Every year, individuals in California navigate the process of settling their tax obligations, and the introduction of Form 540-V has been a strategic move aimed at enhancing the efficiency and accuracy of payments to the Franchise Tax Board. Launched as part of an effort to modernize the payment system, Form 540-V, also known as the Return Payment Voucher for Individuals for the taxable year 1997, represents a crucial tool for taxpayers owing money on their returns. This form guides taxpayers on how to correctly prepare and mail their payment, ensuring it aligns with the state’s requirements for proper processing. It specifies that payments should be made to the Franchise Tax Board, detailing the necessity of including the taxpayer's social security number and the specified tax year on the check or money order. Moreover, Form 540-V instructs on attaching the voucher alongside the payment to the front of the tax return, ensuring visibility and ease of processing. It is designed for those who find themselves with a balance owing, rather than those expecting a refund or with no tax due, thereby streamlining the payment process for both the taxpayers and the tax authorities in California.

| Question | Answer |

|---|---|

| Form Name | California 540 V Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | california payment voucher 2020, ca 540 payment voucher, 540 voucher, california 540 payment voucher |

TAXABLE YEAR |

Instructions for Return Payment Voucher |

CALIFORNIA FORM |

|

||

1997 |

for Individuals |

540 |

Do I Need To Use This Form?

The Franchise Tax Board is modernizing its payment system. Sending this new return payment voucher with your check or money order will help us process your payment accurately and efficiently. We strongly encourage you to use Form

How Do I Prepare and Mail My Payment?

$ Step 1: Prepare Your Check or Money Order

➮Make it payable to Franchise Tax Board for the full amount you owe.

➮Write your social security number and the type of the return on your check or money order :

‘‘1997 Form 540EZ’’; or ‘‘1997 Form 540A’’; or ‘‘1997 Form 540’’; or ‘‘1997 Form 540NR’’.

✍Step 2: Complete the Return Payment Voucher (Form

➮Using blue or black ink, enter your name(s), address and social security number(s) in the space provided.

➮Enter the amount of payment that you are sending with your return. If you are paying penalties or interest

in addition to the tax you owe, be sure to enter the total amount of your check or money order on Form

➮Cut off the voucher on the dotted line.

Step 3: Attach the Return Payment Voucher and Check or Money Order to Your Return

➮Place the check or money order on top of the voucher. Attach both to the front of your return where it says ‘‘Attach check or money order and Form

Step 4: Mail

➮Mail your return, the attached voucher and your check or money order to the following address:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA

|

DETACH HERE |

|

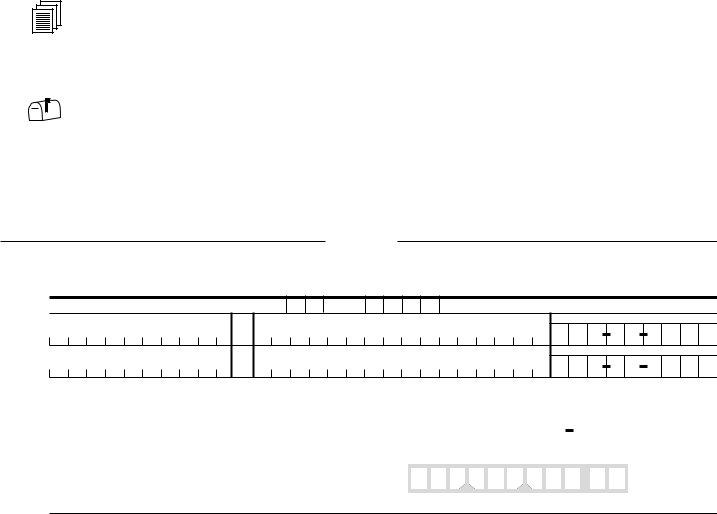

TAXABLE YEAR |

|

CALIFORNIA FORM |

1 9 9 7 |

Return Payment Voucher for Individuals |

540 |

Fiscal year filers, enter year ending: month

year 1 9 9 8

Your first name

INITIAL

Last name

Your social security number

If joint payment, spouse’s first name

INITIAL

Spouse’s last name if different from yours

Spouse’s social security number

|

Present home address — number and street including PO Box or rural route |

|

|

|

|

|

|

|

|

|

|

|

Apt. no. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*540V971* |

City, town or post office |

|

|

|

|

State |

ZIP Code |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make your check or money order payable to ‘‘Franchise Tax Board.’’ |

|

|

Amount of payment |

|||||||||||||||||||||||||||||

|

Write your social security number, type of return and tax year on your |

$ |

|

|

|

|

|

|

|

|

|

• 0 0 |

|||||||||||||||||||||

|

check or money order. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Attach this voucher and your payment to the front of your return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

4

0 V

For Privacy Act Notice, see form FTB 1131. |

Form |