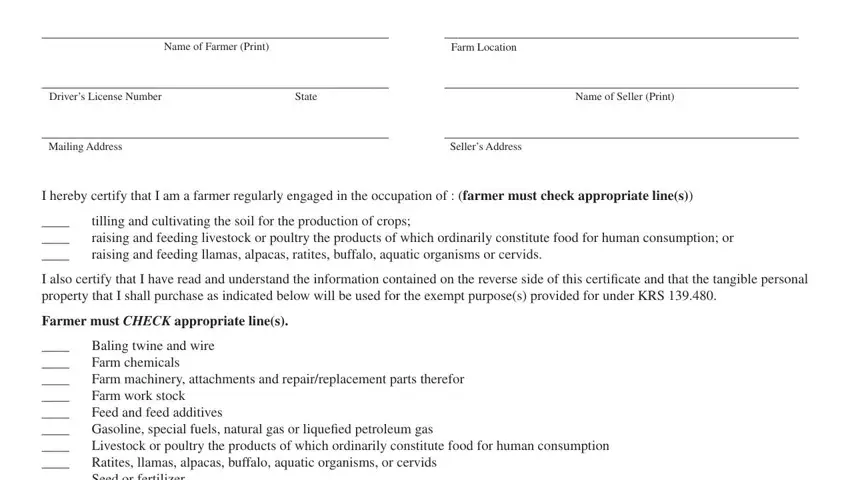

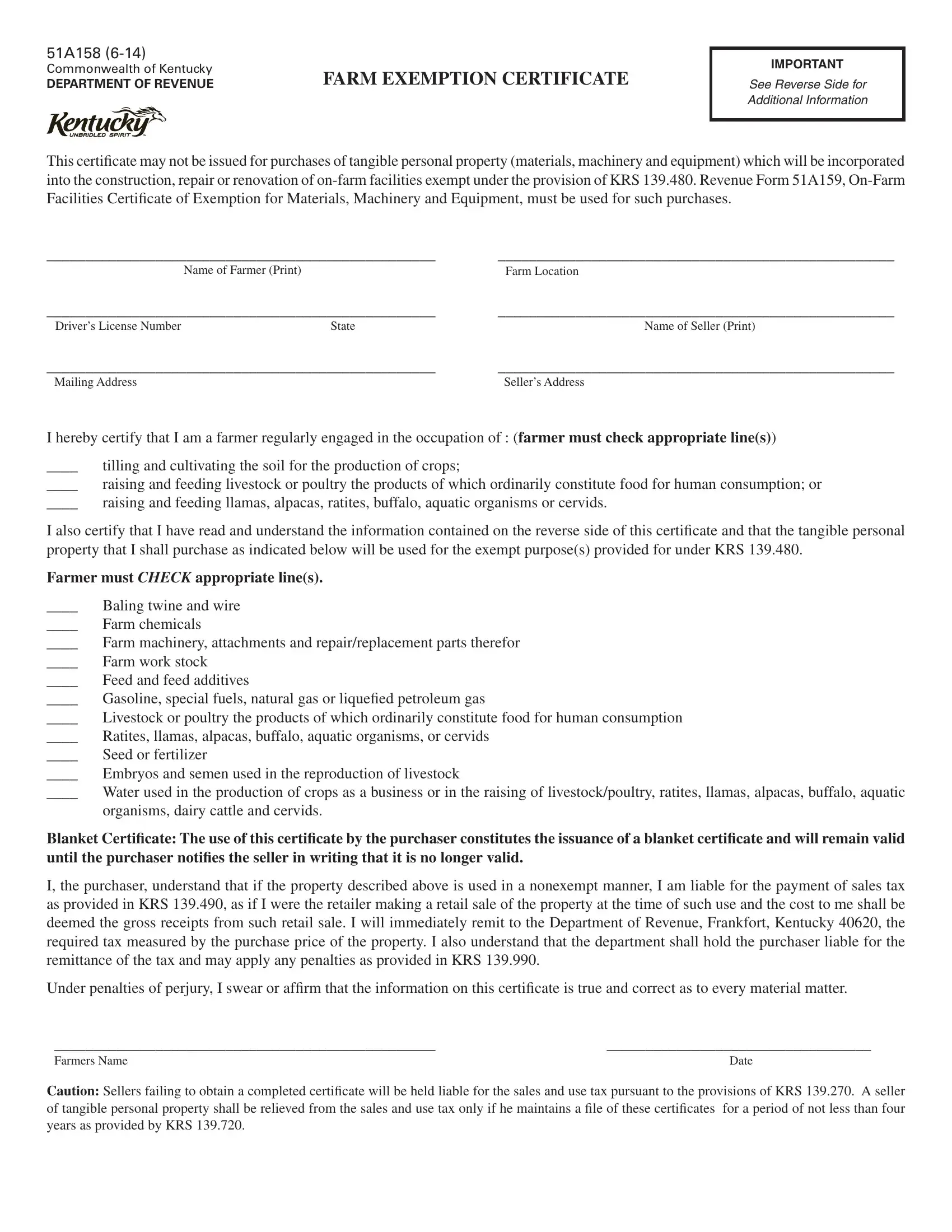

51A158 (6-14)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

FARM EXEMPTION CERTIFICATE

IMPORTANT

SEE REVERSE SIDE FOR ADDITIONAL INFORMATION

This certificate may not be issued for purchases of tangible personal property (materials, machinery and equipment) which will be incorporated into the construction, repair or renovation of on-farm facilities exempt under the provision of KRS 139.480. Revenue Form 51A159, On-Farm Facilities Certificate of Exemption for Materials, Machinery and Equipment, must be used for such purchases.

|

Name of Farmer (Print) |

Farm Location |

Driver’s License Number |

State |

Name of Seller (Print) |

Mailing Address |

|

Seller’s Address |

I hereby certify that I am a farmer regularly engaged in the occupation of : (farmer must check appropriate line(s))

____ |

tilling and cultivating the soil for the production of crops; |

____ |

raising and feeding livestock or poultry the products of which ordinarily constitute food for human consumption; or |

____ |

raising and feeding llamas, alpacas, ratites, buffalo, aquatic organisms or cervids. |

I also certify that I have read and understand the information contained on the reverse side of this certificate and that the tangible personal property that I shall purchase as indicated below will be used for the exempt purpose(s) provided for under KRS 139.480.

Farmer must CHECK appropriate line(s).

____ |

Baling twine and wire |

____ |

Farm chemicals |

____ |

Farm machinery, attachments and repair/replacement parts therefor |

____ |

Farm work stock |

____ |

Feed and feed additives |

____ |

Gasoline, special fuels, natural gas or liquefied petroleum gas |

____ |

Livestock or poultry the products of which ordinarily constitute food for human consumption |

____ |

Ratites, llamas, alpacas, buffalo, aquatic organisms, or cervids |

____ |

Seed or fertilizer |

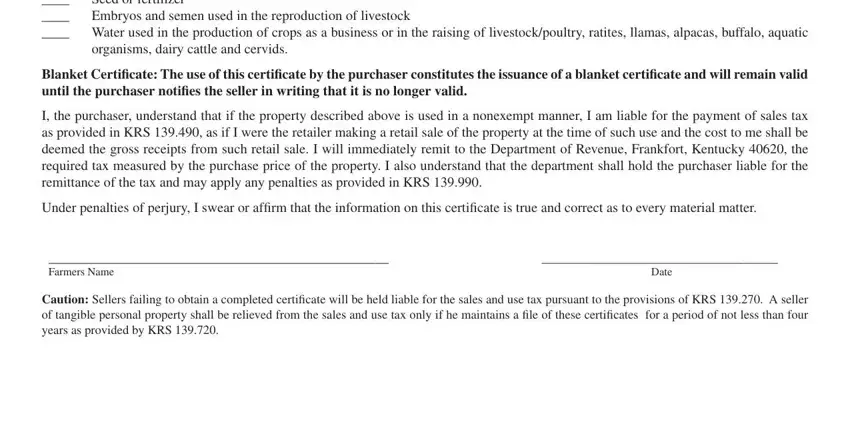

____ |

Embryos and semen used in the reproduction of livestock |

____ |

Water used in the production of crops as a business or in the raising of livestock/poultry, ratites, llamas, alpacas, buffalo, aquatic |

|

organisms, dairy cattle and cervids. |

Blanket Certificate: The use of this certificate by the purchaser constitutes the issuance of a blanket certificate and will remain valid until the purchaser notifies the seller in writing that it is no longer valid.

I, the purchaser, understand that if the property described above is used in a nonexempt manner, I am liable for the payment of sales tax as provided in KRS 139.490, as if I were the retailer making a retail sale of the property at the time of such use and the cost to me shall be deemed the gross receipts from such retail sale. I will immediately remit to the Department of Revenue, Frankfort, Kentucky 40620, the required tax measured by the purchase price of the property. I also understand that the department shall hold the purchaser liable for the remittance of the tax and may apply any penalties as provided in KRS 139.990.

Under penalties of perjury, I swear or affirm that the information on this certificate is true and correct as to every material matter.

_________________________________________________ |

__________________________________ |

Farmers Name |

Date |

Caution: Sellers failing to obtain a completed certificate will be held liable for the sales and use tax pursuant to the provisions of KRS 139.270. A seller of tangible personal property shall be relieved from the sales and use tax only if he maintains a file of these certificates for a period of not less than four years as provided by KRS 139.720.

Baling Twine and Baling Wire—Baling twine and baling wire for the baling of hay and straw. KRS 139.480(27)

Farm Chemicals—Insecticides, fungicides, herbicides, rodenticides, and other farm chemicals to be used in the production of crops as a business, or in the raising and feeding of livestock or poultry the products of which ordinarily constitute food for human consumption, ratites, llamas and alpacas, buffalo, aquatic organisms, or cervids. KRS 139.480(8)

Farm Machinery, Attachments, and Repair and Replacement Parts—The term “farm machinery” means machinery used exclusively and directly in the occupation of tilling the soil for the production of crops as a business, or in the occupation of raising and feeding livestock or poultry or of producing milk for sale. The term “farm machinery,” includes machinery, attachments, and replacements therefor, repair parts, and replacement parts which are used or manufactured for use on, or in the operation of farm machinery and which are necessary to the operation of the machinery, and are customarily so used; but this exemption shall not include automobiles, trucks, trailers, and truck- trailer combinations. KRS 139.480(11)

Examples of items which qualify for exemption in addition to the more commonly known items of “farm machinery” are: irrigation systems, tobacco curing equipment, farm wagons, portable insecticide sprayers, chain saws, mechanical cleaning equipment, mechanical shop equipment, mechanical posthole diggers, silo unloaders (augers), grain and hay elevators, milking machines, automatic washers, mechanical bulk tanks, cooling units, brooders, incubators, automatic egg gathering systems, egg processing equipment, automatic feeding equipment, automatic waterers, tobacco transplant clipping system, tobacco transplant heating systems including fans, and tobacco transplant seeding systems.

Farm Work Stock—Farm work stock for use in farming operations. KRS 139.480(6)

Feed and Feed Additives—Feed, including pre-mixes and feed additives, for livestock or poultry of a kind the products of which ordinarily constitute food for human consumption, ratites, llamas and alpacas, buffalo, aquatic organisms, or cervids. (KRS 139.480)(9) This exemption does not include feed or feed additives for farm work stock.

Gasoline, Special Fuels, Natural Gas and Liquefied Petroleum Gas—Gasoline, special fuels, liquefied petroleum gas, and natural gas used exclusively and directly to operate farm machinery, on-farm grain/soybean facilities, on-farm poultry, livestock, ratite, llama, alpaca, dairy, or aquaculture facilities. KRS 139.480(16)

Livestock—Livestock of a kind the products of which ordinarily constitute food for human consumption provided the sales are made for breeding or dairy purposes and by or to a person regularly engaged in the business of farming. KRS 139.480(4)

Poultry—For use in breeding and egg production. KRS 139.480(5)

Ratites, llamas, alpacas, buffalo, aquatic organisms, or cervids—Used in an agricultural pursuit. KRS 139.480(24), (26), (29), (30), (31)

Seed and Fertilizer—Seeds, the products of which ordinarily constitute food for human consumption or are to be sold in the regular course of business, and commercial fertilizer to be applied on land, the products from which are to be used for food for human consumption or are to be sold in the regular course of business; provided such sales are made to farmers who are regularly engaged in the occupation of tilling and cultivating the soil for the production of crops as a business, or who are regularly engaged in the occupation of raising and feeding livestock or poultry or producing milk for sale; and provided further that tangible personal property so sold is to be used only by those persons designated above who are so purchasing. KRS 139.480(7)

Embryos and Semen—Used in the reproduction of livestock, if the products of these embryos and semen ordinarily constitute food for human consumption, and if the sale is to a person engaged in the business of farming. KRS 139.480(25)

Water—Water used in the production of crops as a business or in the raising of livestock/poultry, ratites, llamas, alpacas, buffalo, aquatic organisms, cervids, and dairy cattle. KRS 139.480(28)

Questions should be directed to the Division of Sales and Use Tax, (502) 564-5170.