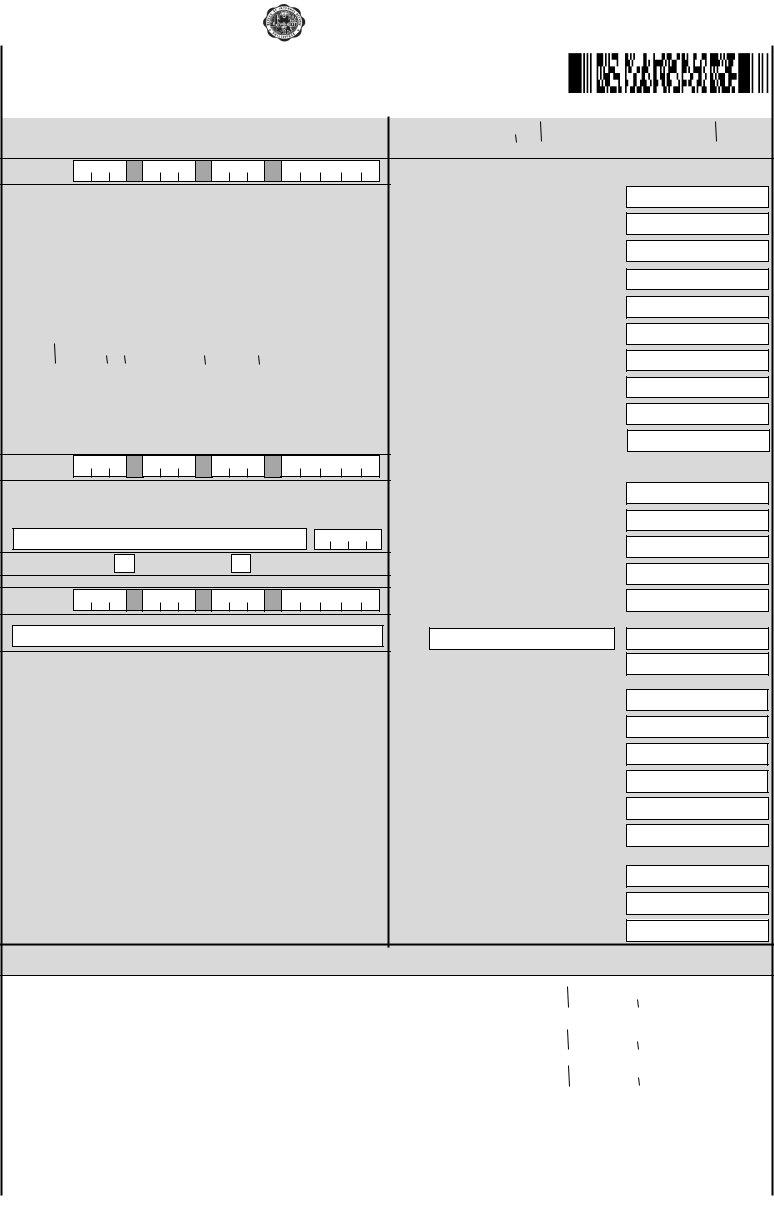

Form 2316 is an information return used to report the receipt of certain types of income from foreign sources. This form is used by both individuals and businesses, and is due on April 15th of the year following the income year. The form must be filed even if no tax is owed. Generally, any income earned or received from a foreign country must be reported on Form 2316. There are a few exceptions, however, so it's important to consult with a tax professional before filing this form. Form 2316 can be confusing, so here we'll walk you through everything you need to know about filing it correctly. We'll cover who needs to file it, what type of income needs to be reported, and some tips for making the

| Question | Answer |

|---|---|

| Form Name | Bir Form 2316 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 2316 bir form, itr 2316 form, bir form 2316, bir 2316 form |

|

|

|

|

|

|

|

|

|

|

Republic of the Philippines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For BIR |

BCS/ |

|

|

|

|

|

|

|

Department of Finance |

|

|

|

|

|

|

|

|

|

Use Only |

Item: |

|

|

|

|

|

|

|

Bureau of Internal Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIR Form No. |

|

|

|

|

|

|

Certificate of Compensation |

|

|

|

|

|

|

|

|||

2316 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Payment/Tax Withheld |

|

|

|

|

|

|

|

||||

|

January 2018 (ENCS) |

|

|

|

|

|

|

For Compensation Payment With or Without Tax Withheld |

|

|

|

2316 01/18ENCS |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Fill in all applicable spaces. Mark all appropriate boxes with an "X". |

|

|

|

|

|

|

|

||||||||||

|

1 For the Year |

|

|

|

|

|

|

|

2 For the Period |

|

|

|

|

|

|

|

|

|

|

(YYYY) |

|

|

|

|

|

|

|

From (MM/DD) |

|

|

|

To (MM/DD) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Part I - Employee Information |

Part |

||||||||||||||

3 |

TIN |

|

|

A. |

Amount |

|

- |

- |

- |

4 |

Employee's Name (Last Name, First Name, Middle Name) |

5 RDO Code |

27 Basic Salary (including the exempt P250,000 & below) |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or the Statutory Minimum Wage of the MWE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

Holiday Pay (MWE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 Registered Address |

|

|

|

|

|

|

|

6A ZIP Code |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

Overtime Pay (MWE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6B Local Home Address |

|

|

|

|

|

|

|

6C ZIP Code |

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

Night Shift Differential (MWE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6D Foreign Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

Hazard Pay (MWE) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

13th Month Pay and Other Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7 |

Date of Birth (MM/DD/YYYY) |

8 Contact Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(maximum of P90,000) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

De Minimis Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9 |

Statutory Minimum Wage rate per day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 SSS, GSIS, PHIC & |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Union Dues (Employee share only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Statutory Minimum Wage rate per month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

Salaries and Other Forms of Compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11 |

|

|

|

Minimum Wage Earner (MWE) whose compensation is exempt from |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

withholding tax and not subject to income tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

Total |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

Part II - Employer Information (PRESENT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Sum of Items 27 to 35) |

|||||||||

12 |

TIN |

|

|

B. TAXABLE COMPENSATION INCOME REGULAR |

|

- |

- |

- |

13 Employer's Name |

|

|

37 |

Basic Salary |

||

|

|

|

|

|||

|

|

|

|

38 |

Representation |

|

|

|

|

|

|||

14 Registered Address |

14A ZIP Code |

|||||

|

|

|||||

|

|

|

|

39 |

Transportation |

15 |

Type of Employer |

Main Employer |

Secondary Employer |

|

|

|

|

|

|

||

|

Part III - Employer Information (PREVIOUS) |

40 |

Cost of Living Allowance (COLA) |

||

|

|

|

|||

16 |

TIN |

|

|

41 Fixed Housing Allowance |

|

|

- |

- |

- |

||

17 Employer's Name |

|

|

42 |

Others (specify) |

|

|

|

|

|

|

42A |

18 Registered Address |

18A ZIP Code |

42B |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTARY |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Part IVA - Summary |

|

|

|

|

|

|

|

|

43 |

Commission |

|

||||

19 |

Gross Compensation Income from Present |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

20 |

Employer (Sum of Items 36 and 50) |

|

|

|

|

|

|

|

|

44 |

Profit Sharing |

|

|||||

Less: Total |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

21 |

Income from Present Employer (From Item 36) |

|

|

|

|

|

|

|

|

45 |

Fees Including Director's Fees |

|

|||||

Taxable Compensation Income from Present |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

22 |

Employer (Item 19 Less Item 20) (From Item 50) |

|

|

|

|

|

|

|

|

46 |

Taxable 13th Month Benefits |

|

|||||

Add: Taxable Compensation Income from |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

23 |

Previous Employer, if applicable |

|

|

|

|

|

|

|

|

|

47 |

Hazard Pay |

|

||||

Gross Taxable Compensation Income |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Sum of Items 21 and 22) |

|

|

|

|

|

|

|

|

48 |

Overtime Pay |

|

||||

24 |

Tax Due |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

49 Others (specify) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

25 |

Amount of Taxes Withheld |

|

|

|

|

|

|

|

|

|

|

|

49A |

|

|

|

|

|

|

25A Present Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25B Previous Employer, if applicable |

|

|

|

|

|

|

|

|

|

|

|

49B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

26 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Total Taxable Compensation Income |

|

||||||||||||||

Total Amount of Taxes Withheld as adjusted |

|

|

|

|

|

|

|

|

50 |

|

|||||||

|

|

(Sum of Items 25A and 25B) |

|

|

|

|

|

|

|

|

|

|

|

(Sum of Items 37 to 49B) |

|

||

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

|

51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Present Employer/Authorized Agent Signature over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CO |

NFORME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Employee Signature over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount paid, if CTC |

||||||

|

CTC/Valid ID No. |

|

|

|

Place of |

|

|

|

|

|

|

Date Issued |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

of Employee |

|

|

|

Issue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

To be accomplished under substituted filing |

||||||||||||||||||||

|

|

I declare, under the penalties of perjury that the information herein stated are |

|

I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return |

|||||||||||||||||||||||||

|

|

reported under BIR Form No. |

(BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines |

||||||||||||||||||||||||||

|

|

Internal Revenue. |

|

|

|

|

|

for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

the BIR Form No. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions |

|||||||||||||||||

|

53 |

|

|

|

|

|

|

|

|

|

of Revenue Regulations (RR) No. |

||||||||||||||||||

|

|

|

|

|

Present Employer/Authorized Agent Signature over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

(Head of Accounting/Human Resource or Authorized Representative) |

54 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Signature over Printed Name |

|||||||||||

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)