This PDF editor allows you to fill out forms. You won't have to do much to edit de4 worksheet b forms. Basically consider the following steps.

Step 1: This web page includes an orange button saying "Get Form Now". Press it.

Step 2: You're now on the file editing page. You can edit, add text, highlight certain words or phrases, insert crosses or checks, and add images.

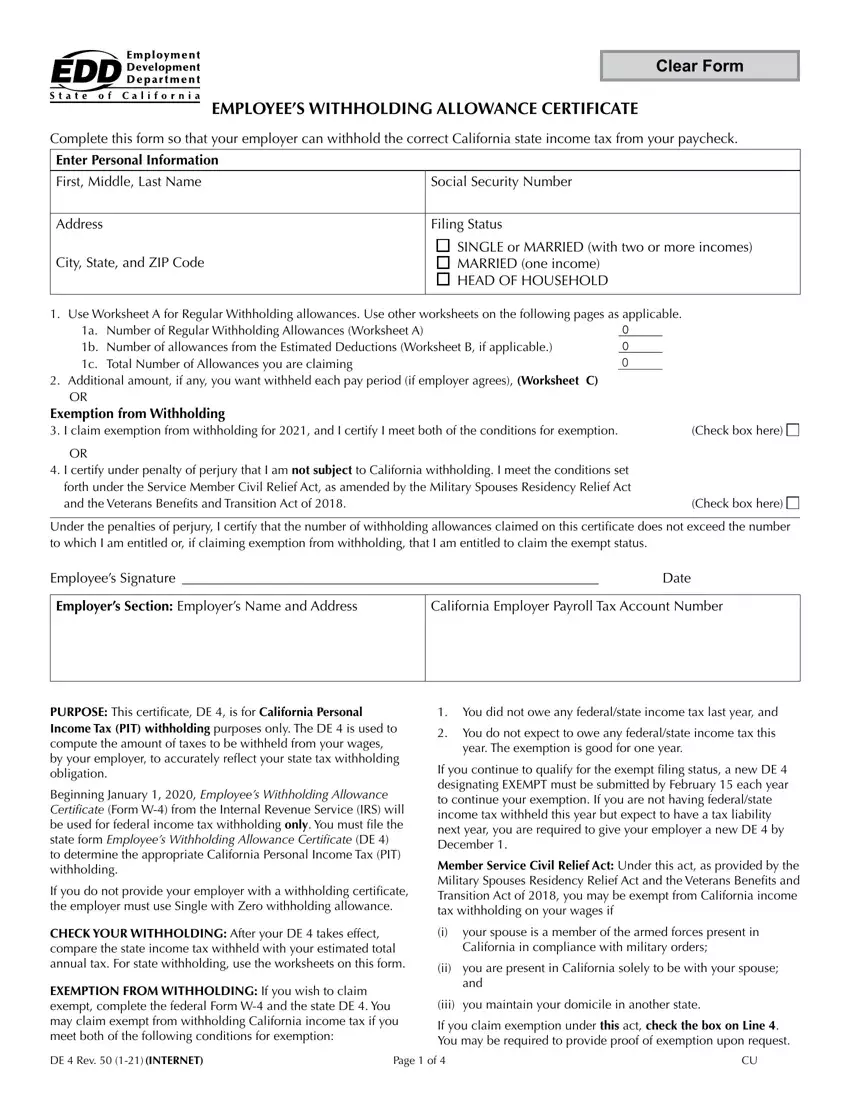

Fill in the ft, b PDF and provide the details for each section:

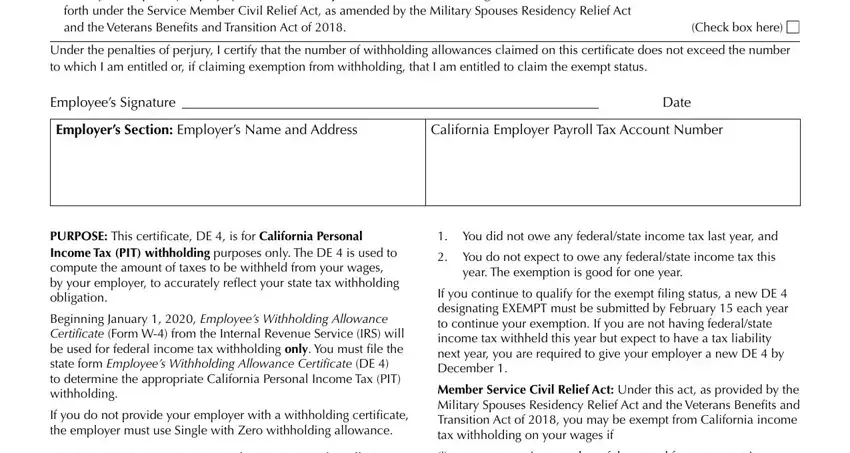

Within the area Check, box, here Employees, Signature Date, and year, The, exemption, is, good, for, one, year type in the particulars which the software asks you to do.

You need to identify the relevant particulars within the part.

The Page, of area has to be applied to put down the rights or responsibilities of both parties.

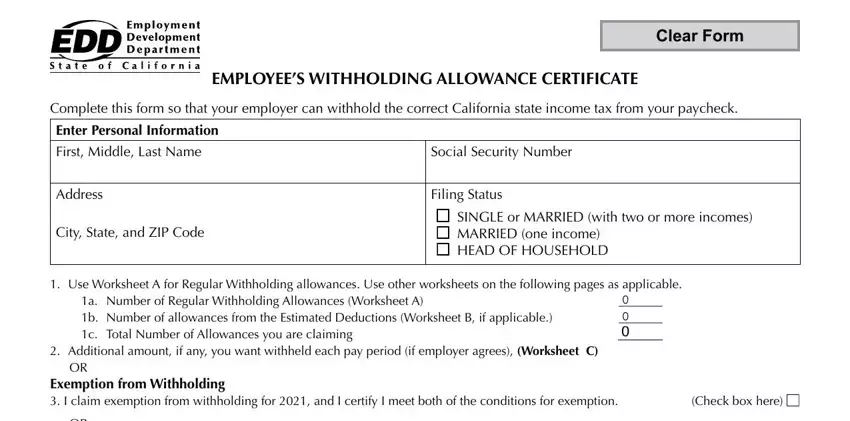

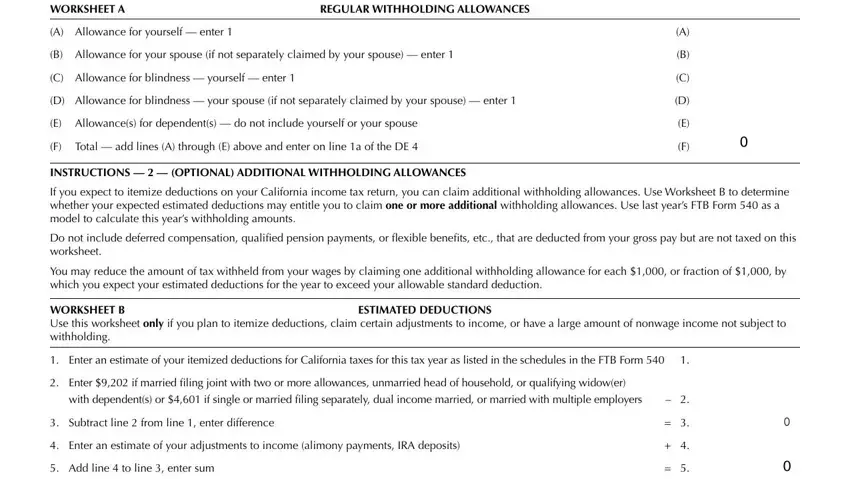

Terminate by analyzing the following fields and preparing them correspondingly: WORKSHEET, A REGULAR, WITHHOLDING, ALLOWANCES A, Allowance, for, yourself, enter C, Allowance, for, blindness, yourself, enter ESTIMATED, DEDUCTIONS Subtract, line, from, line, enter, difference and Add, line, to, line, enter, sum

Step 3: Hit the "Done" button. Now it's possible to upload your PDF file to your gadget. In addition, you can forward it by means of electronic mail.

Step 4: Make a duplicate of each separate form. It's going to save you some time and assist you to prevent problems in the future. By the way, your details will not be shared or viewed by us.