With the help of the online tool for PDF editing by FormsPal, you are able to complete or change 1120 Schedule D Form here. FormsPal is focused on giving you the perfect experience with our editor by consistently presenting new capabilities and enhancements. With these updates, working with our editor becomes easier than ever! With a few basic steps, you'll be able to begin your PDF journey:

Step 1: First, open the tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: This tool provides you with the capability to work with most PDF forms in a variety of ways. Modify it with personalized text, correct existing content, and place in a signature - all when you need it!

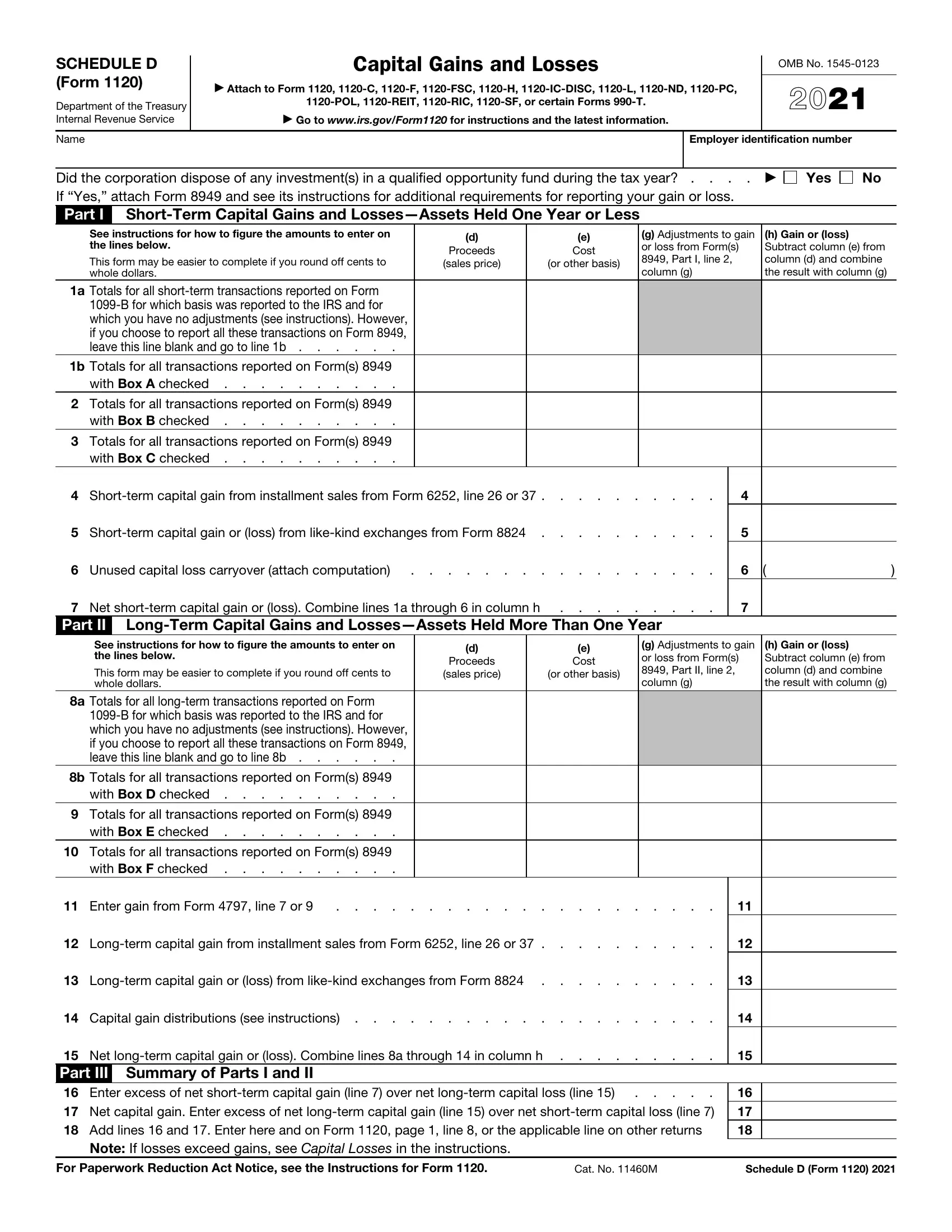

With regards to the blank fields of this particular document, here is what you need to do:

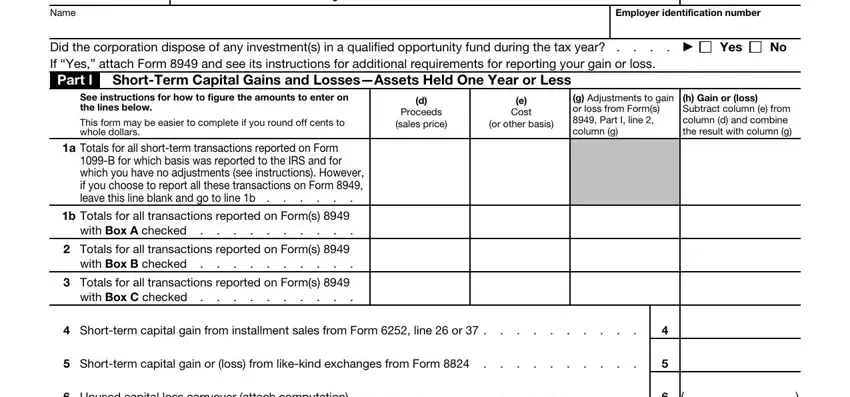

1. To start off, when filling in the 1120 Schedule D Form, start out with the section that has the next blanks:

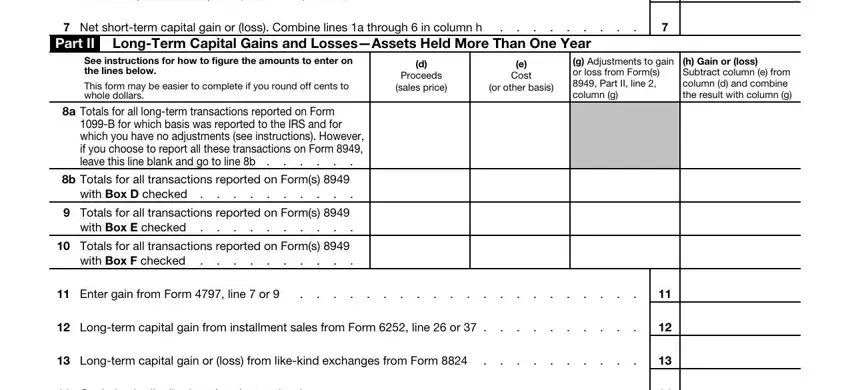

2. Just after filling out the previous step, go on to the subsequent step and complete the necessary particulars in all these blanks - Unused capital loss carryover, Net shortterm capital gain or, LongTerm Capital Gains and, Part II, See instructions for how to figure, This form may be easier to, Proceeds sales price, Cost, or other basis, g Adjustments to gain or loss from, h Gain or loss Subtract column e, a Totals for all longterm, Totals for all transactions, Totals for all transactions, and Totals for all transactions.

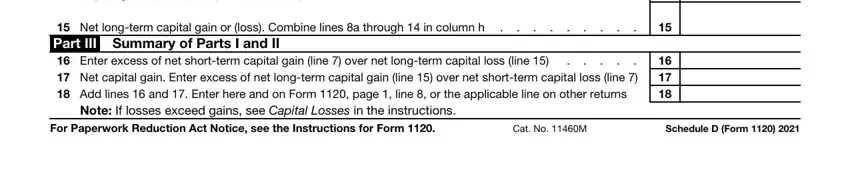

3. This third step is usually hassle-free - fill out all of the fields in Capital gain distributions see, Net longterm capital gain or loss, Net capital gain Enter excess of, Add lines and Enter here and on, Note If losses exceed gains see, For Paperwork Reduction Act Notice, Cat No M, and Schedule D Form to conclude this part.

People generally make mistakes while filling in Net longterm capital gain or loss in this section. You need to revise what you enter right here.

Step 3: When you have reviewed the information you given, click on "Done" to complete your form at FormsPal. Sign up with us today and instantly gain access to 1120 Schedule D Form, all set for downloading. Each and every modification made is handily saved , so that you can modify the pdf at a later point when necessary. Here at FormsPal, we endeavor to make sure all your details are maintained secure.