You are able to work with idbi 15h form online easily in our PDFinity® PDF editor. Our tool is consistently developing to present the best user experience achievable, and that's due to our commitment to continual enhancement and listening closely to feedback from users. It just takes just a few simple steps:

Step 1: Access the form inside our tool by clicking the "Get Form Button" in the top section of this page.

Step 2: The tool offers the capability to customize almost all PDF files in a range of ways. Change it by writing your own text, adjust existing content, and add a signature - all when it's needed!

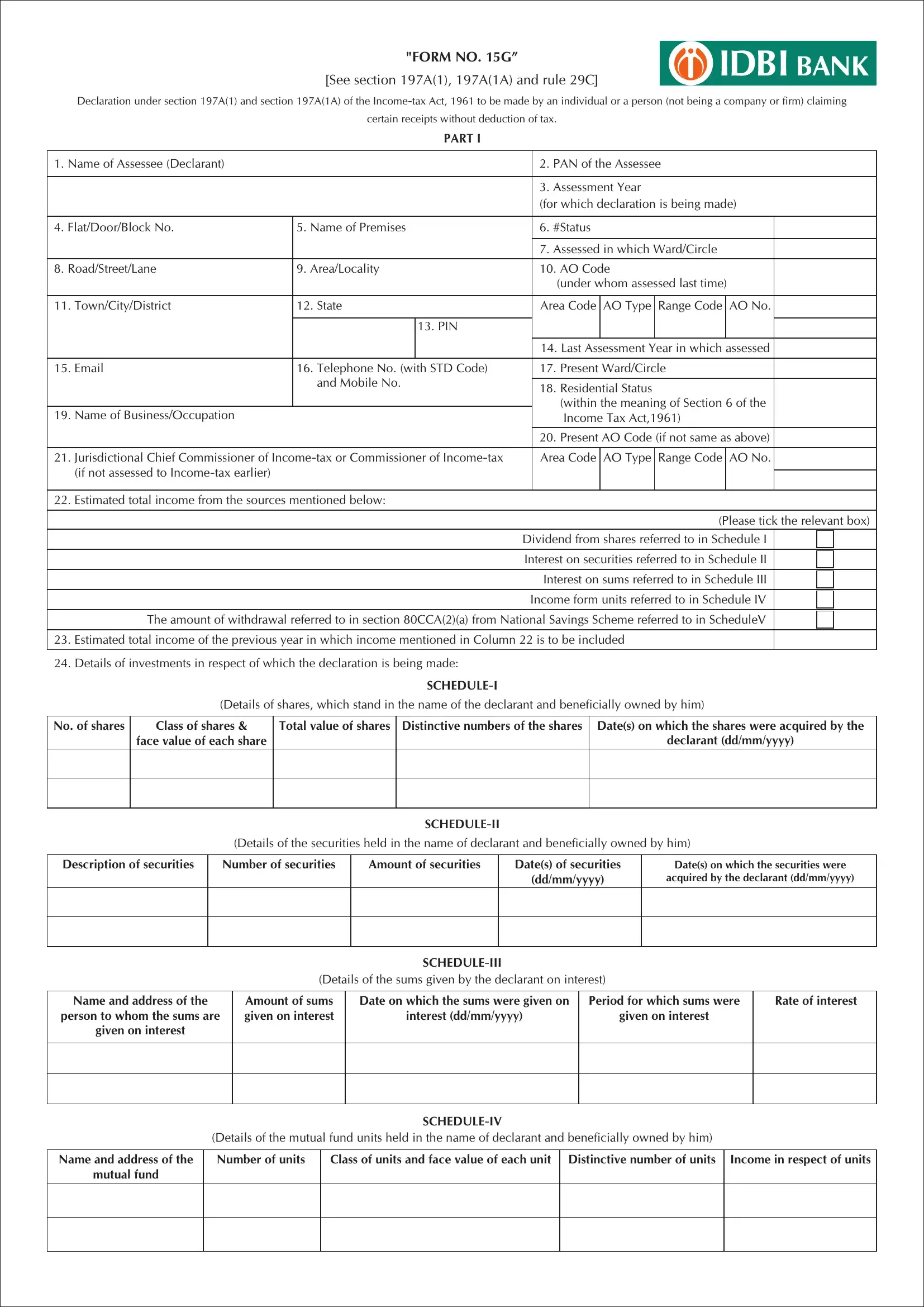

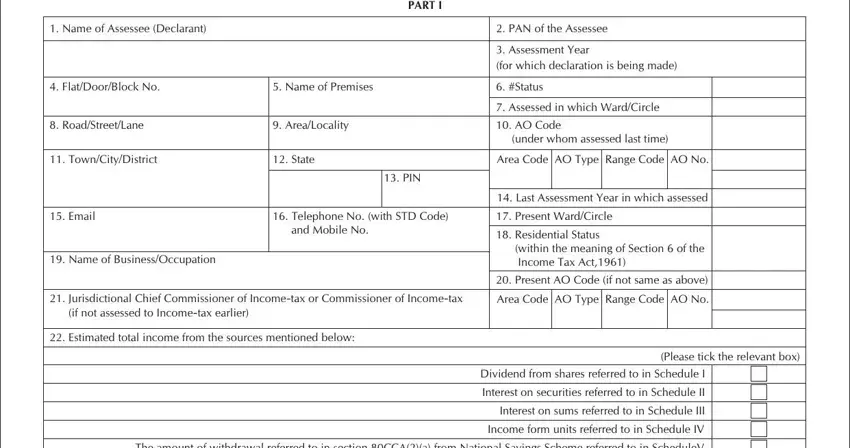

So as to fill out this form, make sure that you provide the right details in every single field:

1. It is critical to complete the idbi 15h form online accurately, therefore be mindful when filling in the segments that contain these particular fields:

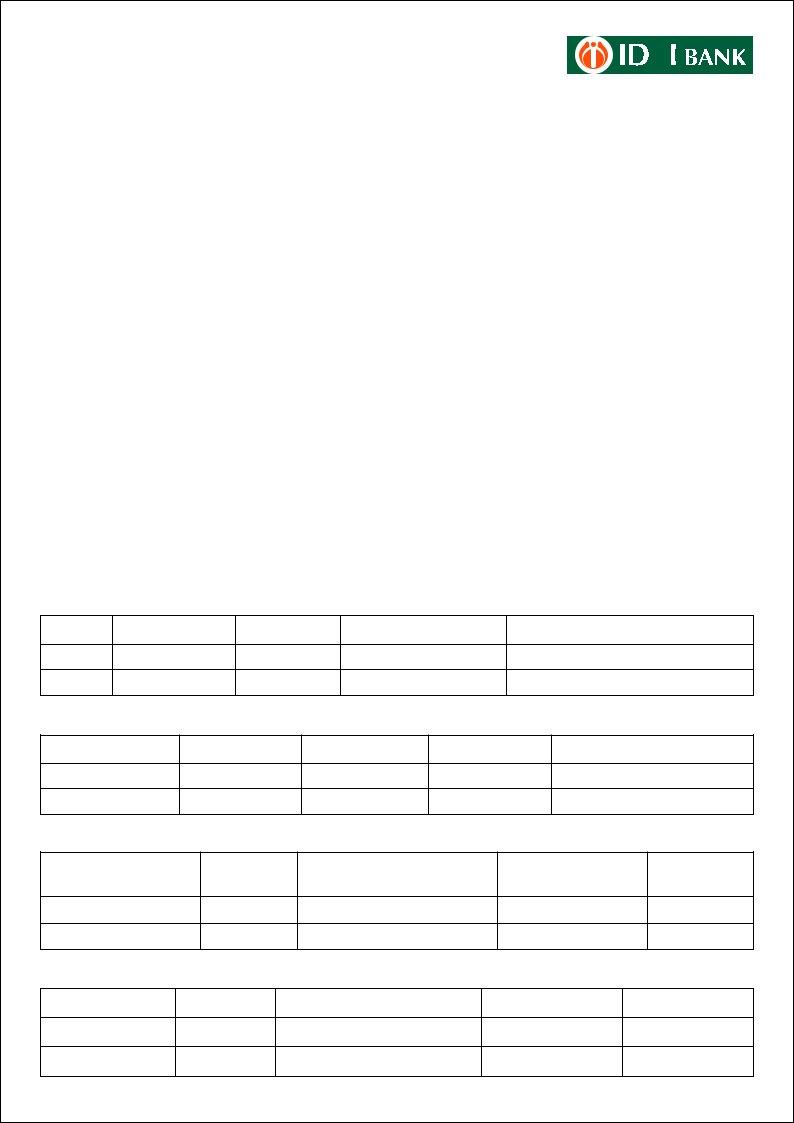

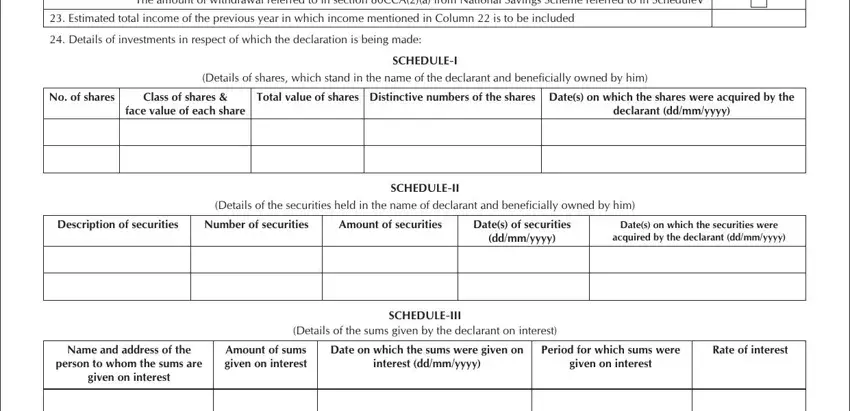

2. The subsequent stage would be to submit these blanks: Dividend from shares referred to, Estimated total income of the, Details of investments in respect, Details of shares which stand in, SCHEDULEI, No of shares, Class of shares , face value of each share, Total value of shares Distinctive, declarant ddmmyyyy, Details of the securities held in, SCHEDULEII, Description of securities, Number of securities, and Amount of securities.

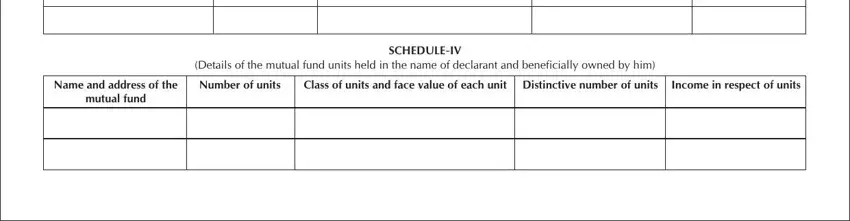

3. Completing Details of the mutual fund units, Class of units and face value of, SCHEDULEIV, Income in respect of units, Name and address of the, and mutual fund is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It is possible to get it wrong while filling out the Income in respect of units, so be sure to go through it again prior to when you finalize the form.

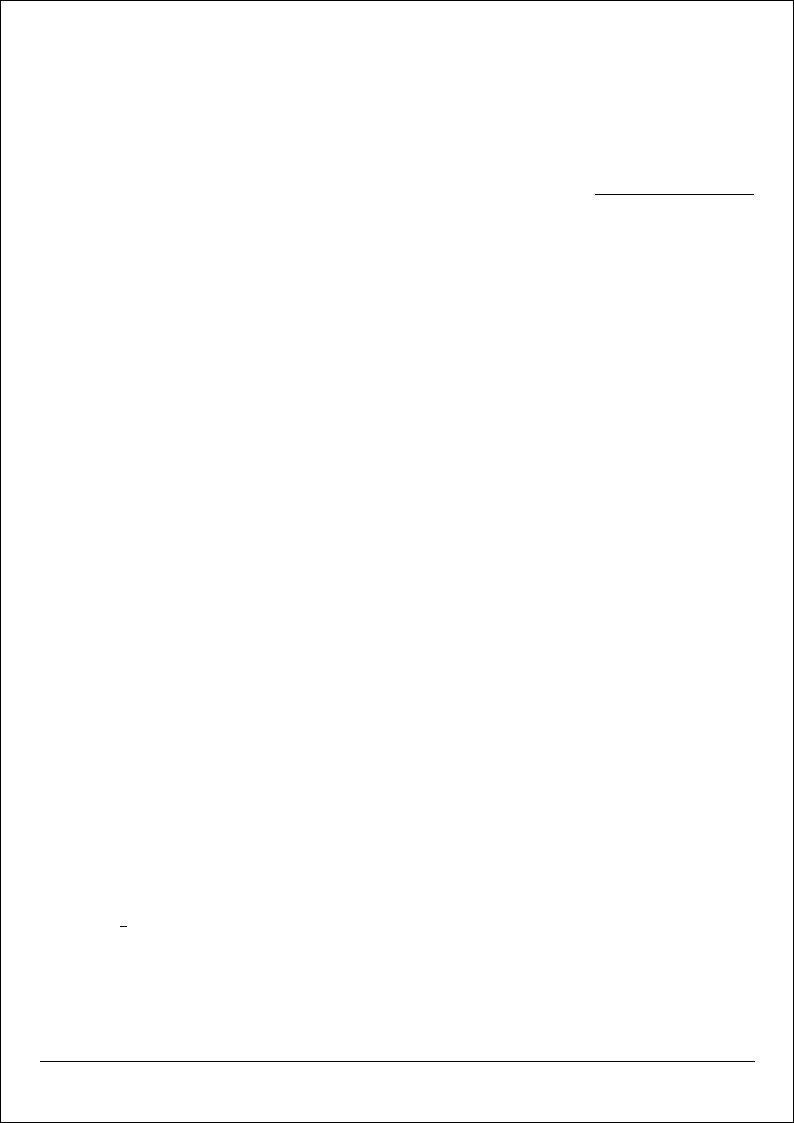

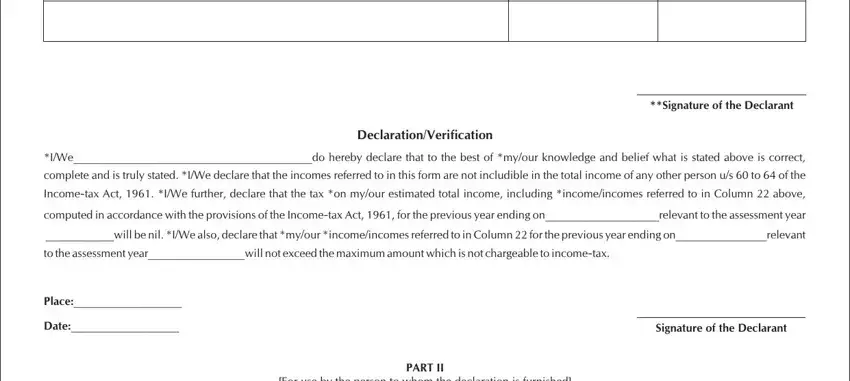

4. To move ahead, this fourth stage involves completing a handful of form blanks. Examples include DeclarationVerification, Signature of the Declarant, IWedo hereby declare that to the, Place, Date, Signature of the Declarant, For use by the person to whom the, and PART II, which are essential to carrying on with this particular process.

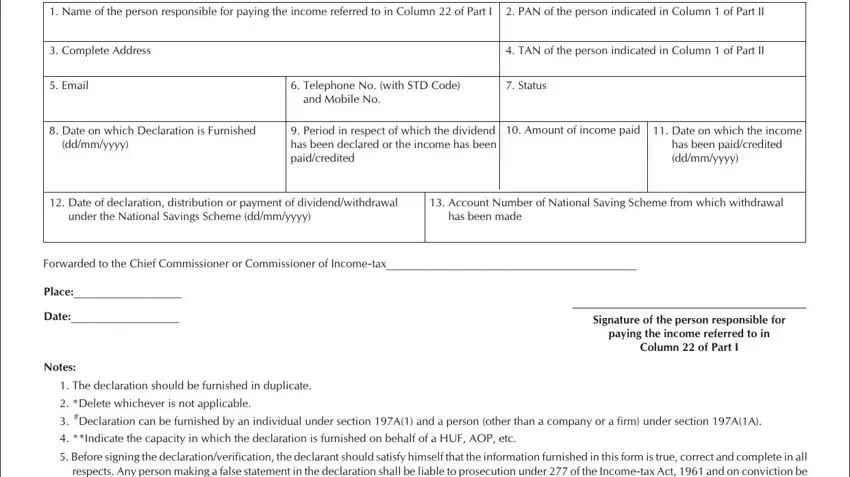

5. The pdf needs to be wrapped up with this segment. Further you can find a detailed listing of form fields that need accurate information in order for your form submission to be accomplished: Name of the person responsible, PAN of the person indicated in, Complete Address, Email, TAN of the person indicated in, Telephone No with STD Code and, Status, Date on which Declaration is, Period in respect of which the, Amount of income paid Date on, has been paidcredited ddmmyyyy, Date of declaration distribution, Account Number of National Saving, Forwarded to the Chief, and Date.

Step 3: Soon after double-checking the fields you have filled out, press "Done" and you are done and dusted! Make a 7-day free trial plan with us and get direct access to idbi 15h form online - which you may then work with as you wish from your personal cabinet. When you use FormsPal, you'll be able to fill out documents without being concerned about personal information breaches or entries being shared. Our secure platform helps to ensure that your private information is maintained safely.