Completing documents together with our PDF editor is simpler compared to most things. To manage acd 1069 form downloads the form, you'll find nothing you will do - basically adhere to the steps listed below:

Step 1: This web page includes an orange button stating "Get Form Now". Press it.

Step 2: At the moment, you can begin modifying the acd 1069 form downloads. Our multifunctional toolbar is readily available - insert, eliminate, change, highlight, and conduct various other commands with the content material in the file.

The next sections are what you are going to prepare to receive the finished PDF file.

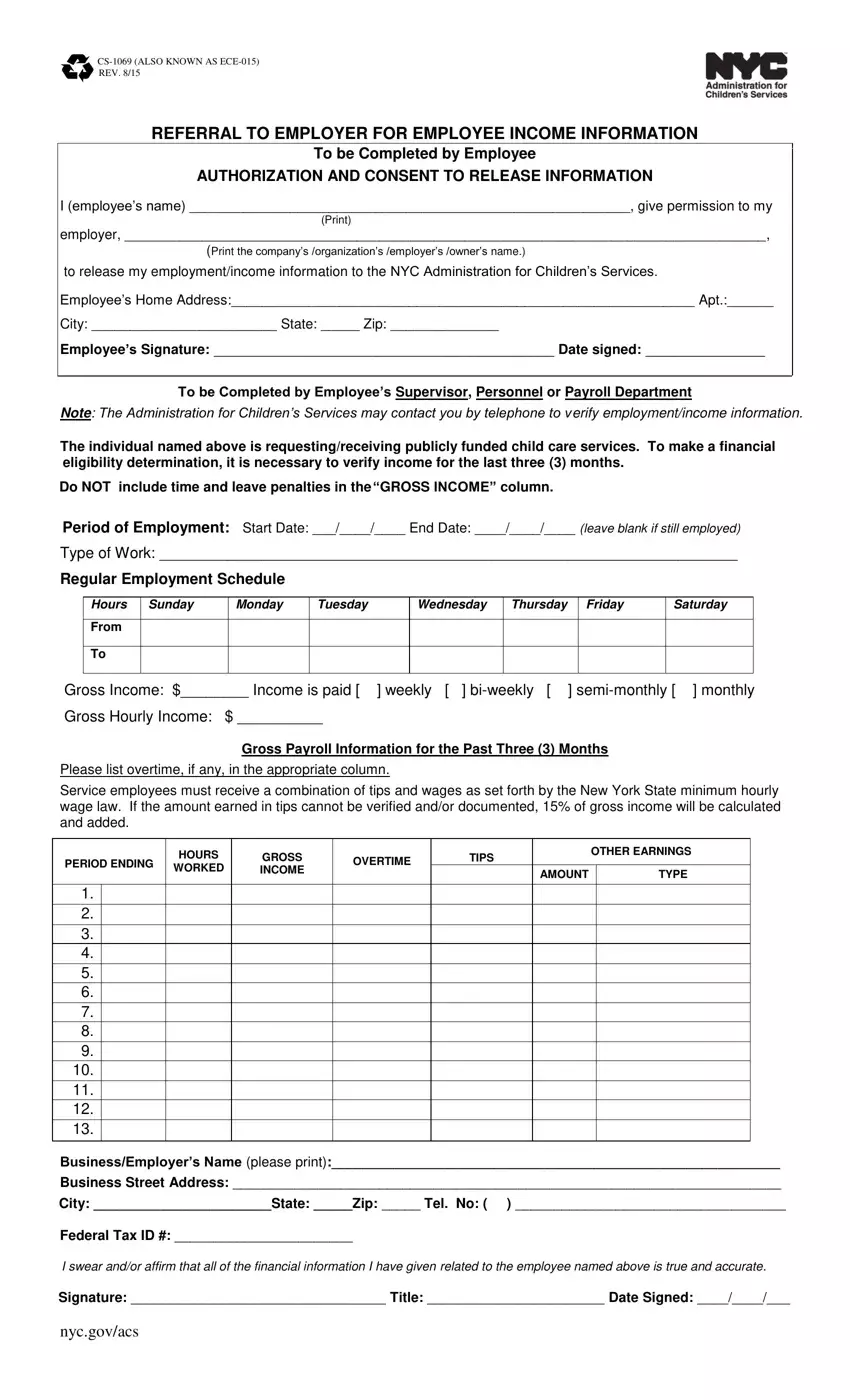

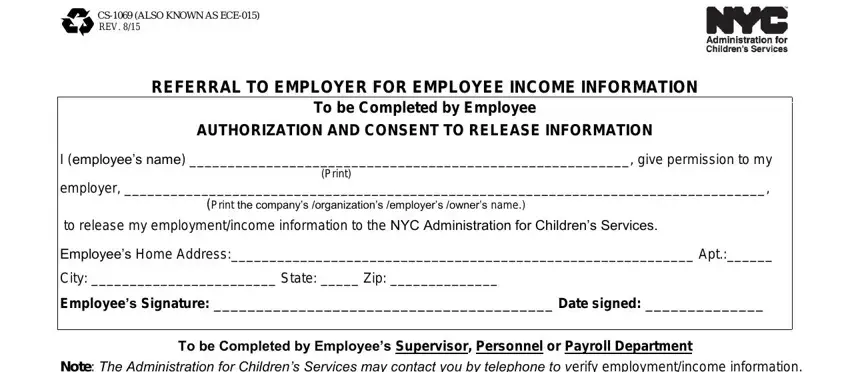

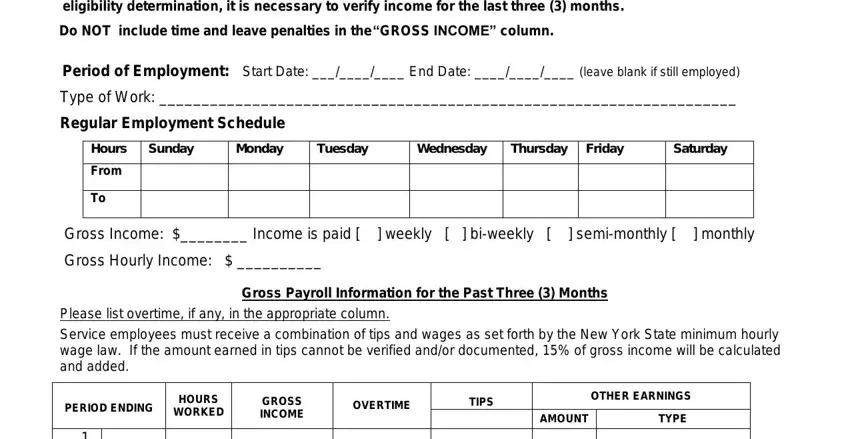

You have to type in the details in the section The individual named above is, GROSS INCOME column, Period of Employment Start Date, Type of Work, Regular Employment Schedule, Hours, Sunday, Monday, Tuesday, Wednesday, Thursday Friday, Saturday, From, Gross Income Income is paid, and Gross Hourly Income.

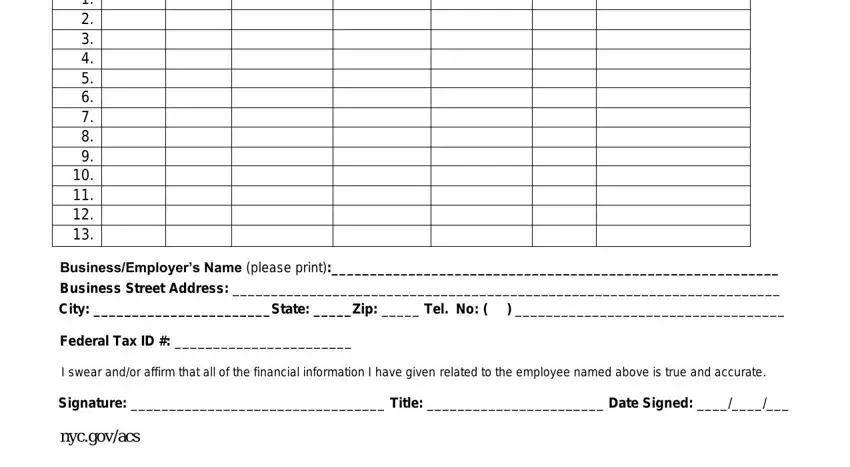

You will be required certain crucial information if you would like fill in the BusinessEmployers Name please, City State Zip Tel No, Federal Tax ID, I swear andor affirm that all of, Signature Title Date Signed, and nycgovacs area.

Step 3: Hit the button "Done". Your PDF file can be transferred. You will be able obtain it to your device or send it by email.

Step 4: You can create duplicates of the file toavoid different potential future problems. Don't get worried, we don't publish or monitor your details.