Chex Systems, Inc.

Notice of Adverse Action Form Samples

Release Date: January 2012

Do you need compliance assistance at the tip of your fingers?

An annual subscription with FIS Regulatory Advisory Services helps you tackle the daily challenges of compliance. As your trusted compliance advisor, we want to make your life easier by providing you with the

most honest, accurate, timely and practical advice possible, and keeping you up to date in the ever-changing orld of federal regulator o plia e. You ill get a ess to the atio ’s ost effe ti e ad isor solutio

trusted by regulated financial institutions and examiners alike!

By signing up today, you will have access to:

Unlimited access to our regulatory compliance experts via the hotline or e-mail for three institution users

Unlimited access to our scheduled webinars on hot topics for three institution users

Unlimited access to our Web site for your entire institution, which includes the Big Orange Book, and other tools like our Mortgage Loan Disclosure Calculator, Compliance Timeline, Sample Policy Manual and much more!

Three hard copies of the Big Orange Book & Quick Reference Guides (updates and new guides at no additional cost throughout the year)

Discounts on educational seminars for any attendee you send

*Contact us for special promotional pricing!

(Regular Price is $4,995)

Call us at (866) 355 - 5150 or

email us at compliance.solutions@fisglobal.com

So what are you waiting for?!

Sign up today!

*Existing Regulatory Service customers can take advantage of this offer depending on renewal dates and subscription level

(i.e. Premium Member, Website Only, BOB only Subscriber). Offer only valid for a new or renewing subscription, and cannot be used on an existing contract.

Please contact Catherine Livingston at (800) 547-2462, ext. 75038 for more details.

Want More Information? |

|

Visit us on the web at: |

|

www.FISregulatoryservices.com |

|

|

|

CONFIDENTIAL |

2 | P a g e |

Chex Systems, Inc. Notice of Adverse Action Form Samples (Release Date: January 2012) |

|

Copyright © 2012 Fidelity National Information Services and/or its subsidiaries. All Rights Reserved. |

|

INFORMATION ABOUT THIS DOCUMENT |

|

As a o e ie e, Che “ ste s, I . ChexSystems |

a pro ide or other ise ake a aila le to its |

customers certain sample adverse action forms, procedures, or other similar information (collectively, Materials . ChexSystems customers acknowledge and agree that the Materials were created for general

application and have not been customized to address usto ers’ specific business operations. ChexSystems does not guarantee that the Materials will comply with any applicable laws, rules or regulations, and the customer is responsible for its use of Materials and bears sole liability for any such use.

Samples in this document include:

1.ChexSystems Adverse Action Notice, without Credit Score Disclosure

2.ChexSystems Adverse Action Notice, with Credit Score Disclosure

3.ChexSystems, plus Credit Bureaus Adverse Action Notice, with Credit Score Disclosure

CHEXSYSTEMS POSITION ON THE CREDIT SCORE DISCLOSURE REQUIREMENT

ChexSystems is not taking a position on whether or not its customers are required to provide the Credit Score Disclosure to declined account applicants; rather, each financial institution is responsible for making this determination on its own behalf. As a convenience to its customers that elect to provide the Credit Score Disclosure to declined account applicants, ChexSystems is now making available the data fields necessary to support the Credit Score Disclosure requirements set forth by the Dodd-Frank Act. These additional data fields are provided in the ChexSystems QualiFile electronic inquiry response.

Chex Systems, Inc. (herein ChexSystems) is a consumer reporting agency and

an indirect wholly owned subsidiary of Fidelity National Information Services, Inc.

CONFIDENTIAL |

3 | P a g e |

Chex Systems, Inc. Notice of Adverse Action Form Samples (Release Date: January 2012) |

|

Copyright © 2012 Fidelity National Information Services and/or its subsidiaries. All Rights Reserved. |

|

Notice of Adverse Action

Notice Date:

We are sorry but we are unable to accommodate your request to open a deposit account with our institution at this time. Our decision was based in whole or in part on information obtained in a report from the consumer reporting agency listed below. You have a right under the Fair Credit Reporting Act to know the information contained in your file at the consumer reporting agency. The reporting agency played no part in our decision and is unable to supply specific reasons why we have denied your request to open a deposit account in our institution. You also have a right to a free copy of your report from the reporting agency, if you request it no later than 60 days after you receive this notice. In addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency.

Chex Systems, Inc.

Attn: Consumer Relations

7805 Hudson Road, Suite 100

Woodbury, MN 55125

Telephone: 800-428-9623

Fax: 602-659-2197

Web: www.consumerdebit.com

If you have any questions regarding your consumer report, you should contact the consumer reporting agency using the contact information above.

If you have any other questions regarding this notice, you should contact:

Institution name:

Institution address:

Institution toll-free telephone number:

As a convenience, Chex may provide or otherwise make available to Client certain sample adverse action forms, procedures, or other similar information (collectively,

Materials ). Clie t a k o ledges a d agrees that the Materials ere reated for ge eral appli atio a d ha e ot ee usto ized to address Clie t’s spe ifi business operations. Chex does not guarantee that the Materials will comply with any applicable laws, rules or regulations, and Client is responsible for its use of Materials and bears sole liability for any such use.

CONFIDENTIAL |

4 | P a g e |

Chex Systems, Inc. Notice of Adverse Action Form Samples (Release Date: January 2012) |

|

Copyright © 2012 Fidelity National Information Services and/or its subsidiaries. All Rights Reserved. |

|

Notice of Adverse Action

Notice Date:

We are sorry but we are unable to accommodate your request to open a deposit account with our institution at this time. Our decision was based in whole or in part on information obtained in a report from the consumer reporting agency listed below. You have a right under the Fair Credit Reporting Act to know the information contained in your file at the consumer reporting agency. The reporting agency played no part in our decision and is unable to supply specific reasons why we have denied your request to open a deposit account in our institution. You also have a right to a free copy of your report from the reporting agency, if you request it no later than 60 days after you receive this notice. In addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency.

Chex Systems, Inc.

Attn: Consumer Relations

7805 Hudson Road, Suite 100

Woodbury, MN 55125

Telephone: 800-428-9623

Fax: 602-659-2197

Web: www.consumerdebit.com

We also obtained your credit score from this consumer reporting agency and used it in making our credit decision. Your credit score is a number that reflects the information in your consumer report. Your credit score can change, depending on how the information in your consumer report changes.

Credit Score: |

|

Score Date: |

Scores range from a low of 100 to a high of 9999

Key factors that adversely affected your credit score (insert here the four key factors that adversely affected the credit score or if the number of recent inquiries is a key factor, insert five key factors including the number of recent inquiries):

If you have any questions regarding your credit score, you should contact the consumer reporting agency using the contact information above.

If you have any other questions regarding this notice, you should contact:

Institution name:

Institution address:

Institution toll-free telephone number:

As a convenience, Chex may provide or otherwise make available to Client certain sample adverse action forms, procedures, or other similar information (collectively,

Materials ). Clie t a k o ledges a d agrees that the Materials ere reated for ge eral appli atio a d ha e ot ee usto ized to address Clie t’s spe ifi

business operations. Chex does not guarantee that the Materials will comply with any applicable laws, rules or regulations, and Client is responsible for its use of Materials and bears sole liability for any such use.

CONFIDENTIAL |

5 | P a g e |

Chex Systems, Inc. Notice of Adverse Action Form Samples (Release Date: January 2012) |

|

Copyright © 2012 Fidelity National Information Services and/or its subsidiaries. All Rights Reserved. |

|

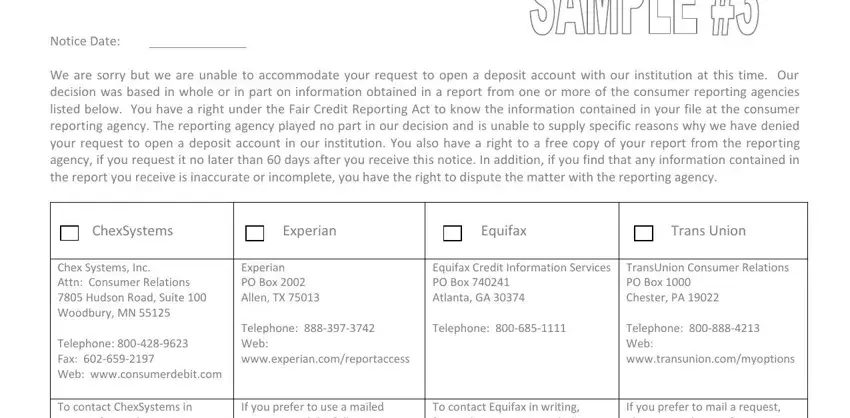

Notice of Adverse Action

Notice Date:

We are sorry but we are unable to accommodate your request to open a deposit account with our institution at this time. Our decision was based in whole or in part on information obtained in a report from one or more of the consumer reporting agencies listed below. You have a right under the Fair Credit Reporting Act to know the information contained in your file at the consumer reporting agency. The reporting agency played no part in our decision and is unable to supply specific reasons why we have denied your request to open a deposit account in our institution. You also have a right to a free copy of your report from the reporting agency, if you request it no later than 60 days after you receive this notice. In addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency.

|

|

ChexSystems |

|

|

Experian |

|

|

Equifax |

|

|

Trans Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chex Systems, Inc. |

Experian |

Equifax Credit Information Services |

TransUnion Consumer Relations |

Attn: Consumer Relations |

PO Box 2002 |

PO Box 740241 |

PO Box 1000 |

7805 Hudson Road, Suite 100 |

Allen, TX 75013 |

Atlanta, GA 30374 |

Chester, PA 19022 |

Woodbury, MN 55125 |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone: 888-397-3742 |

Telephone: 800-685-1111 |

Telephone: 800-888-4213 |

Telephone: 800-428-9623 |

Web: |

|

|

|

Web: |

Fax: 602-659-2197 |

www.experian.com/reportaccess |

|

|

|

www.transunion.com/myoptions |

Web: www.consumerdebit.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To contact ChexSystems in |

If you prefer to use a mailed |

To contact Equifax in writing, |

If you prefer to mail a request, |

writing, forward your request |

request, send the following |

forward your request including |

please provide your first name, |

including your full name, |

information to Experian: your full |

your name, address, former |

last name, middle initial, current |

including middle initial, current |

name, including middle initial and |

address (if you have been at your |

address, Social Security number, |

address, US Social Security |

generation such as SR, JR, II, etc.; |

current address less than two |

date of birth, any previous |

number, date of birth and any |

current mailing address; Social |

years), Social Security Number |

addresses used in the past five |

previous addresses used in the |

Security number; date of birth; |

(required) and the name of the |

years (include any PO Boxes). |

last five years (including PO |

previous addresses for the past |

company that referred you to |

|

|

|

Boxes). |

two years; and two proofs of your |

Equifax. |

|

|

|

|

|

|

current mailing address, such as |

|

|

|

|

|

|

|

|

|

dri er’s li e se, utilit ill, a k or |

|

|

|

|

|

|

|

|

|

insurance statement, etc. |

|

|

|

|

|

|

As a convenience, |

Chex may provide or otherwise make available to Client certain sample adverse action forms, procedures, or other similar information (collectively, |

Materials ). Clie |

t a k o ledges a d agrees that the Materials ere reated for ge eral appli atio a d ha e ot ee usto ized to address Clie t’s spe ifi |

business operations. Chex does not guarantee that the Materials will comply with any applicable laws, rules or regulations, and Client is responsible for its use of Materials and bears sole liability for any such use.

Sample Form Continues on Next Page….

CONFIDENTIAL |

6 | P a g e |

Chex Systems, Inc. Notice of Adverse Action Form Samples (Release Date: January 2012) |

|

Copyright © 2012 Fidelity National Information Services and/or its subsidiaries. All Rights Reserved. |

|

We also obtained your credit score from this consumer reporting agency and used it in making our credit decision. Your credit score is a number that reflects the information in your consumer report. Your credit score can change, depending on how the information in your consumer report changes.

Credit Score: |

|

Score Date: |

Scores range from a low of 100 to a high of 9999

Key factors that adversely affected your credit score (insert here the four key factors that adversely affected the credit score or if the number of recent inquiries is a key factor, insert five key factors including the number of recent inquiries):

If you have any questions regarding your credit score, you should contact the consumer reporting agency using the contact information above.

If you have any other questions regarding this notice, you should contact:

Institution name:

Institution address:

Institution toll-free telephone number:

As a convenience, Chex may provide or otherwise make available to Client certain sample adverse action forms, procedures, or other similar information (collectively,

Materials ). Clie t a k o ledges a d agrees that the Materials ere reated for ge eral appli atio a d ha e ot ee usto ized to address Clie t’s spe ifi business operations. Chex does not guarantee that the Materials will comply with any applicable laws, rules or regulations, and Client is responsible for its use of Materials and bears sole liability for any such use.

Contact Us |

For more information about Risk, Fraud, and Compliance Solutions |

|

e-mail us at: |

MoreInfo@fisglobal.com |

|

or visit us on the Web: |

www.fisglobal.com/products-riskfraudcompliance |

CONFIDENTIAL |

7 | P a g e |

Chex Systems, Inc. Notice of Adverse Action Form Samples (Release Date: January 2012) |

|

Copyright © 2012 Fidelity National Information Services and/or its subsidiaries. All Rights Reserved. |

|