When working in the online editor for PDFs by FormsPal, you may fill in or modify 2000 ot here and now. To keep our editor on the leading edge of efficiency, we work to put into practice user-driven features and improvements on a regular basis. We're at all times grateful for any feedback - help us with remolding the way you work with PDF forms. It merely requires just a few easy steps:

Step 1: First, access the tool by pressing the "Get Form Button" in the top section of this page.

Step 2: The tool allows you to work with PDF forms in a variety of ways. Change it by including personalized text, correct what is already in the PDF, and put in a signature - all close at hand!

This form will require you to type in specific information; in order to ensure correctness, please be sure to pay attention to the guidelines hereunder:

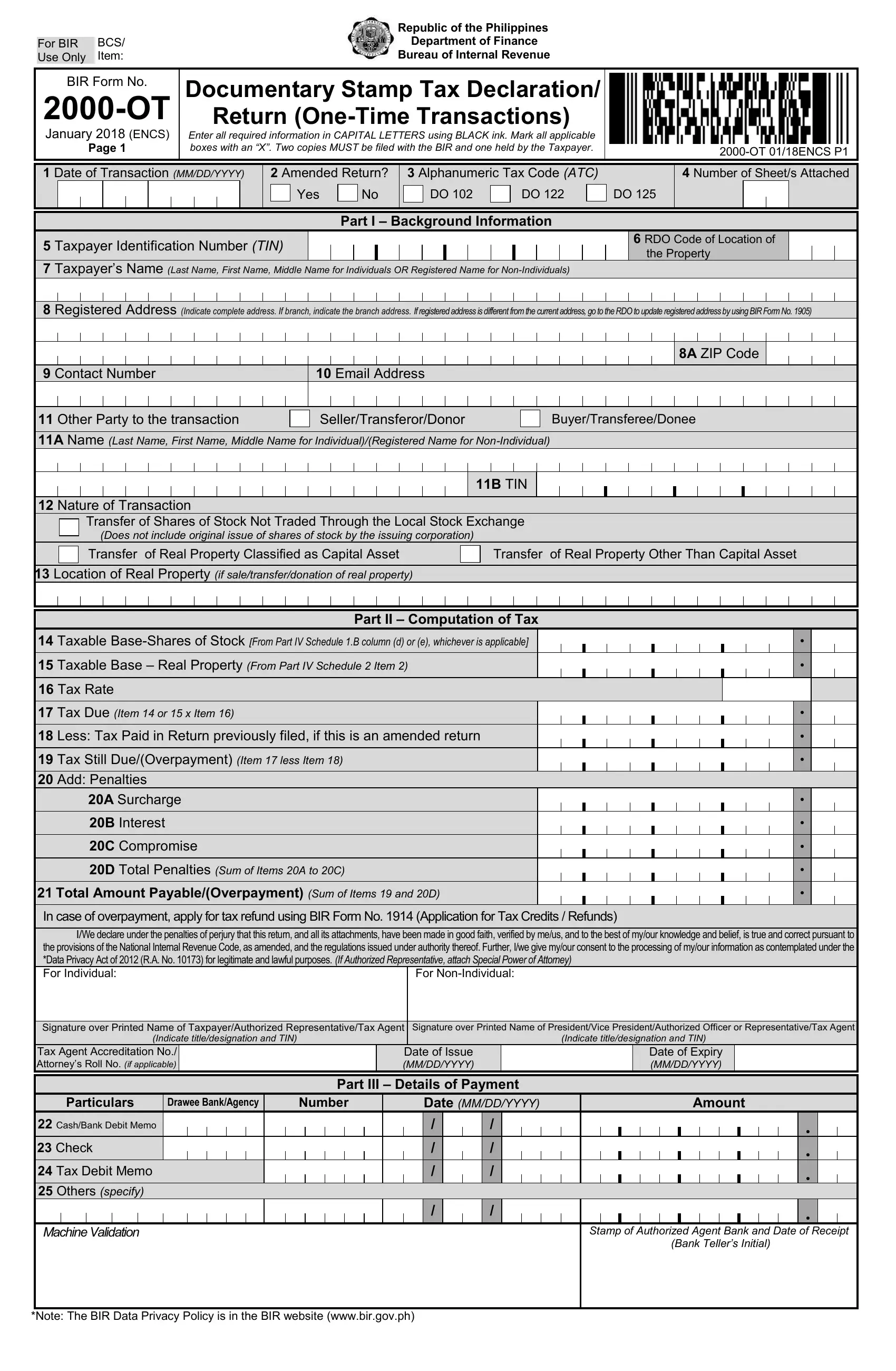

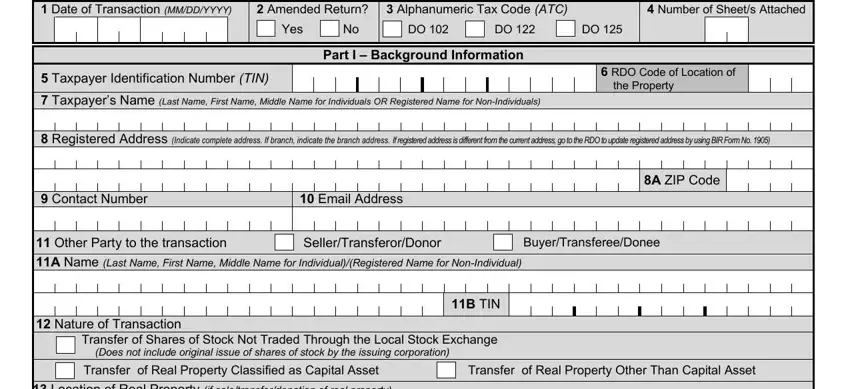

1. When completing the 2000 ot, make certain to complete all essential blanks within the corresponding part. It will help speed up the work, which allows your details to be handled swiftly and properly.

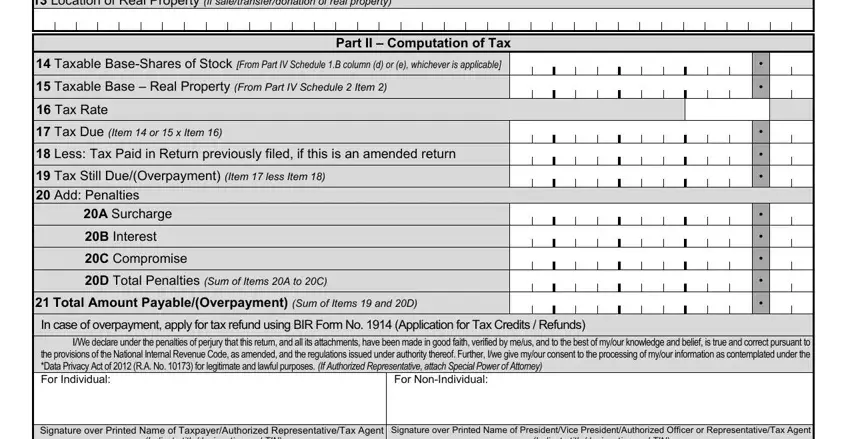

2. Once your current task is complete, take the next step – fill out all of these fields - Location of Real Property if, Part II Computation of Tax, Taxable BaseShares of Stock From, Tax Rate, Tax Due Item or x Item , Less Tax Paid in Return, Tax Still DueOverpayment Item , Add Penalties, A Surcharge, B Interest, C Compromise, D Total Penalties Sum of Items A, Total Amount PayableOverpayment, In case of overpayment apply for, and IWe declare under the penalties of with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

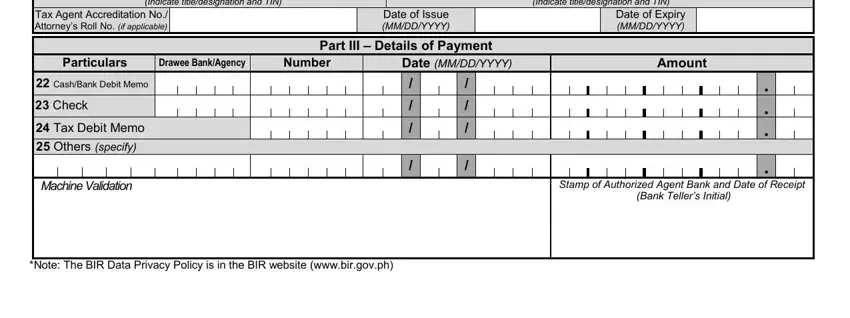

3. Completing Indicate titledesignation and TIN, Indicate titledesignation and TIN, Tax Agent Accreditation No, Date of Issue MMDDYYYY, Date of Expiry MMDDYYYY, Particulars, Drawee BankAgency, Number, Date MMDDYYYY, CashBank Debit Memo, Check Tax Debit Memo Others, Machine Validation, Note The BIR Data Privacy Policy, NOTE Please read the BIR Data, and Amount is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

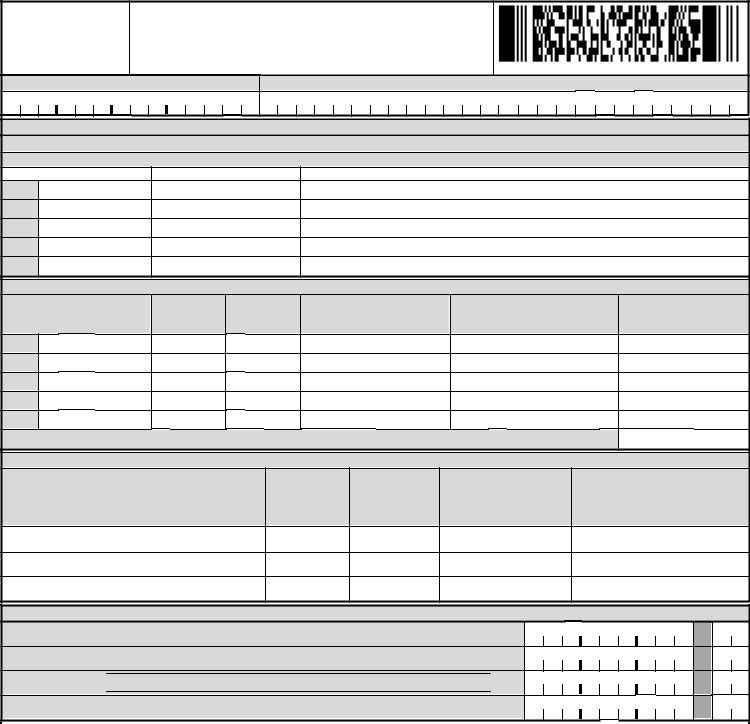

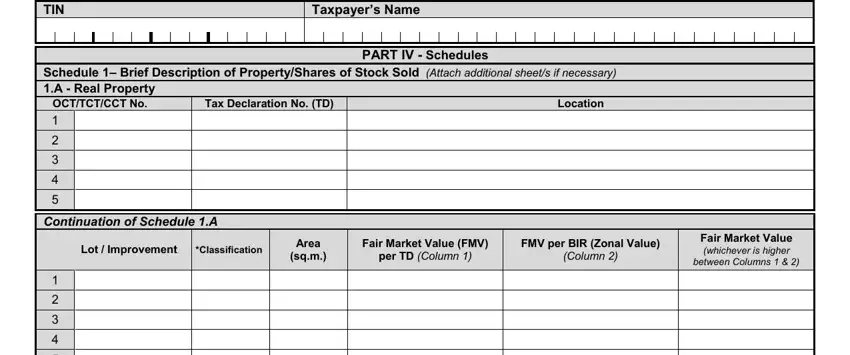

4. To move forward, this fourth stage will require typing in a handful of blanks. Examples of these are TIN, Taxpayers Name, PART IV Schedules, Schedule Brief Description of, Tax Declaration No TD, Continuation of Schedule A, Location, Lot Improvement, Classification, Area sqm, Fair Market Value FMV, FMV per BIR Zonal Value, per TD Column , Column , and OT ENCS P, which you'll find crucial to continuing with this process.

Always be very careful when completing Area sqm and Schedule Brief Description of, as this is where most people make a few mistakes.

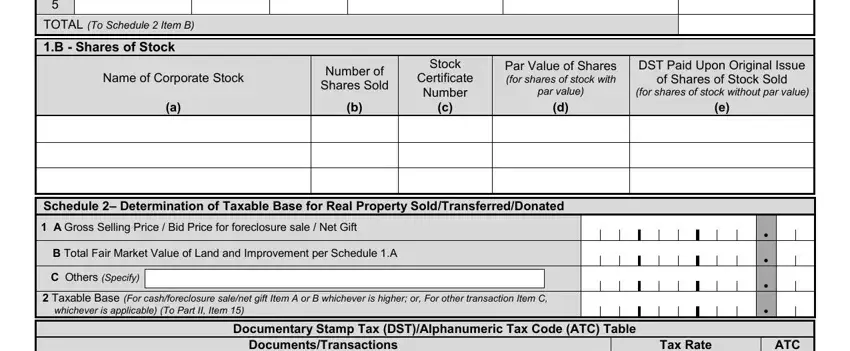

5. This last step to finish this form is critical. Ensure to fill in the mandatory form fields, including TOTAL To Schedule Item B, B Shares of Stock, Name of Corporate Stock, Number of Shares Sold, Stock, Certificate Number, Par Value of Shares for shares of, par value, Schedule Determination of Taxable, B Total Fair Market Value of Land, C Others Specify, Taxable Base For cashforeclosure, between Columns , DST Paid Upon Original Issue, and of Shares of Stock Sold, before using the form. Failing to do it might generate an unfinished and possibly unacceptable document!

Step 3: Before moving on, make certain that form fields are filled in right. Once you confirm that it is correct, click “Done." Create a 7-day free trial plan with us and gain direct access to 2000 ot - download, email, or edit from your FormsPal cabinet. FormsPal guarantees your information privacy by having a secure system that never records or distributes any private information provided. Feel safe knowing your documents are kept confidential whenever you work with our editor!