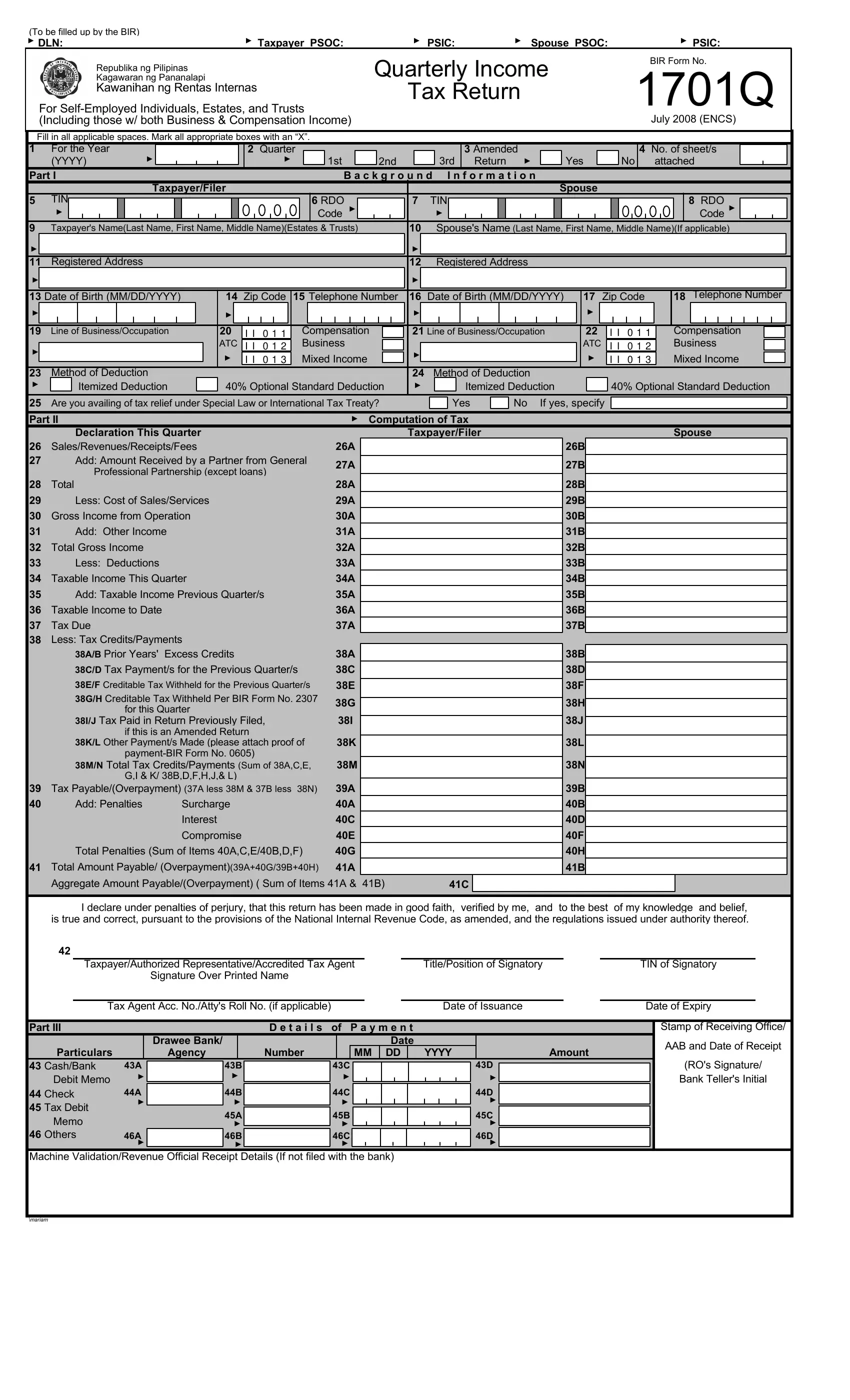

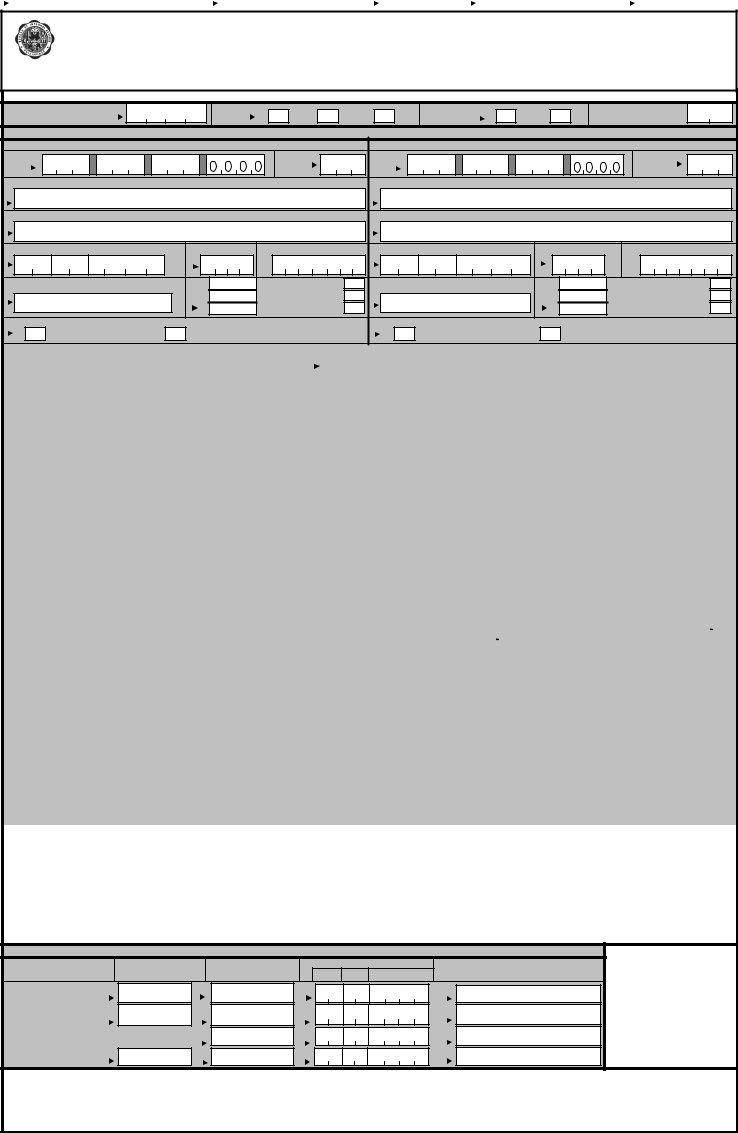

Who Shall File

This return shall be filed in triplicate by the following individuals regardless of amount of gross income:

1)A resident citizen engaged in trade, business, or practice of profession within and without the Philippines.

2)A resident alien, non-resident citizen or non-resident alien individual engaged in trade, business or practice of profession within the Philippines.

3)A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

An individual whose sole income has been subjected to final withholding tax, or who is exempt from income tax pursuant to the Tax Code and other laws, is not required to file an income tax return.

Married individuals shall file a return for the taxable year to include the income of both spouses, computing separately their individual income tax based on their respective total taxable income. Where it is impracticable for the spouses to file one return, each spouse may file a separate return of income. If any income cannot be definitely attributed to or identified as income exclusively earned or realized by either of the spouses, the same shall be divided equally between the spouses for the purpose of determining their respective taxable income.

The income of unmarried minors derived from property received from a living parent shall be included in the return of the parent except (1) when the donor’s tax has been paid on such property, or (2) when the transfer of such property is exempt from donor’s tax.

If the taxpayer is unable to make his own return, the return may be made by his duly authorized agent or representative or by the guardian or other person charged with the care of his person or property, the principal and his representative or guardian assuming the responsibility of making the return and incurring penalties provided for erroneous, false or fraudulent returns.

Compensation income need not be reported in the Quarterly Income Tax Return. The same shall be reported in the Annual Income Tax Return only.

When and Where to File

The return of the taxpayers shall be filed as follows:

1st qtr |

On or before April 15 of the current |

|

taxable year |

2nd qtr |

On or before August 15 of the |

|

current taxable year |

3rd qtr |

On or before November 15 of the |

|

current taxable year |

The income tax return shall be filed with any Authorized Agent Bank (AAB) located within the territorial jurisdiction of the Revenue District Office where the taxpayer is required to register/where the taxpayer has his legal residence or place of business in the Philippines. In places where there are no AABs, the returns shall be filed with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer of the Revenue District Office where the taxpayer is required to register/where the taxpayer has his legal residence or place of business in the Philippines. In case taxpayer has no legal residence or place of business in the Philippines, the return shall be filed with the Office of the Commissioner or Revenue District Office No. 39, South Quezon City.

When and Where to Pay

Upon filing of this return, the estimated tax due shall be paid to the Authorized Agent Bank (AAB) where the return is filed. In places where there are no AABs, payments shall be made directly to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer who shall issue Revenue Official Receipt (BIR Form 2524)) therefor.

Where the return is filed with an AAB, taxpayer must accomplish and submit BIR-prescribed deposit slip, which the bank teller shall machine validate as evidence that payment was received by the AAB. The AAB receiving the tax return shall stamp mark the word “Received” on the return and also machine validate the return as proof of filing the return and payment of the tax by the taxpayer, respectively. The machine validation shall reflect the date of payment, amount paid and the transaction code, the name of the bank, branch code, teller’s code and the teller’s initial. Bank debit memo number and date should be indicated in the return for taxpayers paying under the bank debit system

For eFPS Taxpayer

The deadline for electronically filing and paying the taxes due thereon shall be in accordance with the provisions of existing applicable revenue issuances.

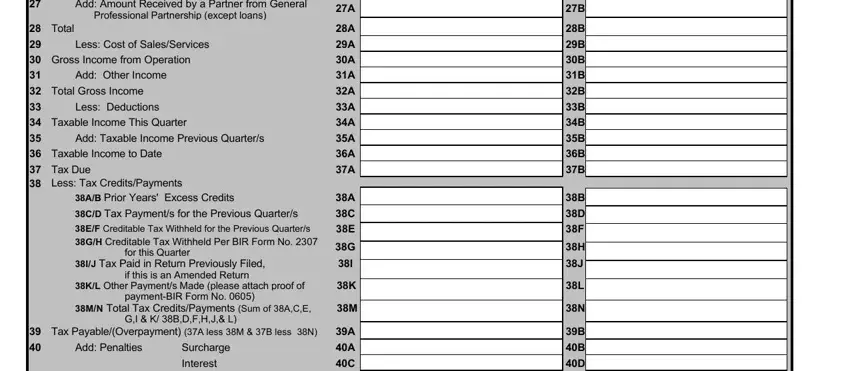

Deductions

A taxpayer engaged in business or in the practice of profession shall choose either the optional standard or itemized (described below) deduction. He shall indicate his choice by marking with “X” the appropriate box, otherwise, he shall be deemed to have chosen itemized deduction. The choice made in the return is irrevocable for the taxable year covered.

Optional Standard Deduction – A maximum of 40% of their gross sales or receipts shall be allowed as deduction in lieu of the itemized deduction. This type of deduction shall not be allowed for non-resident aliens engaged in trade or business. An individual who opts to avail of this deduction need not submit the Account Information Return (AIF)/Financial Statements.

Itemized Deduction – There shall be allowed as deduction from gross income all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade, business or exercise of a profession including a reasonable allowance for salaries, travel, rental and entertainment expenses.

Estimated Income Tax Liability

The taxpayers herein referred shall make and file a declaration of their estimated income for the current period from which they shall derive their estimated income tax liability.

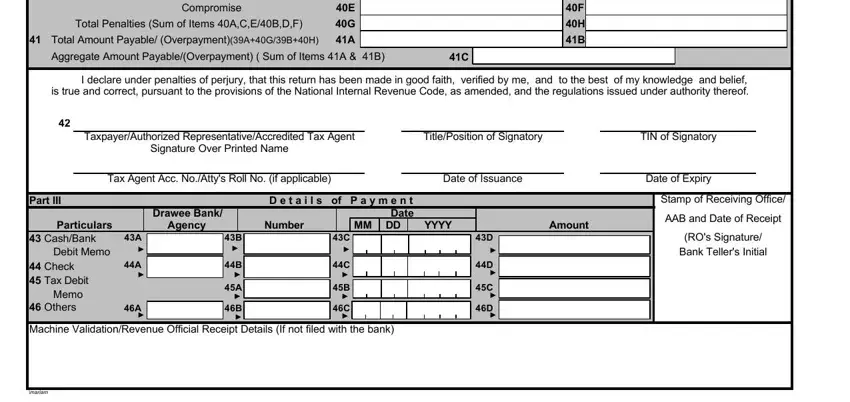

Penalties

There shall be imposed and collected as part of the tax:

1.A surcharge of twenty five percent (25%) for each of the following violations:

a)Failure to file any return and pay the amount of tax or installment due on or before the due dates;

b)Unless otherwise authorized by the Commissioner, filing a return with a person or office other than those with whom it is required to be filed;

c)Failure to pay the full or part of the amount of tax shown on the return, or the full amount of tax due for which no return is required to be filed, on or before the due date;

d)Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment.

2.A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud, for each of the following violations:

a)Willful neglect to file the return within the period prescribed by the Code or by rules and regulations; or

b)In case a false or fraudulent return is willfully made.

3.Interest at the rate of twenty percent (20%) per annum, or such higher rate as may be prescribed by rules and regulations, on any unpaid amount of tax, from the date prescribed for the payment until the amount is fully paid.

4.Compromise penalty.

Attachments Required

1.Certificate of Income Payments Not Subject to Withholding Tax (BIR Form 2304), if applicable;

2.Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if applicable;

3.Duly Approved Tax Debit Memo, if applicable;

4.Authorization letter, if return is filed by authorized representative;

5.Proof of other payment/s made, if applicable; and

6.Summary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax at Source (SAWT), if applicable

The quarterly income tax return does not have to be accompanied with Account Information Form and/or Financial Statements.

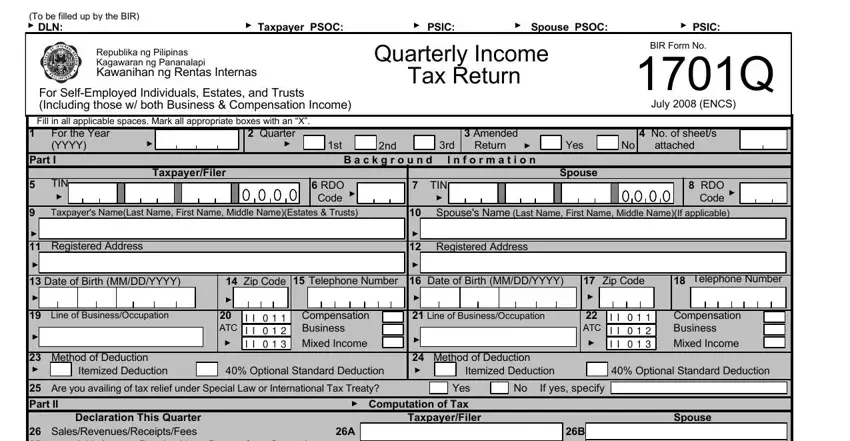

Note: All background information must be properly filled up.

∙All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information:

A.For CPAs and others (individual practitioners and members of GPPs); a.1 Taxpayer Identification Number (TIN); and

a.2 Certification of Accreditation Number, date of Issuance, and Date of Expiry.

B.For members of the Philippine Bar (individual practitioners, members of GPPs);

b.1 Taxpayer Identification Number (TIN); and

b.2 Attorney’s Roll Number or Accreditation Number, if any.

∙Box Nos. 1 and 2 refer to transaction period and not the date of filing this return.

∙The last 4 digits of the 13-digit TIN refers to the branch code.

∙TIN = Taxpayer Identification Number.

ENCS