Understanding the intricacies and the gravity of the Asset Declaration form is crucial for every government employee under the administrative wing of the Government of West Bengal. Aimed at promoting transparency and accountability, this form requires employees to meticulously list all movable and immovable properties owned, acquired, or inherited by them, their spouses, or dependents. Not just a mere formality, the submission process underscores the importance of declaring assets right after New Year's Day with assets as they stood on the 1st of January of the current year, ensuring no asset acquired thereafter is listed until the following year's declaration unless ambiguity demands its immediate record. The directive stretches to include assets held under various degrees of ownership and acquisition manners - be it through savings, inheritance, loans, or any other means, demanding thorough disclosure. Interestingly, the form also mandates the disclosure of assets that are in the process of acquisition, reflecting the government's attempt to leave no stone unturned. Aimed at government employees other than those in inferior service, its completion and submission by the 30th April each year, involve a process designed to safeguard the integrity of the submission, extending to gazetted officers the provision to send their declarations via registered post at government expense. Penalties for non-compliance or misleading declarations highlight the seriousness with which the government views this exercise. With specific instructions on how to declare various types of assets, including land, houses, bank balances, and even jewelry, the Asset Declaration form is an epitome of a meticulous process designed to foster a culture of honesty and integrity within the public sector.

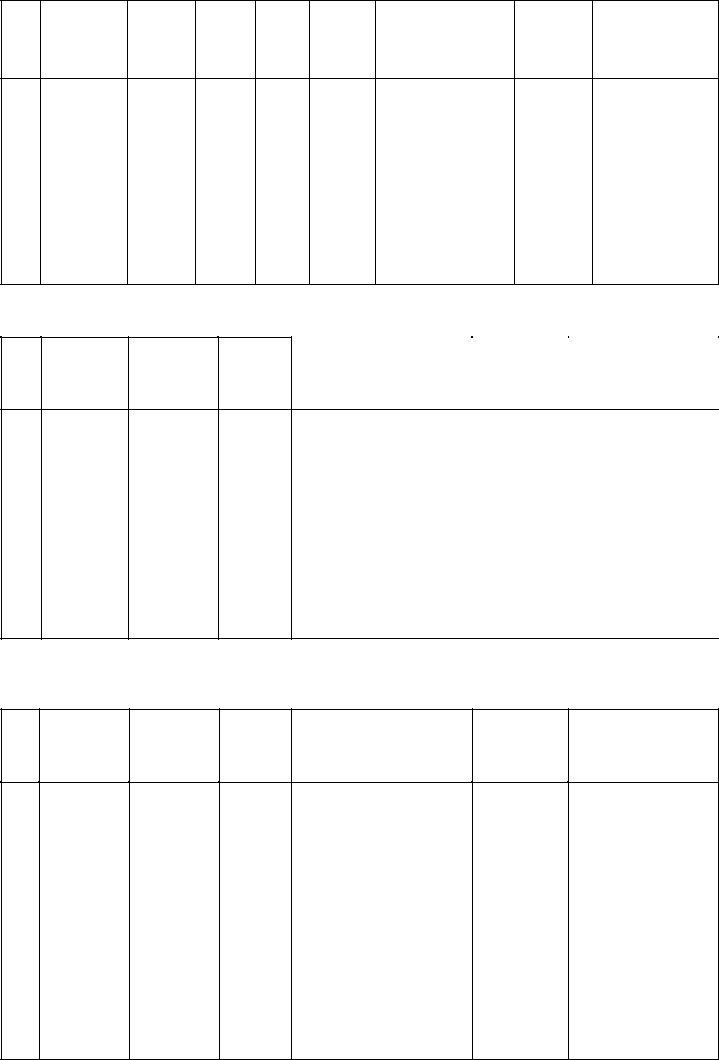

| Question | Answer |

|---|---|

| Form Name | Asset Declaration Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | west bengal form no 34a, asset statement form, asset declaration form west bengal, asset form |

West Bengal Form No. 34 A.

Declaration of Assets as they stood on ________________________________________________________

Name (in full) of Officer ________________________ Service ______________________________________________________

Designation ___________________________________________ now appointed as _____________________________________

Substantive Pay ____________________________________________________________________________________________

Special Pay _______________________________________________________________________________________________

INSTRUCTIONS FOR FILLING UP THE DECLARATION

1.(a) Every Government employee employed under the administrative control of the Government of West Bengal, other than a person in inferior service, shall submit to the proper authority an annual return of the movable and immovable properties owned, acquired or inherited by him, or his wife or dependants or held on lease or mortgage either in his own name or in the name of any member of his family or of any other person. These orders will not apply to member of the

(b)This Declaration of Assets must always refer to 'the 1st January of the current year. Any asset acquired between the 1st January and the date of declaration should not ordinarily be entered in the declaration. But in case of doubt regarding the exact date of the assets in question may be entered for the current year but should be repeated in the declaration of the next year too. It is best to submit the Declaration of Assets as soon after New Year's Day as possible.

(c)A person who has entered Government Service for the first time should submit the return within three months of his joining Government Service and it should relate to his assets as they stood on the 1st of January immediately preceding his date of joining.

2.If there is no change of assets on the 1st January of the previous year the declaration should never be nil. There should be a fresh Declaration of Assets in full as on the 1st January of every year.

3.The Declaration of Assets must show the assets belonging to the Government employee even though they may stand in the name of his wife (in the case of a male Government employee), children, other dependants or benamdars, and must also show the assets belonging to the wife of a male Government employee or to his dependants even though they are acquired by the wife or dependants in their own right.

N.B.

4.Any officer making a declaration discovered to be materially incomplete, misleading or false will earn for himself the penalty of immediate suspension, drawing up of proceedings, which may ultimately result in dismissal from Government Service with forfeiture of pension and all other discretionary benefits. A subsequent explanation that the failure strictly to comply with the instructions or the presence of material defects in the declaration were by oversight or ignorance will not be accepted. Ambiguity in a declaration must be avoided as any ambiguity will be liable to be interpreted against him.

5.In declaring shares and stocks and other securities, jewellery, motor cars, motor cycles, refrigerators, other valuable movable articles and immovable property, the actual price paid by an officer must be mentioned, whatever the face value or depreciation might be. Movable articles costing less than Rs. 500 for each item need not be mentioned. In columns 8 of Part A(1), 6 of Parts A(2) and A(3), and 5 of Parts B(1) and B(2) of the form of Declaration of Assets, the. manner of acquisition of the property must be clearly and unambiguously given, i.e., whether the property was acquired by means of savings from the Government employee 's salary or from income from any other source, or by loan in cash or kind, or by inheritance or by any other means to be specified. If an immovable or movable property is in the process of acquisition, for example, a piece of landed property which is being purchased in installments or under one of the various mortgage schemes, or a car or a refrigerator or other pieces of furniture or jewellery are being

paid for under a

6.In declaring Insurance Policies, the number of policy or policies, the amount of Insurance, the name and address of the Company, the number of years during which premia have to be paid must be mentioned, Fully or partly

7.Every declaration must be made in the prescribed printed form and the prescribed declaration at the foot of every page must be signed.

8.If in the declaration it is not possible to give a correct statement of every assets as it stood exactly on the 1st January, the statement should be correct to the nearest date and that date should be mentioned. (Sometimes" it is difficult to get a precise statement of

9.A Government employee whose service is placed temporarily at the disposal of the Central or any other State Government or any other authority should be required to submit the Declaration of Assets to the Government of West Bengal.

10.The categories of assets mentioned in brackets in the printed declaration form are merely illustrative and not meant to be exhaustive.

11.In declaring precise location in column 2 of Schedule A- Immovable

12.In column 6 of Al and column 4 of A2, please state the full value of the land and the house. If the value has not yet been determined please state how much has generally been paid. In case of a building, state the actual amount of money that has been spent up to 1st January or as near that date as possible even if the construction may be incomplete or just started. In the case of land, please state the amount of loan, if any taken in cash, and in the case of house the amount of such loan in cash or kind including the value of materials purchased on credit.

13.The last date of submission of this Declaration of Assets is the 30th April every year for assets as they stood on the previous 1 st. January of that year. Gazetted Officers will submit these declarations by registered post at Government expense in double sealed covers direct to their appointing authorities / Secretaries in charge of the administrative department concerned. The outer sealed cover will be addressed to the appointing authorities/ Secretaries in charge of administrative department concerned and should not contain any indication of the contents. The inner sealed cover should contain the name of the officer, his service, rank and address and a certificate of the date for which the declaration stands (in the form: Declaration of Assets as they stood on 1st January, 19). On receipt o the declarations the appointing authorities subordinate to Government should send them to the Secretary of the administrative department concerned who will maintain the declarations under his custody.

2

(1)LANDS

Serial

No.

1

Precise

location

2

Area

3

Nature of land 4

Extent

of

interest

5

Value

6

In whose name (wife, child, dependant, other relation or benamdar) the asset is

7

Date and

manner of

Acquisition

8

Remarks

9

Serial

No.

1

Precise

location

2

Extent of

interest

3

Value

4

(2) HOUSES

In whose name (wife, child, |

Date and |

|

dependant, other relation or |

manner of |

Remarks |

benamdar) the asset is |

Acquisition |

7 |

5 |

6 |

|

|

|

|

(3)IMMOVABLE PROPERTIES OF OTHER DESCRIPTION

(Including mortgages and such other rights)

Serial

No.

1

Precise

location

2

Extent of

interest

3

Value

4

In whose name (wife, child, dependant, other relation or benamdar) the asset is

5

Date and

manner of

Acquisition

6

Remarks

7

Signature of Declarant ……………………………………………

3

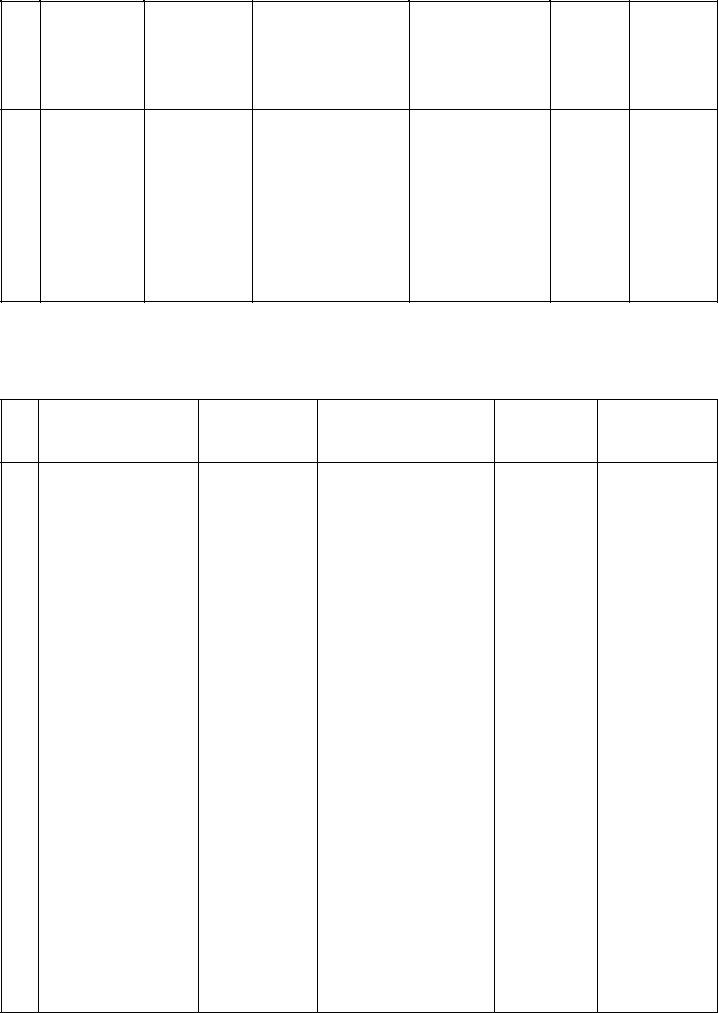

(1)CASH, BANK BALANCE, CREDIT, INSURANCE POLICIES, SHARES, DEBENTURES, ETC.

Serial |

Description of |

No. |

Items |

12

Value

3

In whose name (wife, child, dependant, other relation or benamdar) the asset is

4

In the case of , loan the

name of the person from whom the loan was taken and the relationship of the loanee with that person 4A

Date and

manner of

Acquisition

5

Remarks

6

(2)OTHER MOVABLES

(Including jewellery and other valuables, motor vehicles, refrigerators and' other articles or materials of Rs. 500 and over for each item)

Serial

No.

1

Description of Items

2

Value

3

In whose name (wife, child, dependant, other relation or benamdar) the asset is

4

Date and

manner of

Acquisition

5

Remarks

6

I hereby declare that the Declaration m ado above is complete, true and correct to the best of my knowledge and belief.

Date……………………………… |

Signature of Declarant…..…………………………… |