With the online editor for PDFs by FormsPal, you are able to complete or change 2015 Birt Ez Form here and now. The editor is consistently upgraded by us, receiving cool functions and growing to be more convenient. Starting is simple! What you need to do is follow the next easy steps down below:

Step 1: First, access the editor by clicking the "Get Form Button" above on this webpage.

Step 2: Once you access the PDF editor, you'll notice the form made ready to be filled in. Apart from filling out different blanks, you may as well perform other sorts of actions with the PDF, including putting on custom text, editing the original textual content, adding images, signing the form, and much more.

Pay close attention while filling out this form. Ensure each field is done accurately.

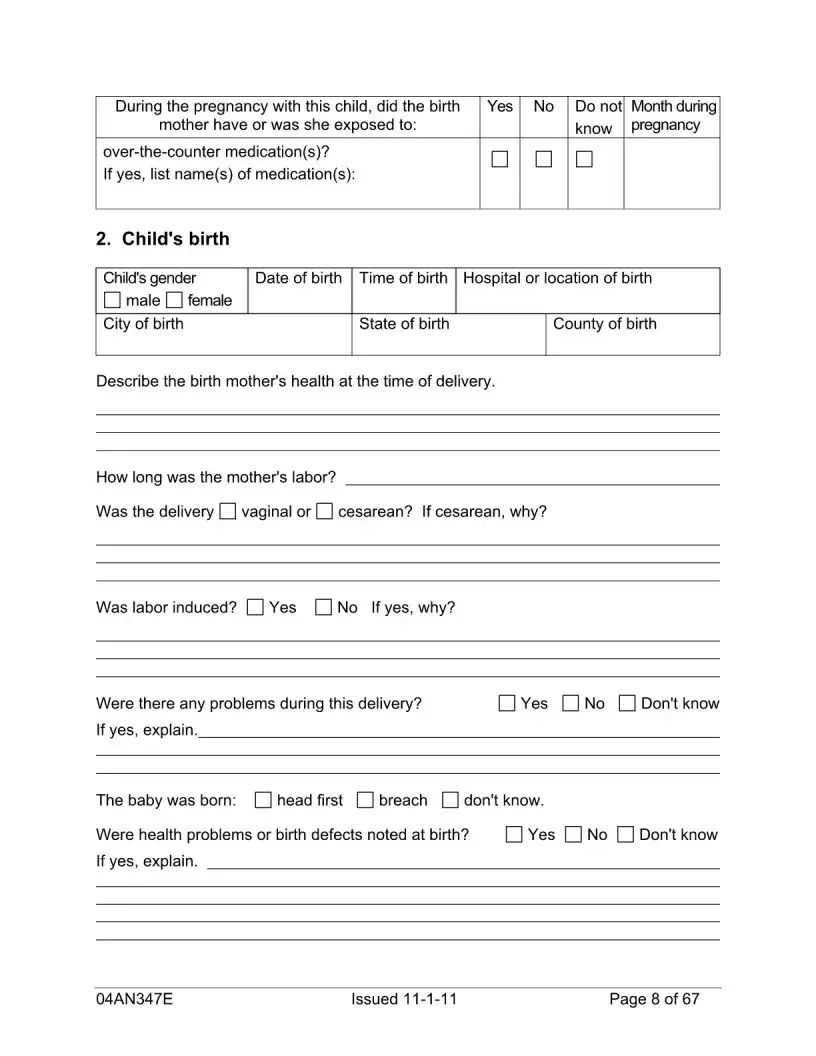

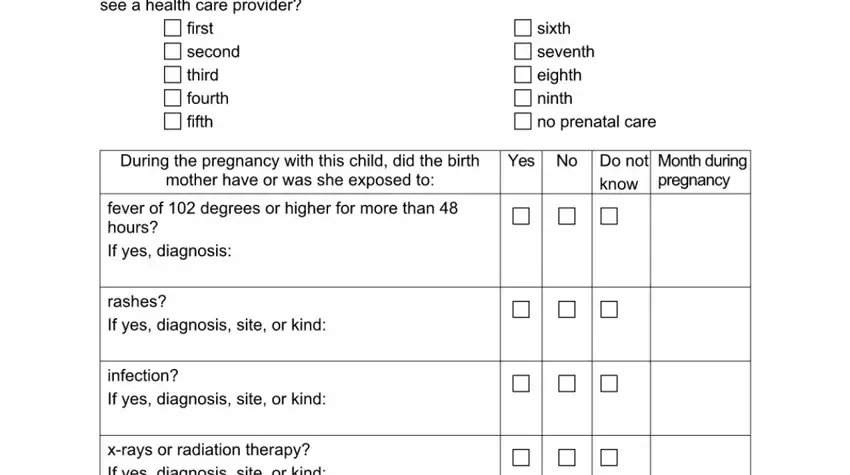

1. Start completing your 2015 Birt Ez Form with a selection of necessary blank fields. Consider all the information you need and be sure not a single thing neglected!

2. The next part would be to fill out these particular fields: .

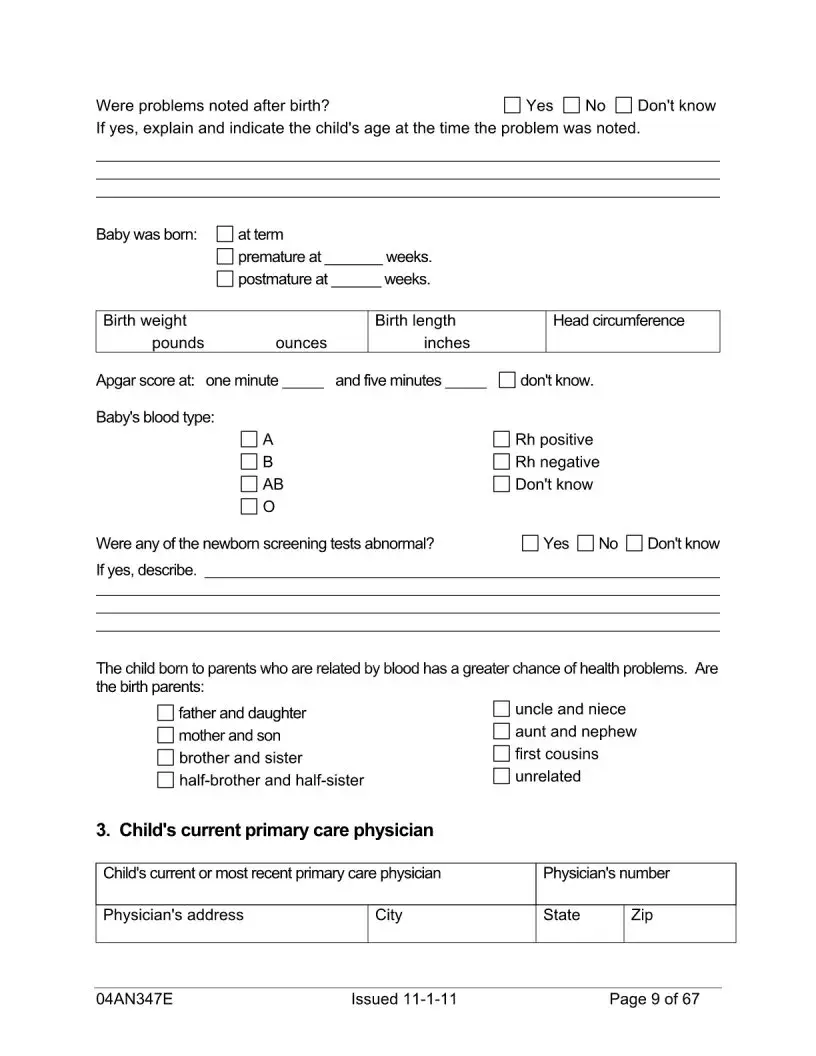

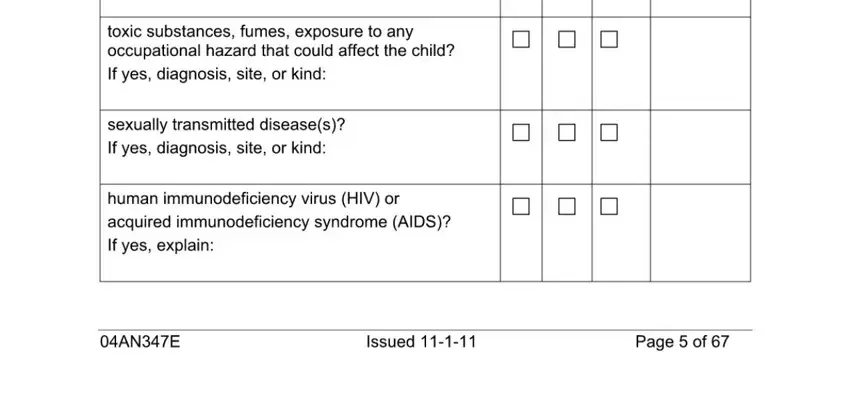

3. The next step is normally hassle-free - complete all the blanks in to finish this segment.

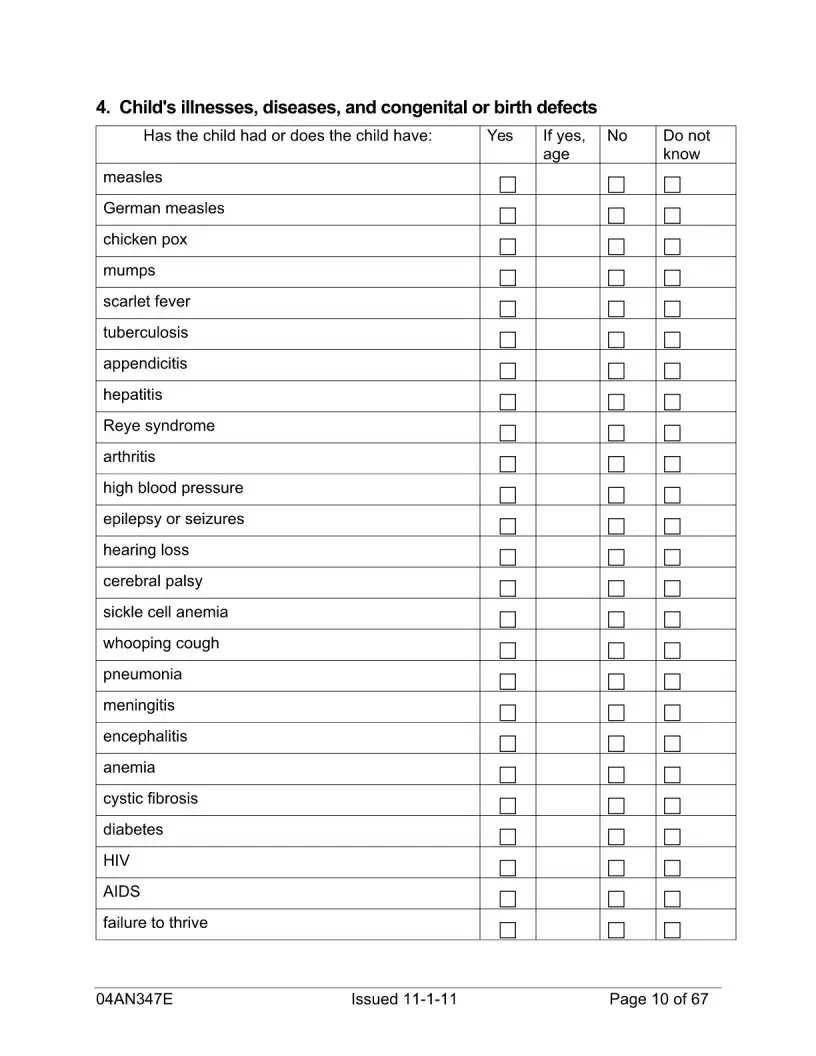

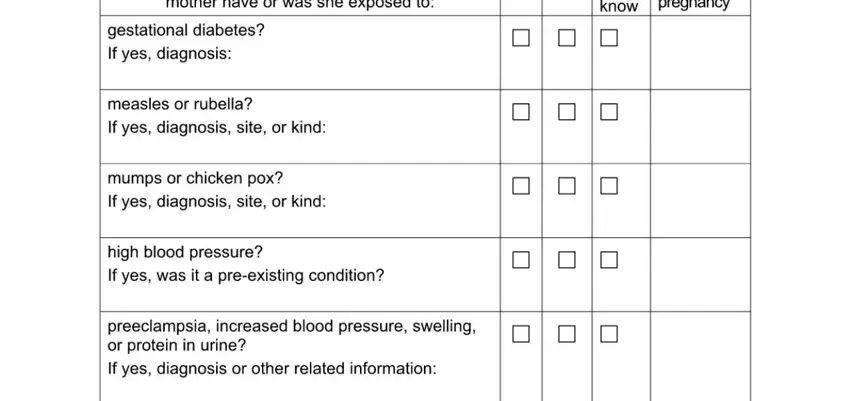

4. This next section requires some additional information. Ensure you complete all the necessary fields - - to proceed further in your process!

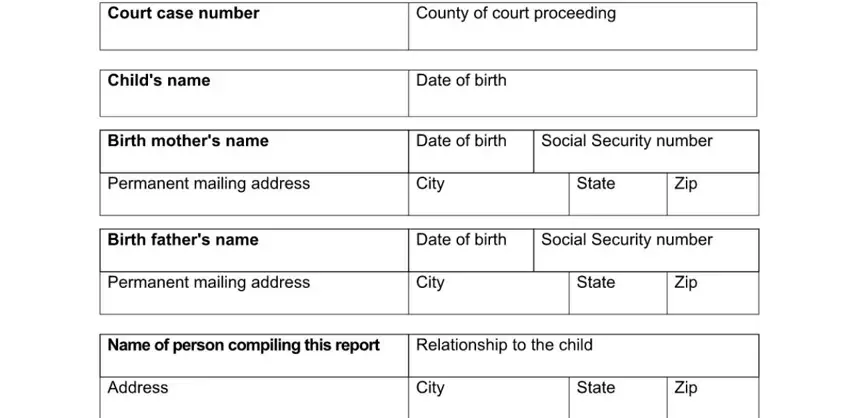

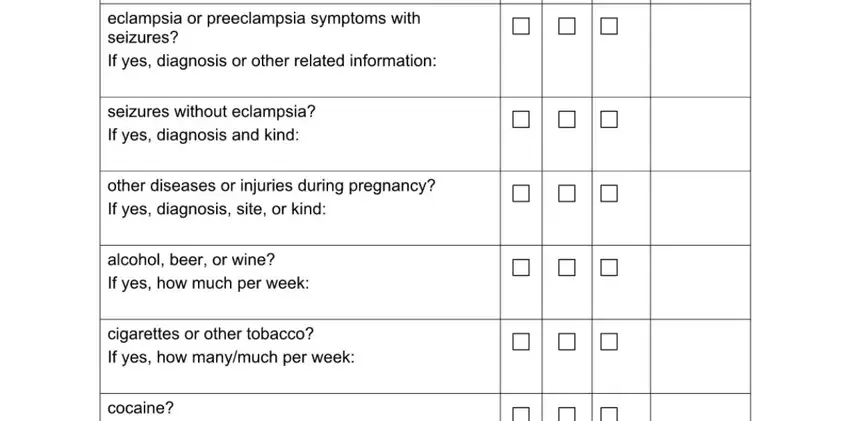

5. Since you near the finalization of this document, there are actually a couple extra requirements that must be satisfied. Mainly, must be filled out.

As to this field and next field, be certain you review things here. These are thought to be the most important fields in the file.

Step 3: Once you've glanced through the information in the fields, click on "Done" to conclude your FormsPal process. Get hold of your 2015 Birt Ez Form as soon as you subscribe to a 7-day free trial. Conveniently view the pdf form in your FormsPal account page, along with any modifications and adjustments being conveniently saved! When using FormsPal, you'll be able to fill out forms without worrying about database leaks or data entries being distributed. Our protected platform ensures that your personal details are kept safely.