When you would like to fill out irs 990 schedule d, you don't have to install any sort of applications - just give a try to our PDF tool. Our professional team is relentlessly working to expand the tool and enable it to be even better for people with its cutting-edge functions. Capitalize on present-day progressive prospects, and find a heap of emerging experiences! It merely requires a few easy steps:

Step 1: Access the PDF doc in our editor by hitting the "Get Form Button" in the top part of this page.

Step 2: The tool will let you customize PDF documents in many different ways. Improve it by writing personalized text, adjust existing content, and include a signature - all readily available!

It will be an easy task to complete the document with our helpful tutorial! Here is what you have to do:

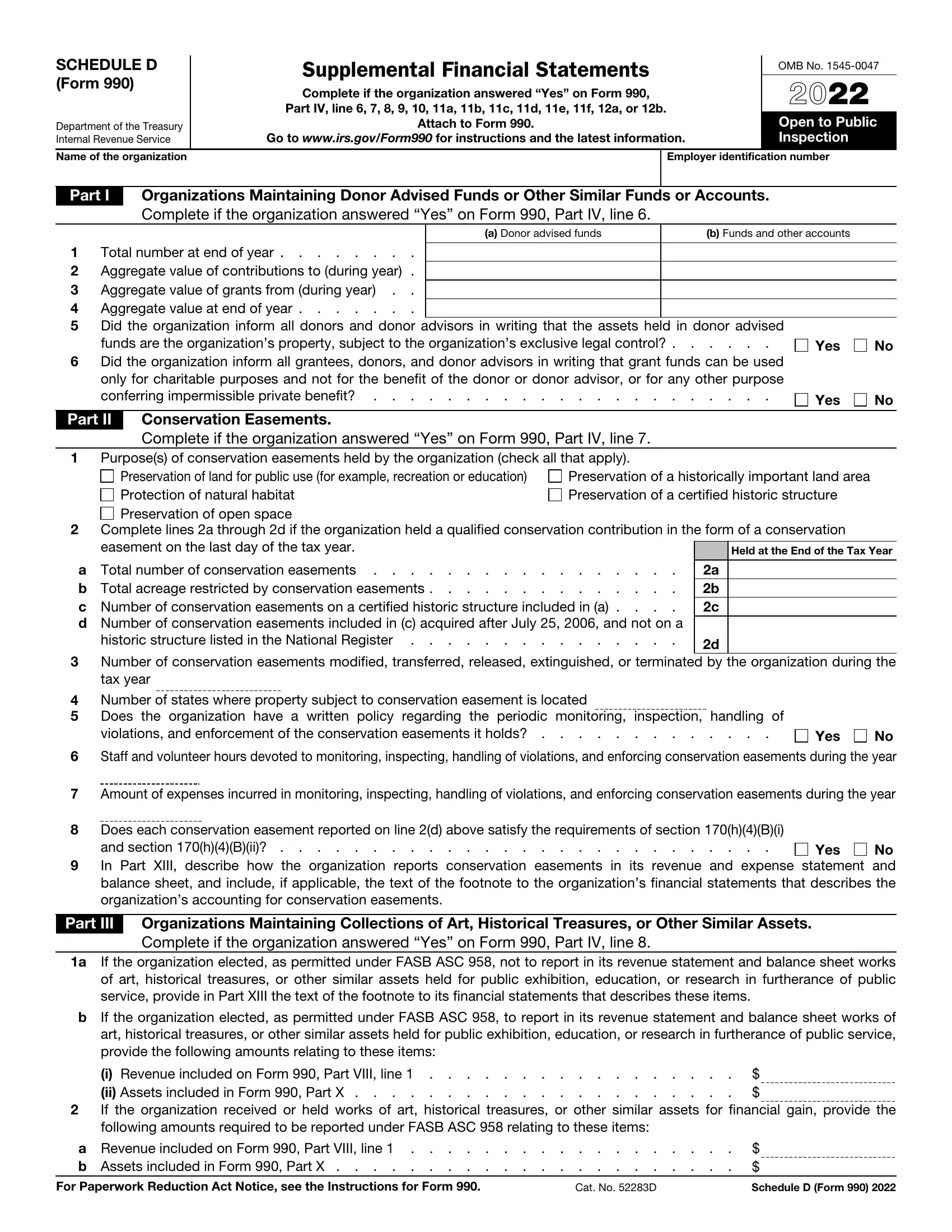

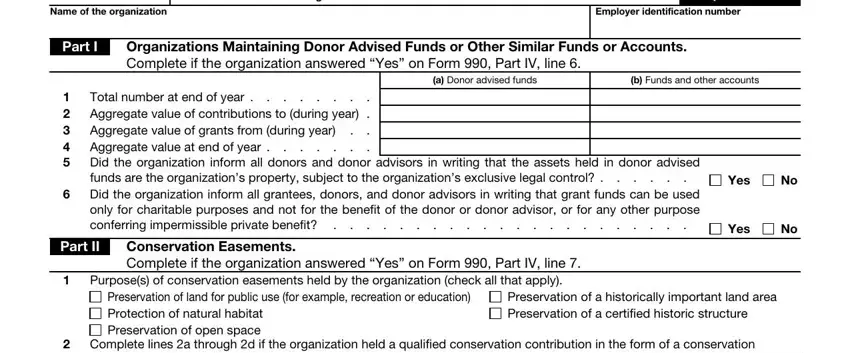

1. When submitting the irs 990 schedule d, be certain to incorporate all of the needed blanks in their corresponding area. This will help expedite the process, enabling your details to be processed efficiently and properly.

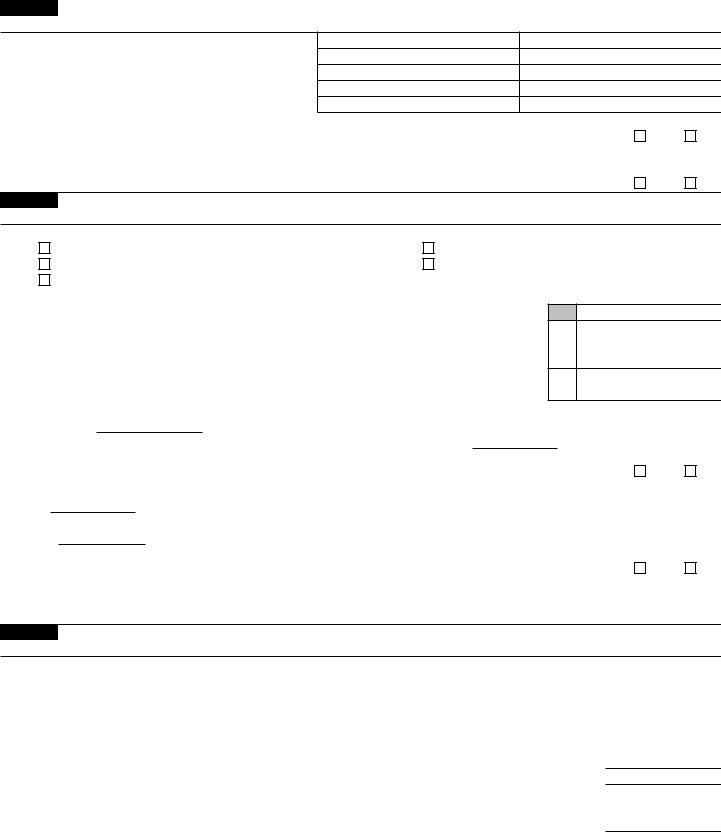

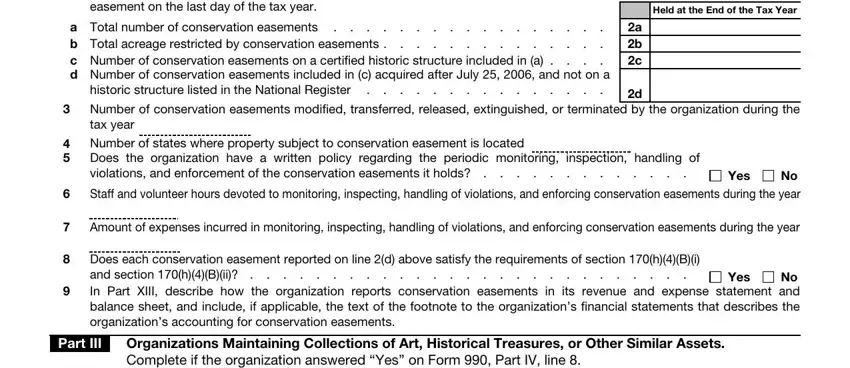

2. Once your current task is complete, take the next step – fill out all of these fields - Complete lines a through d if the, Held at the End of the Tax Year, a Total number of conservation, historic structure listed in the, a b c, Number of conservation easements, No Staff and volunteer hours, Yes, Amount of expenses incurred in, Does each conservation easement, Yes, Part III, and Organizations Maintaining with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

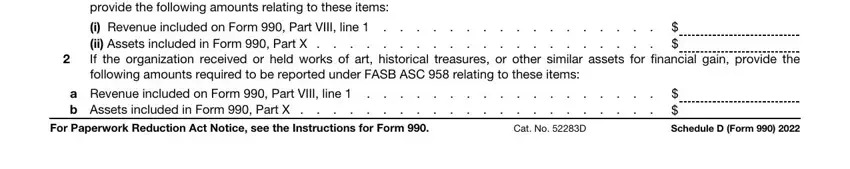

3. Completing If the organization elected as, i Revenue included on Form Part, a Revenue included on Form Part, For Paperwork Reduction Act Notice, Cat No D, and Schedule D Form is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

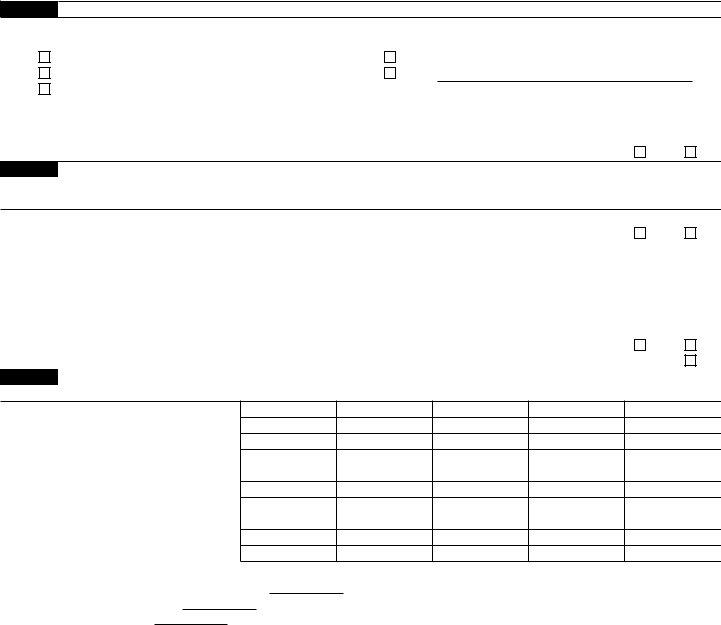

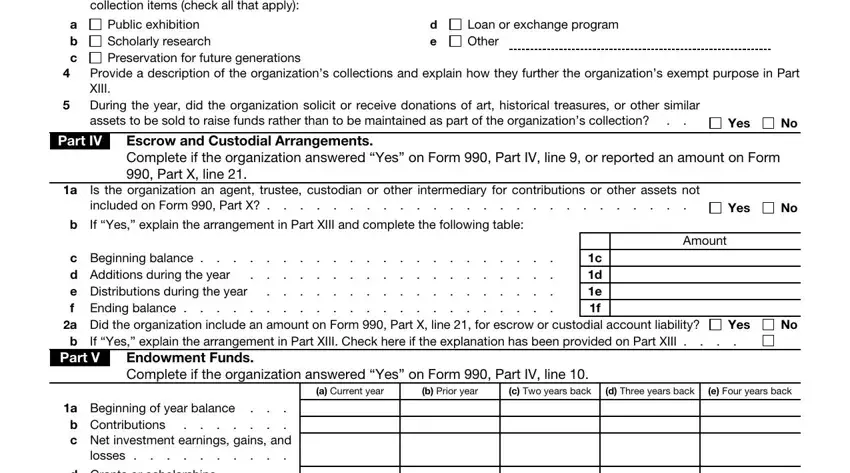

4. Filling in Part III , Using the organizations, a b c , Public exhibition Scholarly, Loan or exchange program Other, Provide a description of the, Yes, Part IV, Escrow and Custodial Arrangements, Is the organization an agent, Yes, b If Yes explain the arrangement, Amount, c Beginning balance d Additions, and Ending balance is crucial in this form section - be sure to don't rush and be attentive with each blank!

Regarding a b c and Provide a description of the, ensure you get them right here. These two are viewed as the most significant fields in this page.

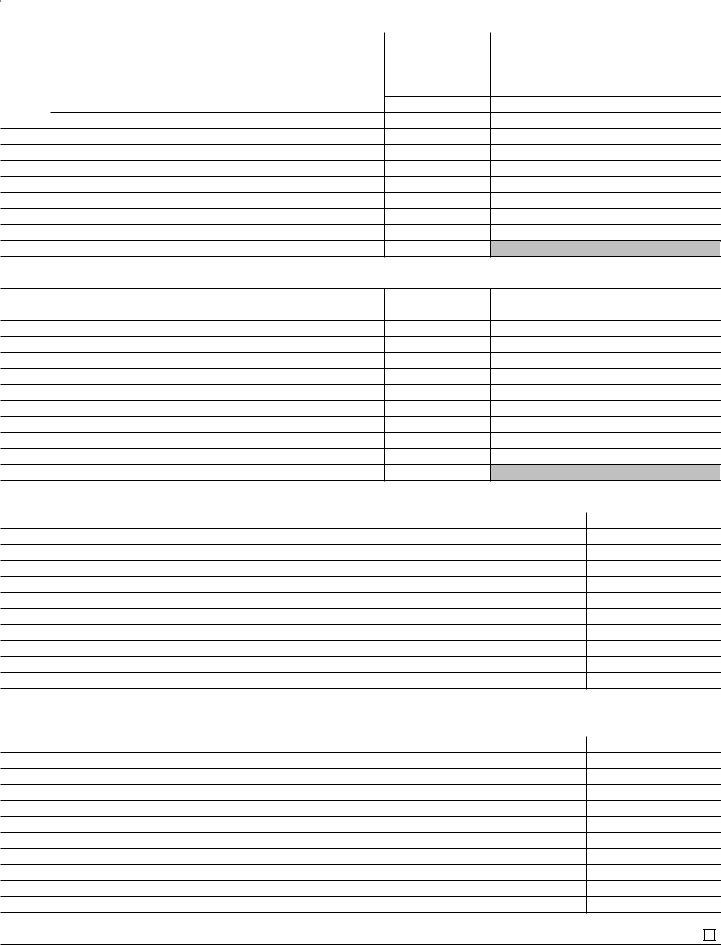

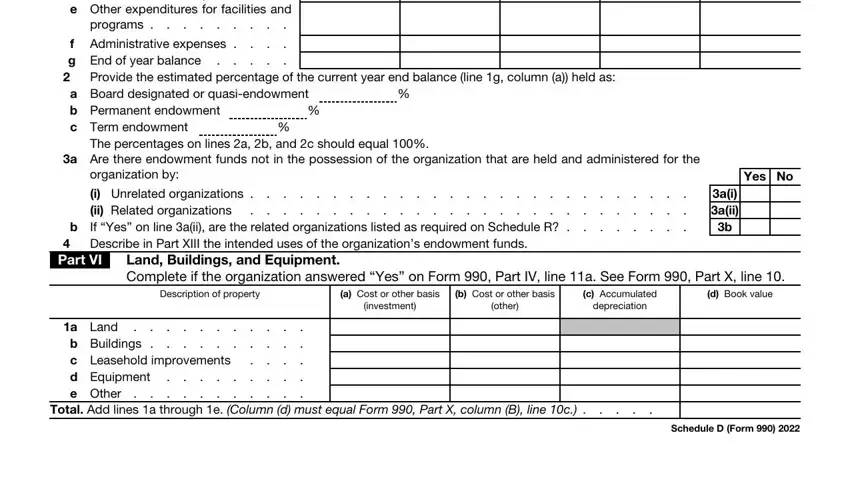

5. This form has to be concluded by filling in this area. Here you will find a comprehensive set of fields that require correct information for your document usage to be accomplished: d Grants or scholarships e, Other expenditures for facilities, f Administrative expenses g End, Provide the estimated percentage, a Board designated or, The percentages on lines a b and c, Yes No, i Unrelated organizations ii, b If Yes on line aii are the, ai aii, Describe in Part XIII the intended, Part VI, Land Buildings and Equipment, Description of property, and a Cost or other basis.

Step 3: Confirm that your information is accurate and then click on "Done" to progress further. Acquire your irs 990 schedule d once you register here for a free trial. Conveniently use the pdf within your personal account page, along with any modifications and changes all saved! When you use FormsPal, you can certainly complete forms without the need to be concerned about data leaks or records being distributed. Our protected platform makes sure that your private details are kept safely.