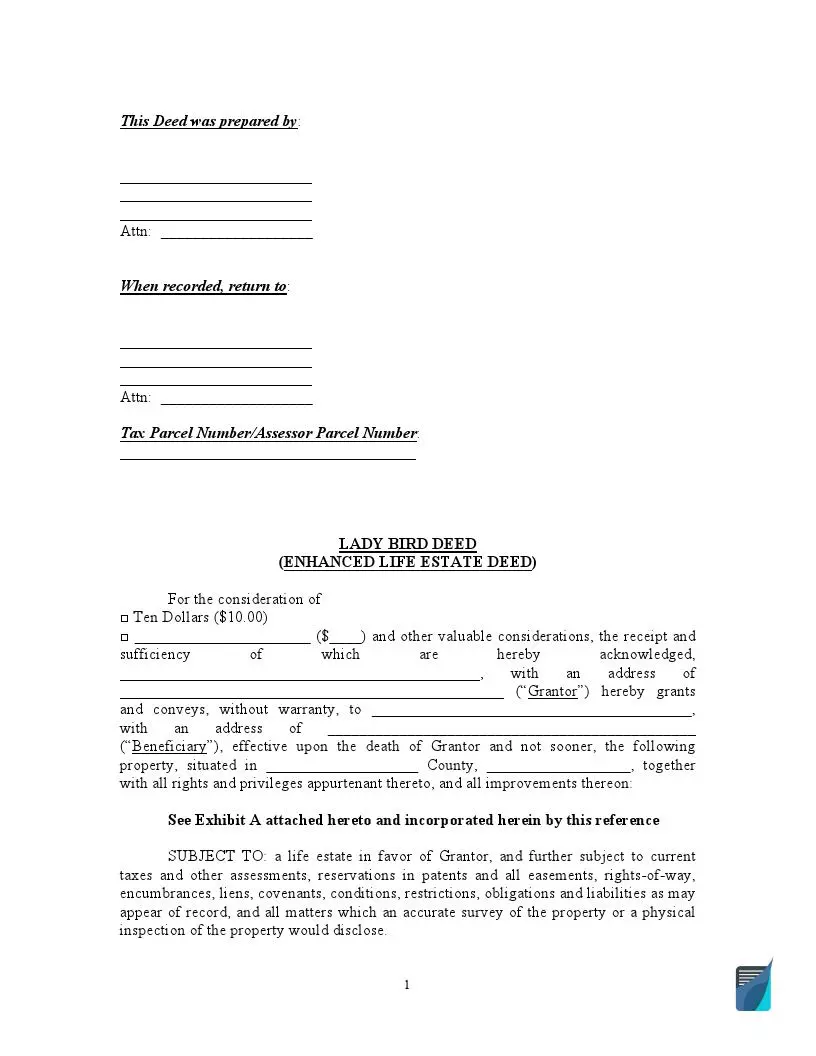

Lady Bird Deed (Enhanced Life Estate Deed)

Many homeowners look for a way to pass their houses to heirs without the need for the latter ones to go through tiresome and costly probate. Those of the property holders who happen to live in states where a lady bird deed is adopted can consider this tool as a good alternative.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Lady Bird Deed?

This document is a more beneficial version of another legal instrument, a life estate, which is reflected in its official name — an enhanced life estate deed. Similar to the standard method, the document allows the beneficiary to automatically take ownership of the real estate after the grantor’s death. Yet, the initial owner retains not only a life estate, meaning that he or she can use the property during their lifetime, but also the power to solely dispose of the asset, i.e., sell or lease it without the beneficiary’s consent. Thus, the deed gives more control over the property to the transferors if compared with the traditional form of title transfer.

The common “lady bird” nickname is often associated with President Johnson’s wife, who is believed to receive some of her husband’s real estate under such a document. However, research shows that Lyndon Johnson never transferred his assets with the help of this tool, although his and his wife’s names were used for an illustrative purpose by a Florida-based attorney who had created the first lady bird form. Anyway, the nickname is now mentioned even in court rulings, at least in those jurisdictions where these deeds are recognized, which are Florida, Michigan, Texas, Vermont, and West Virginia.

When to Use a Lady Bird Deed

Obviously, no one can avail of a deed if it is not legal in the state where a property is located. Currently, the use of an enhanced life estate is allowed in five jurisdictions only, with some of them having other similar solutions. For example, the Texas Real Property Transfer on Death Act does not void these deeds based on Sec. 111.052, so real estate holders in this state seem to have a choice between two options. In Florida, transfer on death deeds are not accepted, which makes local homeowners opt for an enhanced life estate every time they want to forgo probate while keeping full control over their assets.

Lady Bird Deed vs. Other Documents

In most states, local laws provide homeowners with a choice of legal instruments serving to transfer their property to some type of beneficiaries. It might be tricky for a real estate holder to choose the one that works best in a certain situation, so let’s compare the most popular options.

Lady bird deed vs. last will

The key advantage the deed has over a last will is time and cost saving, which originates from the probate-free title transfer attached to the life estate tool. Since there is no proceeding, fees and delays associated with legal actions are cut off, and the grantees can come into the ownership right upon receiving a certificate confirming the grantor’s death. However, the coverage of lady bird deeds is limited to only a few jurisdictions, while wills are accepted everywhere. Besides, wills are more flexible in distributing various kinds of assets since the deeds work for property conveyance only.

Lady bird deed vs. trust

Living trusts can be considered as an alternative to steer away from probate when distributing assets after a person’s death. They require creating a trust agreement where the person acts as a grantor, a trustee, and one of the beneficiaries. It allows moving the assets into the trust while maintaining control over them during the person’s lifetime. Upon his or her death, a successor trustee specified in the agreement steps in to continue managing the assets on behalf of the beneficiaries or to distribute them among the heirs. But establishing a trust usually requires the assistance of an attorney due to the complexity and incurs higher income taxes when the grantor dies.

Lady bird deed vs. TOD

Transfer on death deeds work very similarly to an enhanced life estate, as they also pass some property to grantees after the grantor passes away. Both of the deed types allow the initial owner not only to live in the house in question but also to sell or mortgage it without the beneficiaries’ involvement. That’s why lady bird deeds are even sometimes called TODs, although these instruments still differ in their mechanisms. Namely, a TOD does not create a future interest in real estate, and, thus, it better protects its current holder from creditors who can have claims against the remainder beneficiary. Besides, TODs are valid in about half of jurisdictions across the United States, which makes them more helpful.

Benefits of a Lady Bird Deed

To sum up, the following reasons speak well for preparing an enhanced life estate deed:

- Heirs can avoid wasteful and time-consuming court proceedings required to probate a will.

- Homeowners are free to live in their houses until they die without losing their right to sell, lease, or give them away to someone else while retaining the possibility to transfer the property to the beneficiaries specified in the deed.

- If the holder sees fit, he or she can cancel the deed without the need to get the grantee’s consent.

- A gift tax is not applicable in this case, as the current owner does not pass the real estate to the grantee immediately.

- By retaining the real estate holder’s ownership right, the deed does not violate Medicaid’s look-back period; so, the grantor can qualify for Medicaid benefits while still reserving the property for their heirs since the estate recovery applies to a “probate” property only.

- Selling the property inherited through the deed might come with lower income taxes, as its value is established as at the date of the grantor’s death rather than the date when it was actually acquired.

- For the original homeowner, tax benefits lie in the possibility to avoid uncapping and higher property taxes since the ownership is not transferred in full.

- The document can be created without professional assistance and at a low cost.

Drawbacks of a Lady Bird Deed

Despite the multiple merits of this legal instrument, it is not a one-size-fits-all solution due to some weak points:

- Title insurance companies tend to decline applications from holders of real estate that is subject to this deed type, which results in a lower market value of the property or the need to take legal actions to correct the title.

- Probate might still be required if the grantee specified in the deed dies before the grantor.

- The property taxes paid by the beneficiaries can skyrocket because of uncapping after the initial holder’s death.

- Since the deed creates a remainder interest in the property, it is not shielded against liens placed by creditors.

Details to Include in a Lady Bird Deed

The best way to go with preparing the document is to find an approved form or detailed instructions on the website of your county. For example, Vermont and Florida provide their residents with such an option, but it might not be the case with Texas and Michigan. If you are not sure what to include in the document, turn to an attorney or follow the tips below:

- the full names and addresses of the grantor and the grantee

- the legal description of the property

- consideration if any

- a co-ownership form if several beneficiaries are indicated

- the date of execution

- a statement reserving the transferor’s unrestricted power to convey the property during his or her lifetime

- the grantor’s signature

- information about witnesses and their signatures if required by the state

- a notary statement acknowledging the signatures

There might be different or additional requirements in your location.

Frequently Asked Questions

Can a lady bird deed be contested?

If the deed is executed in compliance with your local requirements, it is unlikely to trigger any disputes. However, any deed can be contested based on issues like the competency of the grantor or the improper identification of the beneficiaries.

Does it have to be notarized?

Generally, the deeds must be notarized and recorded in the public records of the county where the property in question is located. While Florida requires acknowledging the signatures of the grantor and witnesses, Vermont specifies the transferor’s signature only.

Can I revoke such a deed?

Yes, these deeds are revocable, which is one of their main advantages. The real estate holder can change their mind and cancel the document by filing a statement of revocation or replace it with a new lady bird deed by going through the whole process again. In the latter case, the document with a fresher date will nullify the previous deed.