form 14157 can be filled in online effortlessly. Just open FormsPal PDF tool to do the job in a timely fashion. Our tool is continually developing to provide the best user experience attainable, and that is due to our commitment to constant improvement and listening closely to feedback from customers. Getting underway is easy! What you need to do is take the next easy steps directly below:

Step 1: Access the PDF in our tool by pressing the "Get Form Button" in the top part of this webpage.

Step 2: This tool will give you the capability to customize the majority of PDF forms in various ways. Transform it by including customized text, adjust existing content, and place in a signature - all at your fingertips!

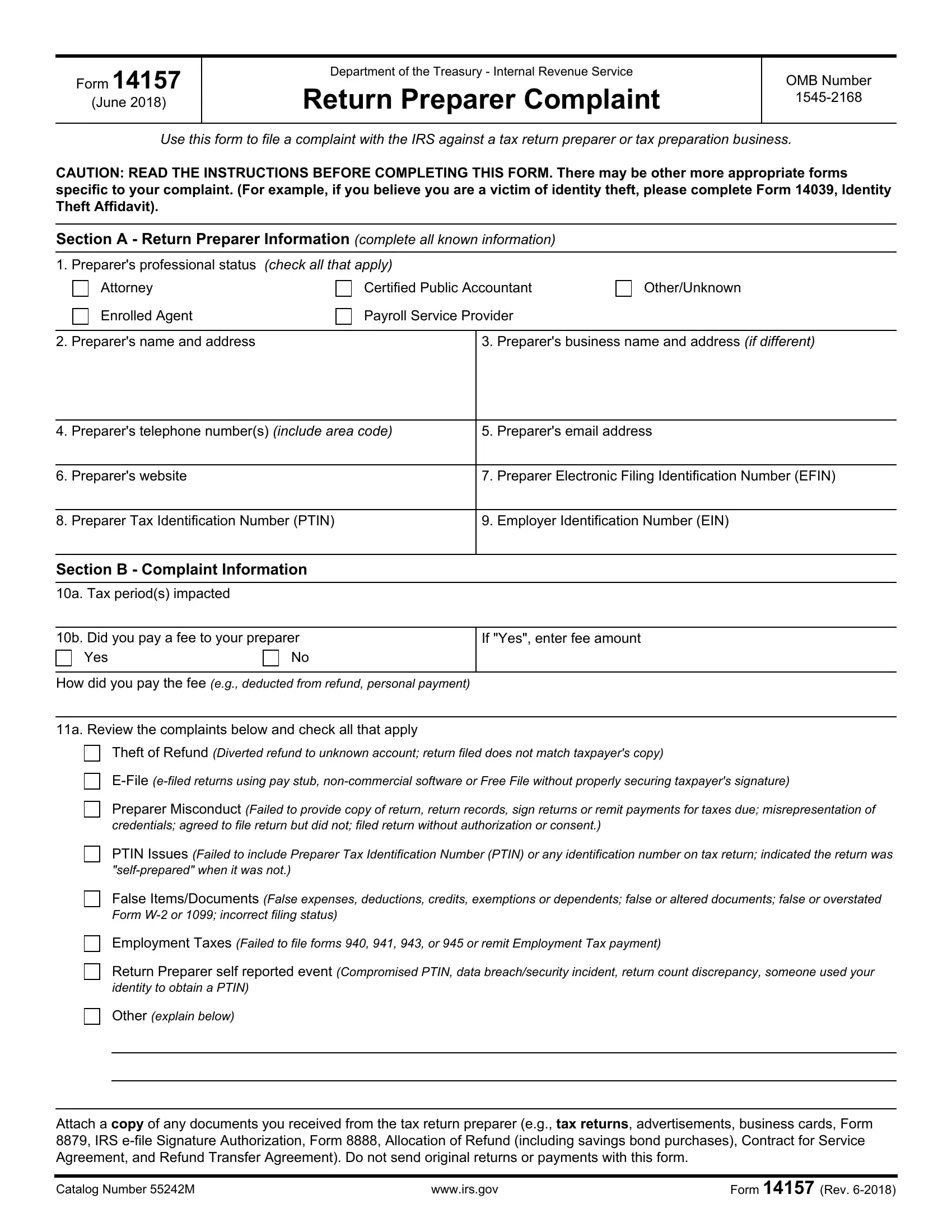

As for the blank fields of this precise form, here's what you want to do:

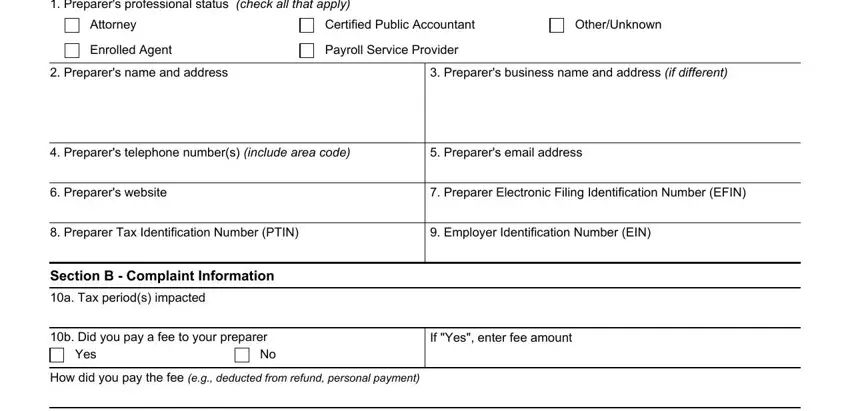

1. Complete the form 14157 with a selection of necessary blank fields. Get all the important information and make sure nothing is omitted!

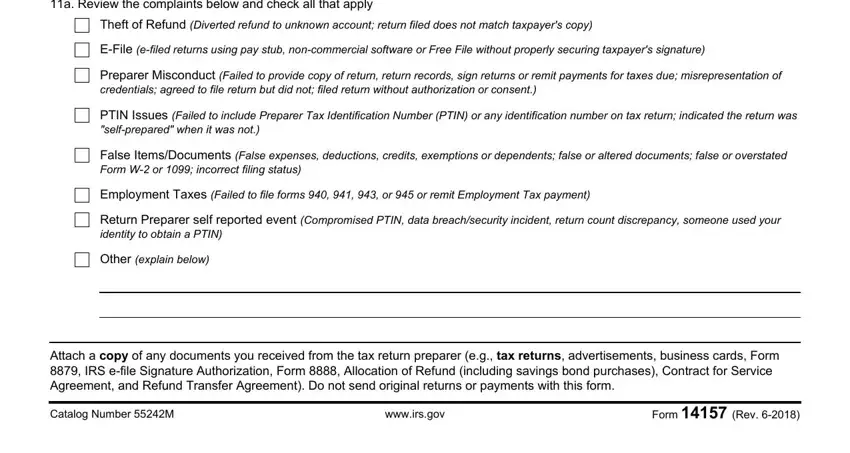

2. Immediately after the prior section is filled out, proceed to type in the relevant details in these - a Review the complaints below and, Theft of Refund Diverted refund to, EFile efiled returns using pay, Preparer Misconduct Failed to, PTIN Issues Failed to include, False ItemsDocuments False, Employment Taxes Failed to file, Return Preparer self reported, Other explain below, Attach a copy of any documents you, Catalog Number M, wwwirsgov, and Form Rev .

Always be really mindful while filling in Theft of Refund Diverted refund to and Preparer Misconduct Failed to, as this is the section in which a lot of people make errors.

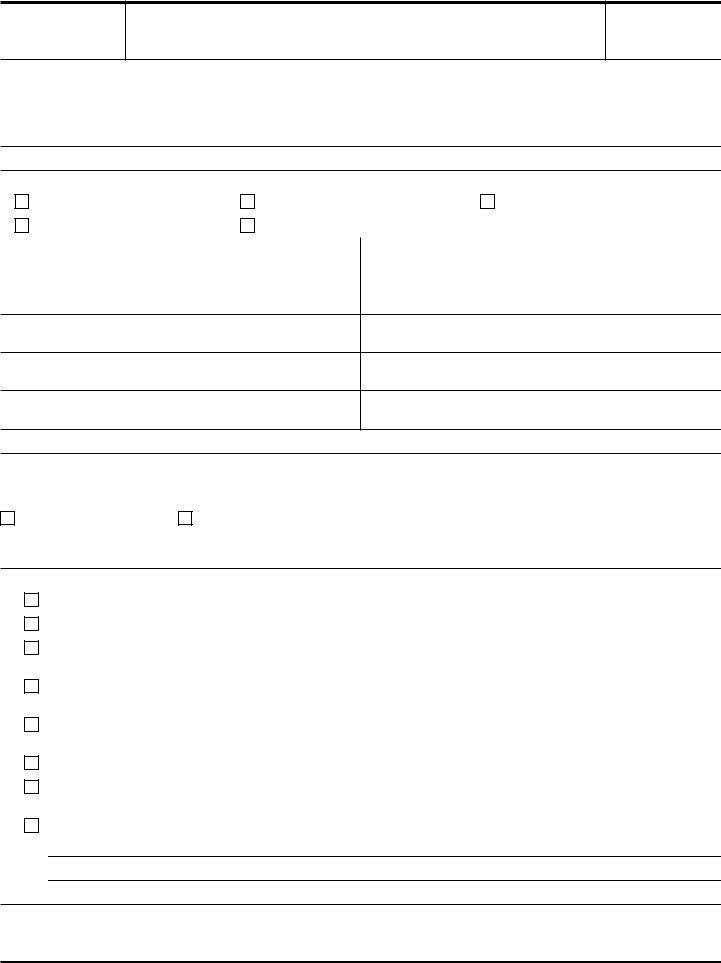

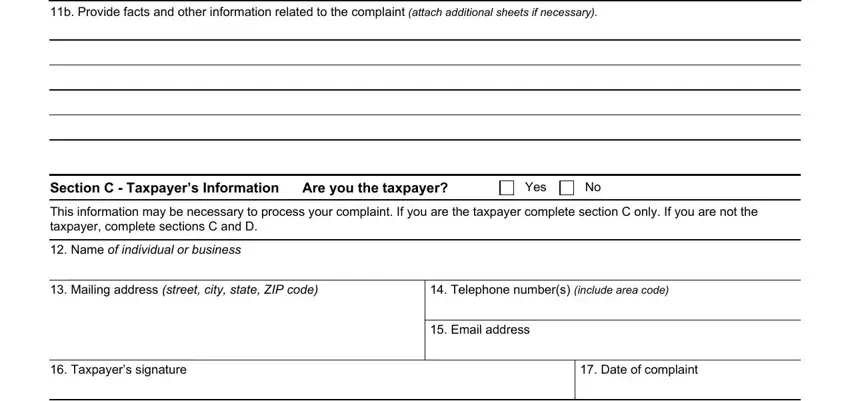

3. The following step should also be quite easy, b Provide facts and other, Section C Taxpayers Information, Yes, This information may be necessary, Name of individual or business, Mailing address street city state, Telephone numbers include area, Email address, Taxpayers signature, and Date of complaint - all of these blanks needs to be completed here.

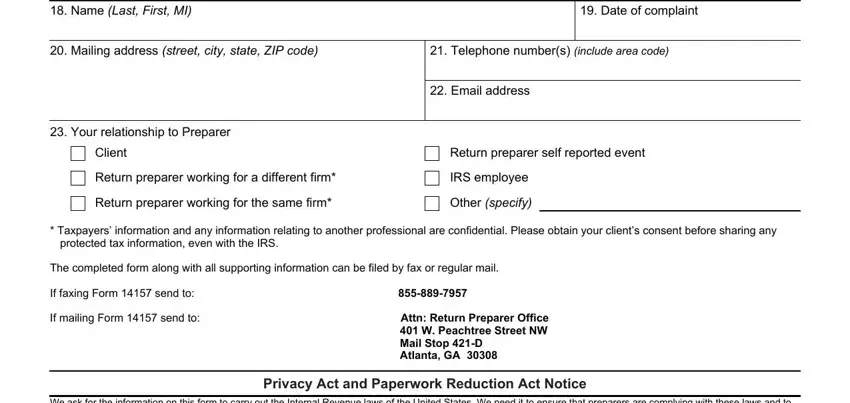

4. Now proceed to this next segment! In this case you'll have these Name Last First MI, Date of complaint, Mailing address street city state, Telephone numbers include area, Email address, Your relationship to Preparer, Client, Return preparer self reported event, Return preparer working for a, Return preparer working for the, IRS employee, Other specify, Taxpayers information and any, protected tax information even, and The completed form along with all blank fields to fill out.

Step 3: Before getting to the next stage, make sure that all form fields have been filled in properly. When you are satisfied with it, click “Done." Right after registering a7-day free trial account here, you will be able to download form 14157 or email it right away. The document will also be easily accessible from your personal account menu with your each and every modification. FormsPal is invested in the privacy of all our users; we make certain that all personal information entered into our system continues to be secure.