The Arizona JT-1/UC-001 form serves as a crucial document for businesses operating within Arizona, streamlining the process for those needing to apply for various types of taxes, including the Transaction Privilege Tax (TPT), Use Tax, and Unemployment Tax. As an efficient gateway for obtaining necessary permits, this joint tax application facilitates business compliance with state tax obligations by allowing applicants to provide detailed information about their business activities, location, and ownership structure. Notably, the form emphasizes the importance of providing a Federal Employer Identification Number for corporations or employers, along with detailed instructions for completion to avoid processing delays due to incomplete applications. Additionally, it encompasses sections tailored to specific business circumstances such as acquiring an existing business, which necessitates completing unemployment tax information, and addresses new or out-of-state contractors’ bonding requirements. Offering the convenience of online completion, this comprehensive application underscores the state's commitment to facilitating business operations while ensuring tax compliance.

| Question | Answer |

|---|---|

| Form Name | Arizona Form Jt 1 Uc 001 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | Mohave, Mtn, aztaxes, arizona joint tax application fillable |

ARIZONA JOINT TAX APPLICATION

IMPORTANT: See attached instructions before completing this |

|

|

|

|

|

||

application. For licensing questions on Transaction Privilege, |

To complete this online, go to |

|

|

Withholding or Use call (602) |

|

||

area codes 520 and 928). For questions on Unemployment Tax call |

www.aztaxes.gov |

|

|

(602) |

|

||

|

|

||

return complete application to: Licensing & Registration Section, |

|

|

|

Incomplete applications will not be processed. |

|||

Department of Revenue, 1600 W Monroe, Phoenix AZ 85007. |

|||

All required information is designated with asterisk *. |

|||

|

|||

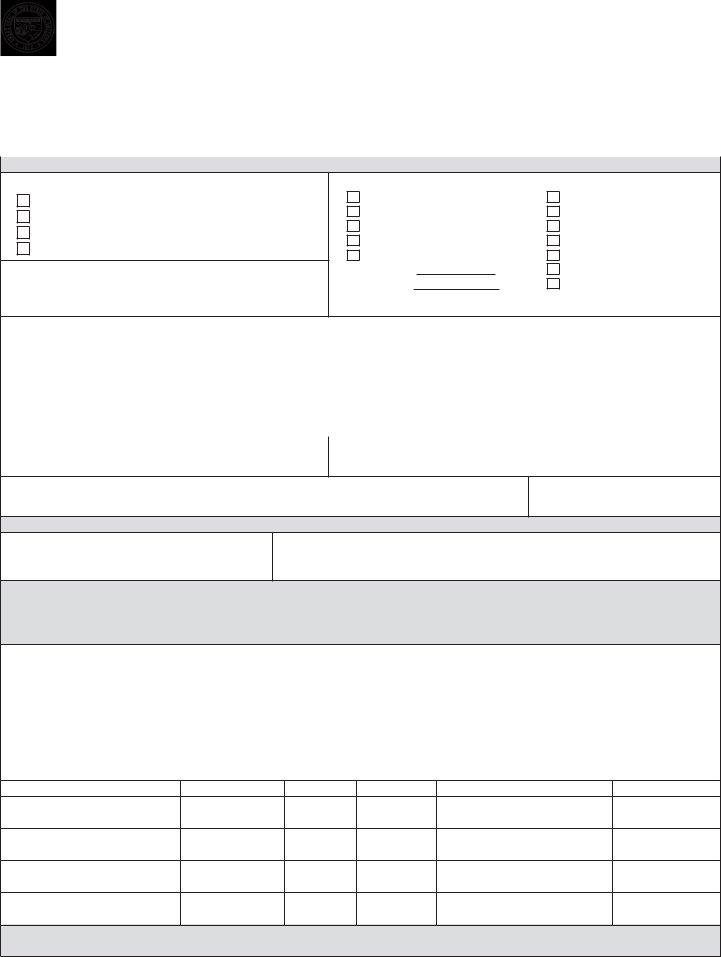

Section A: Taxpayer Information (Please print legibly or type the information on this application.)

1. License Type (Please check all that apply) *

Transaction Privilege Tax (TPT)

Withholding/Unemployment Tax (if hiring employees)

Use Tax

TPT For Cities ONLY

3.Employer Identification Number (Required for Employers and Corporations) or Social Security Number *

2. Type of Ownership

Individual / Sole Proprietorship

Partnership

Limited Liability Company

Limited Liability Partnership

Corporation

State of Inc.

Date of Inc.

Association

Trust

Government

Estate

Joint Venture

Receivership

*Tax exempt organizations must attach a copy of the Internal Revenue Service letter of determination.

4. |

Legal Business Name / Owner / Employing Unit * |

|

|

|

|

|

|

|

|

|

|

||

5. |

Business or “Doing Business As” Name * |

6. Business Phone Number * |

7. |

Fax Number |

||

|

|

( |

) |

|

( |

) |

8. |

Mailing Address (Street, City, State, ZIP code) |

|

|

9. |

Country |

|

|

|

|

|

|

|

|

10. Email Address

11. Is your business located on an Indian Reservation?

Yes |

If yes, |

|

(See Section H for listing of Reservations) |

|

No |

|

|

|

12. Physical Location of Business (Street, City, State, ZIP code) *

13. County

For additional business locations, complete Section B,

14. Are you a construction contractor? *

Yes |

(See bonding requirements below) |

|

No |

|

15. Did you acquire all or part of an existing business? *

Yes |

If yes, you must complete the Unemployment Tax Information (Section D) |

|

No |

|

Prior to the issuance of a Transaction Privilege Tax license, new or out of state contractors are required to post a Taxpayer Bond for Contractors, unless the Contractor qualifies for an exemption from the bonding requirement. The primary type of contracting being performed determines the amount of bond to be posted. Bonds must be issued by a surety company authorized to transact business in Arizona. For more information on bonding, please see the “Taxpayer Bonds” publication.

16. Description of Business (Must include type of merchandise sold or taxable activity or type of employment) *

17. NAICS Code: (Select at least one. Go to www.aztaxes.gov for a |

18. Business Classes (Select at least one. See Section I for a listing of |

||||

|

listing of codes) * |

|

business classes) * |

||

A. |

|

B. |

A. |

|

B. |

|

|

|

|

|

|

C. |

|

D. |

C. |

|

D. |

|

|

|

|

|

|

19. Identification of Owner (and Spouse if married) Partners, Corporate Officers, Members (or Managing Members) or Officials of this employing unit

A. Name (Last, First, MI) *

B. Soc. Sec. No. *

C. Title *

D. % Owned *

E. Complete Residence Address *

F. Phone Number *

( )

( )

( )

( )

If the owner, partners, corporate officers or combination of partners or corporate officers, members and/or managing members own or control more than 50% of another business in Arizona, attach a list of the businesses, percentages owned and unemployment insurance account numbers.

ADOR