Handling PDF files online is certainly easy with our PDF editor. Anyone can fill in monthly tax bir here and use a number of other functions available. The tool is consistently upgraded by our staff, receiving awesome features and becoming greater. Here's what you'll need to do to start:

Step 1: First of all, open the tool by clicking the "Get Form Button" in the top section of this site.

Step 2: Using this advanced PDF editor, you can do more than just fill out blank fields. Try all the features and make your documents look high-quality with custom textual content added in, or optimize the original content to excellence - all accompanied by an ability to add stunning pictures and sign the document off.

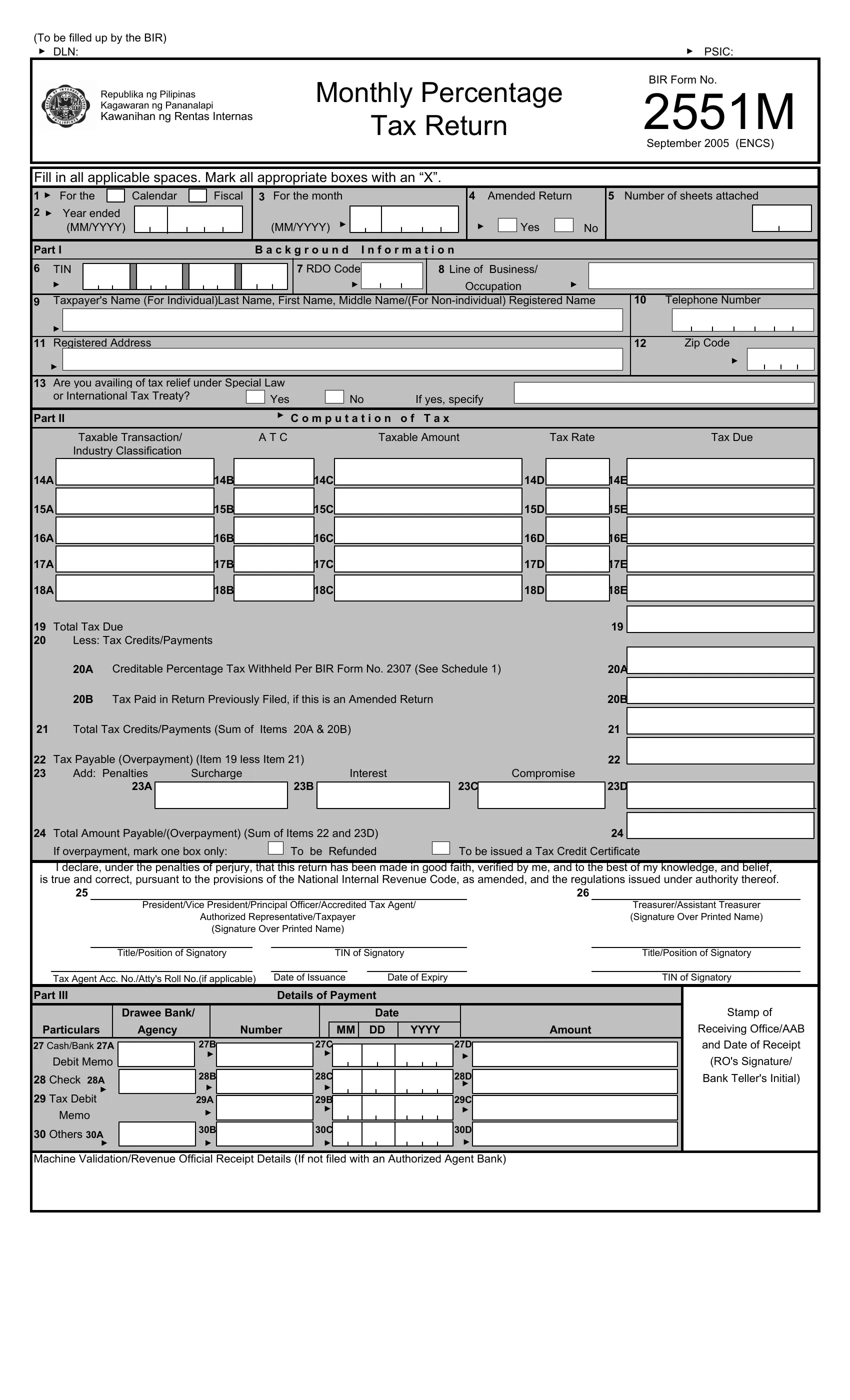

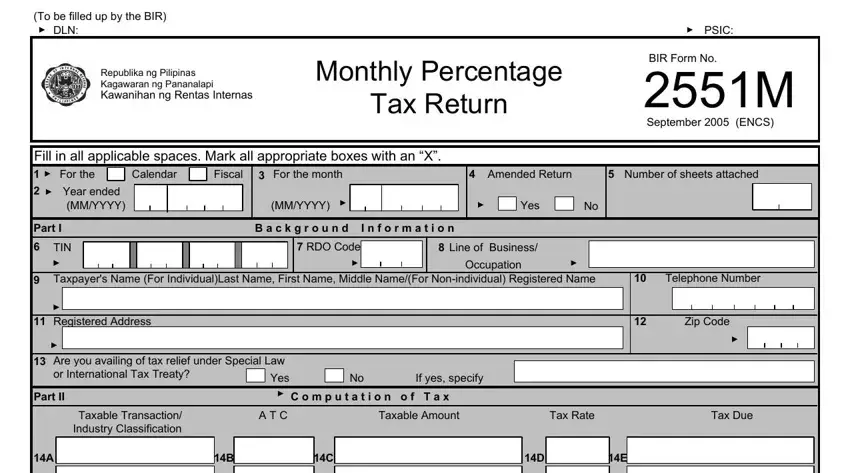

As a way to finalize this PDF form, make certain you provide the required details in every field:

1. It is very important fill out the monthly tax bir correctly, therefore pay close attention while working with the parts comprising these fields:

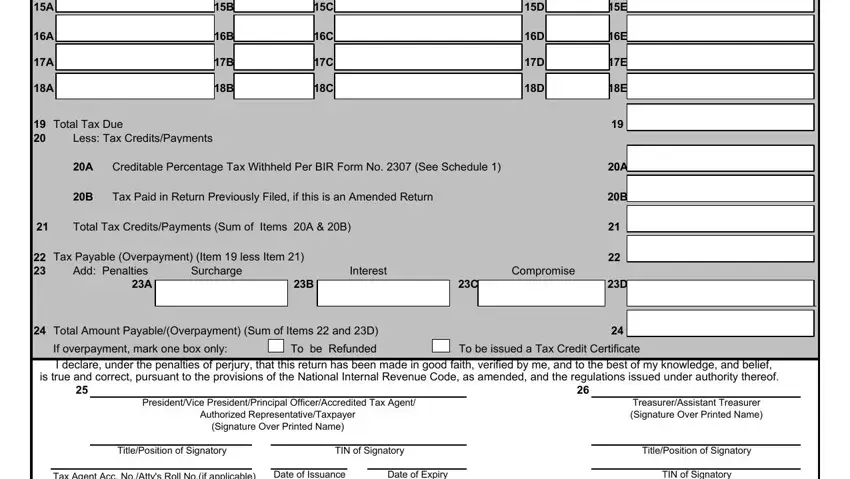

2. The third step is usually to submit the next few blank fields: Total Tax Due , Less Tax CreditsPayments, Creditable Percentage Tax Withheld, Tax Paid in Return Previously, Total Tax CreditsPayments Sum of, Tax Payable Overpayment Item , Surcharge, Add Penalties A, Interest, Compromise, Total Amount PayableOverpayment, If overpayment mark one box only, To be Refunded, To be issued a Tax Credit, and I declare under the penalties of.

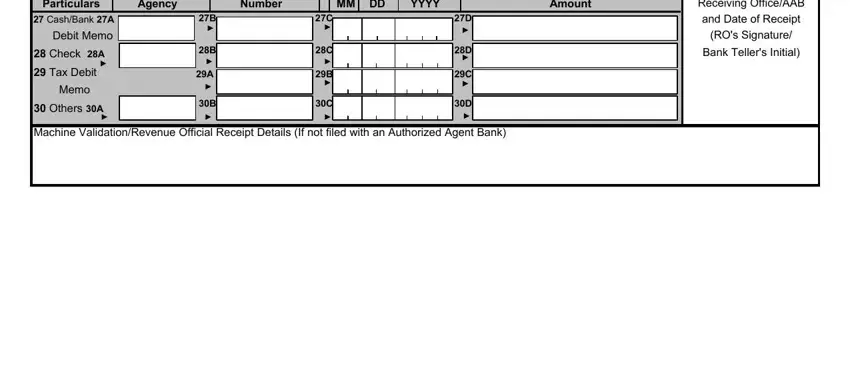

3. Completing Receiving OfficeAAB, and Date of Receipt, ROs Signature, Bank Tellers Initial, Particulars Agency, Number, MM DD YYYY, Amount, CashBank A, Debit Memo, Check A, Tax Debit, Memo, Others A, and Machine ValidationRevenue Official is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

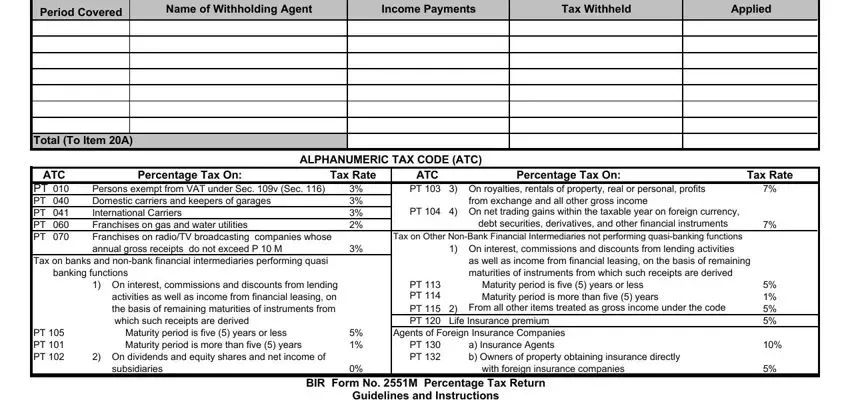

4. To go onward, this fourth part will require typing in a few blank fields. Examples of these are Period Covered, Name of Withholding Agent, Income Payments, Tax Withheld, Applied, Total To Item A, Tax Rate, ATC PT On royalties rentals of, Percentage Tax On, Tax Rate, from exchange and all other gross, PT On net trading gains within, debt securities derivatives and, Percentage Tax On, and ALPHANUMERIC TAX CODE ATC ATC PT , which are vital to going forward with this particular document.

Be extremely careful while filling in Period Covered and Tax Withheld, because this is the section where most people make errors.

Step 3: Just after double-checking the entries, hit "Done" and you're good to go! Sign up with FormsPal now and instantly obtain monthly tax bir, all set for downloading. Each and every edit made is conveniently preserved , which enables you to edit the pdf at a later time when required. We don't sell or share any details you type in when completing forms at our website.