instructions and illustrations to help you accomplish the W-8BEN template. We empower you to use our form-building software to tailor a PDF file and start completing the document immediately.

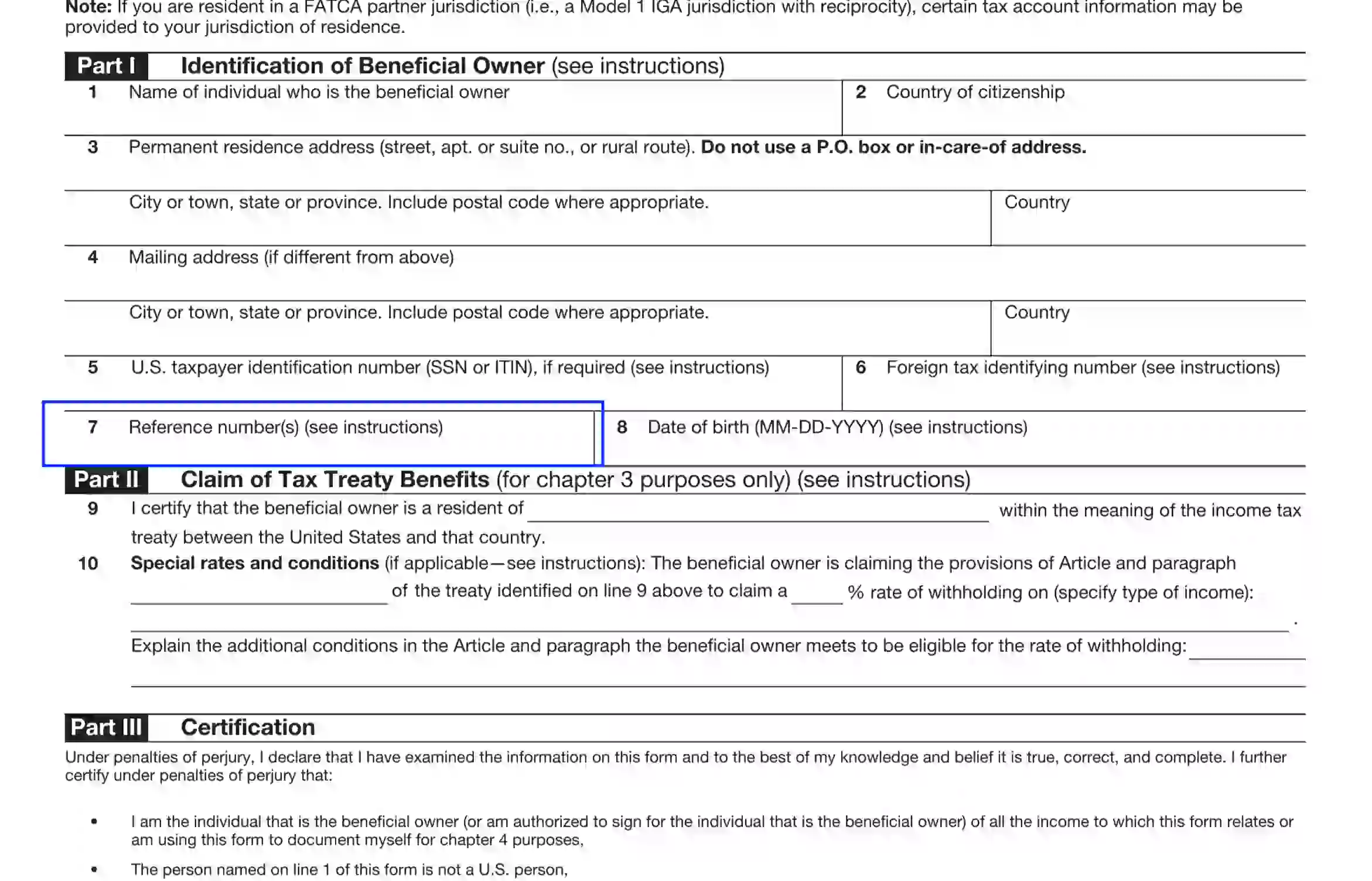

The W-8BEN Form consists of three general parts and an introductory section. Let us view each unit closely:

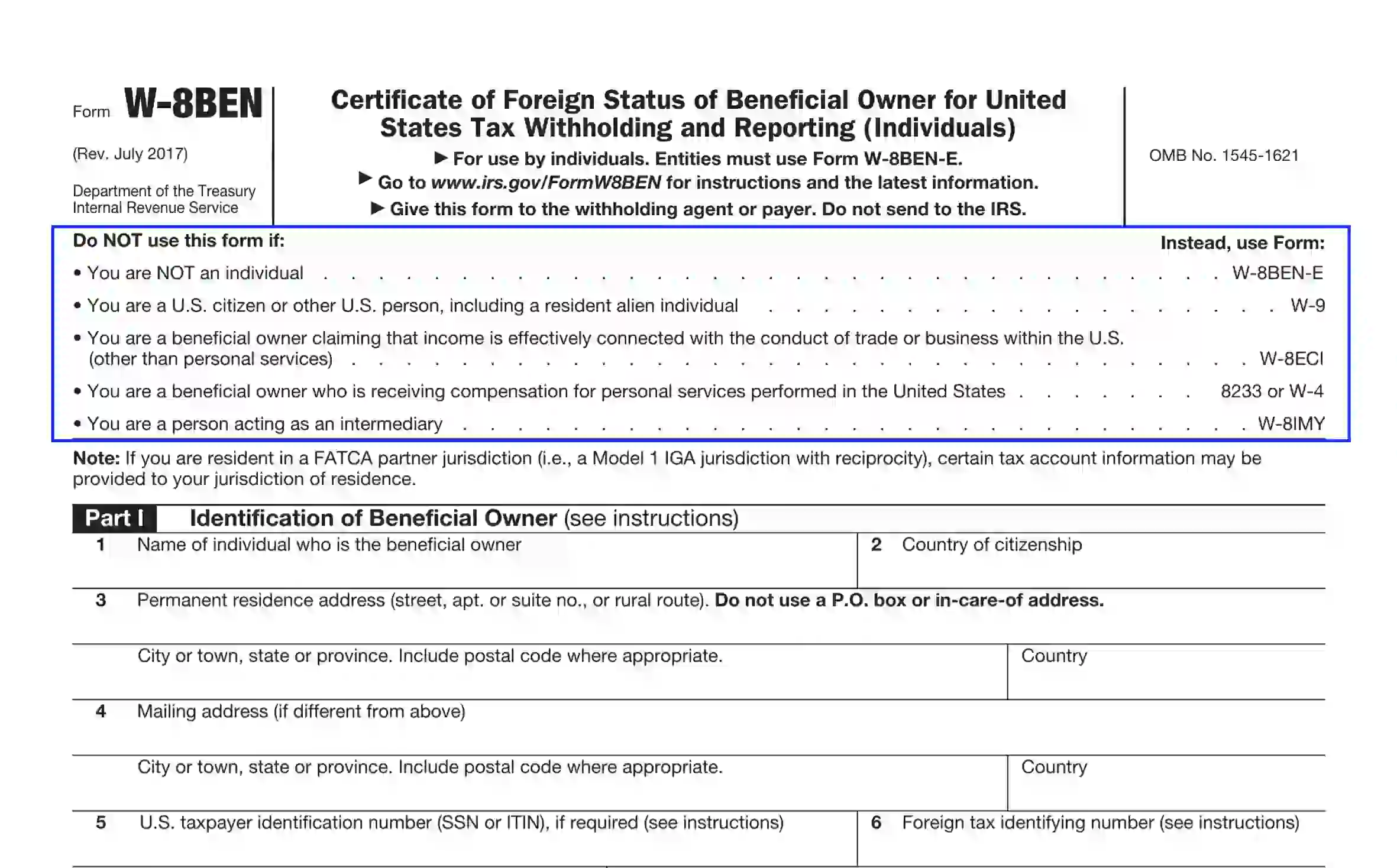

- Consider the Warning Introductory Clause

Prior to entering the required data, please, read the warning at the top of the document. The Internal Revenue Service provides compulsory recommendations for using the form. If you fall within one of these categories, avoid completing W-8BEN and prepare the indicated document.

- Submit the Beneficial Owner’s ID Data in Part 1

This section contains questions 1-9 and requires the petitioner’s personal info. To complete these units, you should enter the following:

- The legal name on Line 1

- Citizenship data on Line 2

- Physical domiciliary address, including the street and apartment (suite) number, city, state, ZIP, and country on Line 3

- Line 4 requires the individual’s mailing address if different from the permanent residency location. Make sure to enter the full data on the model of Line 3.

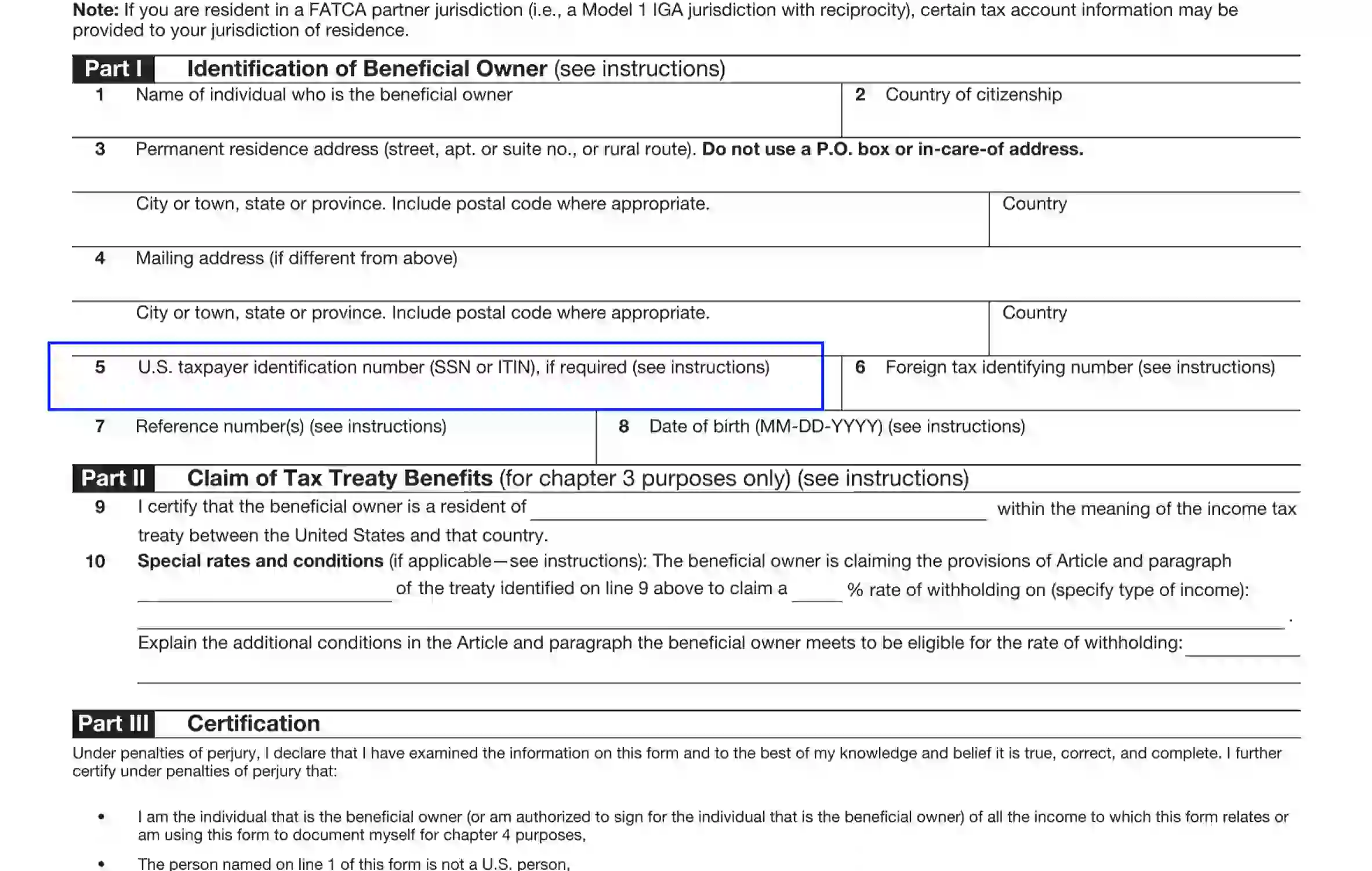

- On Line 5, the petitioner should insert the taxpayer ID data.

If the individual possesses the SSN, they should enter it in the appropriate box. In the event, the petitioner doesn’t have the SSN and cannot be qualified to apply for one, let them indicate the ITIN. You can file the necessary documentation at IRS to get registered within four-six weeks.

It’s worth mentioning that ITIN does not guarantee benefits or adjust one’s employment (or immigration) rank. To have a legal right to social security privileges, the petitioner must submit their SSN or TIN.

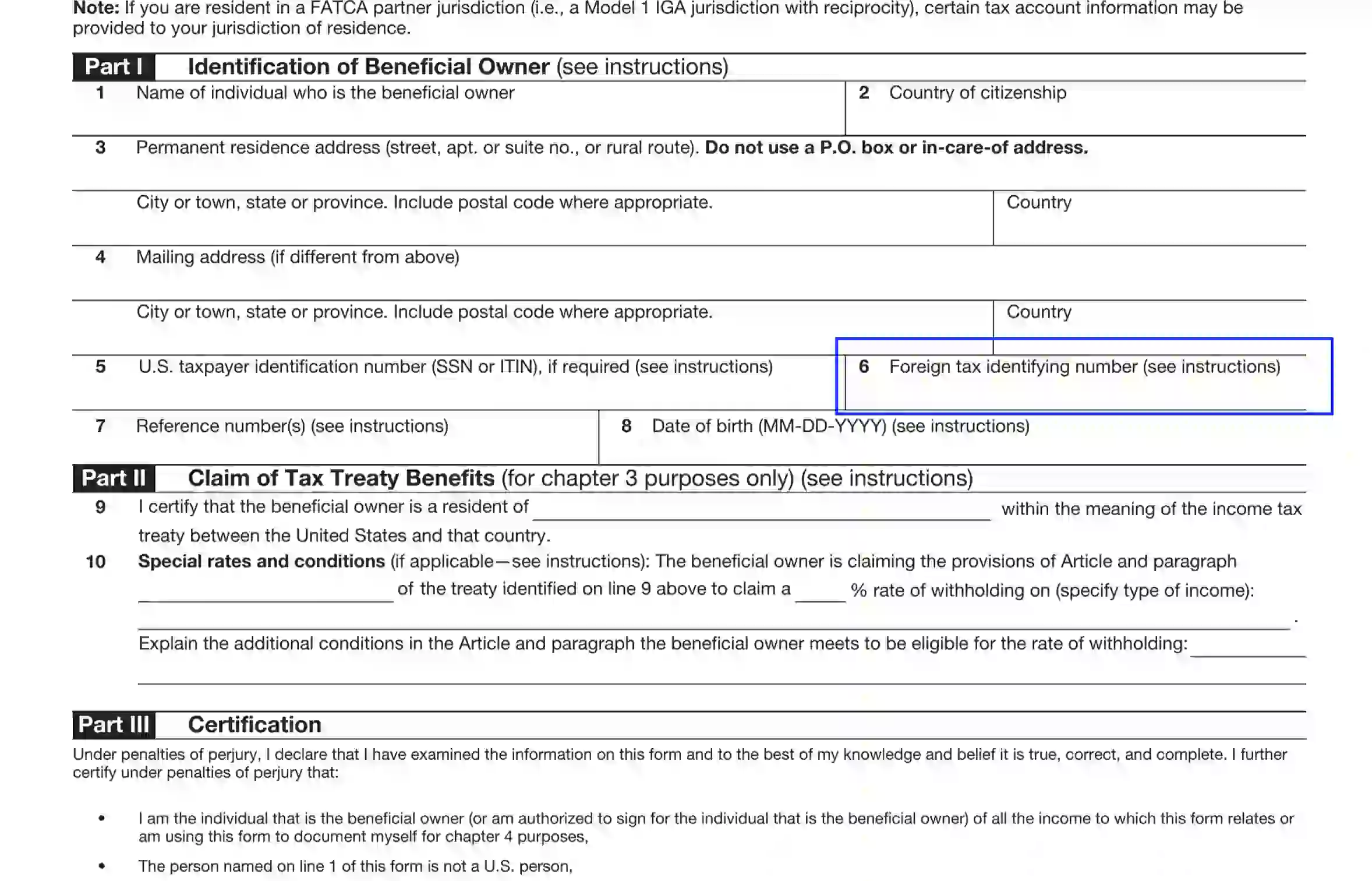

- Line 6 demands the petitioner’s foreign tax ID data.

You should provide the corresponding data when holding a financial account and receiving income from a US-based business. The taxpayer ID number is given by the authorized services of your country of residency defined on Line 3.

Having no TIN requires an explanation that you should deliver in the W-8BEN Form. Clarify the matter on Line 6, or submit an attachment to the document. More details can be found on the IRS official website.

- Include the reference number(s) on Line 7.

Here, the petitioner includes any relevant info, additionally clarifying the W-8BEN claim. The beneficial owner can include account details, for example, to help the agent associate related forms and accounts.

- Specify your date of birth in a month-day-year format on Line 8.

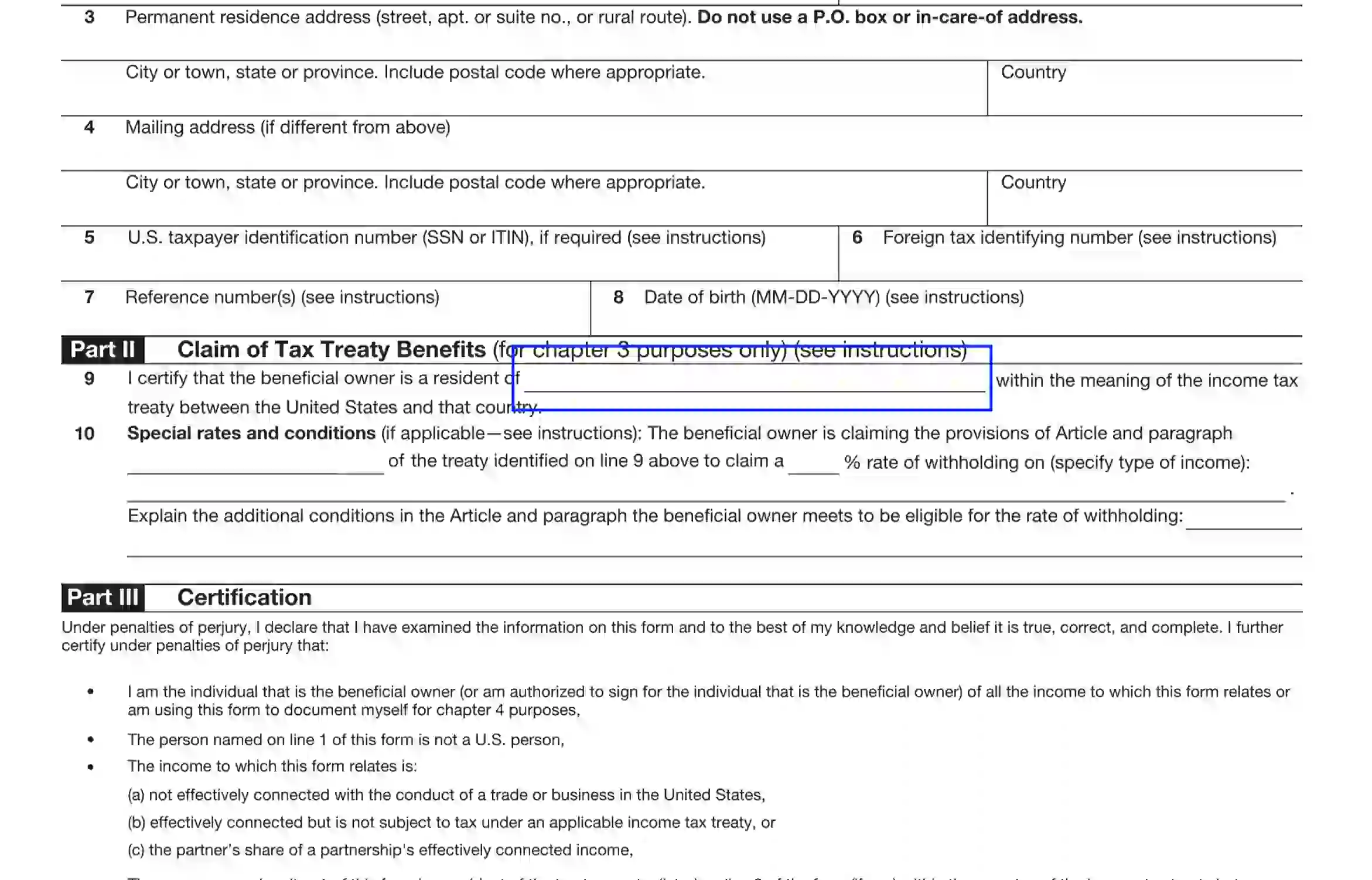

- Identify the Treaty Country

Enter the name of a treaty country the beneficiary person resides. The complete list of the treaties can be found on the IRS official website in the Tax Treaties Section.

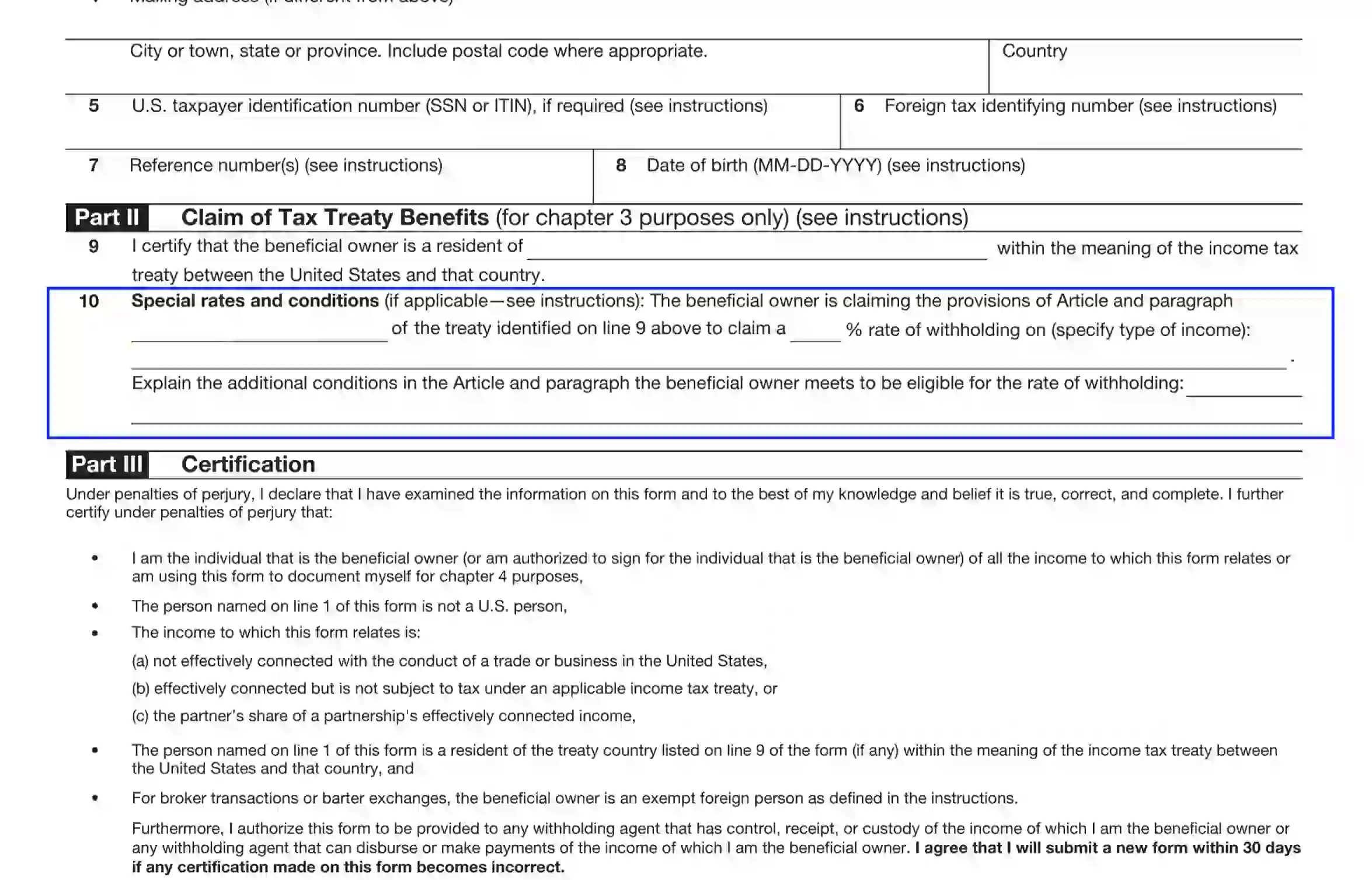

- Complete Line 10 If Appropriate

This subsection is filled out only when applicable, and the petitioner faces terms not provided by subsection nine and Certification Part 3 of the respected document. However, subsection 10 must always be accomplished by foreign researchers and students qualifying for exemption benefits.

Follow the W-8BEN instructions to complete the subsection. You are empowered to include the statute, the withholding percentage, and the type of income. Also, give a reason for having the withholding rate benefits on the line provided.

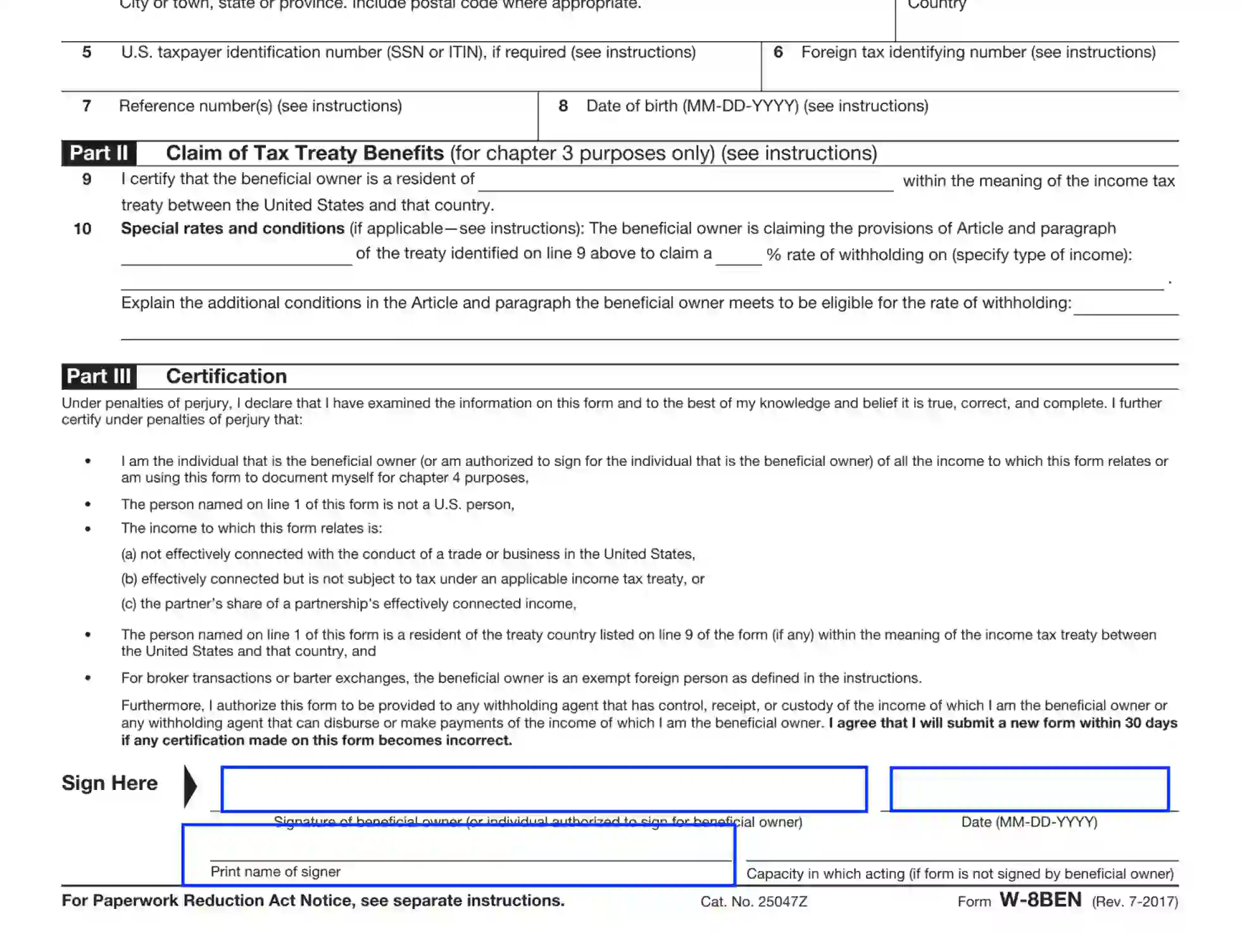

- Sign the Document in Part 3

Part 3 is dedicated to authorization and covers a list of statements that certify that the data submitted by the petitioner are authentic and correct. Read the paragraph attentively and append the signature at the bottom of the W-8BEN paper. Also, place the current date and print your name.

You are allowed to use an electronic signature and render info that the document is acknowledged electronically.

In the event the beneficial owner designates an agent to sign the paper on their behalf, they need to provide a valid Power of Attorney and submit the agent’s name and signature.