Using PDF forms online is definitely quite easy with this PDF tool. You can fill in texas diesel fuel here in a matter of minutes. FormsPal is devoted to providing you with the ideal experience with our editor by continuously adding new capabilities and improvements. Our tool has become a lot more intuitive thanks to the newest updates! Currently, filling out PDF forms is easier and faster than ever. To get started on your journey, take these basic steps:

Step 1: Simply click the "Get Form Button" above on this webpage to access our pdf editing tool. This way, you'll find all that is required to work with your document.

Step 2: With the help of our handy PDF tool, you can accomplish more than simply fill in blanks. Edit away and make your documents seem perfect with customized textual content added in, or fine-tune the original content to excellence - all accompanied by the capability to insert stunning pictures and sign the document off.

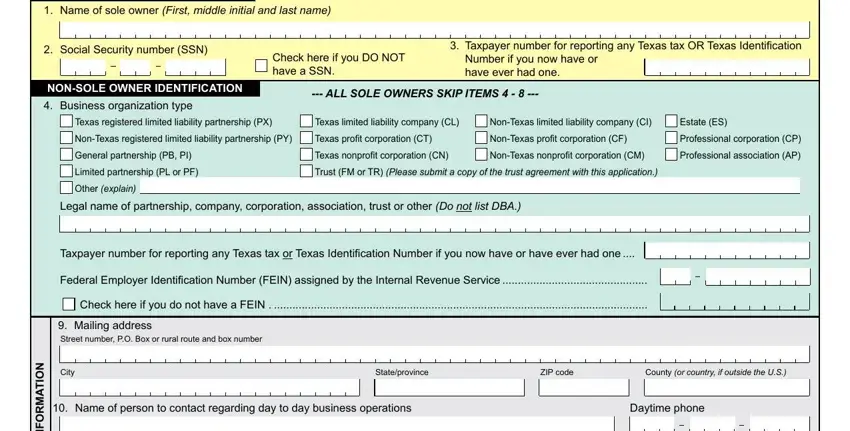

As for the blank fields of this precise PDF, this is what you should do:

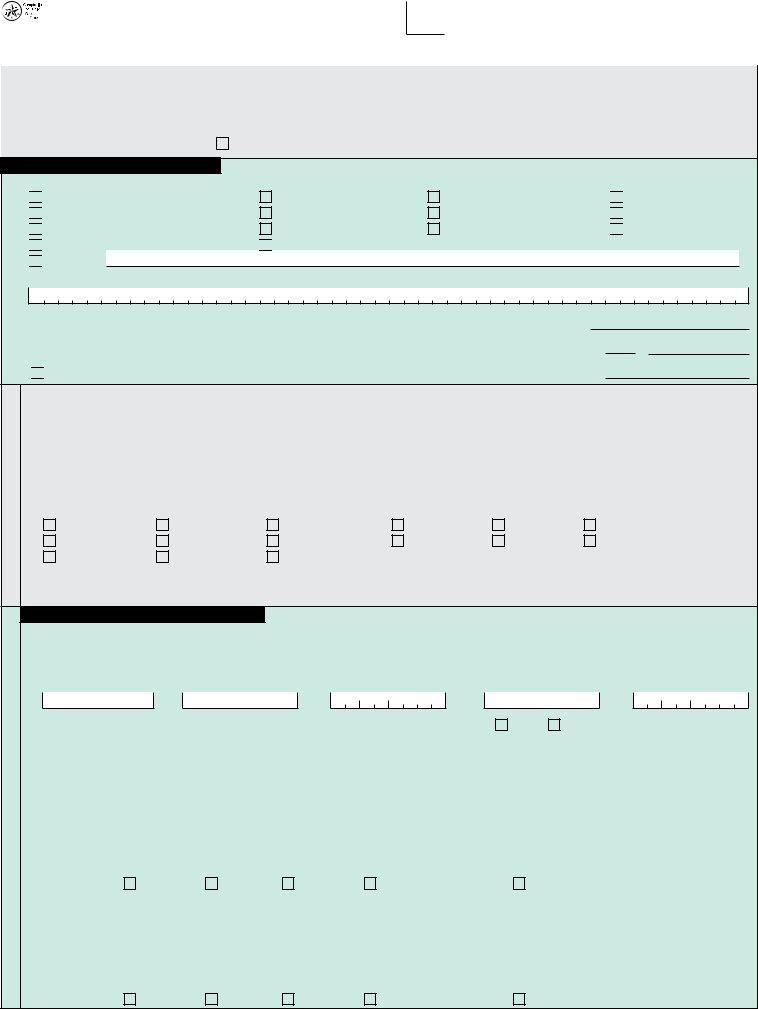

1. The texas diesel fuel needs specific details to be typed in. Be sure the subsequent blank fields are filled out:

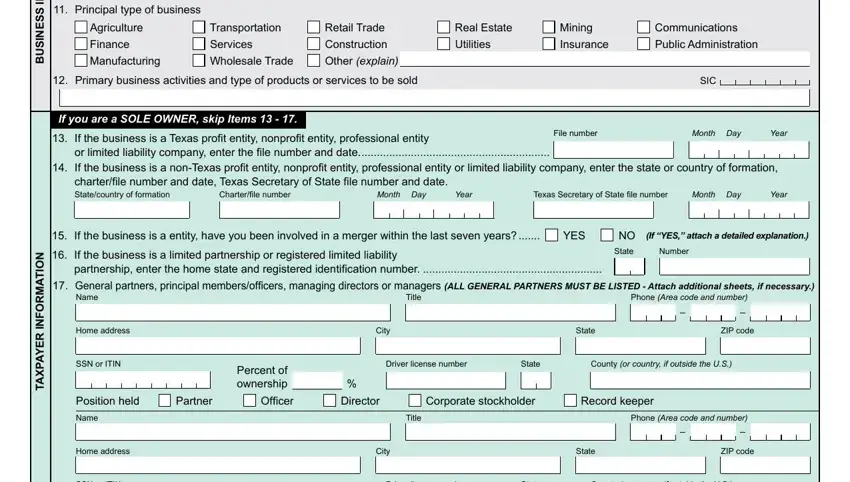

2. Once your current task is complete, take the next step – fill out all of these fields - N O T A M R O F N, S S E N S U B, N O T A M R O F N, R E Y A P X A T, Principal type of business, Agriculture, Finance Manufacturing, Transportation Services Wholesale, Retail Trade Construction Other, Primary business activities and, Real Estate Utilities, Mining Insurance, Communications Public, SIC, and If you are a SOLE OWNER skip Items with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

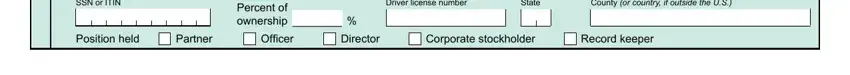

3. This next part focuses on SN or ITIN, Percent of ownership , Driver license number, State, County or country if outside the US, Position held, Partner, Oficer, Director, Corporate stockholder, and Record keeper - type in all of these fields.

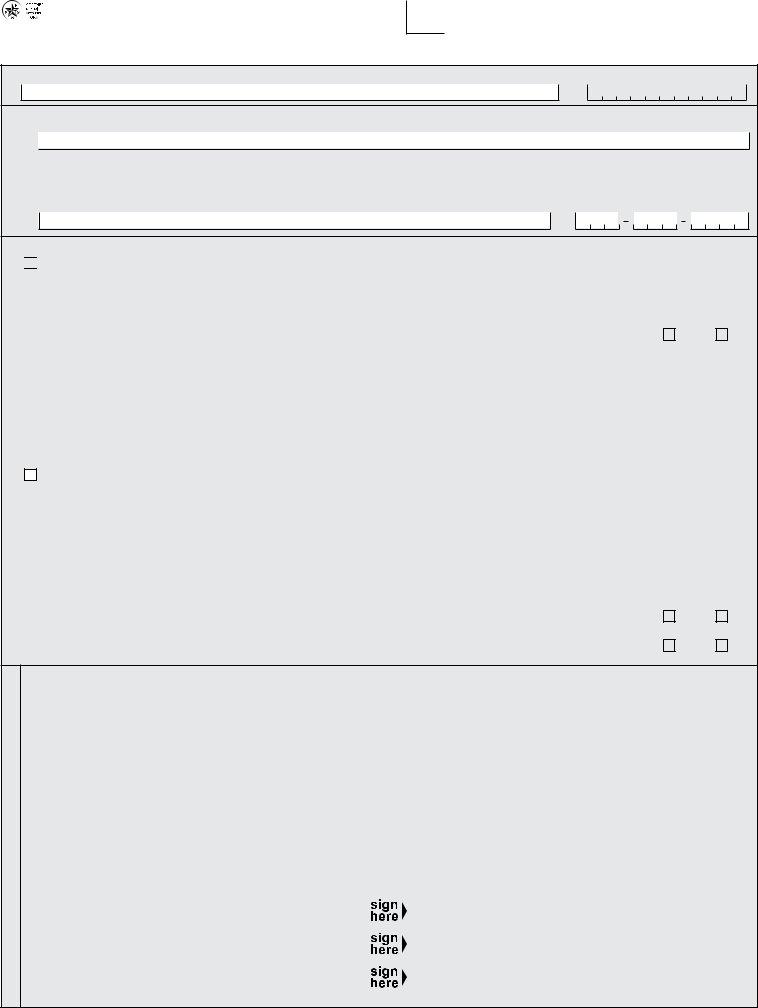

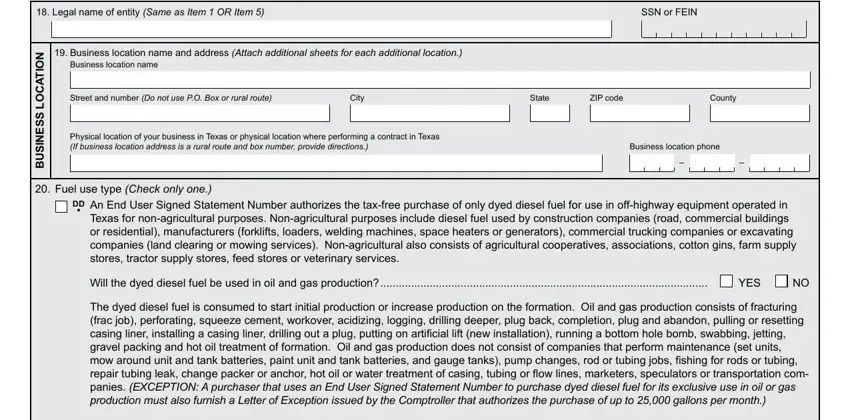

4. You're ready to fill in this fourth form section! In this case you will have these Legal name of entity Same as Item, SSN or FEIN, Business location name and address, Street and number Do not use PO, City, State, ZIP code, County, Physical location of your business, Business location phone, N O T A C O L S S E N S U B, Fuel use type Check only one, DD An End User Signed Statement, Will the dyed diesel fuel be used, and YES fields to do.

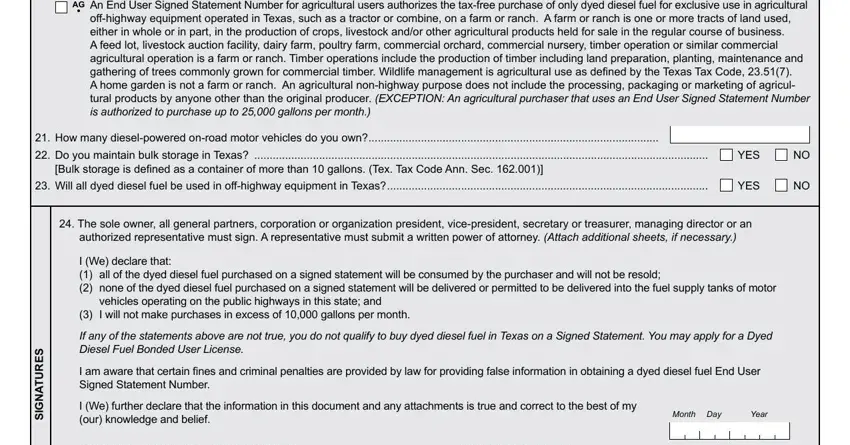

5. Now, the following final portion is precisely what you will need to complete prior to finalizing the form. The blanks in question are the next: AG An End User Signed Statement, offhighway equipment operated in, How many dieselpowered onroad, Bulk storage is deined as a, YES, YES, The sole owner all general, authorized representative must, I We declare that all of the dyed, vehicles operating on the public, I will not make purchases in, S E R U T A N G S, If any of the statements above are, I am aware that certain ines and, and I We further declare that the.

People who work with this PDF often make mistakes when completing How many dieselpowered onroad in this section. Be sure you read twice whatever you type in right here.

Step 3: Before obtaining the next step, ensure that all blank fields have been filled in correctly. When you verify that it's good, click on “Done." After setting up a7-day free trial account at FormsPal, you'll be able to download texas diesel fuel or email it right away. The PDF form will also be readily accessible via your personal account menu with your each and every change. When you work with FormsPal, you're able to complete documents without the need to worry about data breaches or records getting shared. Our secure software helps to ensure that your personal information is maintained safely.