You are able to fill out texas ifta filing online effortlessly in our online PDF tool. We at FormsPal are dedicated to giving you the absolute best experience with our editor by constantly presenting new features and enhancements. With these updates, using our tool becomes easier than ever! It merely requires just a few basic steps:

Step 1: Simply hit the "Get Form Button" above on this site to access our pdf form editing tool. This way, you will find everything that is necessary to fill out your document.

Step 2: Using this online PDF editing tool, you'll be able to do more than just fill in blanks. Edit away and make your forms appear professional with custom textual content put in, or optimize the file's original input to excellence - all that comes along with the capability to incorporate almost any images and sign it off.

Completing this PDF will require focus on details. Make sure that all mandatory areas are done accurately.

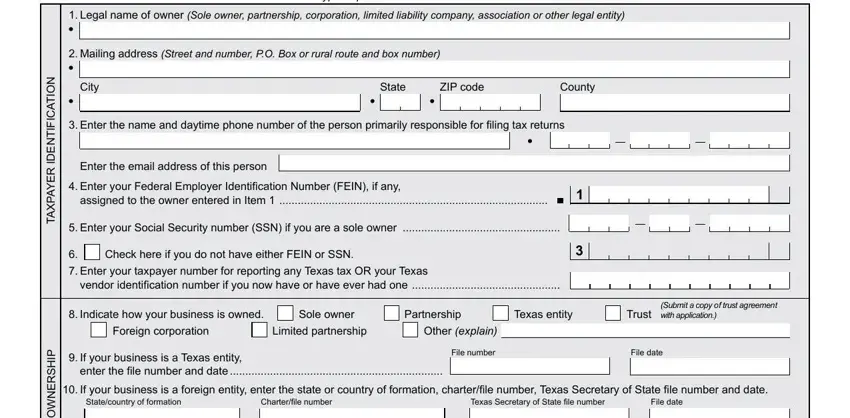

1. For starters, when completing the texas ifta filing online, begin with the part that features the subsequent blank fields:

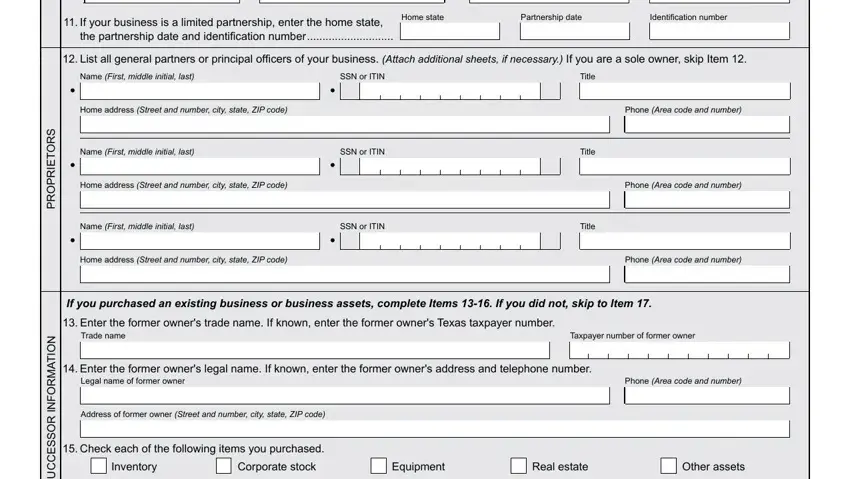

2. The next part would be to fill out the following blank fields: If your business is a limited, the partnership date and, Home state, Partnership date, Identiication number, List all general partners or, Name First middle initial last, SSN or ITIN, Title, Home address Street and number, Name First middle initial last, Home address Street and number, Name First middle initial last, SSN or ITIN, and SSN or ITIN.

Those who use this PDF generally make errors when filling in Title in this area. You need to double-check everything you type in here.

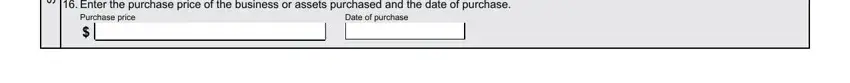

3. Completing R O S S E C C U S, Check each of the following items, Date of purchase, and Purchase price is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

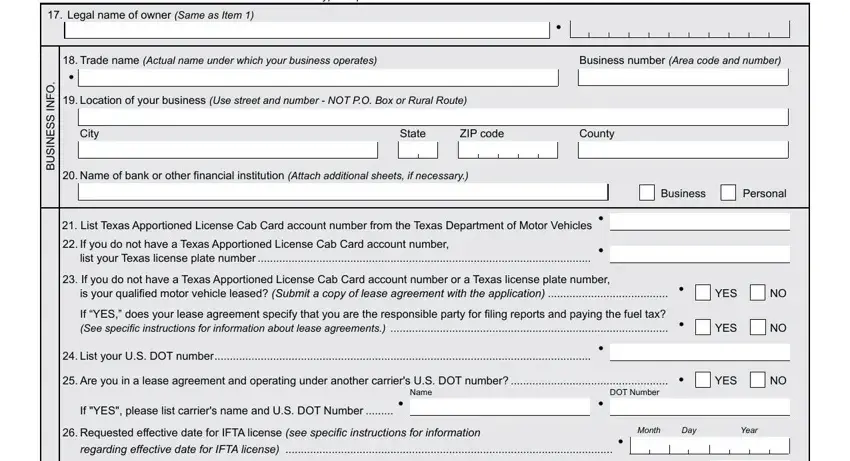

4. This next section requires some additional information. Ensure you complete all the necessary fields - Type or print, Please read instructions Legal, Do not write in shaded areas, Trade name Actual name under, Business number Area code and, Location of your business Use, City, State, ZIP code, County, Name of bank or other inancial, Business, Personal, List Texas Apportioned License, and list your Texas license plate - to proceed further in your process!

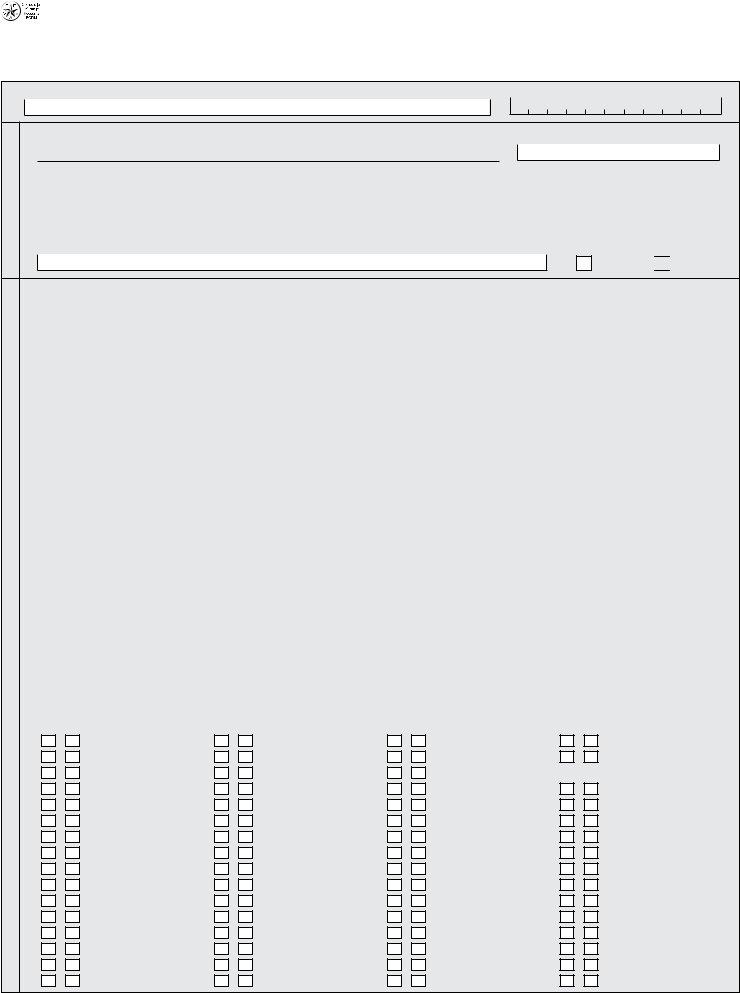

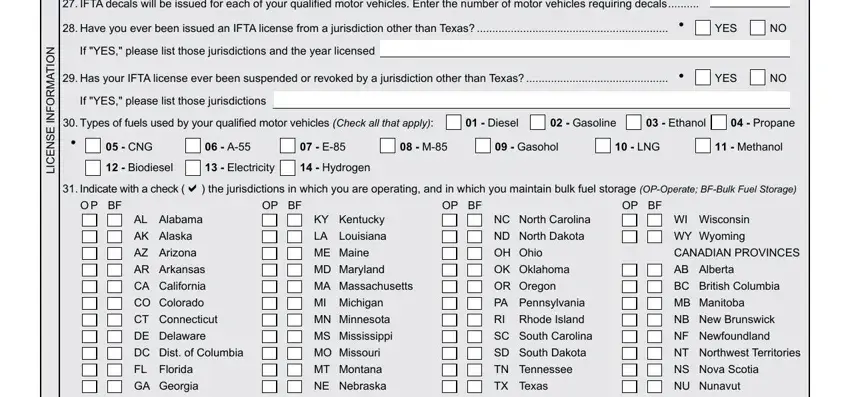

5. This final notch to finalize this form is crucial. Make sure that you fill out the necessary form fields, which includes IF, TA decals will be issued for each, YES, Has your IFTA license ever been, YES, N O T A M R O F N, E S N E C L, If YES please list those, Types of fuels used by your, M, CNG Biodiesel, A Electricity the jurisdic, E Hydrogen, Diesel, and Gasoline, prior to finalizing. Otherwise, it may contribute to an unfinished and possibly invalid paper!

Step 3: As soon as you've looked over the information in the file's blank fields, press "Done" to finalize your FormsPal process. Join FormsPal right now and immediately access texas ifta filing online, ready for downloading. Every single edit you make is handily saved , meaning you can modify the form at a later point if needed. FormsPal offers safe document completion with no personal data record-keeping or any sort of sharing. Rest assured that your information is safe here!