You'll be able to complete bir 2306 downloadable form without difficulty using our PDFinity® PDF editor. To retain our tool on the cutting edge of convenience, we work to implement user-driven features and enhancements on a regular basis. We're routinely glad to get suggestions - help us with revolutionizing how you work with PDF forms. Starting is effortless! Everything you should do is follow the following easy steps below:

Step 1: Simply hit the "Get Form Button" above on this site to see our form editing tool. This way, you will find everything that is necessary to fill out your file.

Step 2: This tool allows you to change nearly all PDF forms in various ways. Change it with any text, correct what's already in the PDF, and place in a signature - all within a couple of clicks!

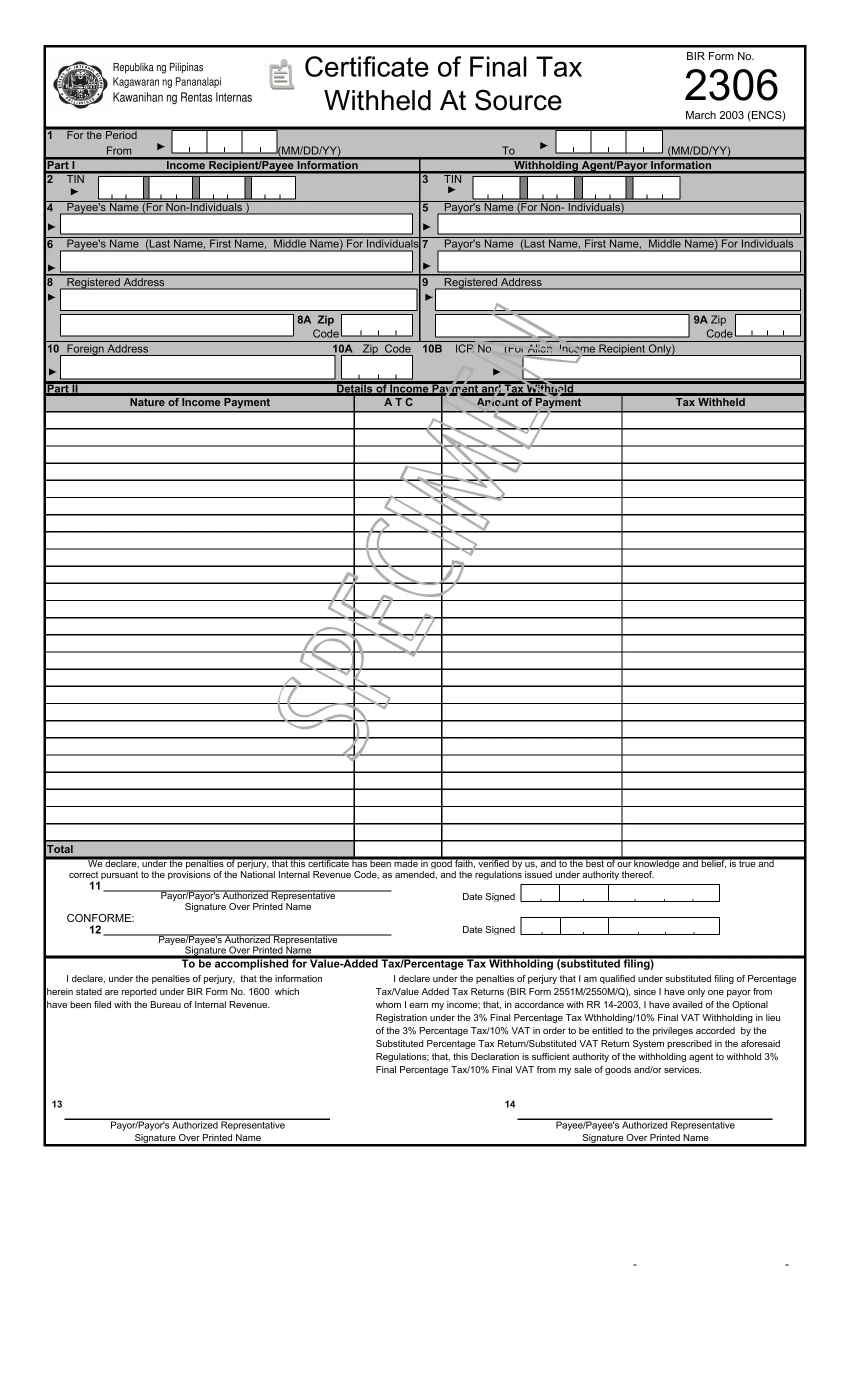

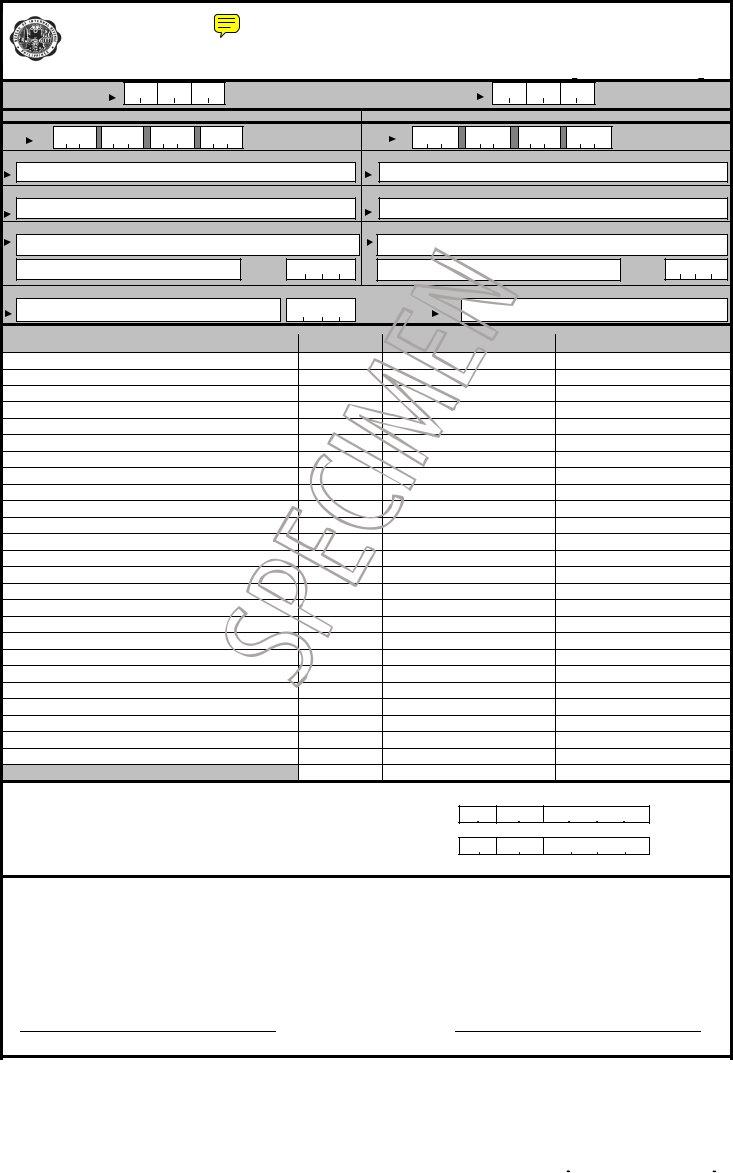

In an effort to finalize this PDF document, make certain you type in the information you need in each and every area:

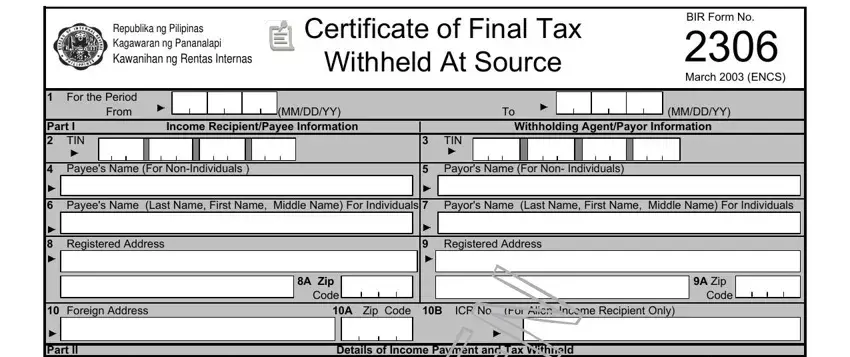

1. The bir 2306 downloadable form will require certain information to be typed in. Make sure the next fields are complete:

Step 3: Prior to moving forward, you should make sure that all blanks were filled in correctly. As soon as you believe it is all good, click on “Done." Go for a free trial subscription at FormsPal and get immediate access to bir 2306 downloadable form - downloadable, emailable, and editable from your FormsPal cabinet. FormsPal guarantees protected document completion devoid of personal data recording or sharing. Be assured that your data is safe here!