Any time you need to fill out massachusetts non resident income tax, you don't have to install any kind of programs - just use our online PDF editor. To keep our tool on the cutting edge of efficiency, we work to implement user-driven capabilities and enhancements regularly. We're always thankful for any feedback - join us in reshaping PDF editing. It just takes a few simple steps:

Step 1: Click the "Get Form" button above on this webpage to access our PDF editor.

Step 2: The editor will let you customize your PDF in various ways. Transform it by writing customized text, adjust what's originally in the PDF, and put in a signature - all within the reach of a few clicks!

It's straightforward to finish the document with this practical guide! This is what you should do:

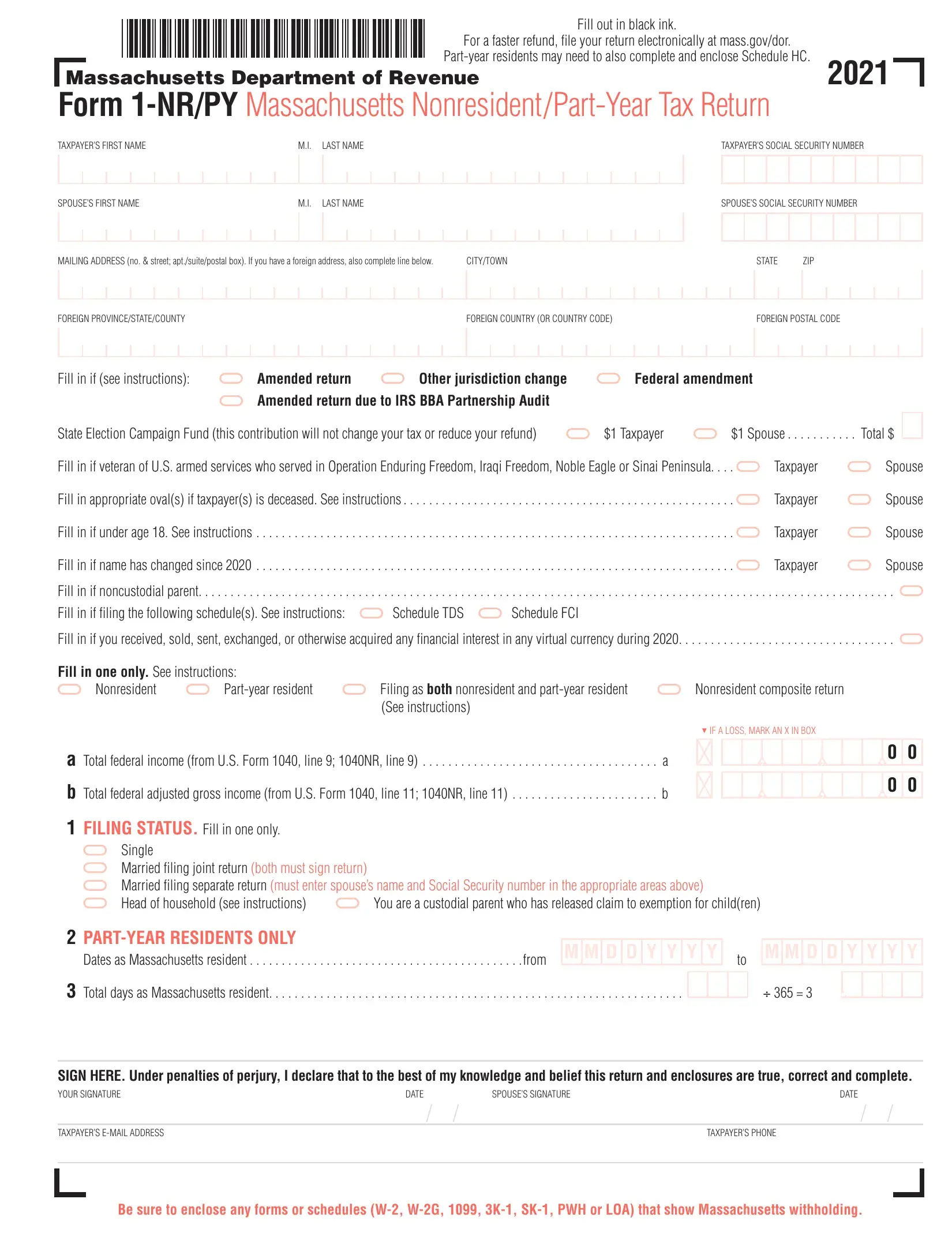

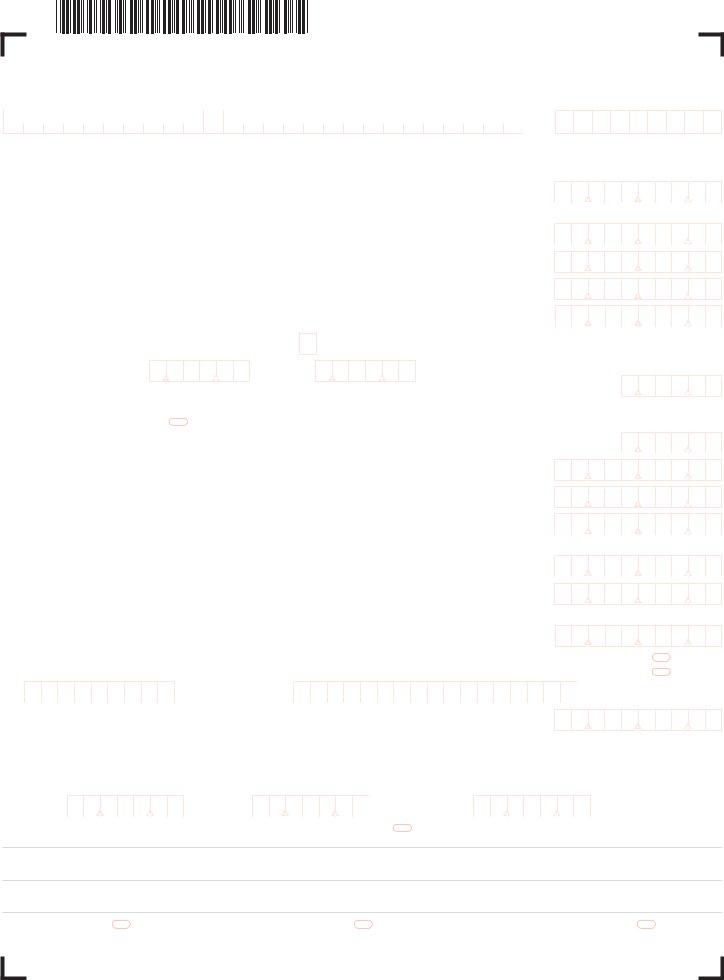

1. To start off, while filling out the massachusetts non resident income tax, start with the page containing following blank fields:

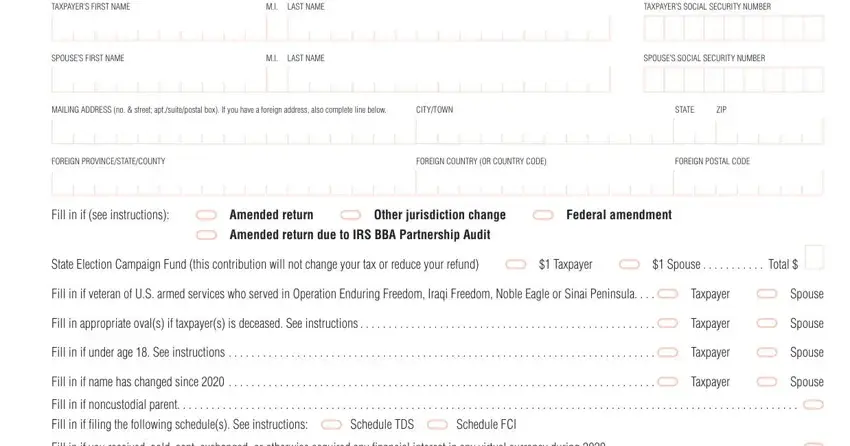

2. Once the previous selection of blank fields is done, go on to enter the relevant information in these - Fill in one only See instructions, Nonresident, Partyear resident, Filing as both nonresident and, Nonresident composite return, See instructions, a Total federal income from US, b Total federal adjusted gross, IF A LOSS MARK AN X IN BOX, FILING STATUS Fill in one only, Single Married filing joint return, You are a custodial parent who has, PARTYEAR RESIDENTS ONLY, Dates as Massachusetts resident , and M M D D Y Y Y Y.

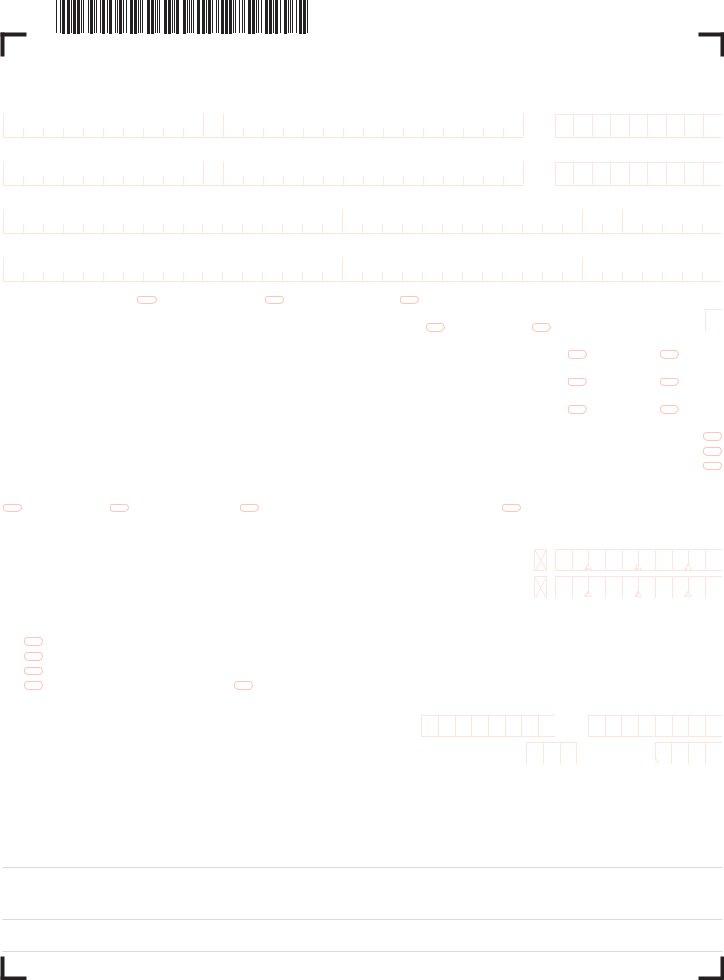

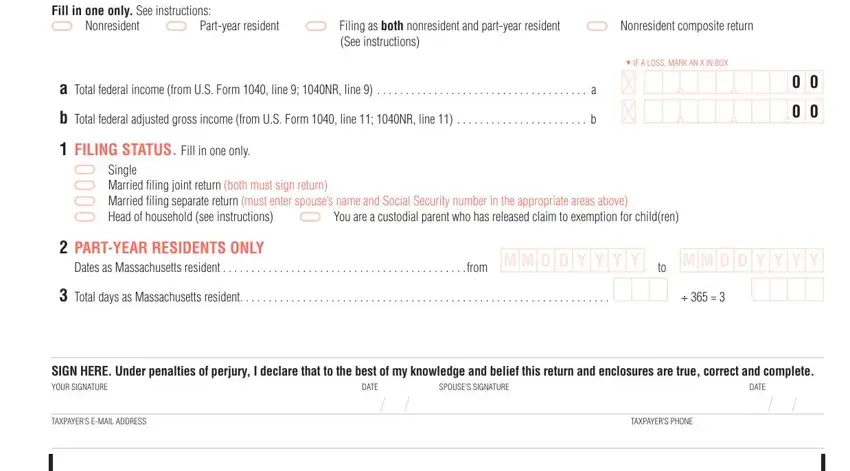

3. Through this step, review TAXPAYERS FIRST NAME, LAST NAME, TAXPAYERS SOCIAL SECURITY NUMBER, EXEMPTIONS, a Personal exemptions If single or, jointly enter , b Number of dependents do not, b, c Age or over before , d Blindness, You, You, Spouse , c, and Spouse . Each of these are required to be completed with greatest accuracy.

It's easy to make a mistake while filling in the TAXPAYERS FIRST NAME, consequently ensure that you go through it again prior to deciding to submit it.

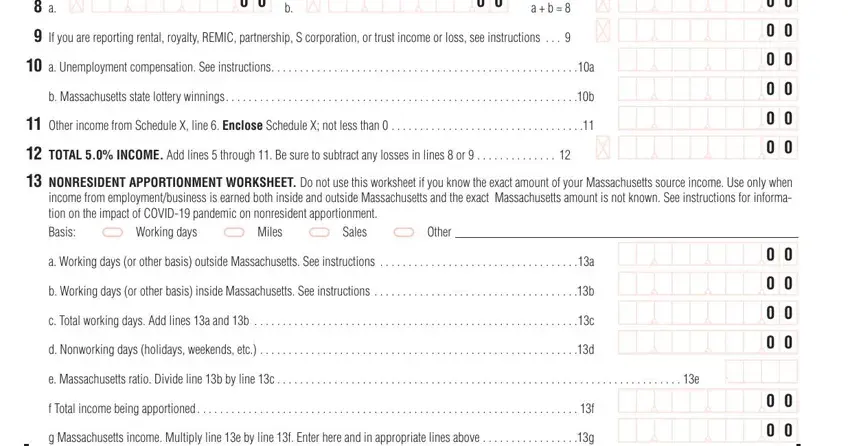

4. This next section requires some additional information. Ensure you complete all the necessary fields - a b , If you are reporting rental, a Unemployment compensation See, b Massachusetts state lottery, Other income from Schedule X line, TOTAL INCOME Add lines through , NONRESIDENT APPORTIONMENT, Working days, Miles, Sales, Other, a Working days or other basis, b Working days or other basis, c Total working days Add lines a, and d Nonworking days holidays - to proceed further in your process!

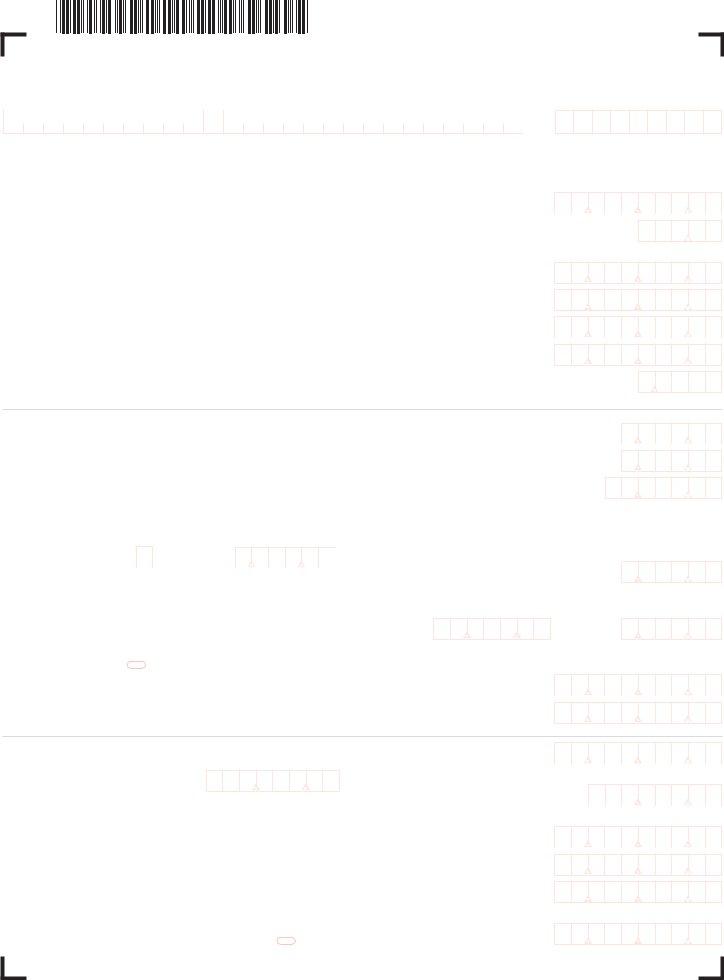

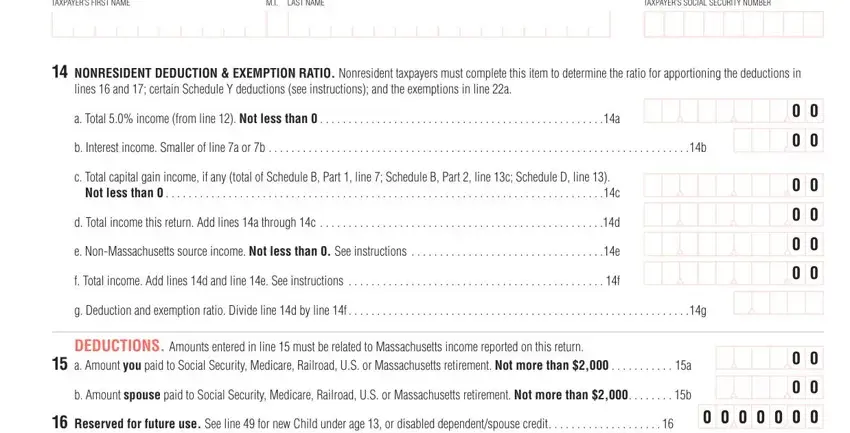

5. Since you come near to the finalization of this form, you'll find several more things to complete. Particularly, TAXPAYERS FIRST NAME, LAST NAME, TAXPAYERS SOCIAL SECURITY NUMBER, NONRESIDENT DEDUCTION EXEMPTION, lines and certain Schedule Y, a Total income from line Not, b Interest income Smaller of line, c Total capital gain income if any, Not less than , d Total income this return Add, e NonMassachusetts source income, f Total income Add lines d and, g Deduction and exemption ratio, DEDUCTIONS Amounts entered in line, and a Amount you paid to Social should be done.

Step 3: Once you have reviewed the details in the file's blank fields, simply click "Done" to complete your form. Go for a 7-day free trial plan with us and obtain immediate access to massachusetts non resident income tax - downloadable, emailable, and editable from your FormsPal cabinet. FormsPal is focused on the confidentiality of all our users; we ensure that all personal data used in our tool is secure.